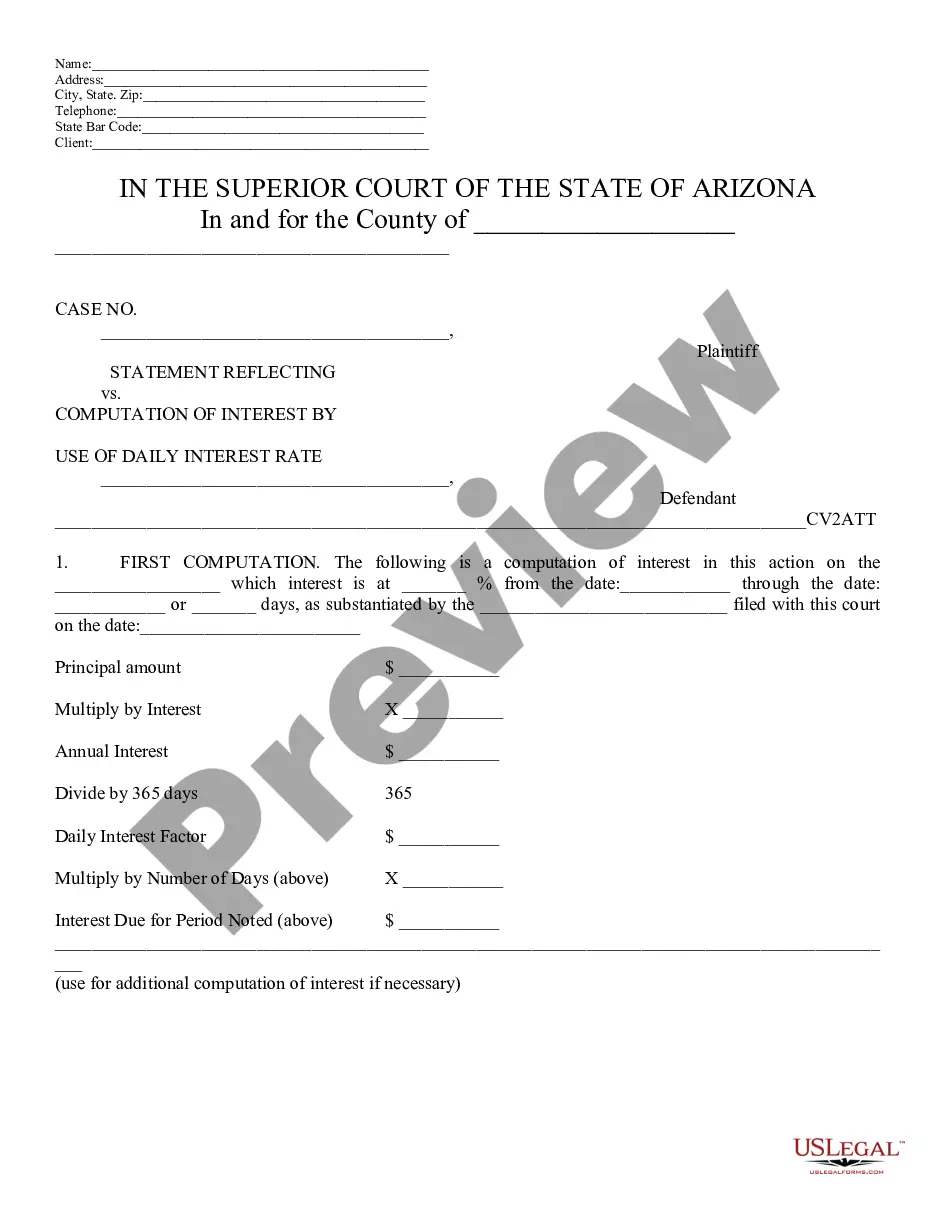

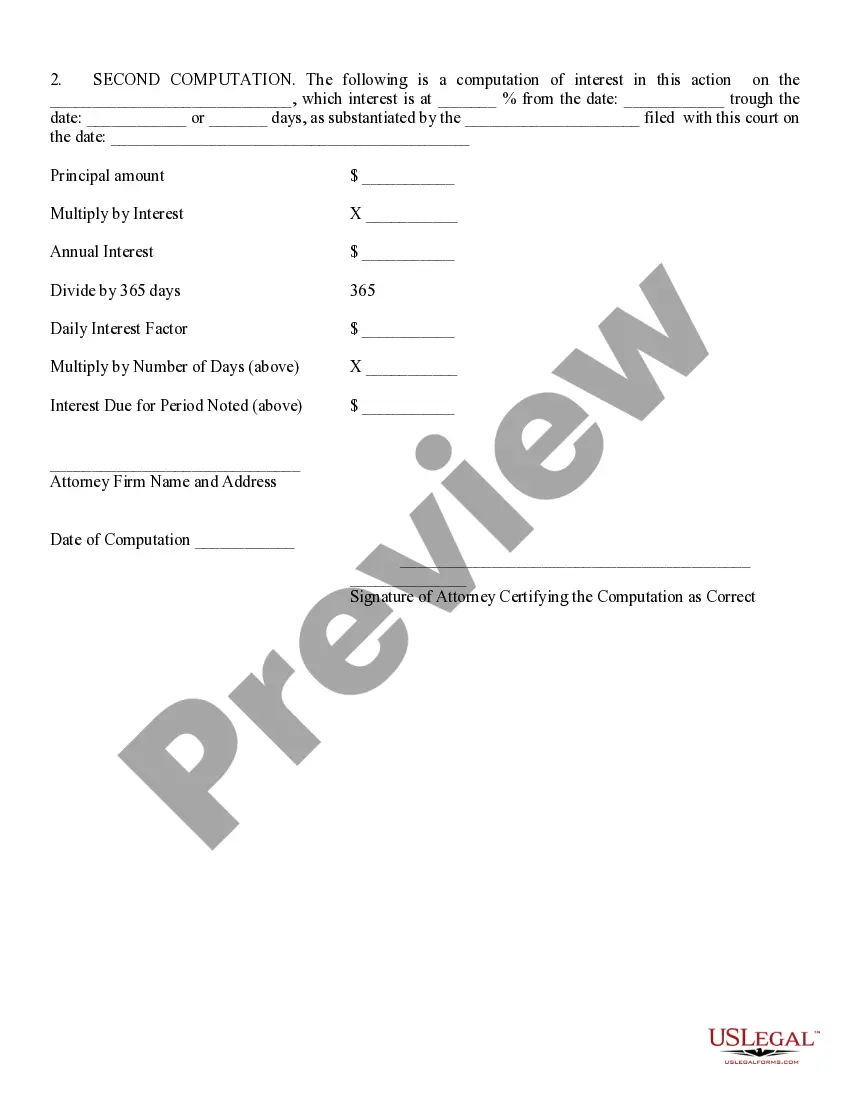

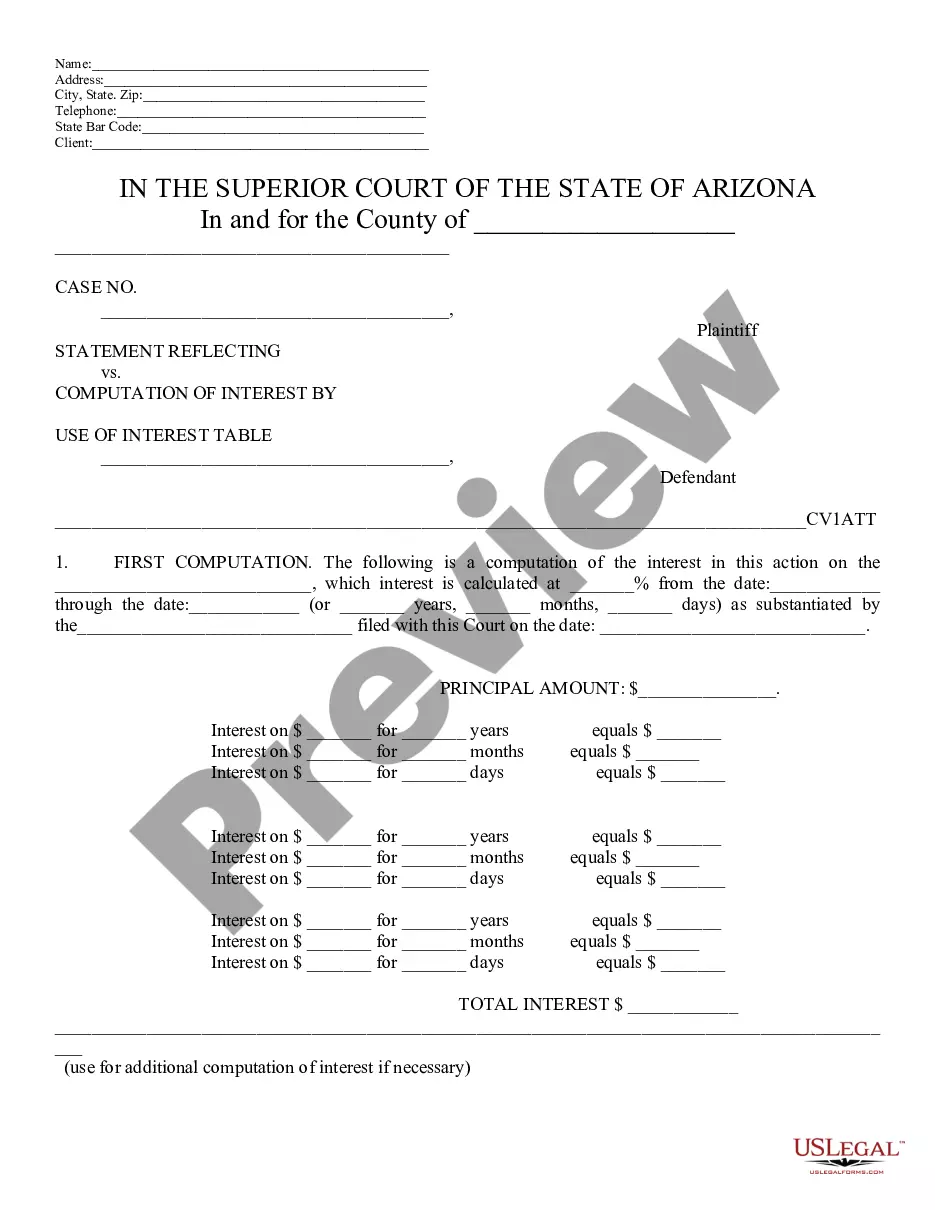

Statement Reflecting Computation of Interest By Daily Interest Rate: This statement reflects the way an attorney arrived at the total amount for damages, attorney's fees,e tc. It displays his/ her mathmatical equation, as well as the exact interest rate he/ she used in their findings. This form is available in both Word and Rich Text formats.

Gilbert Arizona Statement Reflecting Computation of Interest By Daily Interest Rate

Description

How to fill out Arizona Statement Reflecting Computation Of Interest By Daily Interest Rate?

Obtaining authenticated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms repository.

It’s an online compilation of over 85,000 legal documents for both personal and professional requirements as well as various real-world scenarios.

All the forms are appropriately categorized by the field of use and jurisdiction areas, making it as swift and straightforward as ABC to find the Gilbert Arizona Statement Reflecting Computation of Interest By Daily Interest Rate.

Maintaining paperwork organized and compliant with legal standards is crucial. Take advantage of the US Legal Forms library to always have vital document templates for any requirements readily available!

- Review the Preview mode and form description.

- Ensure you have selected the accurate one that satisfies your needs and fully aligns with your local jurisdiction regulations.

- Look for another template if necessary.

- If you find any discrepancies, make use of the Search tab above to locate the correct one.

- If it works for you, proceed to the next step.

Form popularity

FAQ

Calculating daily finance interest begins with identifying the principal and the annual finance rate. After converting the annual rate into a daily rate (annual rate divided by 365), multiply this rate by the principal for daily interest. This method allows you to gauge how financial obligations evolve each day. For comprehensive analyses, the Gilbert Arizona Statement Reflecting Computation of Interest By Daily Interest Rate is an excellent resource.

To calculate daily interest, first determine the principal and the annual interest rate. Convert the annual rate to a daily rate by dividing it by 365, and multiply it by the principal. This straightforward process helps clarify how interest accumulates daily. For detailed computations, consider utilizing the Gilbert Arizona Statement Reflecting Computation of Interest By Daily Interest Rate.

The formula to calculate daily interest involves taking the principal amount and multiplying it by the daily interest rate. The daily interest rate is derived by dividing the annual interest rate by 365. This simple formula allows for quick and easy calculations related to loans and investments. You can use the Gilbert Arizona Statement Reflecting Computation of Interest By Daily Interest Rate for accurate computations.

The daily interest rate is the interest a borrower pays or earns on a principal amount for one day. To find it, divide the annual interest rate by 365 days. This rate is crucial for understanding how loans or savings grow over time. The Gilbert Arizona Statement Reflecting Computation of Interest By Daily Interest Rate provides valuable insights into how this rate applies to your financial scenarios.

To calculate daily interest in Excel, start by determining the principal amount and the annual interest rate. Convert the annual rate into a daily rate by dividing it by the number of days in a year. Using an Excel formula, multiply the principal by the daily interest rate to obtain the daily interest amount. Utilizing tools like the Gilbert Arizona Statement Reflecting Computation of Interest By Daily Interest Rate can simplify this process.

Yes, Arizona does tax interest income and it is considered part of your taxable income. Interest income is typically taxed at the state's individual income tax rates. Using the Gilbert Arizona Statement Reflecting Computation of Interest By Daily Interest Rate can help you understand how interest is calculated on unpaid taxes, allowing you to properly report your income.

Filing Form 165 late in Arizona can lead to a penalty of 5% of the tax due for each month the form is overdue, capping at 25%. The Gilbert Arizona Statement Reflecting Computation of Interest By Daily Interest Rate will also apply, calculating daily interest for the unpaid taxes. To minimize penalties, you should file your forms on time and consider utilizing platforms like uslegalforms for guidance.

If you fail to file your taxes in Arizona, you may face various penalties, including fines and legal consequences. Furthermore, the state will impose interest on the tax amount owed, which is often calculated using the Gilbert Arizona Statement Reflecting Computation of Interest By Daily Interest Rate. To protect yourself from these serious implications, it is crucial to remain compliant with tax regulations.

In Arizona, the penalty for filing state taxes late can include fines and interest accrued daily. Specifically, you may incur a penalty of 4.5% of the unpaid tax amount for each month you are late, with the Gilbert Arizona Statement Reflecting Computation of Interest By Daily Interest Rate helping to determine the interest component. Timely filing and payment can help you avoid these costs.

The fine for a late tax return varies depending on the amount of tax owed. In Gilbert, Arizona, if you file your return after the due date, you could face additional penalties, along with interest that is calculated using the Gilbert Arizona Statement Reflecting Computation of Interest By Daily Interest Rate. To avoid these fines, it is essential to file your taxes on time.