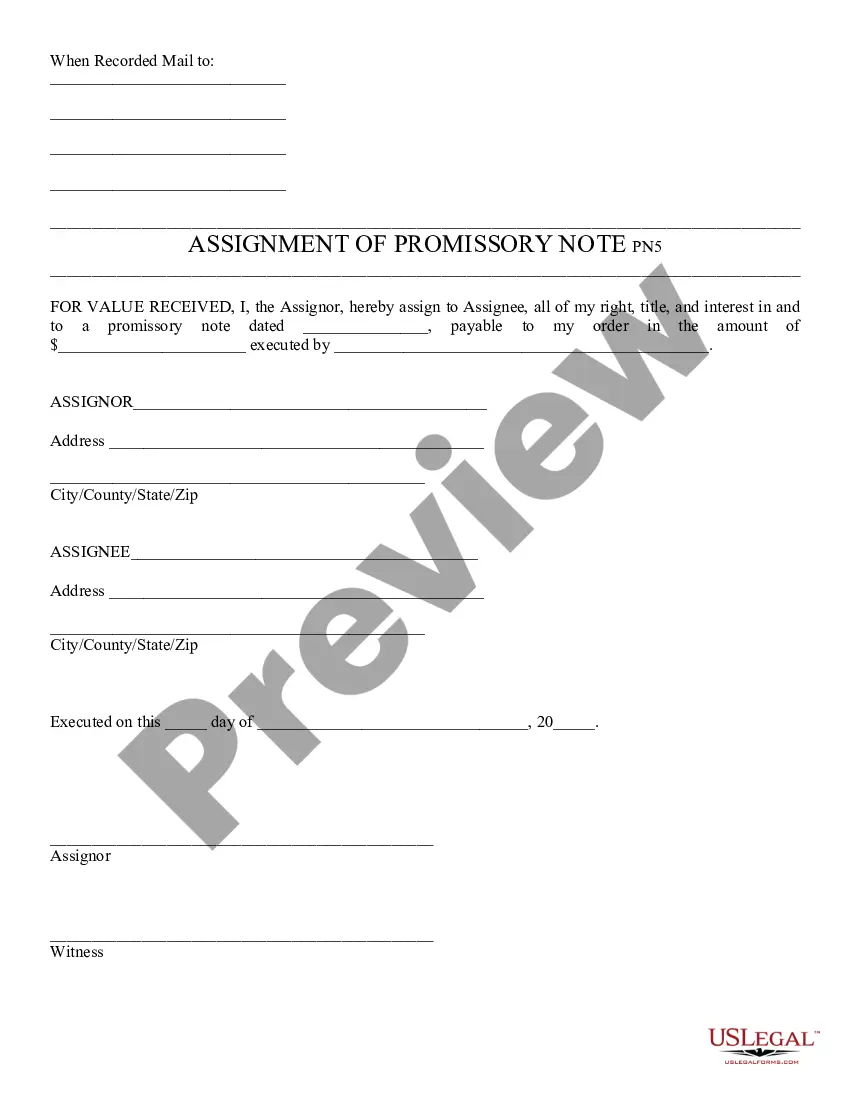

Assignment of Promissory Note - Arizona: This form gives any rights which a party may have had in a promissory note, over to another individual. Both the Assignee and the Assignor should sign this document in front of a Notary Public. It is available for download in both Word and Rich Text formats.

Tucson Arizona Assignment of Promissory Note

Description

How to fill out Arizona Assignment Of Promissory Note?

If you are looking for a suitable form template, it’s challenging to find a better location than the US Legal Forms site – likely the most extensive collections on the internet.

Here you can obtain numerous form examples for business and personal use by categories and regions, or keywords.

Utilizing our enhanced search feature, locating the latest Tucson Arizona Assignment of Promissory Note is as simple as 1-2-3.

Complete the transaction. Utilize your credit card or PayPal account to finalize the registration process.

Obtain the form. Choose the format and save it on your device.

- In addition, the validity of each document is verified by a group of professional lawyers that consistently review the templates on our platform and refresh them according to the latest state and county requirements.

- If you are already familiar with our system and possess a registered account, all you need to acquire the Tucson Arizona Assignment of Promissory Note is to Log In to your user account and click the Download option.

- If this is your first time using US Legal Forms, simply adhere to the instructions below.

- Ensure you have located the form you desire. Review its details and use the Preview feature (if accessible) to examine its content. If it doesn’t meet your requirements, use the Search field at the top of the page to find the necessary document.

- Validate your selection. Click the Buy now option. Subsequently, select your preferred pricing plan and provide information to register for an account.

Form popularity

FAQ

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

Because promissory notes are negotiable instruments, the basic promissory note is a negotiable promissory note. Therefore, if you, as payer, give a promissory note to someone who has given you a loan, that person can then turn around and transfer or assign the note to a third party.

That is, the lender can sell or assign the note to a third party who the borrower must then repay. However, a promissory note is never assignable by the borrower, without the express written consent and approval of the lender.

You can get your loan agreement notarized! A notary public signature acts as a third-party witness to your agreement. You're not required to notarize a promissory note, and your note can still be valid without it.

When the loan is evidenced by one Promissory Note, the Lender may not at a later date cause any additional notes to be issued. (1) The Lender may assign all or part of the guaranteed portion of the loan to one or more Holders by using the Assignment Guarantee Agreement.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

If you are the borrower, issue the promissory note to the institution or individual that needs it to obtain a loan for you. This should be done with an addendum stating the assignment of your rights or the completion of the assignment paperwork required by the lender.

There is no legal requirement for a promissory note to be witnessed or notarized in Arizona. Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

Under an assignment of loan, a lender (the assignor) assigns its rights relating to a loan agreement to a new lender (the assignee). Only the assignor's rights under the loan agreement are assigned. The assignor will still have to perform any obligations it has under the facility agreement.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.