Tennessee Business Credit Application

Understanding this form

The Business Credit Application is a legal document used by individuals or entities to request credit for purchases from a business. This form establishes the repayment terms, interest rates, and conditions for default, differentiating it from other credit-related forms by also offering a personal guarantee by signatories in certain circumstances.

Main sections of this form

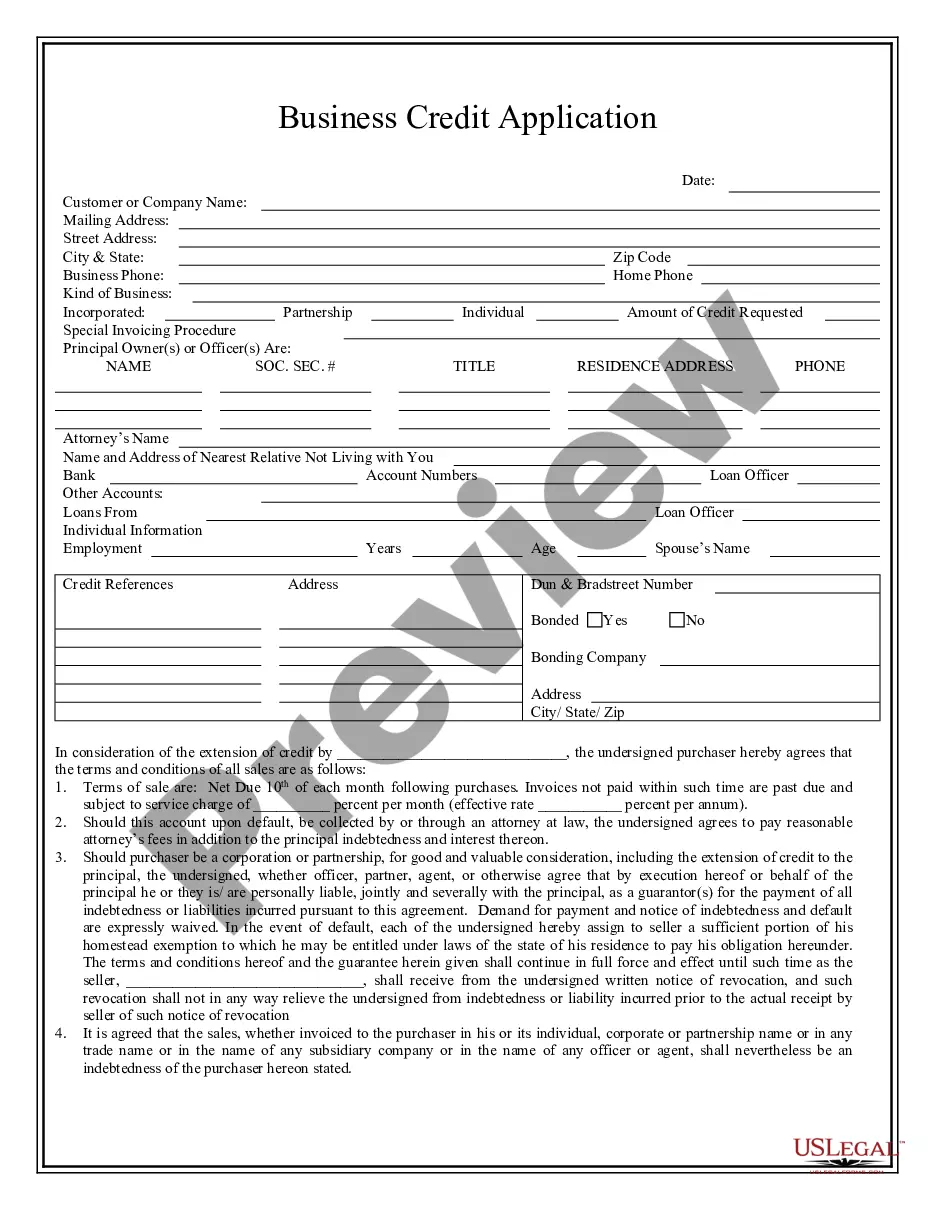

- Purchaser's details and identification information

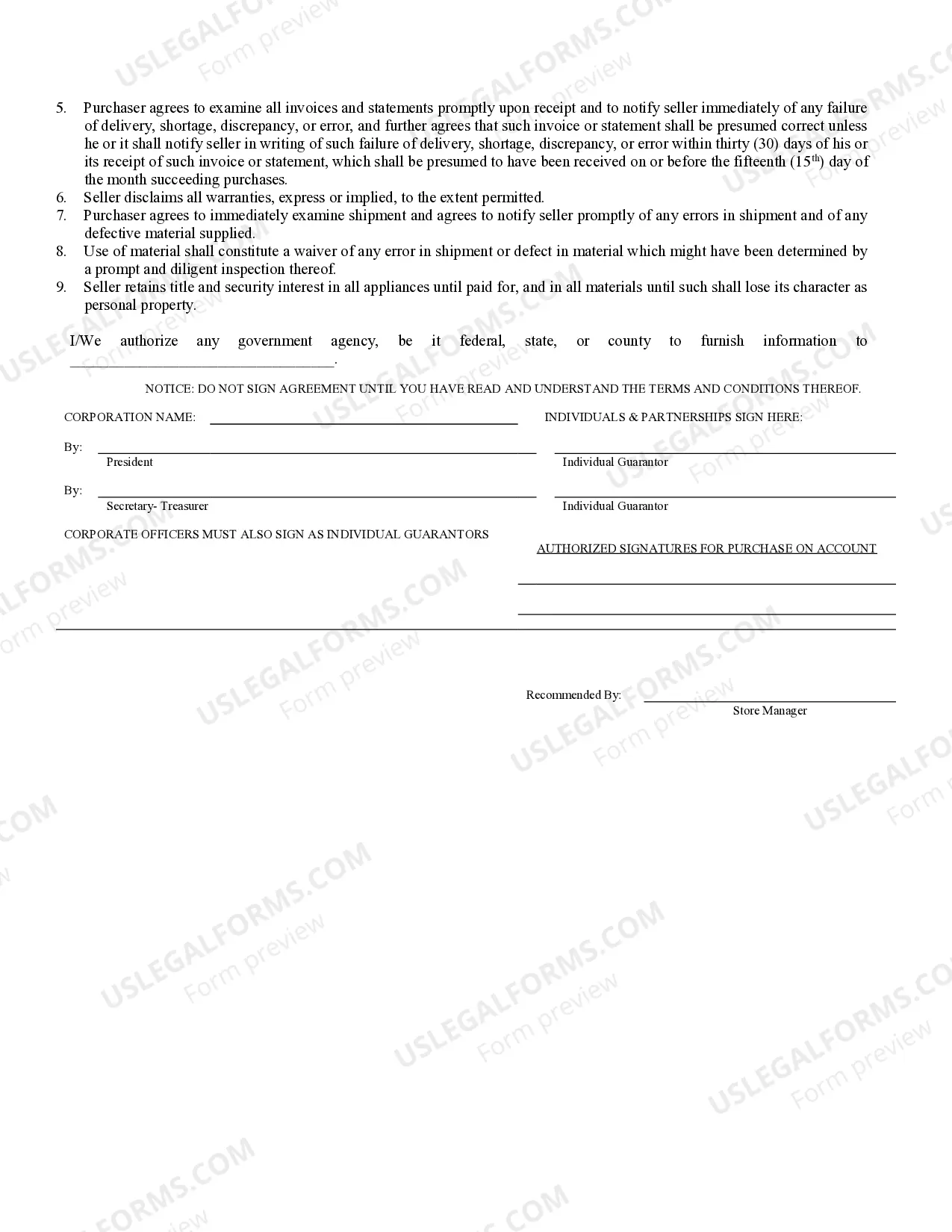

- Terms of sale, including payment due dates and interest charges

- Provisions for attorney fees and liability in case of default

- Privacy authorization for information requests from government agencies

- Disclaimer of warranties by the seller

Situations where this form applies

This form should be used when a business extends credit to a purchaser for goods or services, and the seller wishes to have documented terms for repayment and liabilities. It is essential for establishing the framework for payment and securing the seller's interests in the goods sold until payment is completed.

Who needs this form

- Business owners extending credit to customers

- Individuals purchasing goods on credit from businesses

- Corporations and partnerships looking to establish credit terms with suppliers

Steps to complete this form

- Identify the seller by entering their business name and address.

- Fill in the purchaser's details and specify the type of business entity.

- Set the payment terms, including the due date and interest rate on late payments.

- Sign the form as the purchaser or authorized representative, ensuring all parties agree to the terms.

- Provide any required information pertaining to personal guarantees if applicable.

Notarization requirements for this form

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to carefully review the repayment terms and interest rates.

- Not signing the document where a personal guarantee is required.

- Neglecting to authorize the seller to obtain necessary information from relevant agencies.

Benefits of completing this form online

- Convenience of completing and downloading the form from any location.

- Editable fields allow for easy customization of terms and conditions.

- Reliable legal framework based on templates drafted by licensed attorneys.

Looking for another form?

Form popularity

FAQ

In addition to opening a business credit card, you can build your business's credit by opening accounts with vendors that report payments to the business credit bureaus.If they don't, consider opening accounts with new vendors after verifying they'll report your payments.

Incorporate your business. Obtain a federal tax identification number (EIN). Open a business bank account. Establish a business phone number. Open a business credit file. Obtain business credit card(s). Establish a line of credit with vendors or suppliers.

Building business credit can take timeYou can take steps to build your business credit even if your personal credit isn't great. And once you've established good business credit, you may be able to qualify for financing without a personal guarantee.

Anyone can go to one of the reporting agencies and look up your business's score though they may have to pay to do so. Several business credit reporting agencies track business credit scores. Three of the major ones are Dun & Bradstreet, Equifax Business and Experian Business.

What credit score do I need to get a business loan? You will usually need a score of at least 500 to secure a business loan, such as a short-term loan or line of credit.

Incorporate your business. Obtain a federal tax identification number (EIN). Open a business bank account. Establish a business phone number. Open a business credit file. Obtain business credit card(s). Establish a line of credit with vendors or suppliers.

Apply for a business credit card if you don't already have one. Get a credit card with a low spending limit in your business's name. Apply for third-party guaranteed lending, such as an SBA loan, for funding. Apply for a credit card from a specific store.

Register your business entity. Get an employer identification number (EIN) Open a business banking account. Establish a business address and phone number. Apply for a business DUNS number. Open trade lines with your suppliers. Get a business credit card or business line of credit.