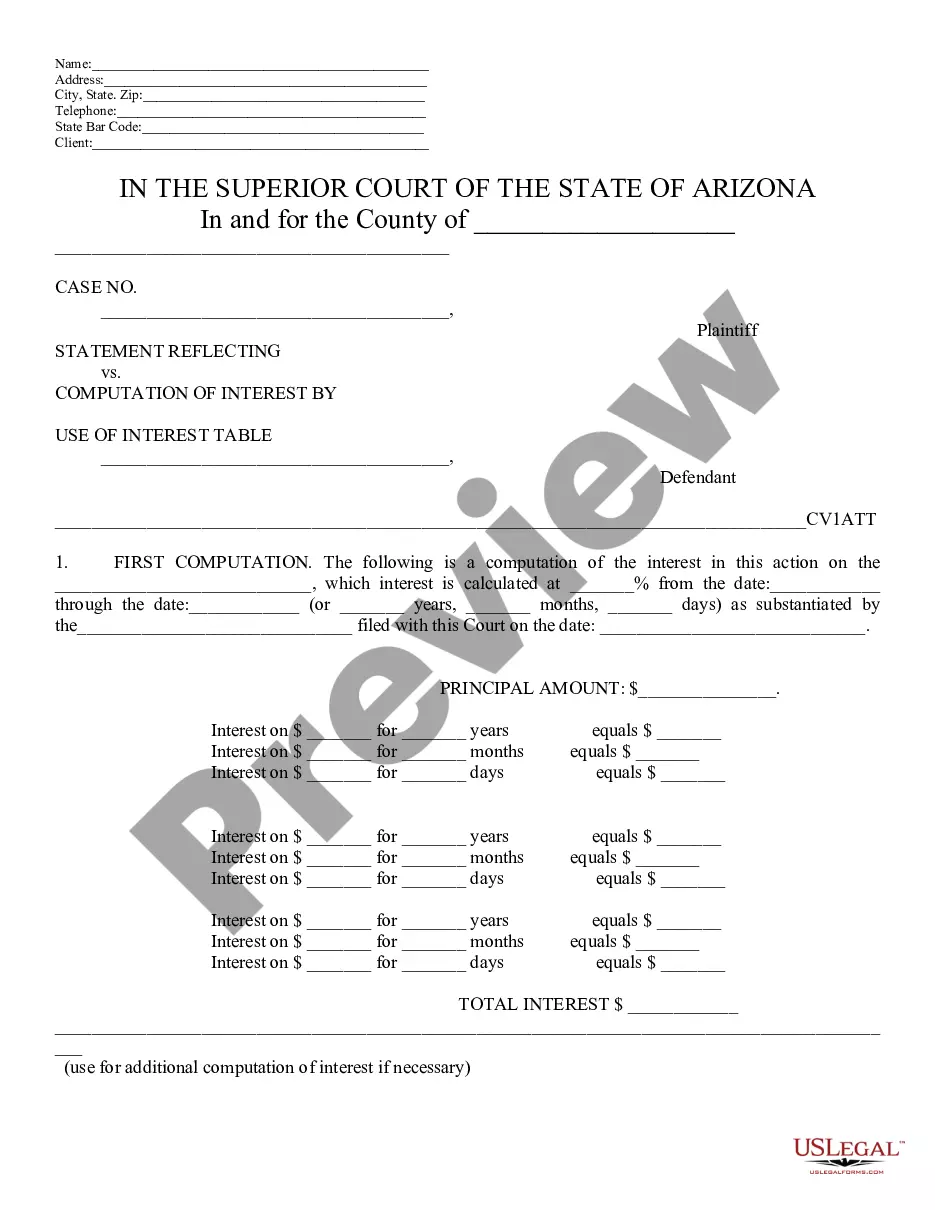

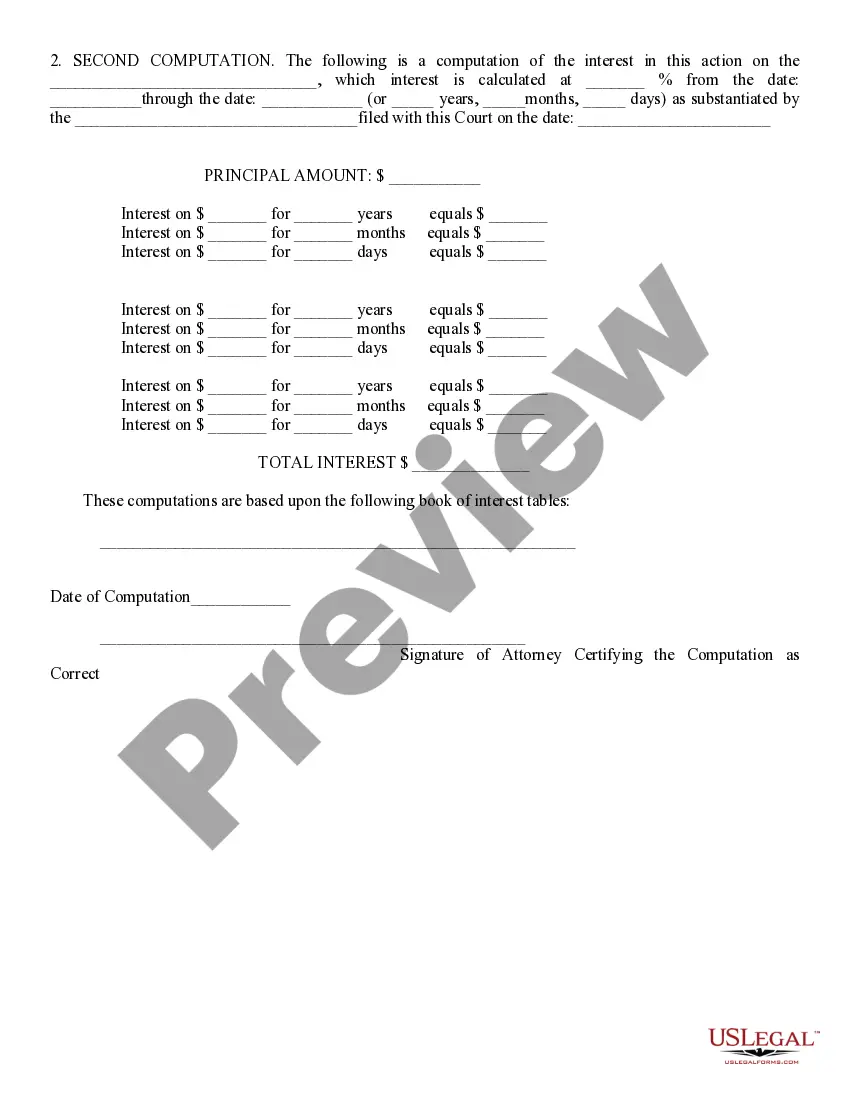

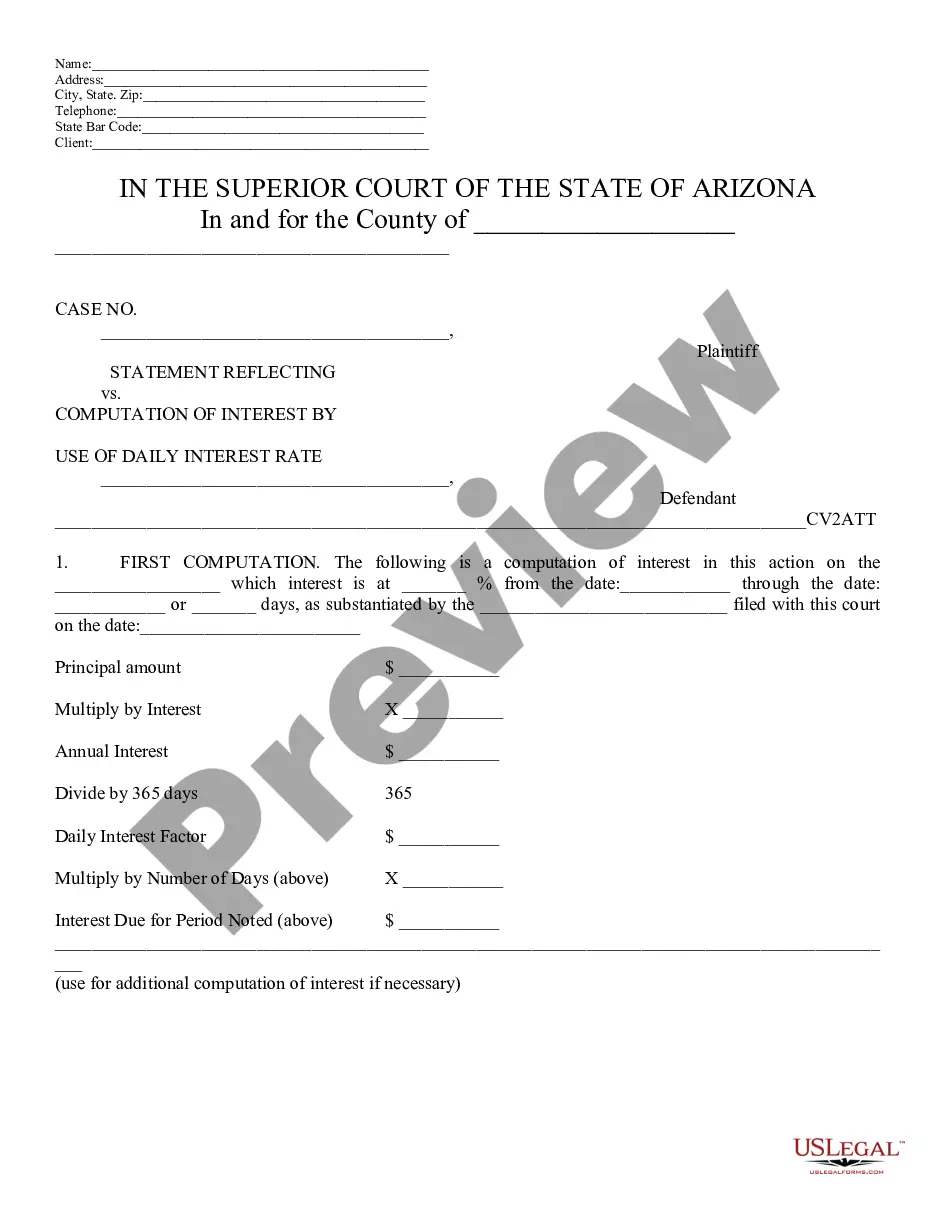

This is a Statement Reflecting Computation of Interest Using Interest Table. It reflects the interest accrued in a particular case. It further displays how the attorney arrived at the computation, by showing the interst table used. It is signed and dated by the presenting attorney.

Phoenix Arizona Statement Reflecting Computation of Interest Using Interest Table

Description

How to fill out Arizona Statement Reflecting Computation Of Interest Using Interest Table?

If you have previously utilized our service, Log In to your account and retrieve the Phoenix Arizona Statement Reflecting Computation of Interest Using Interest Table on your device by clicking the Download button. Ensure your subscription is active. If it isn’t, renew it based on your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your file.

You have ongoing access to all the documents you have acquired: you can find them in your profile under the My documents section whenever you wish to use them again. Utilize the US Legal Forms service to efficiently find and save any template for your personal or business requirements!

- Verify you have the correct document. Review the description and use the Preview function, if applicable, to see if it satisfies your needs. If it doesn’t meet your criteria, use the Search tab above to find the suitable one.

- Purchase the document. Click the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and complete the transaction. Input your credit card information or choose the PayPal option to finalize the purchase.

- Obtain your Phoenix Arizona Statement Reflecting Computation of Interest Using Interest Table. Select the file format for your document and download it to your device.

- Finalize your document. Print it or utilize professional online editors to complete and sign it digitally.

Form popularity

FAQ

Most interest income is taxable as ordinary income on your federal tax return, and is therefore subject to ordinary income tax rates. There are a few exceptions, however. Generally speaking, most interest is considered taxable at the time you receive it or can withdraw it.

Since the interest is exempt from state income tax under federal law, it is not required to be added to Arizona gross income under A.R.S.

It is your gross wages less any pretax deductions, such as your share of health insurance premiums. Complete this form within the first five days of your employment to select an Arizona withholding percentage. You may also have your employer withhold an extra amount from each paycheck.

Residents living in Arizona for the whole year or for part of the year must file taxes if their gross income is more than $12,400, more than $18,550 for the head of household or more than $24,800 for married couples filing jointly.

Nonresident individuals must file income tax returns in both Arizona and their home state.

Most interest income earned by investments is taxable on both the federal and state levels. You pay taxes on interest income at your ordinary income tax rate. You can avoid or defer taxes on interest earned in tax-advantaged accounts and by certain assets.

If you are sending a payment with this return, mail to Arizona Department of Revenue, PO Box 52016, Phoenix, AZ 85072-2016. Include the payment with Form 140NR.

140NR. Nonresident Personal Income Tax Return. FOR CALENDAR YEAR.

Generally, interest accrues on any unpaid tax from the due date of the return until the date of payment in full. The interest rate is determined quarterly and is the federal short-term rate plus 3 percent.

The best way to determine your liability is to talk with your tax advisor. If you don't have a tax advisor, you can look at your last year's return. Your liability can be found on Line 48 of your Arizona Form 140 and Line 58 for both your Arizona 140PY (Part Year Resident) and Arizona 140NR (Non-Resident) forms.