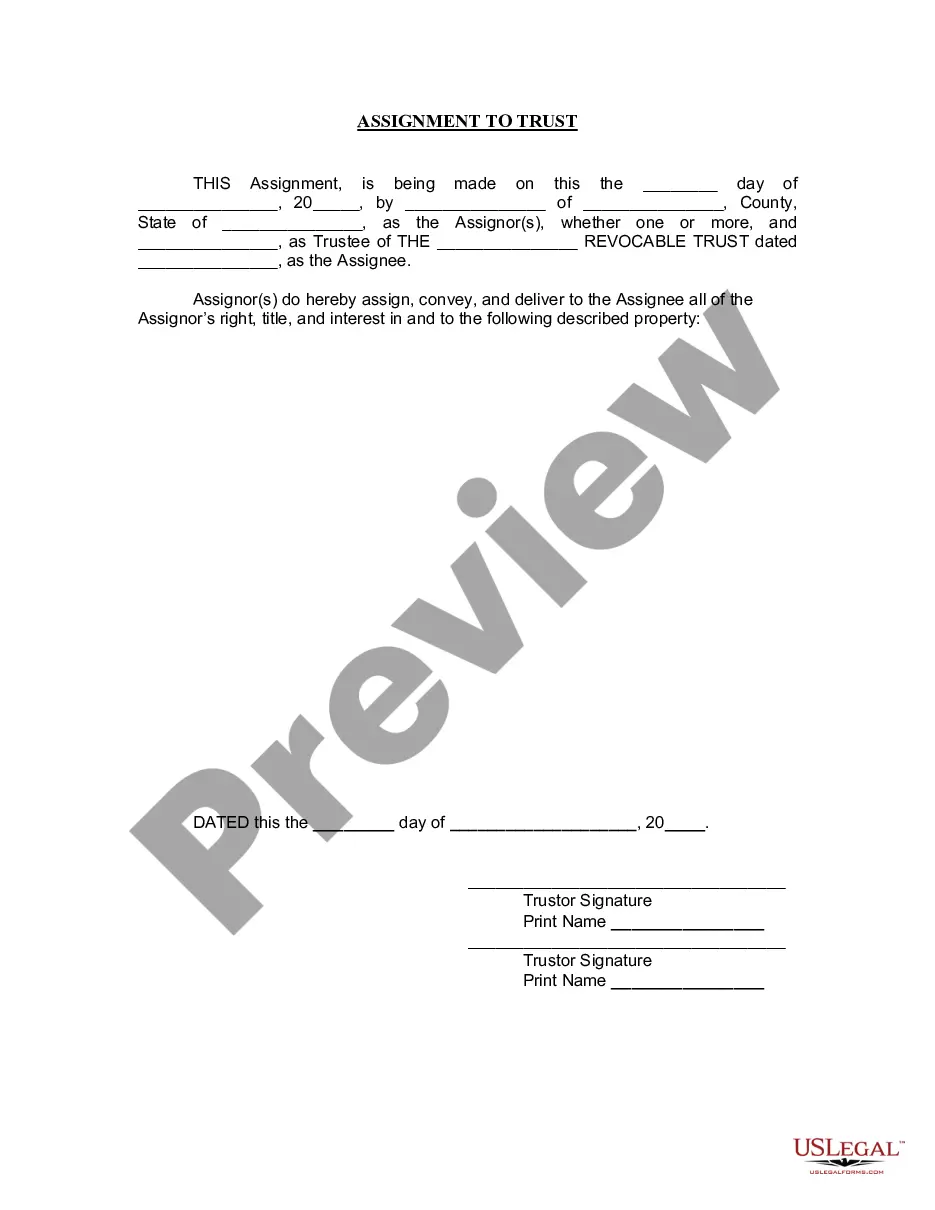

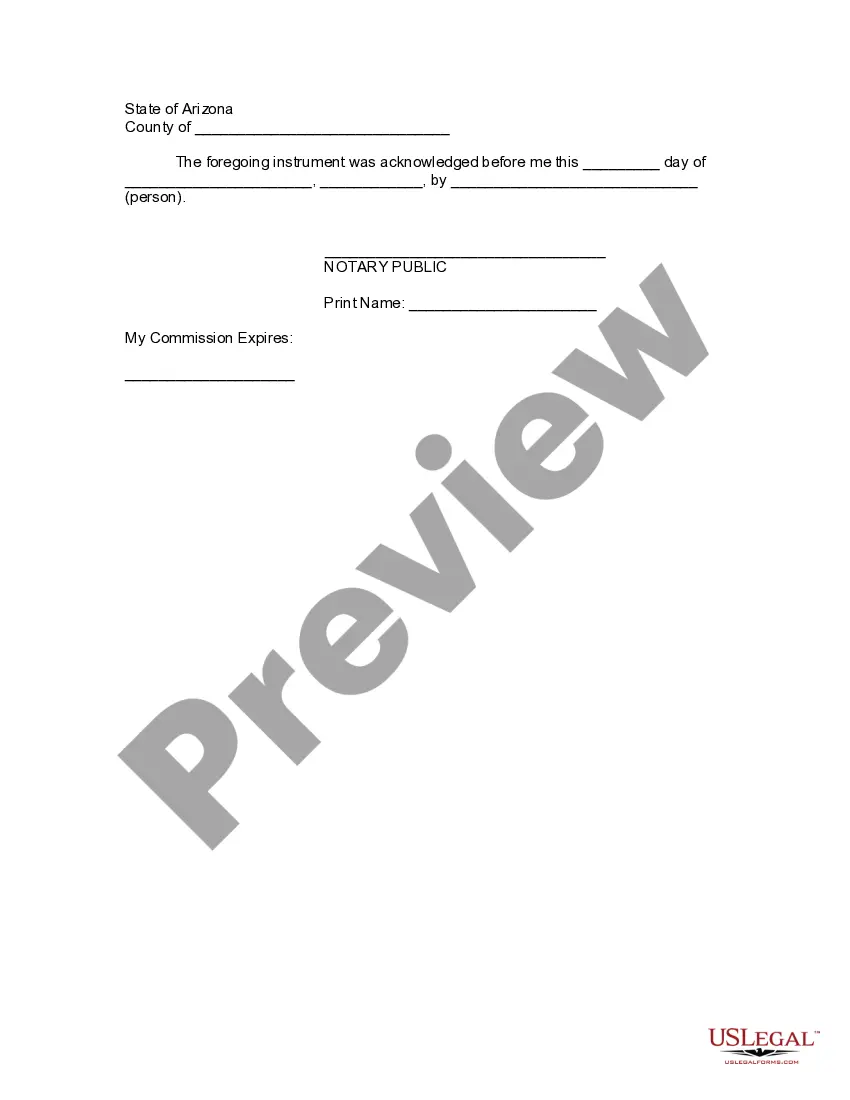

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Tucson Arizona Assignment to Living Trust

Description

How to fill out Arizona Assignment To Living Trust?

If you are looking for an authentic document, there’s no more suitable platform than the US Legal Forms site – likely the most extensive libraries available online.

Here you can find numerous sample forms for business and personal use categorized by types and regions, or keywords.

With our enhanced search feature, locating the latest Tucson Arizona Assignment to Living Trust is as simple as 1-2-3.

Complete the payment. Utilize your credit card or PayPal account to finalize the registration process.

Obtain the document. Specify the file format and save it to your device.

- Moreover, the accuracy of every document is verified by a group of professional attorneys who routinely assess the templates on our site and update them according to the newest state and county requirements.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Tucson Arizona Assignment to Living Trust is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the guidance below.

- Ensure you have located the sample you need. Review its description and utilize the Preview function to view its contents. If it doesn’t meet your needs, use the Search option located at the top of the screen to discover the suitable document.

- Validate your choice. Click the Buy now button. Then, select your desired pricing plan and enter your details to create an account.

Form popularity

FAQ

The beneficiary can (where there is one beneficiary or if there are several beneficiaries and all of them agree) direct the trustee to transfer the trust property to him (if there are several beneficiaries to all of them) or to such other person as the beneficiary (or the beneficiaries may desire).

What Is a Revocable Living Trust in Arizona? A revocable living trust in Arizona is a living trust that can be changed or canceled as long as the Grantor is alive. They help to avoid probate (which can be expensive and can take a long period of time) while giving you control of your assets while you're still living.

In Arizona, the average cost for a living trust is around $1,500. However, this price may vary depending on the location and size of the trust. For example, trusts in major metropolitan areas may be more expensive than those in rural areas. Smaller trusts may also cost less than larger ones.

The Cons. While there are many benefits to putting your home in a trust, there are also a few disadvantages. For one, establishing a trust is time-consuming and can be expensive. The person establishing the trust must file additional legal paperwork and pay corresponding legal fees.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

The new Arizona Trust Code requires the trustee to provide to the trust's beneficiaries an annual report of trust property, including trust liabilities, receipts, disbursements, a list of trust assets and, if feasible, the fair market value of the trust assets.

Living trusts do not shelter your assets from Medicaid eligibility spend down laws. To create a living trust in Arizona you need to create a trust document that lays out all the details of your trust and names the trustee and beneficiaries.

Real Estate ? Real estate which is to be transferred into a trust must be conveyed in an Arizona Deed. The document must be signed by all parties in front of a Notary Public and filed with the County Recorder's Office.

As such, Arizona trustees must provide every trust beneficiary with notice, if the trust became irrevocable when the trustor died. Also, where there is a Will, the trustee must file it with the Superior Court in the trustor's home county.

To create a living trust in Arizona you need to create a trust document that lays out all the details of your trust and names the trustee and beneficiaries. You will sign the document in front of a notary. To complete the process, you fund the trust by transferring the ownership of assets to the trust entity.