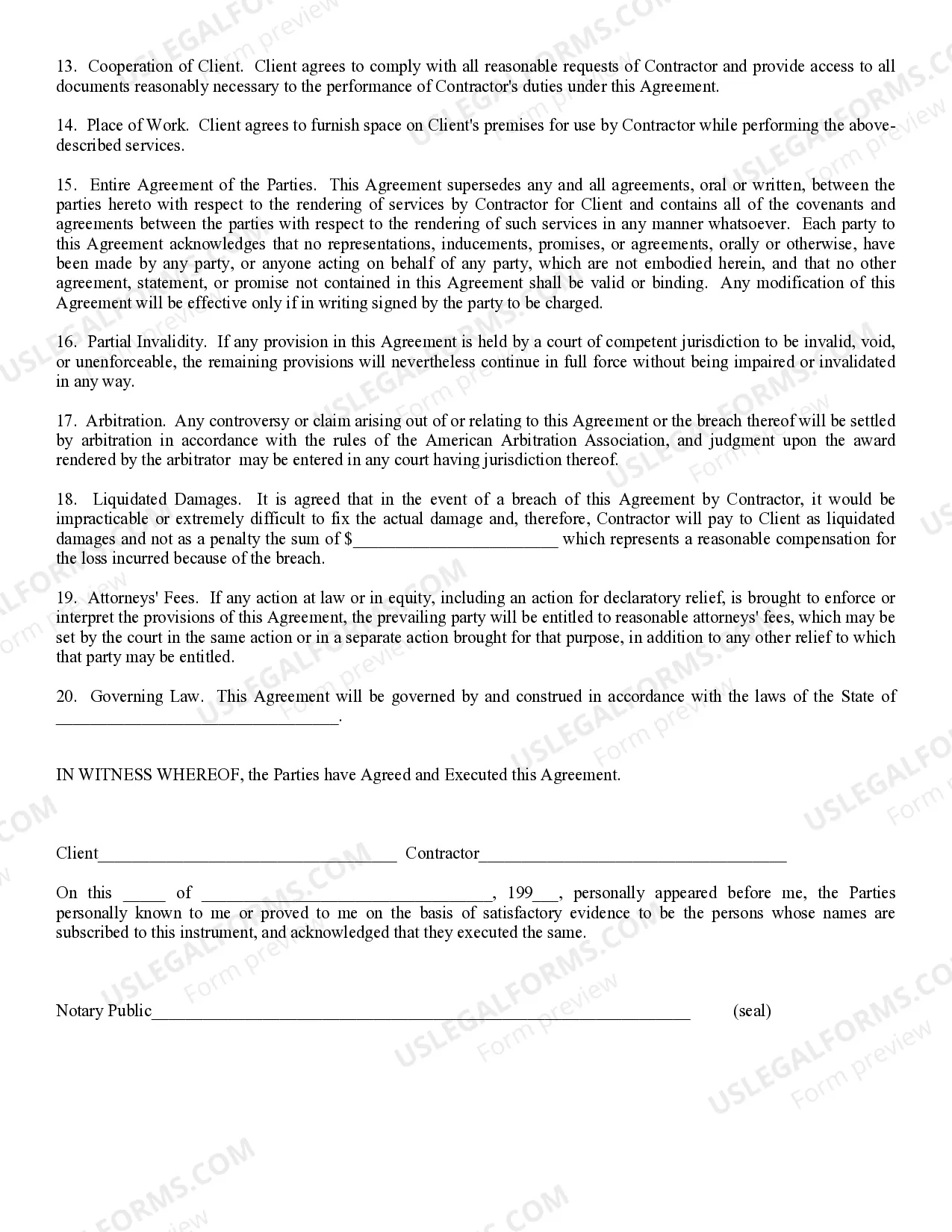

Independent Contractor: This is a contract to be used by an independent contractor. The independent contractor uses this type of contract before beginning a job with either a sub-contractor and/or Owner of a parcel of land. This form is available in both Word and Rich Text formats.

Tempe Arizona Self-Employed Independent Contractor Agreement

Description

How to fill out Arizona Self-Employed Independent Contractor Agreement?

Take advantage of the US Legal Forms and gain instant access to any document you desire.

Our helpful site with a plethora of document templates simplifies the process of locating and acquiring nearly any document sample you require.

You can download, complete, and sign the Tempe Arizona Self-Employed Independent Contractor Agreement in just a few minutes instead of spending hours searching the internet for a suitable template.

Using our collection is an excellent method to enhance the security of your document submissions. Our qualified attorneys frequently review all the documents to verify that the templates are applicable for a specific state and adhere to updated laws and regulations.

Initiate the downloading process. Click Buy Now and select your preferred pricing plan. Then, create an account and complete your purchase using a credit card or PayPal.

Save the document. Choose the format to acquire the Tempe Arizona Self-Employed Independent Contractor Agreement and edit, complete, or sign it according to your needs. US Legal Forms is one of the largest and most reliable template repositories on the web. We are always eager to assist you with virtually any legal matter, even if it’s just downloading the Tempe Arizona Self-Employed Independent Contractor Agreement.

- How can you obtain the Tempe Arizona Self-Employed Independent Contractor Agreement.

- If you already possess a subscription, simply Log In to your account. The Download option will be visible on all documents you view.

- Additionally, you can access all previously saved documents in the My documents section.

- If you do not yet have an account, follow these instructions.

- Open the page with the template you require. Verify that it is the form you wanted: review its title and description, and utilize the Preview option if it is offered. Otherwise, use the Search field to locate the desired one.

Form popularity

FAQ

In many cases, a 1099 contractor in Arizona needs a business license depending on the services offered. Local regulations can dictate the requirement, so it's important to check with your municipality. A comprehensive Tempe Arizona Self-Employed Independent Contractor Agreement may also stipulate business licensing requirements, helping to structure your working relationship with clients.

It depends on the nature of the work being performed. Some independent contractors may require a business license, especially in regulated industries. By using a Tempe Arizona Self-Employed Independent Contractor Agreement, you can outline your responsibilities and ensure compliance with local laws, making it a critical document for your business.

Yes, in Arizona, certain types of contractors, especially those in construction, need a specific license. However, if you are a freelancer working as a contractor in a different field, such as consulting, a license might not be necessary. It is wise to explore your obligations based on your business type and consider a Tempe Arizona Self-Employed Independent Contractor Agreement for clarity.

In Arizona, 1099 employees, or independent contractors, do not receive the same benefits as traditional employees. They must manage their own taxes and may be required to complete a Tempe Arizona Self-Employed Independent Contractor Agreement with their clients. This agreement clarifies terms of service and helps both parties understand their tax responsibilities.

Yes, there is a difference between being self-employed and an independent contractor. Self-employed individuals run their own businesses and take full responsibility for their operations, while independent contractors work on a contract basis for clients or companies. In the context of a Tempe Arizona Self-Employed Independent Contractor Agreement, the distinction is essential for understanding tax obligations and business relationships.

To become an independent contractor in Arizona, start by registering your business and obtaining any necessary licenses. Then, create a solid business plan that outlines your services and target market. Furthermore, drafting a comprehensive Tempe Arizona Self-Employed Independent Contractor Agreement will provide clarity and protect your rights as a contractor as you navigate client relationships.

Working as an unlicensed contractor in Arizona is generally not permitted and can lead to legal consequences. Unlicensed individuals cannot perform contract work above a certain monetary threshold. To safeguard your activities, consider utilizing a Tempe Arizona Self-Employed Independent Contractor Agreement, as it can help you establish a professional identity while also adhering to state regulations.

In Arizona, various business types can be eligible for a contractor license, including corporations, partnerships, and sole proprietorships. Each type must meet specific criteria set by the Arizona Registrar of Contractors. When you draft a Tempe Arizona Self-Employed Independent Contractor Agreement, ensure that your business structure aligns with these licensing requirements.

Yes, as a sole proprietor in Arizona, you typically need a business license to operate legally. This license helps ensure that you comply with local regulations. Additionally, having a Tempe Arizona Self-Employed Independent Contractor Agreement can clarify your role and responsibilities, providing legal protection for both parties involved.

Yes, Arizona requires businesses to file 1099 forms for independent contractors who earn $600 or more in a tax year. It is crucial to report these payments accurately to the IRS and the state of Arizona to comply with tax regulations. By filling out a 1099 form, businesses ensure that contractors receive credit for their income. Stay organized and reference your Tempe Arizona Self-Employed Independent Contractor Agreement for payment details.