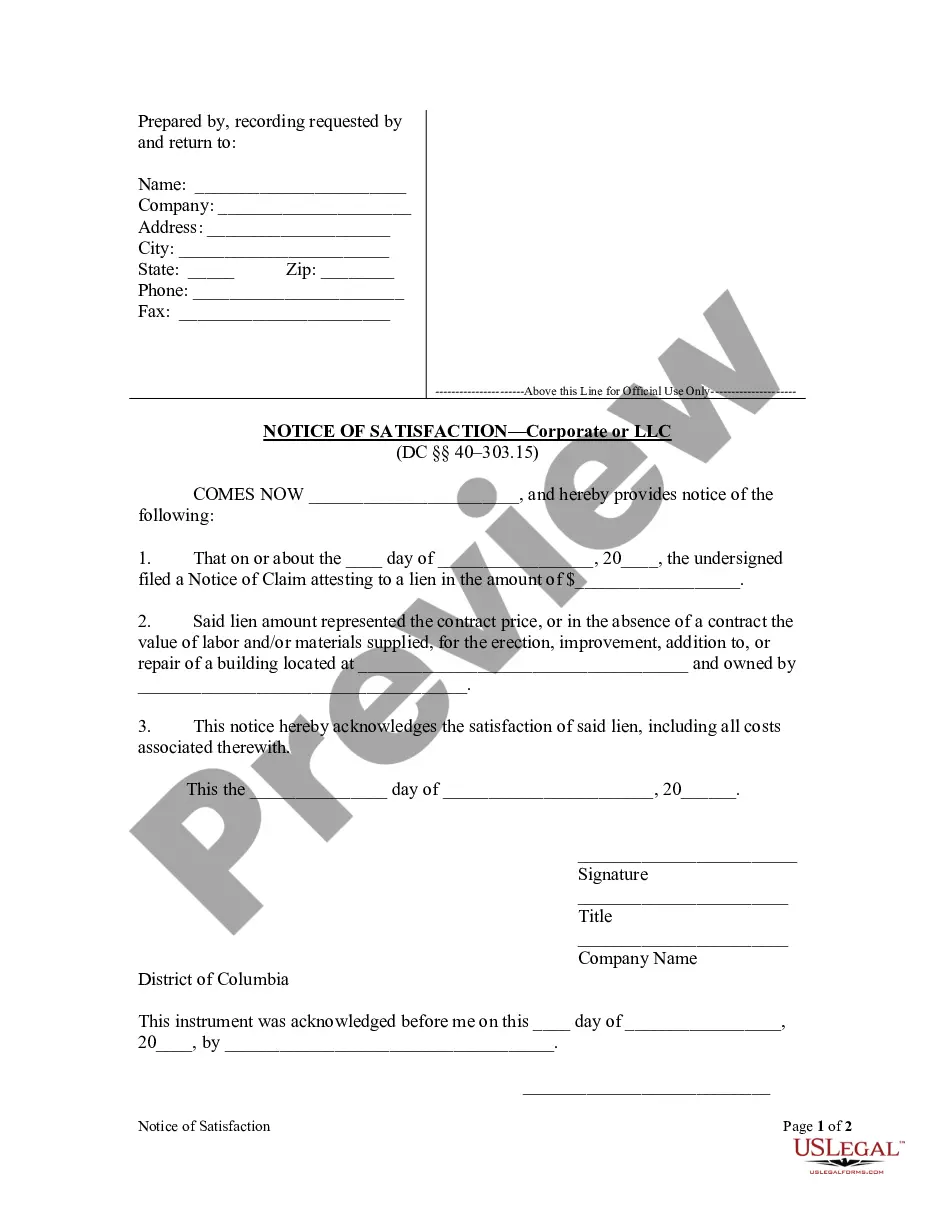

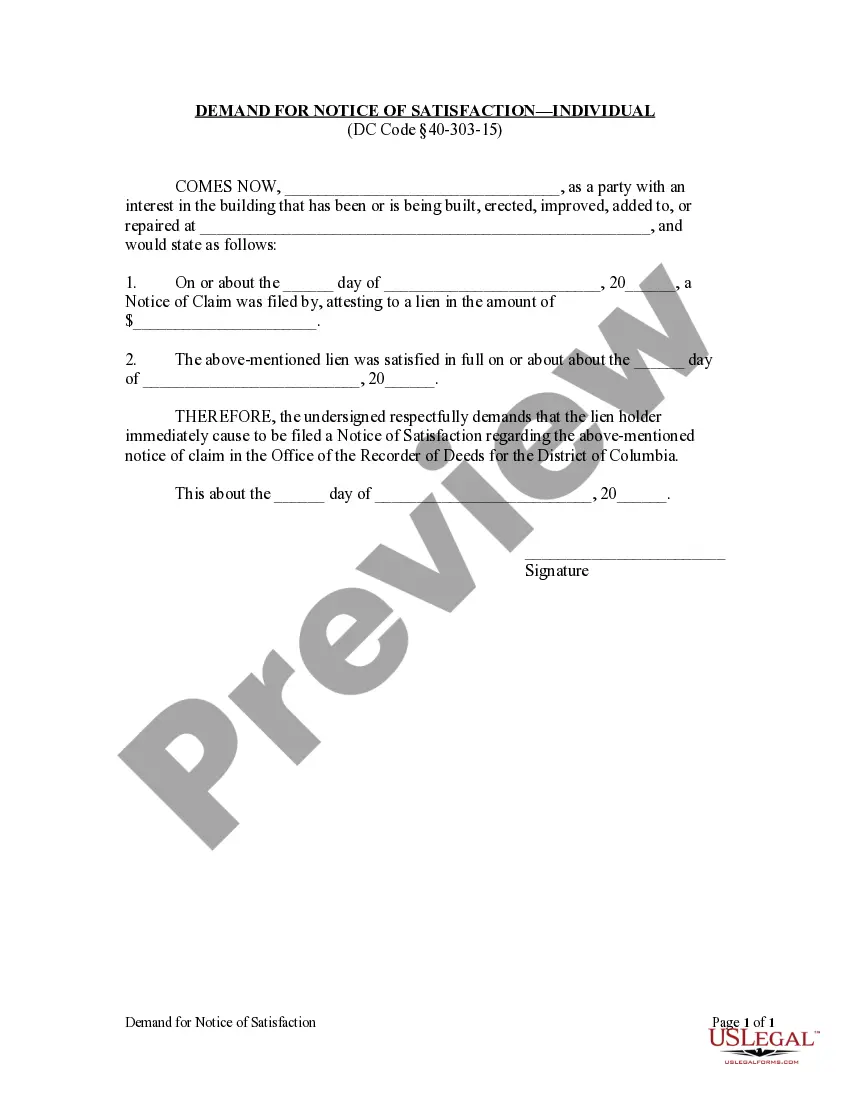

This form is used by a corporate party who has an interest in property under lien to demand that the lienholder file a Notice of Satisfaction.

District of Columbia Demand for Notice of Satisfaction by Corporation

Description

How to fill out District Of Columbia Demand For Notice Of Satisfaction By Corporation?

The greater the number of documents you need to prepare - the more anxious you become.

You can locate numerous District of Columbia Demand for Notice of Satisfaction by Corporation or LLC forms online, however, you are uncertain which ones to trust.

Simplify the process and make obtaining templates more convenient with US Legal Forms. Acquire accurately composed forms that are designed to comply with the state regulations.

Enter the required information to set up your profile and settle your order using PayPal or credit card. Choose a preferred document format and download your sample. Locate all documents you obtain in the My documents section. Simply visit there to create a new copy of your District of Columbia Demand for Notice of Satisfaction by Corporation or LLC. Even when using expertly crafted templates, it’s still vital to consider consulting a local attorney to verify completed samples to ensure your document is accurately filled out. Achieve more for less with US Legal Forms!

- If you currently possess a US Legal Forms subscription, Log In to your account, and you will find the Download button on the District of Columbia Demand for Notice of Satisfaction by Corporation or LLC’s page.

- If you haven't used our website before, complete the registration process with these steps.

- Ensure the District of Columbia Demand for Notice of Satisfaction by Corporation or LLC is applicable in your residing state.

- Verify your choice by reading the description or by using the Preview mode if available for the chosen document.

- Click Purchase Now to initiate the registration process and select a pricing plan that meets your needs.

Form popularity

FAQ

DC 30 is the general corporate franchise tax return form, while DC 65 is specific to unincorporated businesses and partnerships. Understanding the scope of each form helps ensure you file correctly based on your business structure. Both forms interrelate with the District of Columbia Demand for Notice of Satisfaction by Corporation, highlighting the importance of filing the correct documentation.

Any corporation doing business or registered in the District of Columbia is required to file a DC franchise tax return. This includes corporations that earn income, have in-state assets, or maintain a physical presence in DC. The District of Columbia Demand for Notice of Satisfaction by Corporation is particularly important for ensuring adherence to these tax obligations.

Form 1120 is the IRS extension form used by corporations to apply for additional time to file their annual income tax returns. Filing this form grants a six-month extension, ensuring that corporations can thoroughly prepare their financial documents. When addressing the District of Columbia Demand for Notice of Satisfaction by Corporation, be diligent about ensuring all documents are aligned with both federal and local regulations.

To file an extension for your corporate tax return in DC, you need to complete the specific extension form and send it to the Department of Revenue before the original tax due date. Properly filing the extension ensures you avoid late fees while preparing an accurate tax return. Utilize the District of Columbia Demand for Notice of Satisfaction by Corporation to affirm your status as you manage this process.

Yes, the District of Columbia requires corporations to file an annual report to maintain good standing. This report includes essential information about the corporation's activities and finances. Incorporating the District of Columbia Demand for Notice of Satisfaction by Corporation into your annual filing can help demonstrate your commitment to regulatory compliance.

To request an extension for DC taxes, you typically need to fill out the appropriate extension form, which can be found on the DC Department of Revenue's website. You must submit the form before the original due date of your tax return. By using the District of Columbia Demand for Notice of Satisfaction by Corporation, you can confirm your compliance and alleviate concerns about potential penalties.

The DC corporate tax extension form is used by corporations operating in the District of Columbia to request additional time to file their corporate income tax returns. This form allows businesses to extend their filing deadline while still complying with tax regulations. To effectively utilize the District of Columbia Demand for Notice of Satisfaction by Corporation, ensure you submit this form timely to avoid late penalties.

Process generally refers to the overall legal proceedings, while service of process specifically denotes how legal documents are delivered to parties involved. Understanding this distinction is important when addressing legal matters in the District of Columbia, particularly concerning the Demand for Notice of Satisfaction by Corporation. For clarity and efficiency, using US Legal Forms can provide the precise documents and support you need.

Yes, the District of Columbia accepts federal extensions for corporations, allowing them additional time to meet their legal obligations. This can be particularly beneficial when dealing with complex issues like the District of Columbia Demand for Notice of Satisfaction by Corporation. Understanding the process and utilizing tools like US Legal Forms can help ensure compliance and avoid potential pitfalls.

The process service department is typically a section within a government or private organization responsible for serving legal papers. This department ensures that all legal documents are delivered in compliance with the law, protecting the integrity of judicial processes. If you need assistance related to the District of Columbia Demand for Notice of Satisfaction by Corporation, consider using services provided by US Legal Forms to navigate the requirements smoothly.