This form is a generic example that may be referred to when preparing such a form.

Stockton California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually

Description

How to fill out California Promissory Note With No Payment Due Until Maturity And Interest To Compound Annually?

Obtaining validated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms database.

It is an online repository of over 85,000 legal documents for personal and professional requirements as well as various real-world scenarios.

All forms are accurately classified by usage area and jurisdiction, allowing you to find the Stockton California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually swiftly and effortlessly.

Keeping documentation orderly and compliant with legal standards is crucial. Leverage the US Legal Forms library to always have essential document templates readily available for any requirements!

- For those who are already acquainted with our catalog and have utilized it previously, acquiring the Stockton California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually requires merely a few clicks.

- All you need to do is Log In to your account, select the document, and click Download to save it on your device.

- The procedure will necessitate just a few additional actions to finalize for new users.

- Adhere to the instructions below to commence with the most comprehensive online form library.

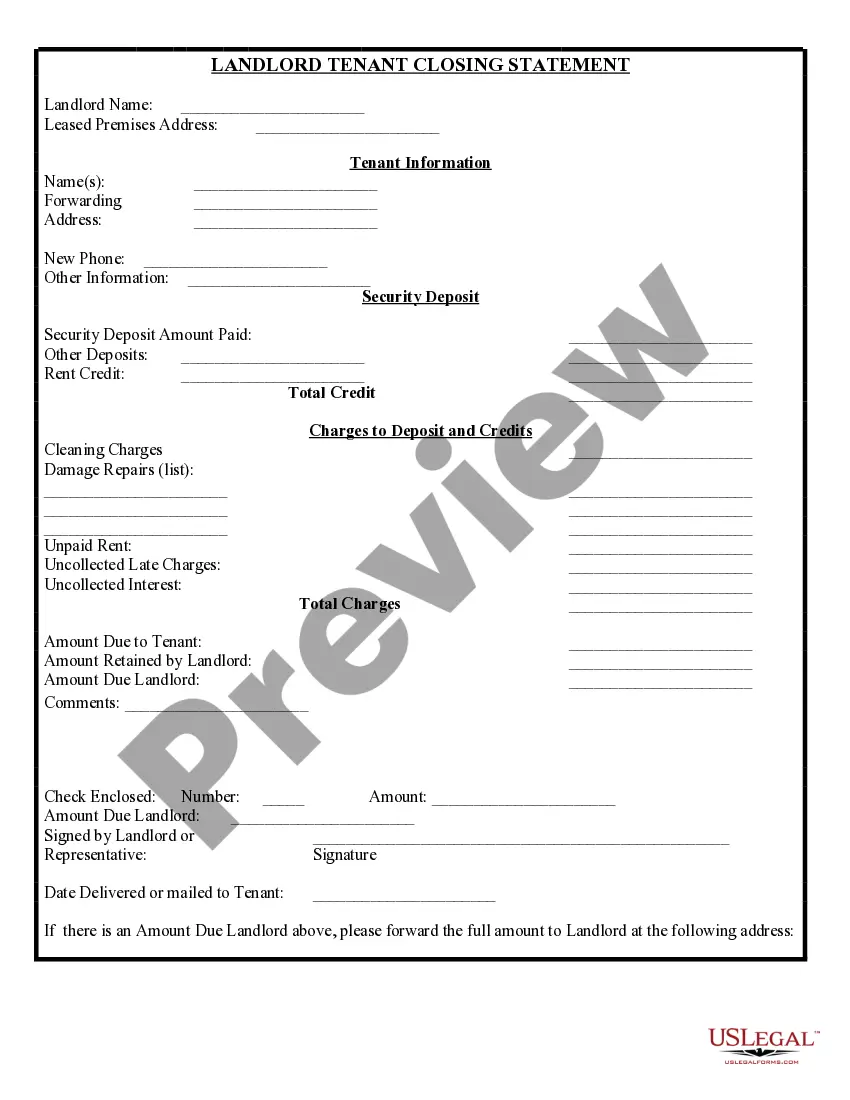

- Check the Preview mode and form description. Ensure you’ve selected the appropriate one that satisfies your needs and completely aligns with your local jurisdiction requirements.

Form popularity

FAQ

A promissory note can feature either simple or compound interest; it depends on the terms specified in the agreement. A Stockton California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually specifies that interest compounds, meaning it is calculated on both the initial principal and any accrued interest. This can affect the total repayment amount, so it's important to understand your note's structure.

Typically, a promissory note does not count as income until the payment is actually received. However, interest earned from a Stockton California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually may be considered taxable income. It is important to consult a tax professional to understand the full implications of any interest accrued. This way, you can ensure compliance with tax regulations.

In California, promissory notes are governed by the Uniform Commercial Code, which outlines the rights and obligations of both lenders and borrowers. Specifics, like a Stockton California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually, must adhere to local regulations. It is crucial to ensure that the note is written in clear language and properly executed to avoid legal issues. Understanding these regulations can help both parties alleviate potential disputes down the line.

When creating a promissory note, it is essential to include clear terms, such as the amount, interest rate, and repayment schedule. A Stockton California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually must clearly specify when interest accumulates and when repayment is owed. These documents must be signed by the borrower and lender to ensure their enforceability. Furthermore, both parties should retain copies for their records.

One of the main disadvantages of a promissory note is the potential for default, leaving the lender at risk of losing the invested amount. Additionally, without proper terms, misunderstandings may arise regarding payment schedules and interest accrual. By choosing a Stockton California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually, you can mitigate some risks by establishing clear terms without immediate payments. This approach fosters trust and clarity for both parties involved.

Yes, you can have a promissory note with no interest, commonly referred to as a non-interest bearing note. However, it’s important to consider the implications of this choice. In a Stockton California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually, you have a unique opportunity to structure your financial agreement favorably. It provides a clear understanding of your obligations without the stress of interest payments.

To calculate compound interest on a promissory note, use the formula for compound interest mentioned earlier and apply the specifics of your note, such as the principal, interest rate, and compounding frequency. For instance, with a Stockton California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually, calculate the interest accrued at each annual increment until the note's maturity. This insight helps you understand your total liability ahead of time. If needed, USLegalForms can assist you in the calculations and documentation.

Yes, a promissory note requires a maturity date, which is the date when the financial obligations must be fulfilled. In the context of a Stockton California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually, the maturity date becomes even more crucial since all payments, including interest, are due at once. This date creates a clear timeline for both parties involved. Make sure to include this information prominently in the document to avoid confusion later.

Recording interest on a promissory note involves keeping accurate, detailed records of the interest accrued over time. In cases like a Stockton California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually, it is important to note how interest is added to the principal each year until maturity. This will help you maintain clear bookkeeping practices and prevent any potential disputes. Using a financial management tool or services from USLegalForms can simplify this process for you.

Yes, interest can compound on a promissory note, depending on its terms. In the case of a Stockton California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually, the interest compounds annually, which means the interest earned each year is added to the principal amount. This compounding effect increases your total return over time. It is beneficial to understand how frequently interest compounds as this impacts the total amount due at maturity.