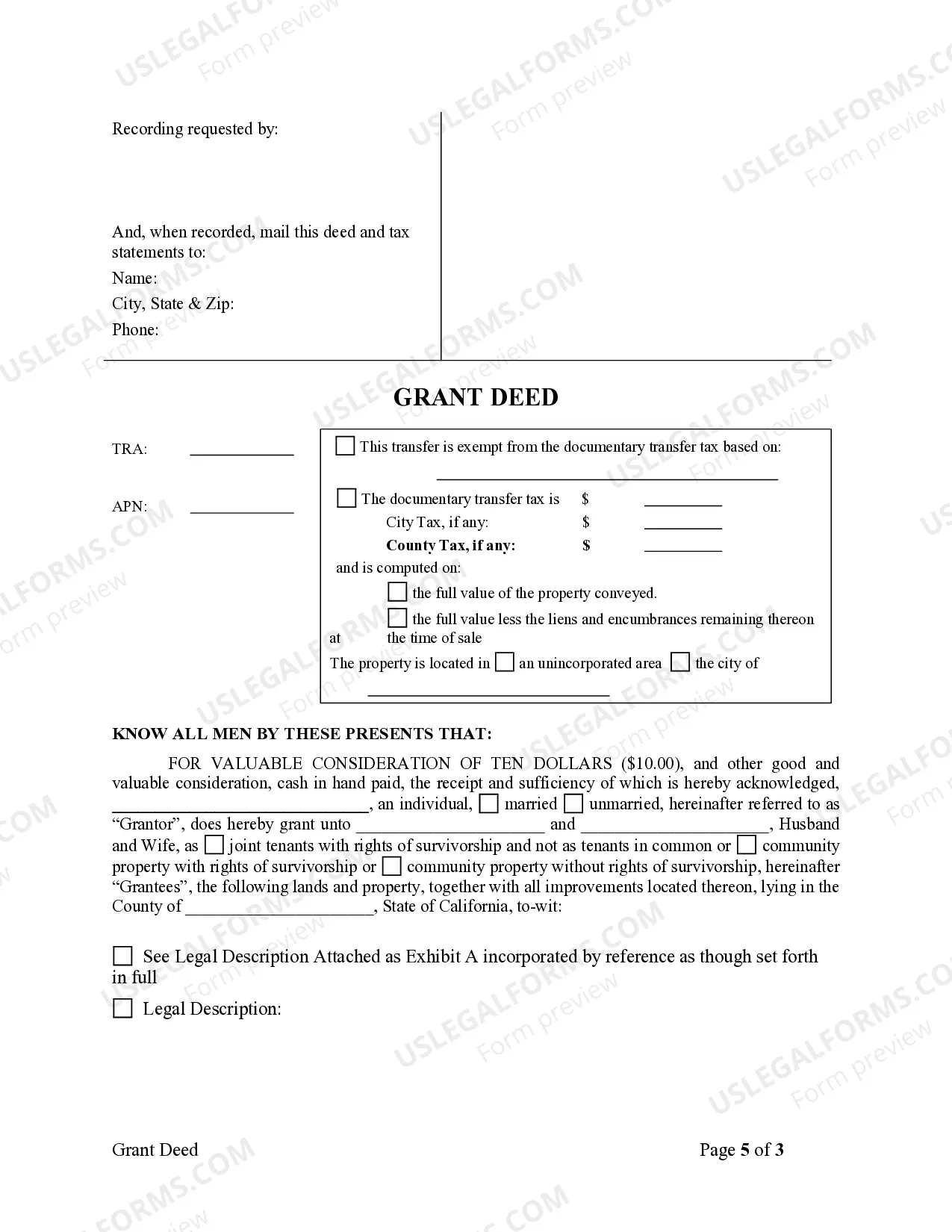

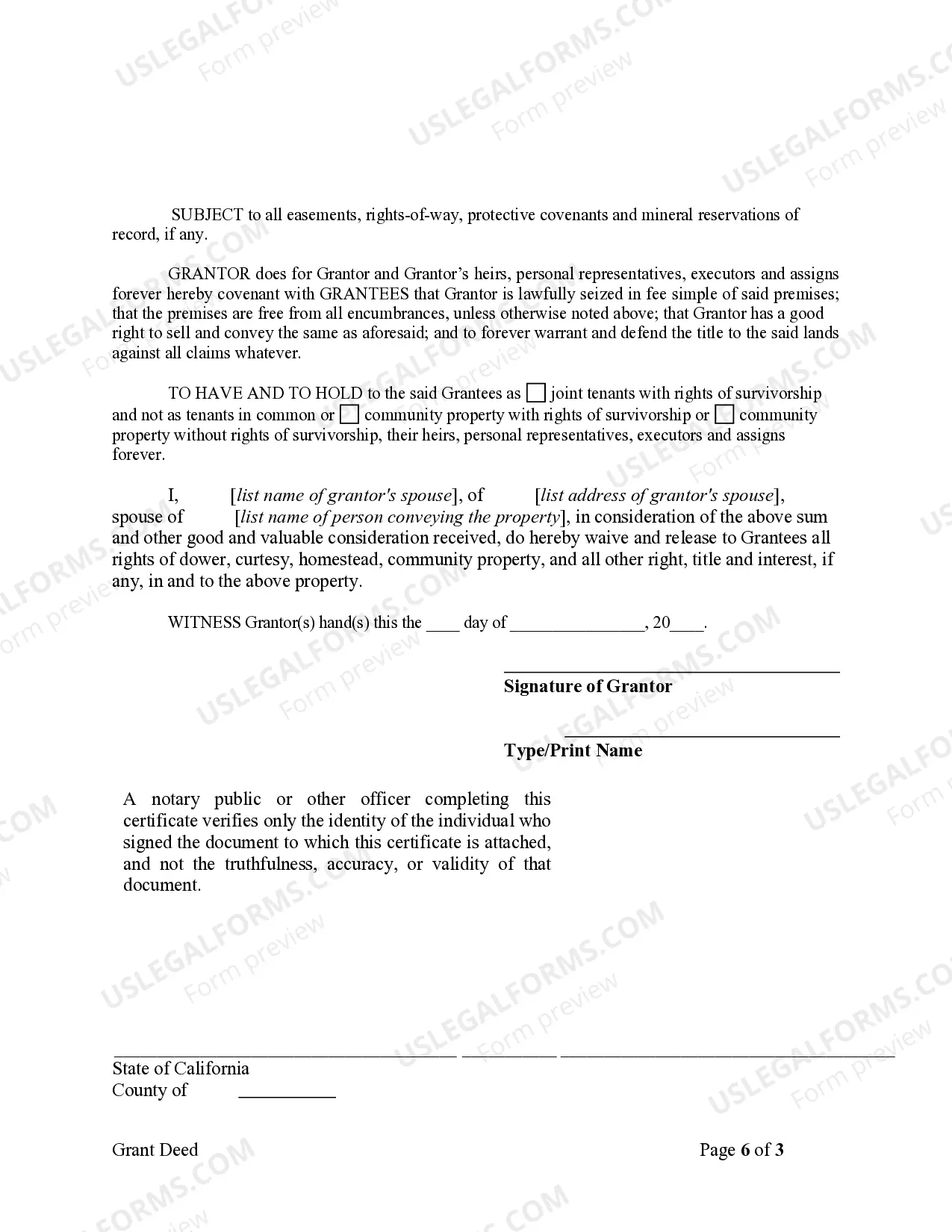

This Grant Deed is needed when an individual wishes to grant certain property to a Husband and Wife. Upon signing this form, the Husband and Wife will be the sole owners of the property granted to them by the individual.

Irvine California Grant Deed from Individual to Husband and Wife

Description

How to fill out California Grant Deed From Individual To Husband And Wife?

If you are in search of an appropriate form template, it’s impossible to find a more user-friendly service than the US Legal Forms site – one of the most comprehensive repositories on the internet.

With this repository, you can locate thousands of document examples for business and personal use categorized by types and states, or keywords.

With our sophisticated search feature, obtaining the latest Irvine California Grant Deed from Individual to Husband and Wife is as straightforward as 1-2-3.

Execute the payment. Use your credit card or PayPal account to finalize the registration process.

Obtain the template. Select the file format and download it to your device.

- Furthermore, the accuracy of each entry is confirmed by a team of qualified attorneys who consistently review the templates on our platform and refresh them in accordance with the latest state and county regulations.

- If you are already familiar with our system and possess a registered account, all you need to do to acquire the Irvine California Grant Deed from Individual to Husband and Wife is to Log In to your account and select the Download option.

- If you are utilizing US Legal Forms for the first time, simply adhere to the instructions below.

- Ensure you have located the sample you desire. Review its description and utilize the Preview option (if available) to inspect its content. If it does not meet your requirements, employ the Search feature located at the top of the page to find the required document.

- Validate your choice. Click the Buy now button. After that, choose your preferred pricing plan and provide the necessary information to create an account.

Form popularity

FAQ

The best tenancy for a married couple typically depends on their individual circumstances. Joint Tenancy offers survivorship benefits, which simplifies the transfer process if one spouse passes away. Alternatively, Community Property provides equal ownership and can also have tax advantages when it comes to inheritance. Evaluating these options carefully will help couples make informed decisions about their property and assets.

In California, married couples can hold title to property in several ways, such as Joint Tenancy or Community Property. Joint Tenancy allows for the right of survivorship, meaning the surviving spouse automatically inherits the property. Community Property, on the other hand, indicates that both spouses equally own all property acquired during the marriage. Understanding these options can be crucial when managing assets, especially when considering an Irvine California Grant Deed from Individual to Husband and Wife.

It is advisable for both husband and wife to be on the car title. This approach clarifies ownership and rights in case of any disputes. Including both names also simplifies the transfer of ownership, should either partner decide to sell the vehicle. Overall, it's a practical step for married couples to consider.

The best way to title a house for a married couple depends on their individual circumstances and preferences. Many couples prefer to use a community property title for its simplicity and shared ownership benefits, while others might choose joint tenancy for the right of survivorship. When preparing an Irvine California Grant Deed from Individual to Husband and Wife, it's important to consider future implications like estate planning and taxes. Utilizing platforms like US Legal Forms can help streamline the process and ensure you choose the best option.

Married couples in California typically hold title either as community property or as joint tenants. Community property offers equal ownership and includes any income earned during the marriage. Alternatively, holding title as joint tenants allows for the right of survivorship, meaning the property automatically transfers to the surviving spouse. For those considering an Irvine California Grant Deed from Individual to Husband and Wife, understanding these options is crucial for effective asset management.

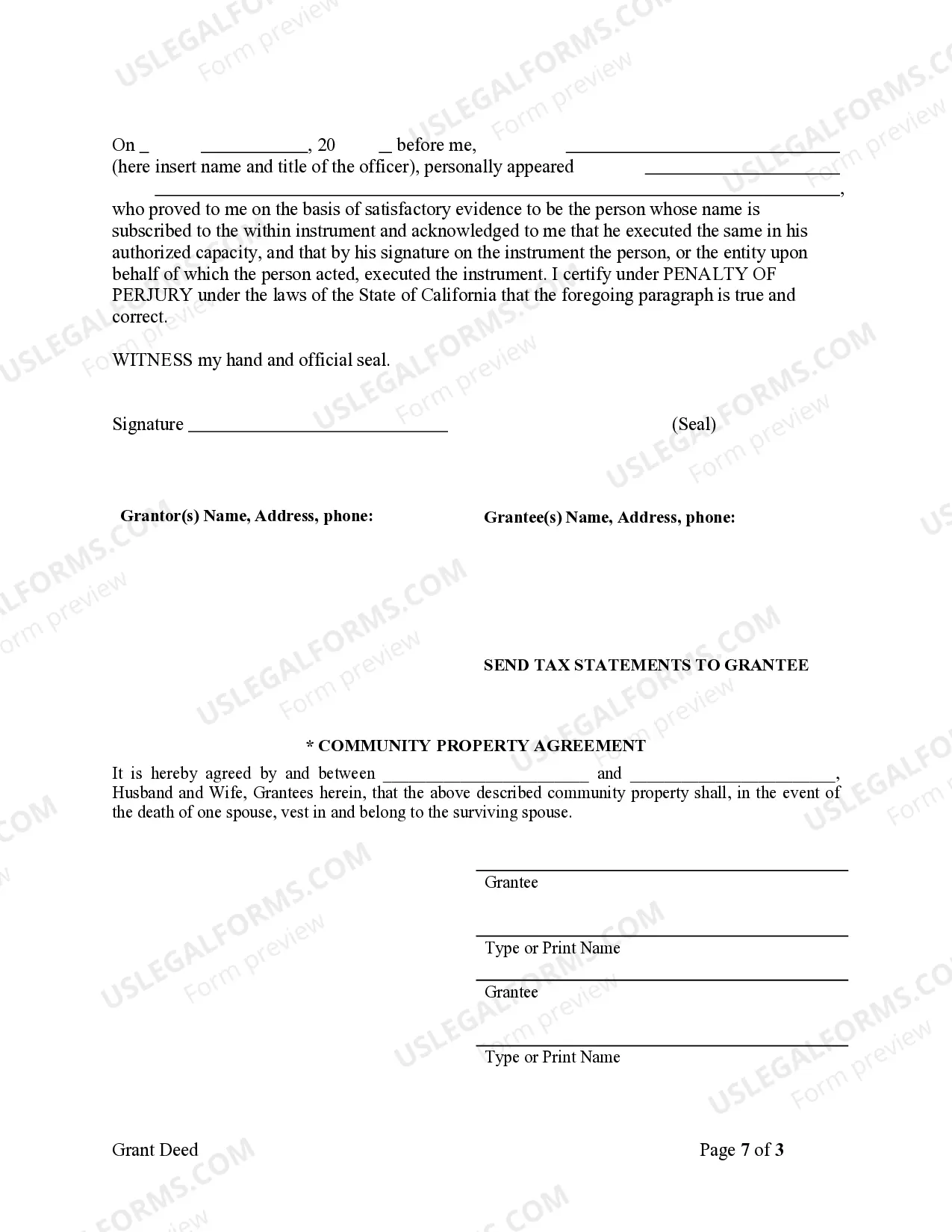

Removing a person from a grant deed involves drafting a new deed that names the remaining owners and excludes the individual you wish to remove. This action may require the original owner's consent, especially if they are a joint owner. After preparing the new deed, it must be signed and recorded with the appropriate county office. For those navigating this process, uslegalforms provides resources to assist you with creating an Irvine California Grant Deed from Individual to Husband and Wife that meets legal requirements.

To amend a grant deed in California, you typically need to create a new deed that reflects the changes you wish to make. This new deed should be properly executed, including all necessary signatures, and then recorded with the county where the property is located. Whether you're updating names or changing the property description, it’s crucial to follow the correct legal procedures to ensure the amendment is valid. Uslegalforms can help simplify this process by offering user-friendly templates for your Irvine California Grant Deed from Individual to Husband and Wife.

In California, a grant deed, including an Irvine California Grant Deed from Individual to Husband and Wife, can be revoked through a subsequent legal document called a revocation of grant deed. This document must be recorded with the county recorder’s office to effectively cancel the original deed. Additionally, it's important to ensure that all parties involved understand the implications of this revocation. For assistance in creating the revocation, consider using uslegalforms, which provides templates and guidance.

One potential disadvantage of a grant deed is that it may not provide as much protection against future claims compared to a warranty deed. If the property has hidden liens or other issues, you may have limited recourse. As you consider an Irvine California Grant Deed from Individual to Husband and Wife, be aware of these factors and consult resources like uslegalforms for guidance.

The effect of an interspousal transfer deed in California is to legally change the title of the property without a formal sale. This deed confirms the ownership interests of both spouses, which may simplify situations like divorce or estate planning. When creating an Irvine California Grant Deed from Individual to Husband and Wife, this tool provides clarity in property ownership.