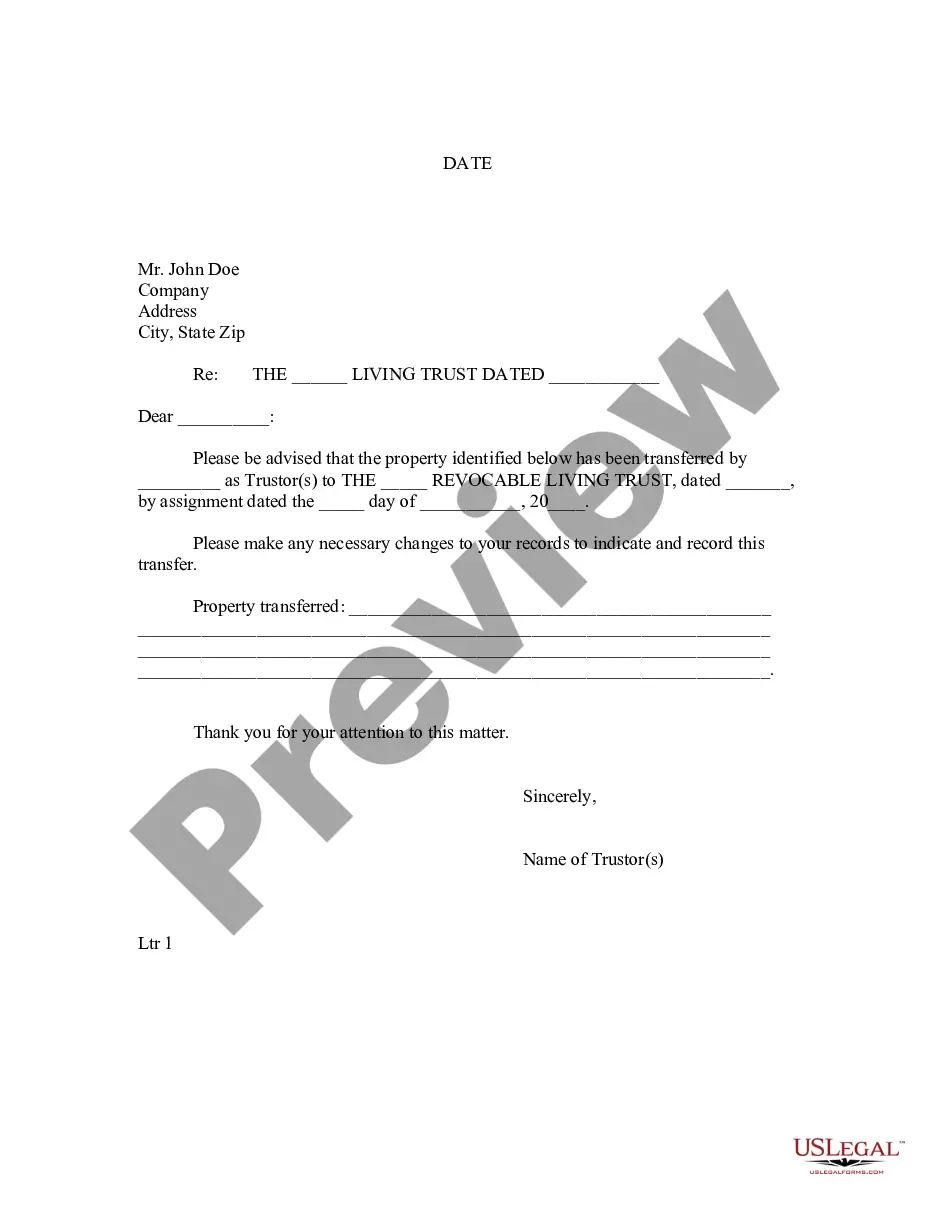

This Letter to Lienholder to Notify of Trust form is a letter notice to a lienholder to notify the lienholder that property has been transferred to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trustor would use this form to specify what specific property was being held by the trust.

Tucson Arizona Letter to Lienholder to Notify of Trust

Description

How to fill out Arizona Letter To Lienholder To Notify Of Trust?

Regardless of one's social or professional position, completing legal documents is an unfortunate requirement in the current professional landscape.

Frequently, it's nearly impossible for an individual without any legal expertise to create such documentation from the ground up, primarily due to the intricate terminology and legal subtleties they entail.

This is where US Legal Forms steps in to assist.

Verify that the document you have selected is tailored to your area since the regulations of one state or locality do not apply to another.

Preview the document and read a brief synopsis (if available) of situations the form can be utilized for.

- Our service provides an extensive repository with more than 85,000 ready-to-use state-specific documents suitable for nearly any legal circumstance.

- US Legal Forms also serves as a valuable tool for associates or legal advisors looking to save time by utilizing our DIY documents.

- Whether you need the Tucson Arizona Letter to Lienholder to Notify of Trust or any other form that will be acceptable in your state or region, with US Legal Forms, everything is readily accessible.

- Here’s how to quickly obtain the Tucson Arizona Letter to Lienholder to Notify of Trust using our dependable service.

- If you are an existing customer, proceed to Log In to your account to access the relevant document.

- However, if you are new to our collection, make sure to follow these instructions before securing the Tucson Arizona Letter to Lienholder to Notify of Trust.

Form popularity

FAQ

To release a lien, the lien holder must sign and date two (2) release of lien forms. Mail one (1), signed and dated, copy of a lien release to the Oklahoma Tax Commission, P.O. Box 269061 Oklahoma City, Ok 73126, and one (1), signed and dated, copy of the lien release to the debtor.

What should I do? The seller must work with the lender to have the lien electronically released, and then the seller can use the Title Transfer Bill of Sale form (#38-1306) to sign over the vehicle to the buyer.

Be sure to include the following pieces of information in your lien: The name, company name and address (including county) of the property owner against whom your lien is filed; the same information about the delinquent client, if different; the beginning and ending dates of the unpaid service; the due date for payment

Lien release letters should have a conspicuous title such as ?Release of Lien? at the top of the page. The first paragraph should list the date the lien was placed on the property and the names and addresses of both the lienholder and the owner of the property.

Arizona is a title holding state. If you are purchasing the vehicle on payments, the seller should record the lien on the title, and then hold the title until you have paid off the loan. Once the loan is paid in full, the seller will endorse the lien release on the front of the title and mail the title to you.

O If the lienholder is an individual, a notice of release (lien release section of DOR-4809) must be completed, signed, and notarized. An estate executor may release the lien by submitting the above with an original or certified copy of the probate court order. information is legible.

General Lien Release Mail, email or fax a request for a Release of Lien form to the Federal Deposit Insurance Corporation's Division of Resolutions and Receiverships, or DRR. This written request must be clear and detailed. Kentucky residents must mail or fax the DRR Customer Service Center In Schaumburg, Illinois.

When you buy a vehicle, Arizona law requires that you apply for a title within 15 days of purchase or a penalty may be assessed.

Lienholders hold the title until the lien is satisfied. The vehicle owner must hold a valid registration. All title transactions, including new, transfer, duplicate and corrected, that indicate a lien are processed in the usual manner.