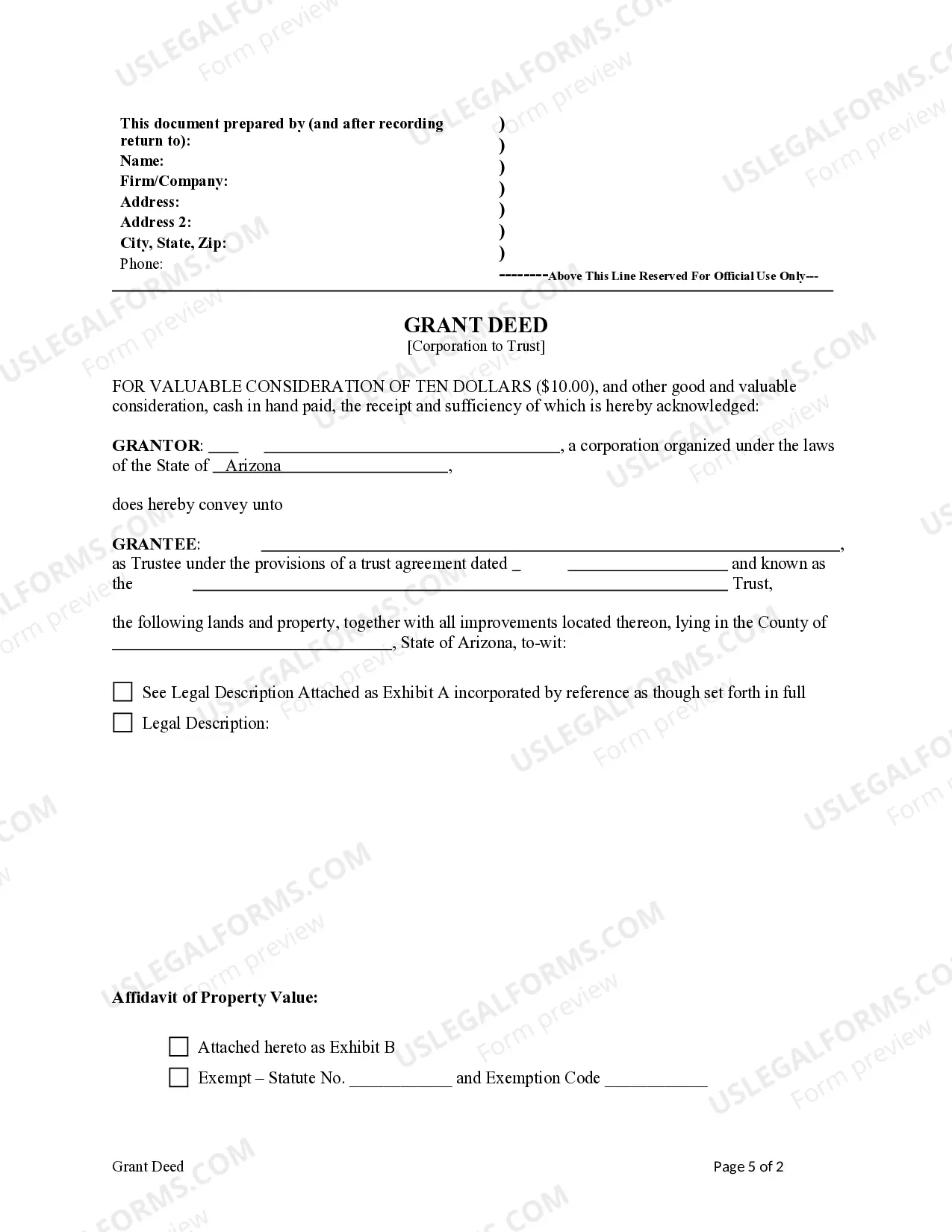

This form is a Warranty Deed where the Grantor is a limited liability company (LLC) and the Grantee is Trust. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Gilbert Arizona Grant Deed from a Corporation to a Trust

Description

How to fill out Arizona Grant Deed From A Corporation To A Trust?

If you are looking for a legitimate document, it’s incredibly difficult to find a more user-friendly service than the US Legal Forms website – likely the most extensive online repositories.

With this repository, you can obtain a vast array of templates for business and personal uses categorized by types and locations, or specific terms.

Thanks to the advanced search feature, locating the latest Gilbert Arizona Grant Deed from a Corporation to a Trust is as simple as 1-2-3.

Confirm your choice. Click the Buy now button. Afterwards, choose your desired subscription plan and fill in the information to create an account.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

- Additionally, the relevance of each document is validated by a team of professional lawyers who routinely examine the templates on our platform and update them in accordance with the latest state and county regulations.

- If you are familiar with our site and possess a registered account, all you need to do to acquire the Gilbert Arizona Grant Deed from a Corporation to a Trust is to Log In to your account and select the Download option.

- If you are using US Legal Forms for the first time, simply adhere to the instructions provided below.

- Ensure you have selected the document you need. Review its description and use the Preview function (if present) to examine its contents.

- If it doesn’t fulfill your needs, use the Search option at the top of the page to locate the suitable file.

Form popularity

FAQ

You can write your own trust in Arizona, but it is advisable to understand the legal requirements involved. While DIY options may seem tempting, an improperly drafted trust can create issues later, especially when including assets like a Gilbert Arizona Grant Deed from a Corporation to a Trust. Using a reputable platform like uslegalforms can help you create a legally sound trust that meets your needs, ensuring your wishes are honored.

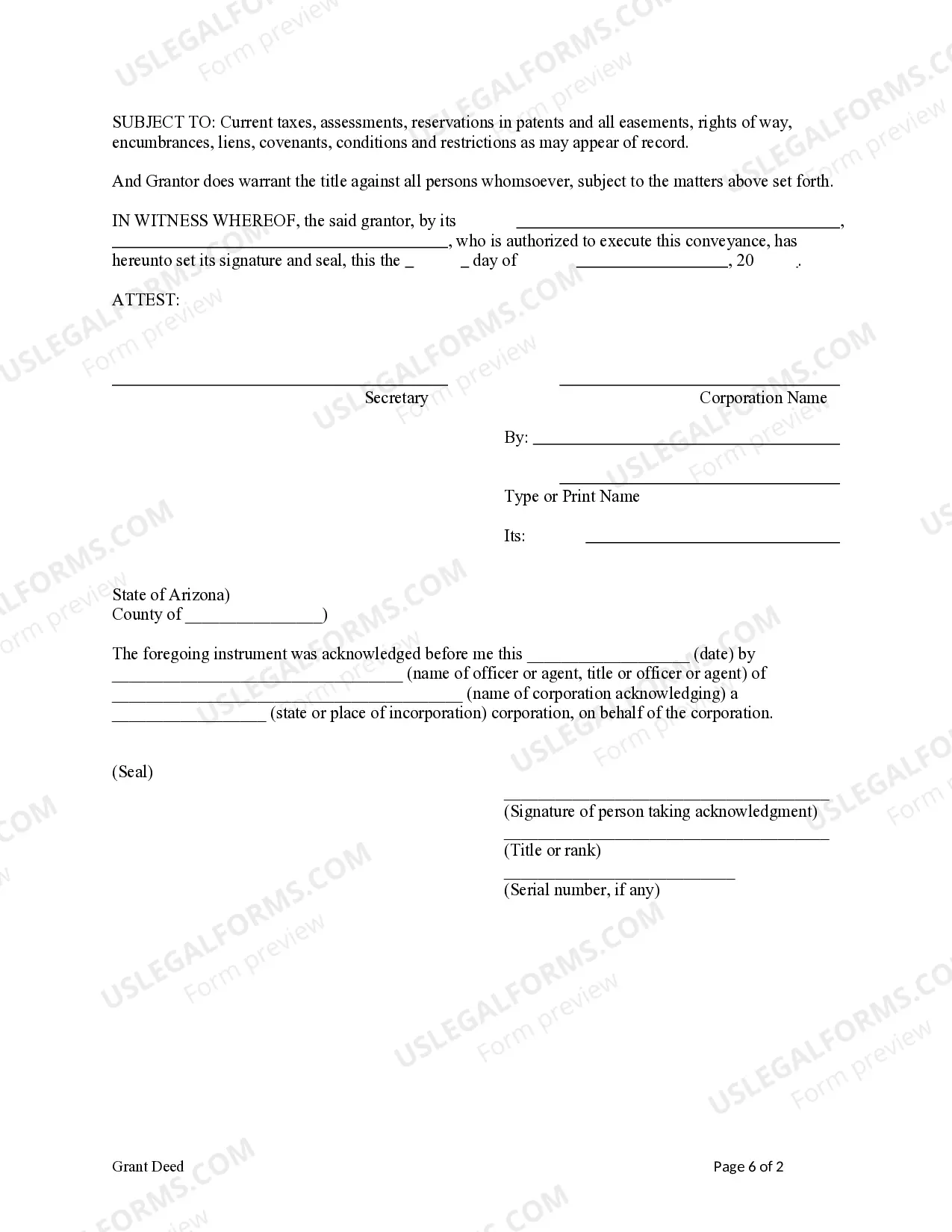

In Arizona, a deed of trust is generally signed by the borrower and the trustee. If you are dealing with a Gilbert Arizona Grant Deed from a Corporation to a Trust, representatives of both the corporation and the trust may need to sign as authorized officers or agents. This ensures that the deed is valid and enforceable under Arizona law. Make sure to verify who has the authority to sign by checking the organization's bylaws.

Many parents overlook the importance of properly funding the trust. Without transferring assets, such as a Gilbert Arizona Grant Deed from a Corporation to a Trust, the trust will not serve its intended purpose. Additionally, failing to communicate with family members about the trust's goals can lead to confusion down the line. It's crucial to seek professional guidance to avoid these common pitfalls.

Yes, Arizona is indeed a deed of trust state. This means that property loans are typically secured using a deed of trust rather than a mortgage. This method can offer quicker foreclosure processes and more flexibility for lenders. If you're exploring options like the Gilbert Arizona Grant Deed from a Corporation to a Trust, becoming familiar with the local laws regarding deeds of trust is essential.

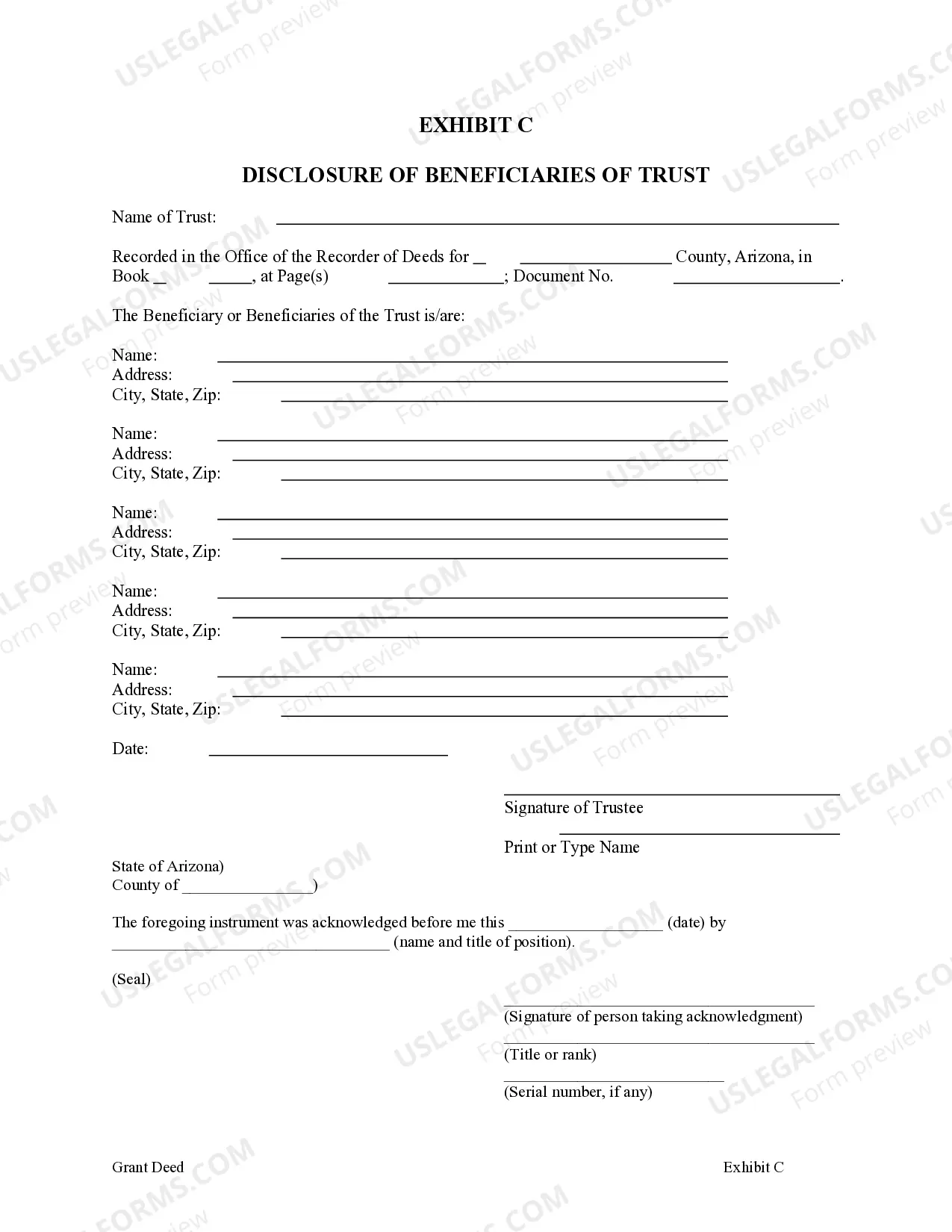

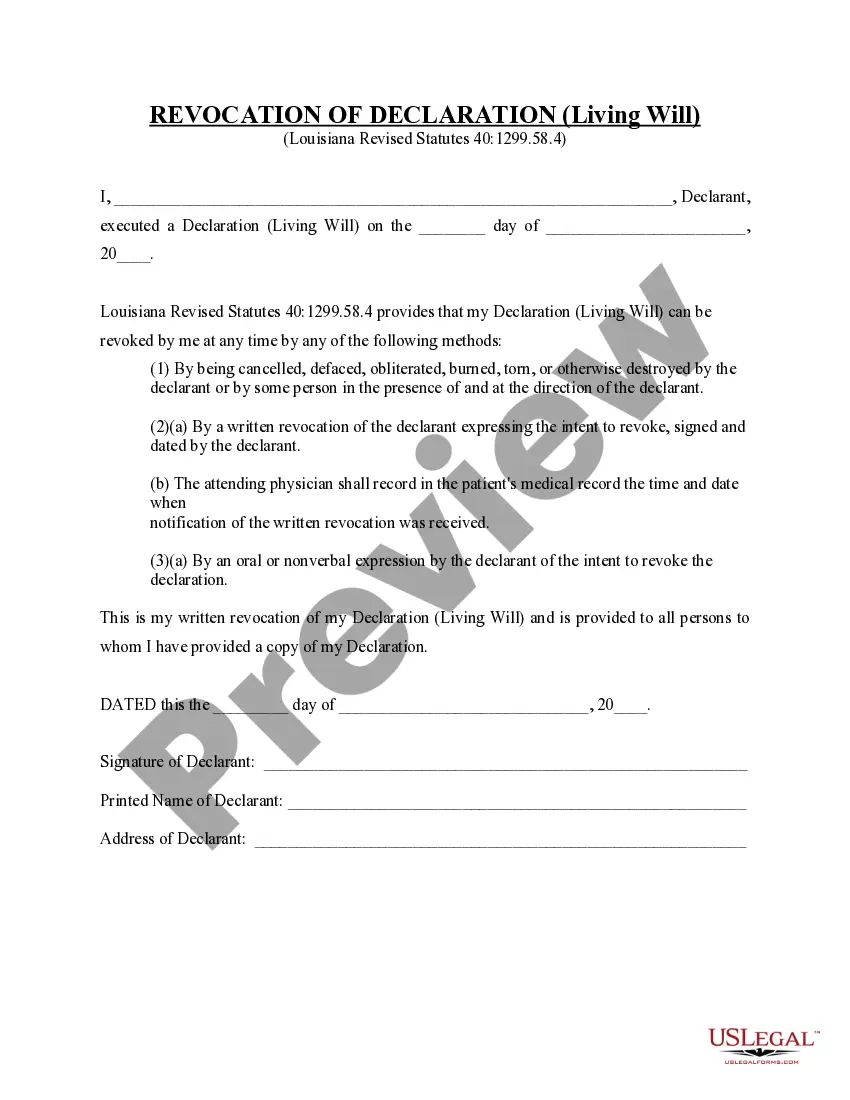

A trust is a legal arrangement where a trustee manages assets for the benefit of the beneficiaries, while a beneficiary deed allows an individual to transfer property directly to a beneficiary upon death. The Gilbert Arizona Grant Deed from a Corporation to a Trust provides asset protection and can simplify estate management. Understanding these distinctions can help you make informed decisions about your estate planning.

To transfer a deed to a trust in Arizona, you typically need to prepare a deed that specifies the property being transferred and identifies the trust as the new owner. This document must be signed, notarized, and then recorded with the county recorder's office. Utilizing resources from US Legal Forms can guide you through this process, ensuring your Gilbert Arizona Grant Deed from a Corporation to a Trust is completed correctly and legally.

Filing a trust in Arizona involves preparing the trust document that outlines the terms of the trust and appointing a trustee. You will also need to ensure the document complies with state laws. While you can create a trust on your own, using a platform like US Legal Forms can simplify the process, allowing you to efficiently establish a Gilbert Arizona Grant Deed from a Corporation to a Trust.

Certain assets cannot be placed in a trust, including personal health accounts and certain retirement accounts like IRAs and 401(k)s, as they have specific regulations. Additionally, assets that are not legally transferable or those requiring beneficiary designations cannot be included in a trust. It is essential to consult legal guidelines or services like USLegalForms to understand what can and cannot be placed in a trust. Ensuring clarity on this matter helps in planning your estate effectively.

Placing your house in a trust in Arizona starts with drafting a new grant deed that lists the trust as the new owner. After preparing the deed, sign it before a notary, and file it with your county recorder's office. This action will transfer ownership, allowing your home to be managed according to your specified trust guidelines. Engaging with resources like USLegalForms can help streamline this process and ensure all requirements are met.

To put items into a trust, begin by identifying the specific items you wish to transfer. Next, you will need to retitle these items, which may involve creating new ownership documents or changing accounts. It is crucial to follow legal procedures accurately, as this ensures that the items are properly protected under the trust’s terms. Using USLegalForms can guide you through the necessary steps to facilitate this process efficiently.