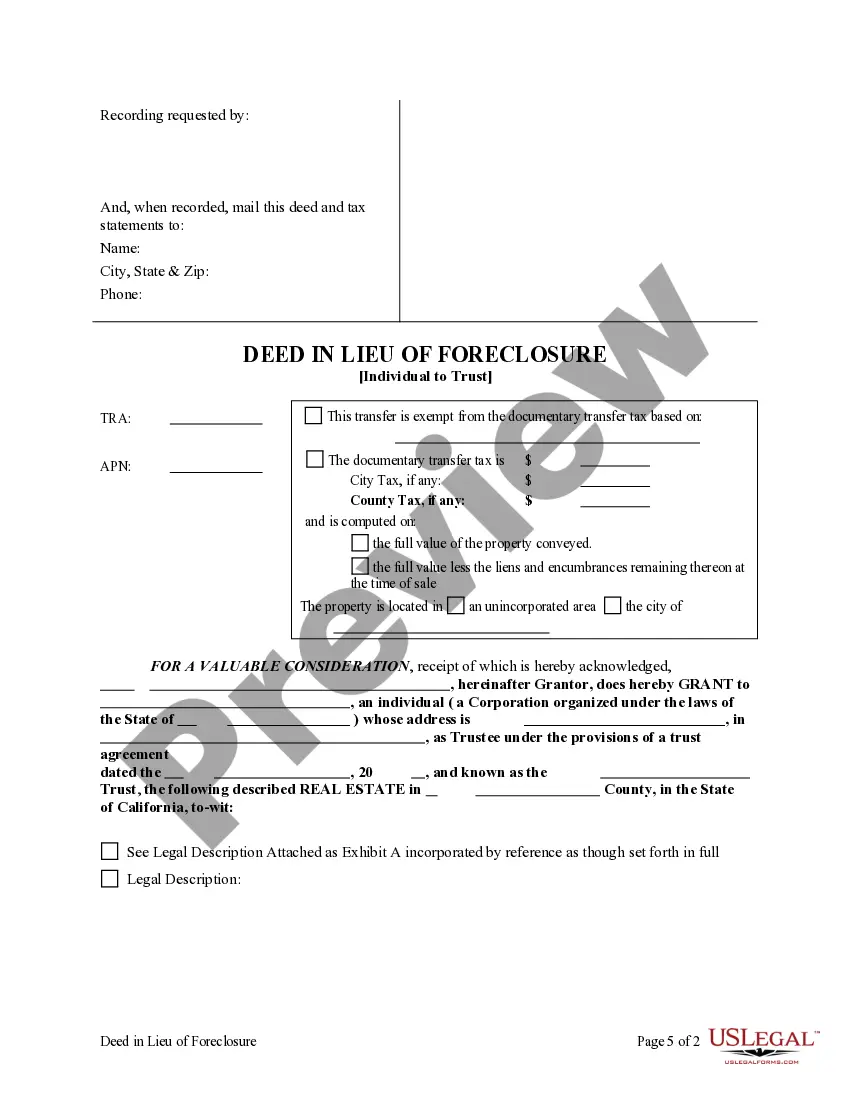

This s a Grant Deed in the form of a Deed in Lieu of Foreclosure where the Grantor and the Grantee is a Trust. Grantor conveys and grants the described property to the Grantee. The transfer to the Grantee serves as satisfaction of the prior Deed of Trust and Promissory Note. This deed complies with all state statutory laws.

San Diego California Deed in Lieu of Foreclosure - Individual to a Trust

Description

How to fill out California Deed In Lieu Of Foreclosure - Individual To A Trust?

If you have previously utilized our service, Log In to your account and download the San Diego California Deed in Lieu of Foreclosure - Individual to a Trust onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it as per your payment arrangement.

If this is your initial encounter with our service, follow these uncomplicated steps to acquire your document.

You have uninterrupted access to all documents you have bought: you can find them in your profile within the My documents section whenever you need to access them again. Take advantage of the US Legal Forms service to effortlessly locate and save any template for your personal or business requirements!

- Verify that you have located an appropriate document. Review the description and use the Preview option, if available, to ascertain if it fulfills your requirements. If it doesn't meet your criteria, utilize the Search tab above to locate the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription option.

- Establish an account and make a payment. Use your credit card information or the PayPal method to finalize the purchase.

- Retrieve your San Diego California Deed in Lieu of Foreclosure - Individual to a Trust. Choose the file format for your document and save it onto your device.

- Fill out your sample. Print it or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

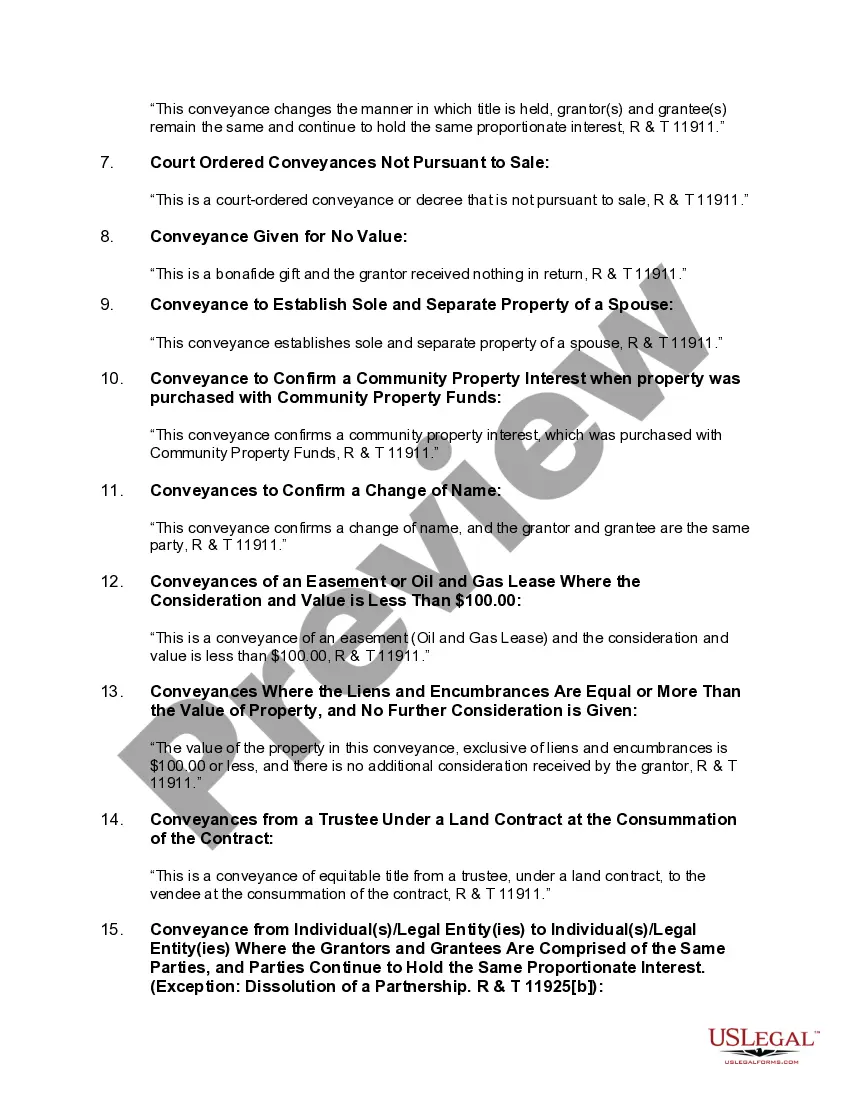

While there are benefits to placing your house in a trust, there are also some disadvantages to consider. You may experience upfront costs for setting up the trust and maintaining it over time. Additionally, assets in a trust may not be eligible for certain public benefits, which could impact your financial planning. It's important to weigh these factors if you look into options like a San Diego California Deed in Lieu of Foreclosure - Individual to a Trust.

Transferring a deed to a trust in California involves creating and signing a deed that designates your trust as the new property owner. You should prepare this document accurately to ensure it reflects your intentions clearly. After signing, submit it to the county recorder's office for proper recording. This important step can aid individuals considering a San Diego California Deed in Lieu of Foreclosure - Individual to a Trust, protecting your assets effectively.

To transfer a house to a trust in California, start by obtaining the necessary trust documents from a legal service, such as USLegalForms. You will need to execute a new deed that states the property's ownership is moving from you as an individual to your trust. Once you complete the deed, file it with your local county recorder's office to make the transfer official. This process is crucial for those interested in options like a San Diego California Deed in Lieu of Foreclosure - Individual to a Trust.

A deed of trust may be rendered invalid due to several reasons, such as improper execution, lack of proper notarization, or failure to meet statutory requirements. Additionally, if there is fraudulent activity involved, that can also invalidate the deed. As you explore options like the San Diego California Deed in Lieu of Foreclosure - Individual to a Trust, ensuring the legality of the deed is crucial for protecting your interests.

The new foreclosure law in California includes various provisions that aim to provide more protections for homeowners, particularly during economic hardships. These laws emphasize modifications and alternatives to foreclosure, which can help homeowners keep their properties. Understanding the San Diego California Deed in Lieu of Foreclosure - Individual to a Trust can play a critical role in navigating these legal changes effectively.

Yes, a trust deed can be foreclosed in California, typically through a non-judicial process. This method allows lenders to reclaim the property without going through the court system, which can expedite the process. If you are facing this situation, exploring the San Diego California Deed in Lieu of Foreclosure - Individual to a Trust may offer you a more favorable solution.

One main disadvantage of a deed of trust is that it can lead to a non-judicial foreclosure process, which may happen more quickly than a conventional foreclosure. Additionally, if you are unable to make your mortgage payments, you risk losing your home without the opportunity to defend yourself in court. This aspect makes the San Diego California Deed in Lieu of Foreclosure - Individual to a Trust an appealing alternative for those seeking to avoid such risks.

To put your property in a trust in California, you need to create a trust document that outlines the terms and conditions of the trust. This document should specify you as the grantor and name the trust as the property holder. Then, you will need to formally transfer the property title into the trust, often using a deed that indicates a San Diego California Deed in Lieu of Foreclosure - Individual to a Trust. Consider using platforms like US Legal Forms for clear guidance and templates to make this process straightforward.