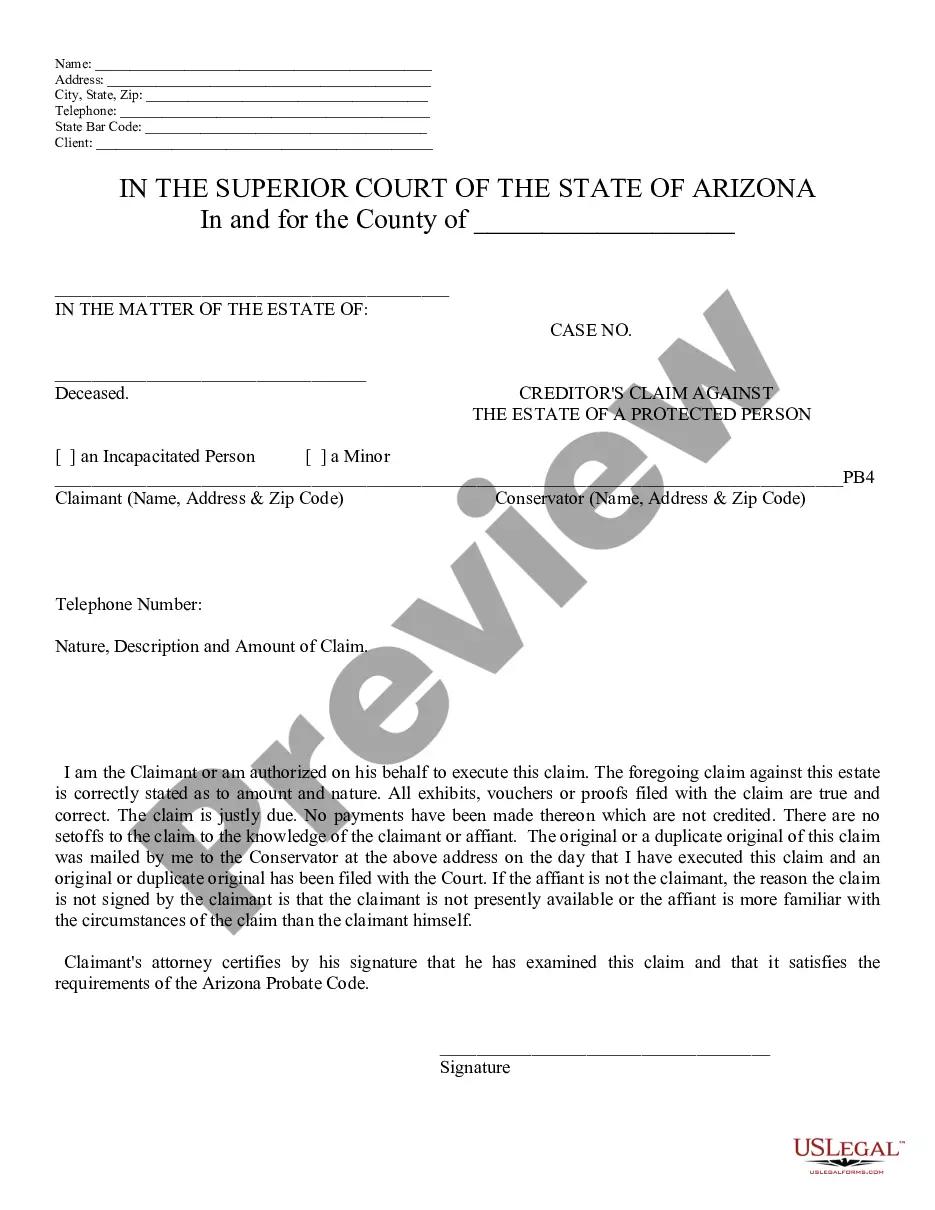

Creditors Claim in Probate - Arizona: This form is signed by a creditor, stating that he/she has a claim against the decedent's estate. The form further lists the claim, and the services performed for said claim. It is available for download in both Word and Rich Text formats.

Mesa Arizona Creditors Claim in Probate

Description

How to fill out Arizona Creditors Claim In Probate?

Take advantage of the US Legal Forms and receive instant access to any document you require.

Our user-friendly platform, featuring thousands of templates, enables you to locate and acquire nearly any document sample you need.

You can download, complete, and validate the Mesa Arizona Creditors Claim in Probate in mere minutes rather than spending hours searching online for a suitable template.

Utilizing our library is an excellent method to enhance the security of your document submission.

If you don’t have an account yet, follow the instructions outlined below.

- Our expert legal professionals routinely review all documents to verify that the templates are suitable for a specific state and adhere to new regulations and statutes.

- How do you obtain the Mesa Arizona Creditors Claim in Probate.

- If you currently hold a subscription, simply Log In to your account.

- The Download button will be activated for all samples you view.

- Additionally, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

Remember, credit does not die and continues after the death of the debtor, meaning that creditors have a right to claim from the deceased's estate. Remember, the executor is obliged to pay all the estate's debts before distributing anything to their heirs or legatees of the deceased.

§6502(a)(1). This provision says that the IRS can collect the unpaid tax by either levy or by a court proceeding begun within 10 years after the tax is assessed. The ability of the IRS to collect unpaid tax from a decedent's estate and the application of the 10-year statute was at issue in a recent case.

In the state of Arizona, probate is only required if the decedent has any assets that did not transfer automatically upon their death. These assets tend to be titled individually in the decedent's name and will require a probate court to transfer the title of ownership to the intended beneficiary.

How Long Do You Have to Make a Claim? Once a Grant of Probate or letters of administration have been issued, there is a deadline of six months during which you can lodge a claim against a deceased person's estate.

Section 28A-19-1 - Manner of presentation of claims (a) A claim against a decedent's estate must be in writing and state the amount or item claimed, or other relief sought, the basis for the claim, and the name and address of the claimant; and must be presented by one of the following methods: (1) By delivery in person

When someone dies, their beneficiaries have up to two years to open probate. Once probate is opened, there aren't any time limits that will cause the case to expire.

How Long Do You Have to Make a Claim? Once a Grant of Probate or letters of administration have been issued, there is a deadline of six months during which you can lodge a claim against a deceased person's estate.

Contact the County Probate Court To find out if an estate is in probate, you can check with the county probate court. Probate proceedings are public, so there aren't any privacy laws that would prevent you from contacting the court for information.

How Long Do You Have to File Probate After Death in Arizona? According to Arizona Code 14-3108, probate must be filed within two years of the person's death.

For those claims, under ARS §14-3803(C)(2), the creditor must present a claim within four months after it arises or ?two years after the decedent's death plus the time remaining in the period commenced by an actual or published notice pursuant to § 14-3801, subsection A or B,? whichever is later.