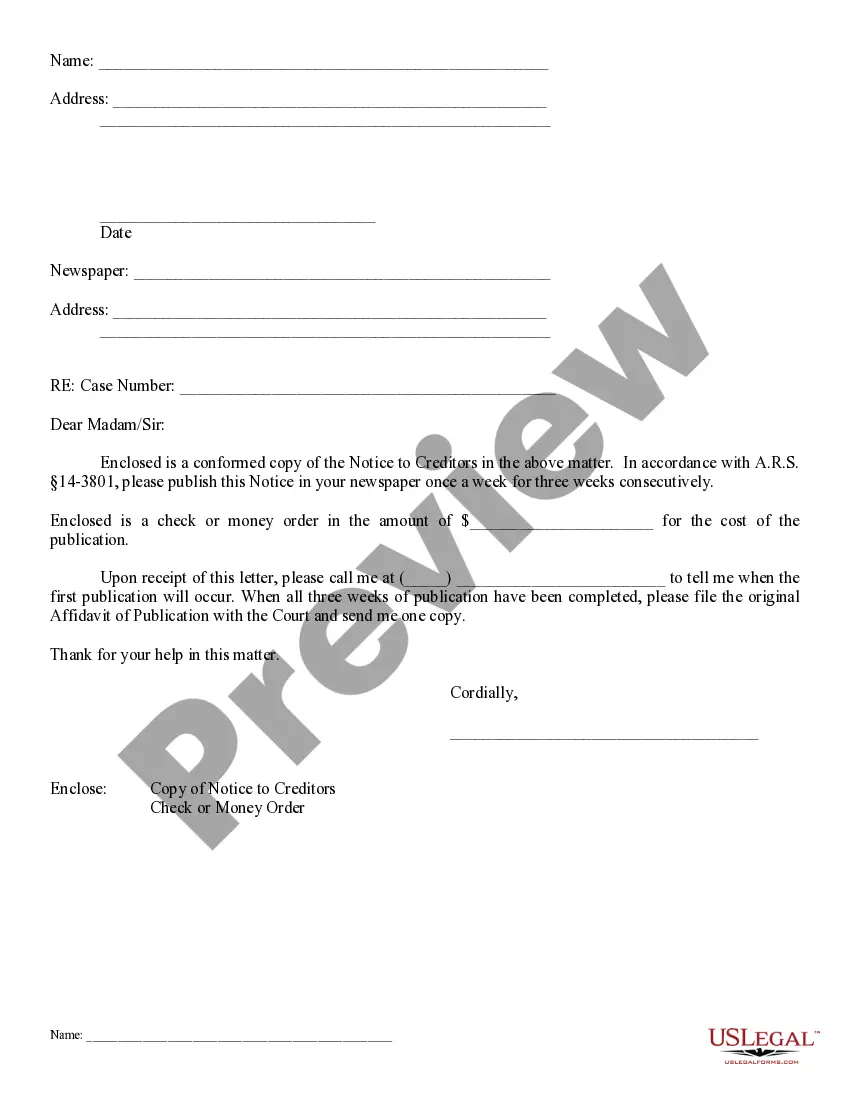

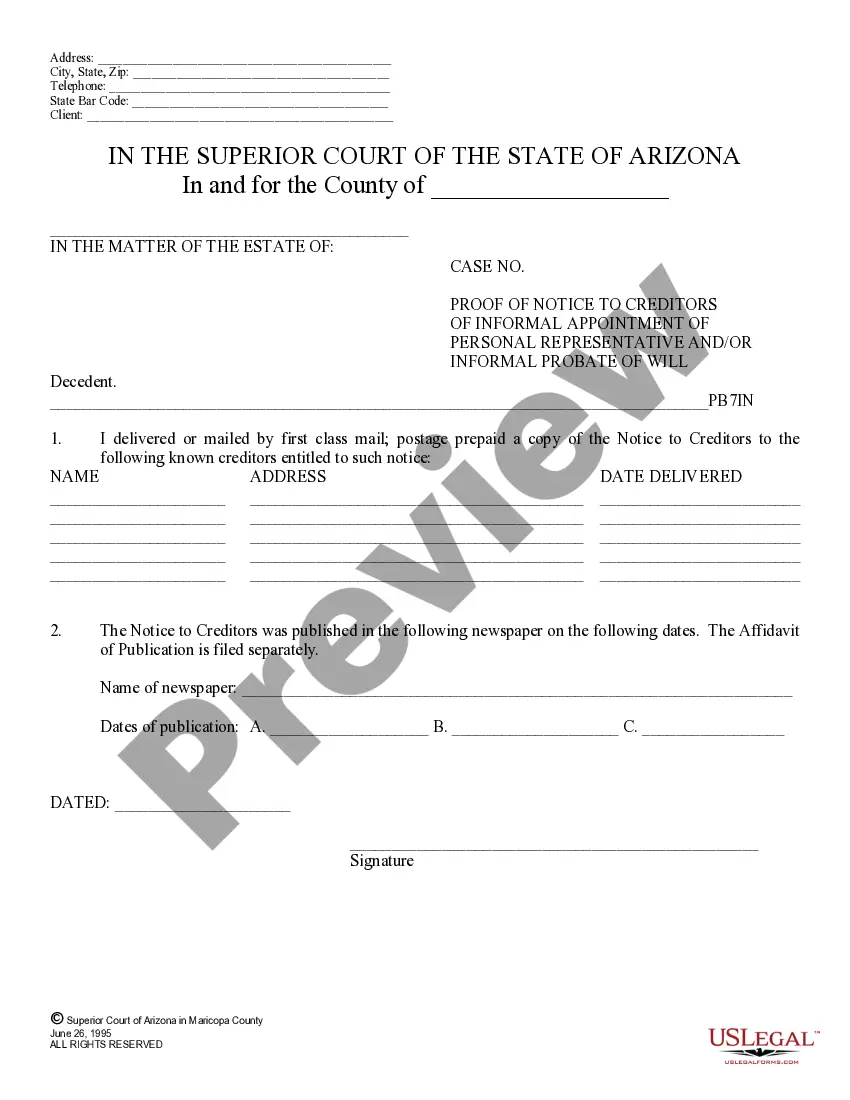

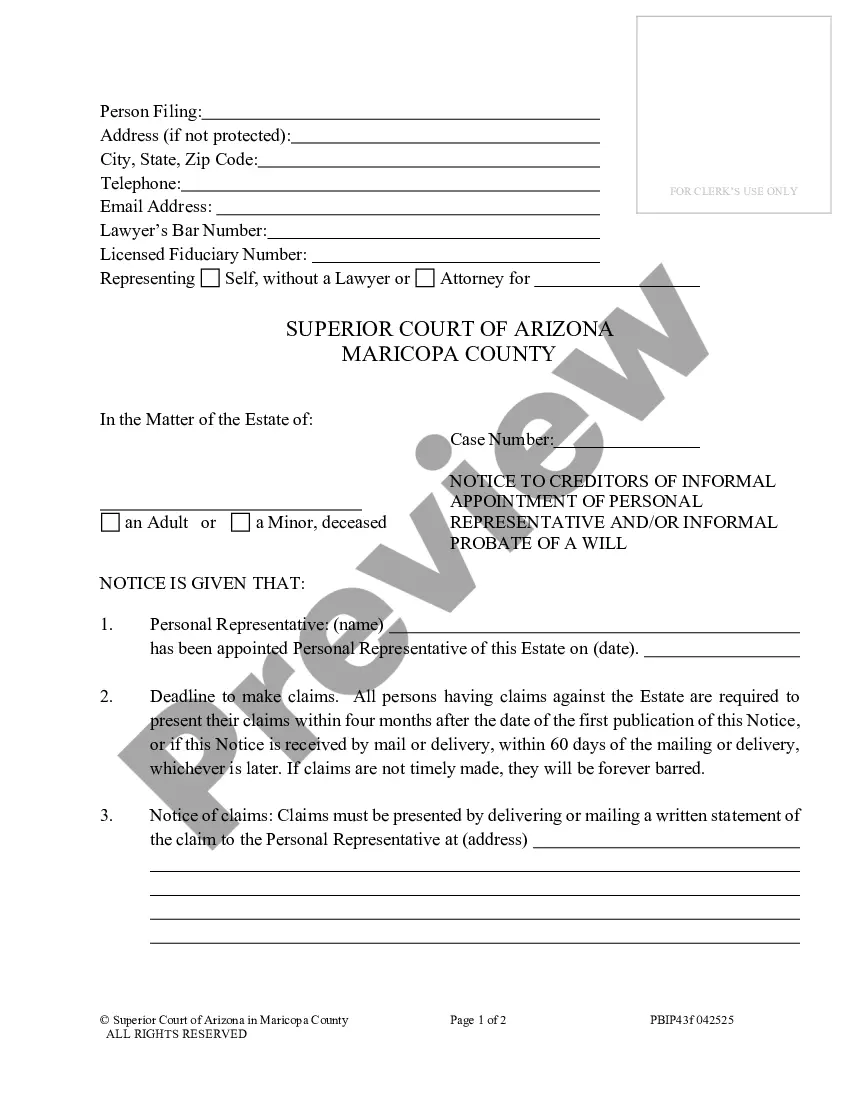

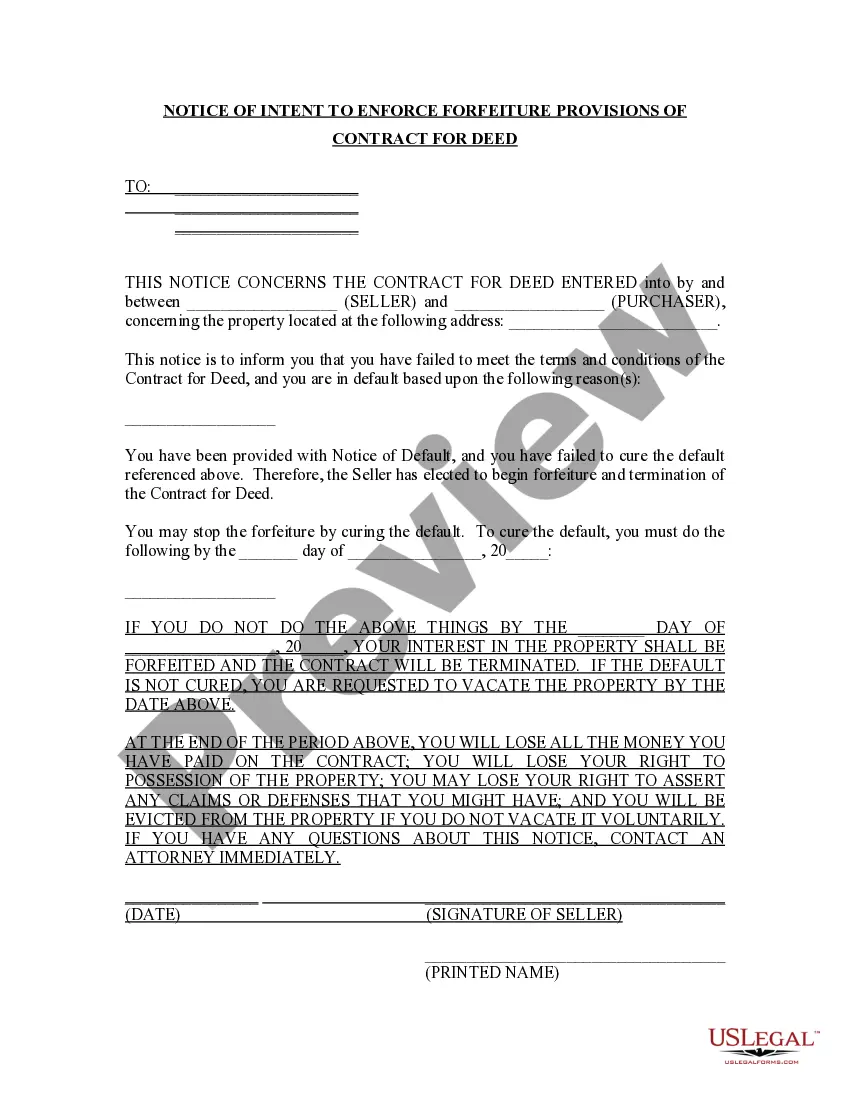

A Notice form provides legal notification to a party of an important aspect of a legal matter. Failure to provide proper notice is often the cause of delays in the progress of lawsuits and other legal matters. This model form, a Notice to Creditors in Probate - Arizona, provides notice of the stated matter. Because each case is unique, you will need to adapt the form to fit your specific facts and circumstances. Available for download now.

Tucson Arizona Notice to Creditors in Probate

Description

How to fill out Arizona Notice To Creditors In Probate?

Are you searching for a dependable and budget-friendly provider of legal forms to acquire the Tucson Arizona Notice to Creditors in Probate? US Legal Forms is your ideal solution.

Whether you need a straightforward agreement to establish rules for living with your partner or a collection of forms to facilitate your separation or divorce process through the court, we have you covered. Our platform offers over 85,000 current legal document templates for both personal and business needs. All templates we provide are not generic and are tailored to meet the requirements of specific states and regions.

To download the document, you must Log In to your account, find the necessary template, and click the Download button next to it. Please remember that you can access and download your previously purchased document templates at any time from the My documents tab.

Are you a newcomer to our site? No problem. You can create an account with great ease, but first, ensure to do the following.

Now you can set up your account. Next, choose the subscription plan and proceed to payment. Once the payment is finalized, download the Tucson Arizona Notice to Creditors in Probate in any available format. You can revisit the website anytime to redownload the form free of charge.

Obtaining current legal forms has never been simpler. Try US Legal Forms today and say goodbye to wasting your precious time searching for legal documents online once and for all.

- Check if the Tucson Arizona Notice to Creditors in Probate complies with the laws of your state and locality.

- Review the form’s specifics (if available) to understand who and what the form is designed for.

- Reinitiate the search if the template does not fit your particular situation.

Form popularity

FAQ

How Long Do You Have to File Probate After Death in Arizona? According to Arizona Code 14-3108, probate must be filed within two years of the person's death.

In the state of Arizona, probate is only required if the decedent has any assets that did not transfer automatically upon their death. These assets tend to be titled individually in the decedent's name and will require a probate court to transfer the title of ownership to the intended beneficiary.

How Long Do You Have to Make a Claim? Once a Grant of Probate or letters of administration have been issued, there is a deadline of six months during which you can lodge a claim against a deceased person's estate.

Remember, credit does not die and continues after the death of the debtor, meaning that creditors have a right to claim from the deceased's estate. Remember, the executor is obliged to pay all the estate's debts before distributing anything to their heirs or legatees of the deceased.

Executors must not unreasonably delay distributing the estate for their own gain or any other party. However, even after the executor's year, the court will not order a distribution of the estate if the executors can show there is good reason to wait.

For those claims, under ARS §14-3803(C)(2), the creditor must present a claim within four months after it arises or ?two years after the decedent's death plus the time remaining in the period commenced by an actual or published notice pursuant to § 14-3801, subsection A or B,? whichever is later.

Since every estate is different, the time it takes to settle the estate may also differ. Most times, an executor would take 8 to 12 months. But depending on the size and complexity of the estate, it may take up to 2 years or more to settle the estate.

A Personal Representative, or executor, has 365 days in which to administer the estate of the deceased and to distribute their assets to the Beneficiaries. As complex estates can take longer than a year to wind up, this isn't a strict deadline.

According to Arizona law (ARS14-3108), the executor of an estate has two years from the date of death to file probate. This timeframe can be extended under certain circumstances, such as if the deceased left behind minor children.