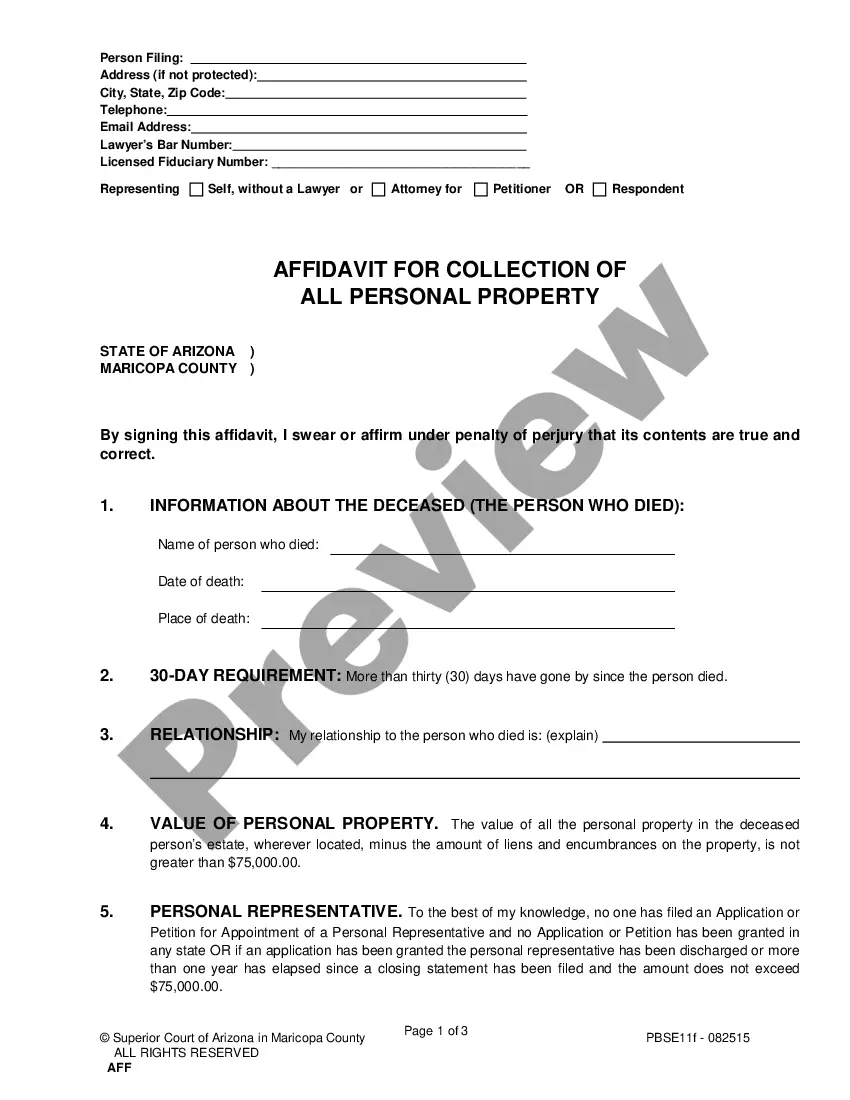

An Affidavit is a sworn, written statement of facts, signed by the 'affiant' (the person making the statement) before a notary public or other official witness. The affiant swears to the truth and accuracy of the statement contained in the affidavit. This document, a Non-Probate Affidavit for Collection of Personal Property of Decedent , is a model affidavit for recording the type of information stated. It must be signed before a notary, who must sign and stamp the document. Adapt the text to fit your facts. Available for download now in standard format(s).

Surprise Arizona Nonprobate Affidavit for Collection of Personal Property of Decedent

Description

How to fill out Arizona Nonprobate Affidavit For Collection Of Personal Property Of Decedent?

Utilize the US Legal Forms and gain immediate access to any document you need.

Our helpful site with a vast array of document templates streamlines the way to find and acquire almost any document sample you need.

You can save, complete, and certify the Surprise Arizona Nonprobate Affidavit for Collection of Personal Property of Decedent in just a few minutes instead of spending numerous hours online searching for a suitable template.

Employing our collection is an excellent approach to enhance the security of your form submissions. Our experienced attorneys routinely examine all documents to ensure that the forms are applicable for a specific state and comply with updated laws and regulations.

US Legal Forms is likely one of the largest and most reliable document repositories online. We are here to assist you with nearly any legal process, even if it's merely downloading the Surprise Arizona Nonprobate Affidavit for Collection of Personal Property of Decedent.

Feel free to take advantage of our form catalog and make your document experience as efficient as possible!

- How can you acquire the Surprise Arizona Nonprobate Affidavit for Collection of Personal Property of Decedent.

- If you already hold a subscription, simply Log In to your account. The Download option will be visible on all the documents you access. Additionally, you can locate all previously saved documents under the My documents menu.

- If you haven't created an account yet, follow the steps below.

- Locate the template you need. Ensure that it is the template you were after: confirm its title and description, and take advantage of the Preview feature if it is accessible. Otherwise, use the Search bar to find the right one.

- Initiate the saving process. Click Buy Now and choose your preferred pricing plan. Then, set up an account and make payment using a credit card or PayPal.

- Download the document. Choose the format to obtain the Surprise Arizona Nonprobate Affidavit for Collection of Personal Property of Decedent and edit and fill it out, or sign it according to your needs.

Form popularity

FAQ

In Arizona, an affidavit of property value may be necessary when you are gathering a decedent's assets, especially when preparing the Surprise Arizona Nonprobate Affidavit for Collection of Personal Property of Decedent. This affidavit helps establish the value of the property to be collected, ensuring a smooth transfer. It is wise to consult legal resources to understand your specific situation and requirements.

The approval time for a small estate affidavit can vary, typically taking a few days to a few weeks, depending on the state and the complexity of the estate. It's a straightforward process, often requiring just the necessary documentation and signatures. Knowing how this process works is beneficial, particularly when comparing it to the Surprise Arizona Nonprobate Affidavit for Collection of Personal Property of Decedent, which also aims to expedite asset distribution.

The small estate process in New York allows heirs to collect a decedent's property without lengthy probate proceedings when the estate is under $50,000. Heirs can utilize a small estate affidavit to affirm their rights to assets, making it a smoother experience. By understanding how this process parallels the Surprise Arizona Nonprobate Affidavit for Collection of Personal Property of Decedent, you can make informed decisions for asset collection.

In New York, the threshold for a small estate affidavit is currently set at $50,000. This means that if a decedent's total assets fall below this amount, heirs can use the small estate affidavit to facilitate the collection of property. This process aligns with the principles that define the Surprise Arizona Nonprobate Affidavit for Collection of Personal Property of Decedent, where fast and efficient collection is key.

A small estate generally refers to a decedent's estate that meets specific criteria and can be settled without formal probate proceedings. In contrast, a probate estate is one that requires judicial intervention to distribute assets. Understanding these differences is essential, as the Surprise Arizona Nonprobate Affidavit for Collection of Personal Property of Decedent can help expedite the process for small estates.

In Kansas, a small estate affidavit does not typically need to be filed with the court unless disputes arise. This process allows heirs to collect a decedent's property directly, saving time and legal fees. Utilizing the Surprise Arizona Nonprobate Affidavit for Collection of Personal Property of Decedent can further streamline the transfer of assets without court intervention.

In Arizona, an affidavit of heirship serves as a legal document that establishes the identity of heirs after a person's death. This form simplifies the process of distributing property when no formal probate is required. It is crucial in creating a clear pathway for heirs to collect the personal property of a decedent, especially in cases involving the Surprise Arizona Nonprobate Affidavit for Collection of Personal Property of Decedent.

Arizona assesses property value based on factors such as market conditions, property size, and improvements made to the property. Local assessors evaluate these elements to determine the assessed value, which impacts property taxes. Understanding this process can help property owners, especially in the context of the Surprise Arizona Nonprobate Affidavit for Collection of Personal Property of Decedent, as accurate assessments can influence the estate's financial obligations. Utilizing platforms like uslegalforms can aid in navigating property assessments effectively.

In Arizona, seniors aged 65 and older may qualify for property tax exemptions or reductions, but they do not automatically stop paying property taxes. Instead, seniors can apply for programs such as the Senior Property Valuation Protection program to reduce their taxable value. Thus, it's essential for qualified seniors to explore ways to lessen their financial responsibilities related to property taxes. For those needing assistance, resources like uslegalforms can provide guidance on eligibility and applications.

An Affidavit of fact for real property is a legal document that provides a sworn statement regarding the ownership or condition of a property. In the context of Surprise Arizona Nonprobate Affidavit for Collection of Personal Property of Decedent, this affidavit plays a crucial role in establishing claims to inherited assets. It serves as evidence and can help simplify the transfer process of personal property after someone has passed away. Using this type of affidavit can expedite settling an estate and reduce complications.