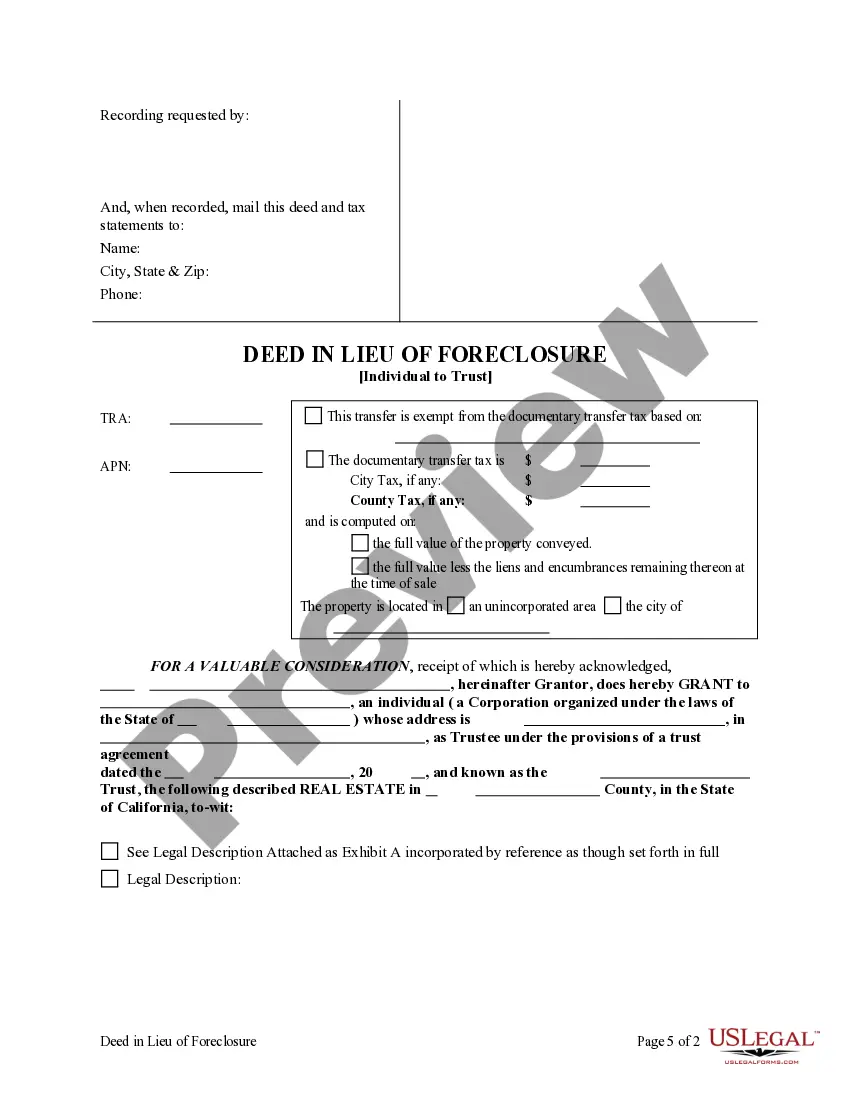

This s a Grant Deed in the form of a Deed in Lieu of Foreclosure where the Grantor and the Grantee is a Trust. Grantor conveys and grants the described property to the Grantee. The transfer to the Grantee serves as satisfaction of the prior Deed of Trust and Promissory Note. This deed complies with all state statutory laws.

Fontana California Deed in Lieu of Foreclosure - Individual to a Trust

Description

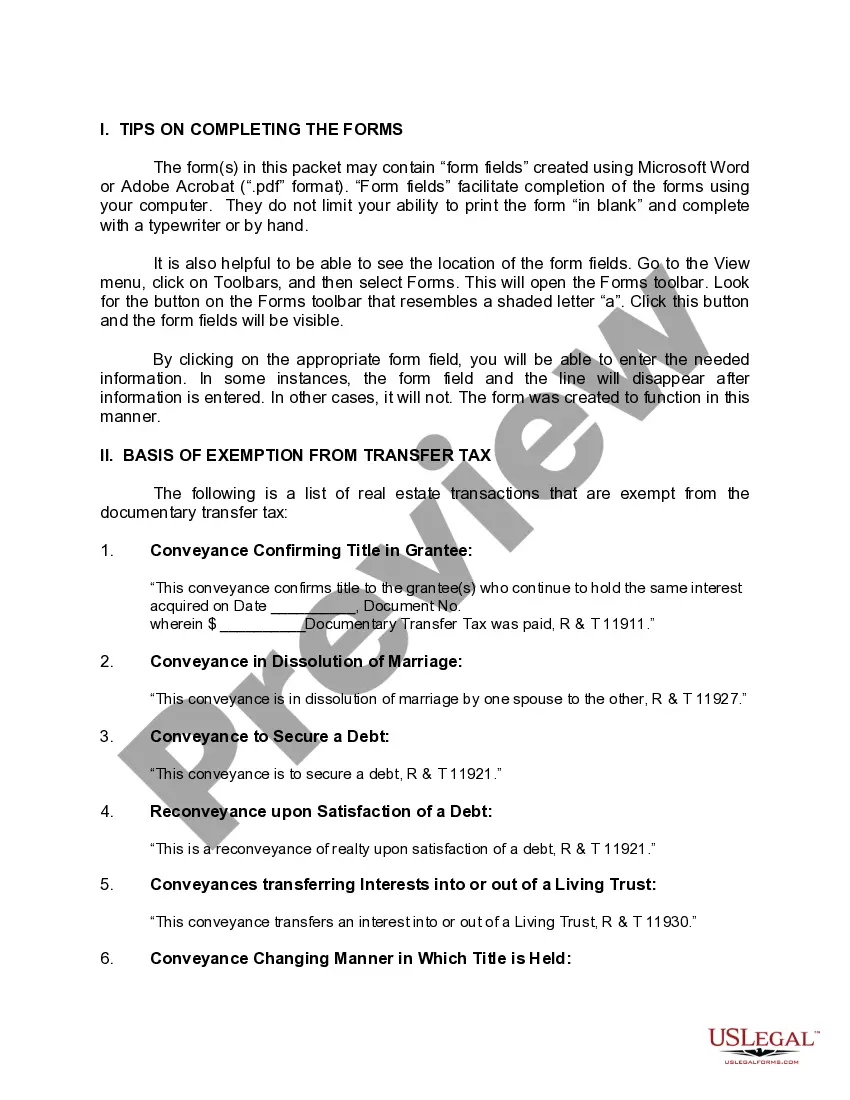

How to fill out California Deed In Lieu Of Foreclosure - Individual To A Trust?

Do you require a dependable and affordable provider of legal templates to obtain the Fontana California Deed in Lieu of Foreclosure - Individual to a Trust? US Legal Forms is your primary option.

Whether you need a straightforward agreement to establish guidelines for living together with your partner or a collection of documents to progress your separation or divorce through the legal system, we have you covered. Our site presents over 85,000 current legal document templates for both personal and business purposes. All templates provided are not generic and are tailored to the necessities of specific jurisdictions and regions.

To acquire the form, you must Log In to your account, find the desired template, and click the Download button adjacent to it. Keep in mind that you can download your previously acquired form templates at any time via the My documents section.

Is this your first visit to our site? No problem. You can easily create an account, but first, be sure to do the following.

Now you can establish your account. Then select a subscription plan and proceed to payment. After completing the payment, download the Fontana California Deed in Lieu of Foreclosure - Individual to a Trust in any of the available formats. You can revisit the website whenever needed and re-download the form at no extra cost.

Finding current legal documents has never been more straightforward. Try US Legal Forms today, and stop wasting hours searching for legal papers online.

- Check if the Fontana California Deed in Lieu of Foreclosure - Individual to a Trust meets the criteria of your state and locality.

- Review the details of the form (if available) to understand who and what the form is designed for.

- Restart the search if the template does not fit your specific needs.

Form popularity

FAQ

In California, lenders typically use a deed of trust rather than a mortgage. A deed of trust involves three parties: the borrower, the lender, and a neutral third party called the trustee. This arrangement allows for a faster and more straightforward foreclosure process, which can be beneficial during events like a Fontana California Deed in Lieu of Foreclosure - Individual to a Trust. By understanding this distinction, homeowners can better navigate their options and make informed decisions.

To record a deed of trust in California, you need to prepare the document with specific information, including details about the borrower, lender, and property. After signing the deed, submit it to the county recorder's office where the property is located. If you are managing a Fontana California Deed in Lieu of Foreclosure - Individual to a Trust, recording the deed properly helps to complete the legal process and ensures public notice of the transaction. Using a reliable platform like US Legal Forms can simplify this task and ensure all requirements are met.

A deed in lieu of foreclosure in California allows property owners to transfer ownership of their property to the lender to avoid foreclosure. This process can be beneficial for homeowners facing financial difficulties, as it offers a way to settle their mortgage obligation more easily. The Fontana California Deed in Lieu of Foreclosure - Individual to a Trust simplifies this process, especially for those converting property into a trust for estate planning. Consulting uslegalforms can help you smoothly navigate these legal requirements.

In California, the statute of limitations for a deed of trust is generally four years. This period applies to actions to enforce the deed or recover amounts secured by it. It's important to keep track of this timeline, especially if you're involved in a Fontana California Deed in Lieu of Foreclosure - Individual to a Trust scenario, to ensure your rights are protected.

When a deed is invalid, it means that it does not have legal effect and cannot be enforced. Various factors contribute to this status, such as improper execution, lack of necessary information, or failure to meet legal requirements. Knowing the implications of an invalid deed is crucial, especially when considering options like a Fontana California Deed in Lieu of Foreclosure - Individual to a Trust.

Yes, a trust deed can be foreclosed in California if the borrower defaults on their obligations. The trustee can initiate the foreclosure process under the terms outlined within the deed. Understanding this process, especially when considering a Fontana California Deed in Lieu of Foreclosure - Individual to a Trust, is essential for those looking to protect their assets.

To file a deed of trust in California, start by obtaining the necessary documents from a legal service like USLegalForms. Prepare the deed along with all required information, then sign it before a notary public. After that, you must record the document with the county recorder’s office to make it legally effective.

A trust may be invalidated in California for several reasons. Common factors include the lack of a clear intent to create a trust, a failure to comply with the formalities required for creation, or the incapacity of the trustor at the time of establishment. Additionally, if the trust’s purpose is illegal or contrary to public policy, it could be deemed invalid.