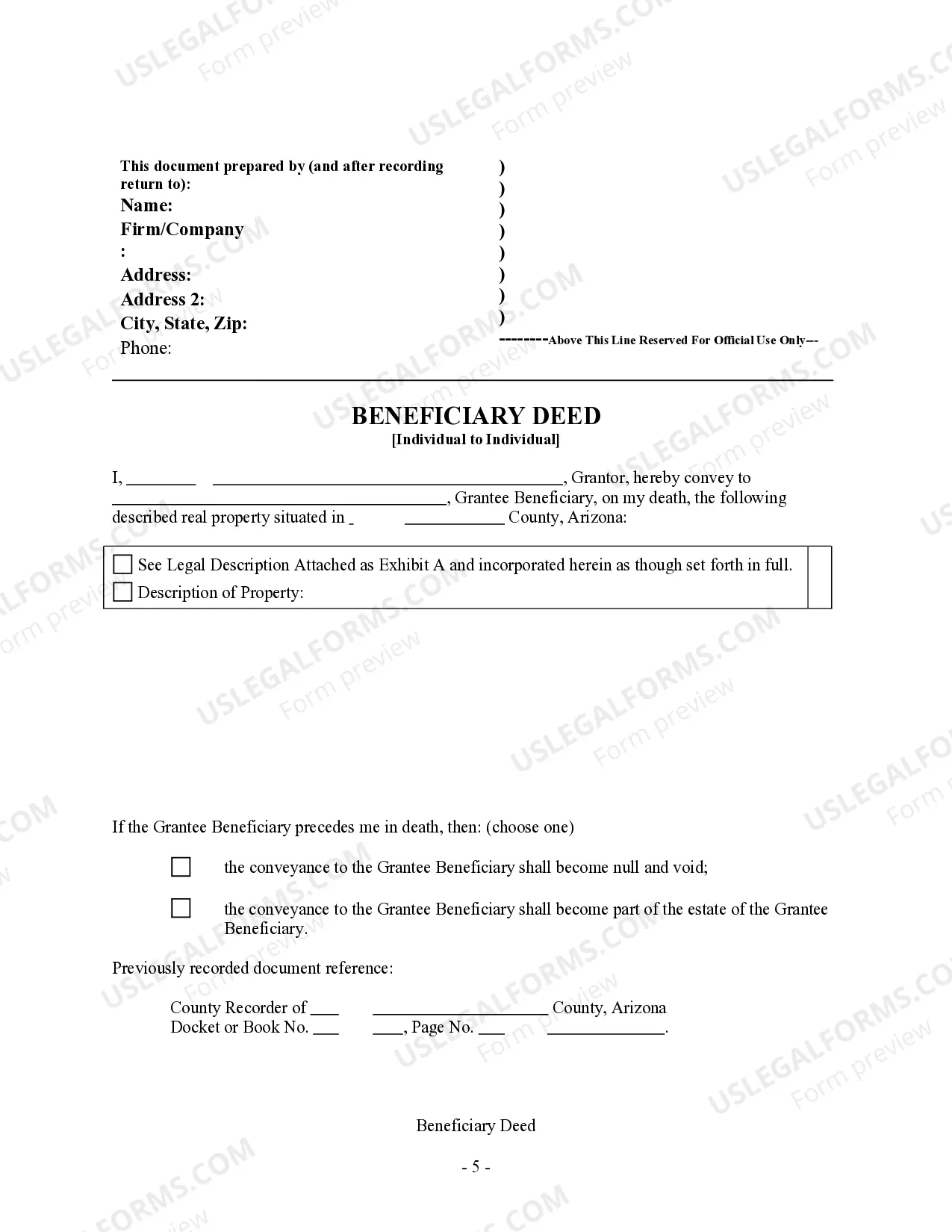

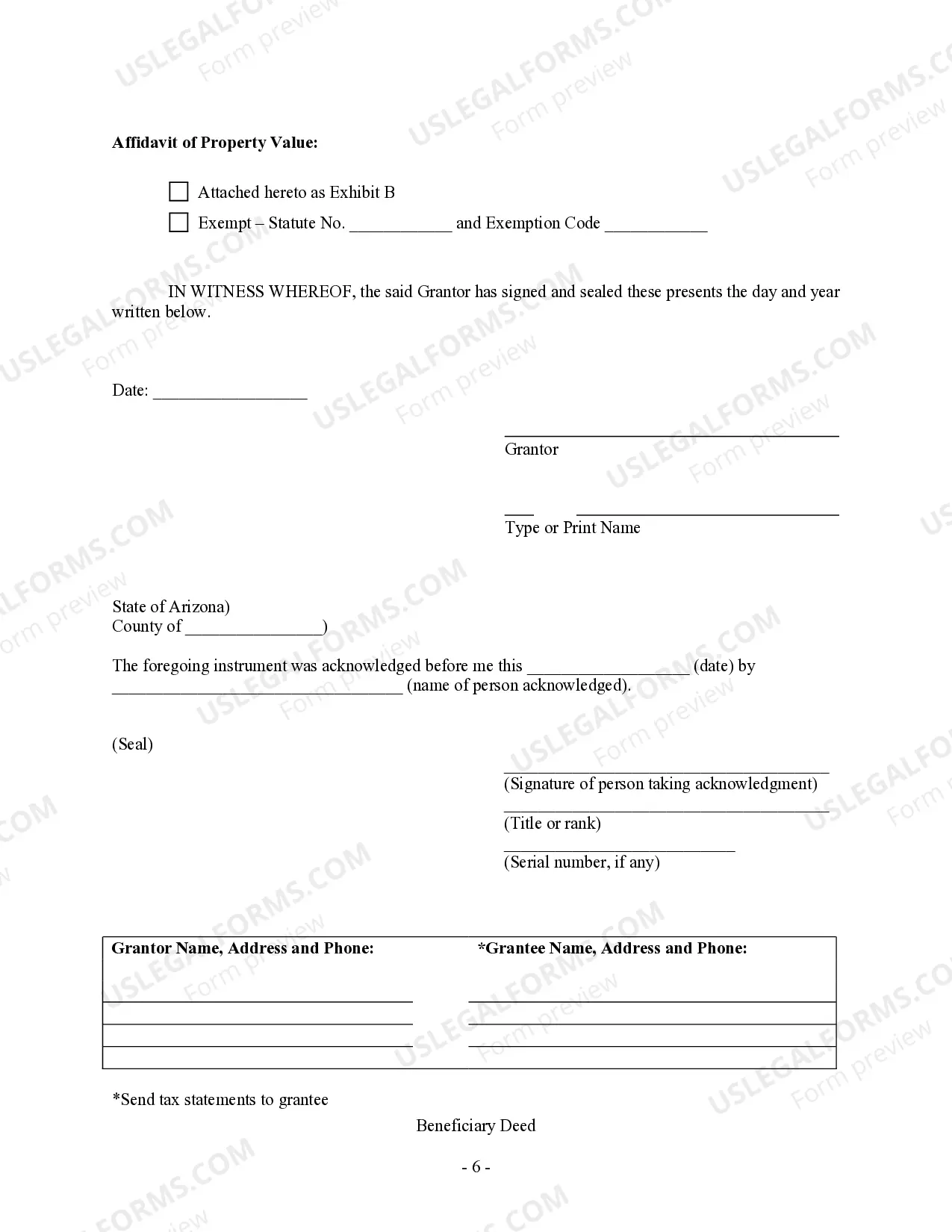

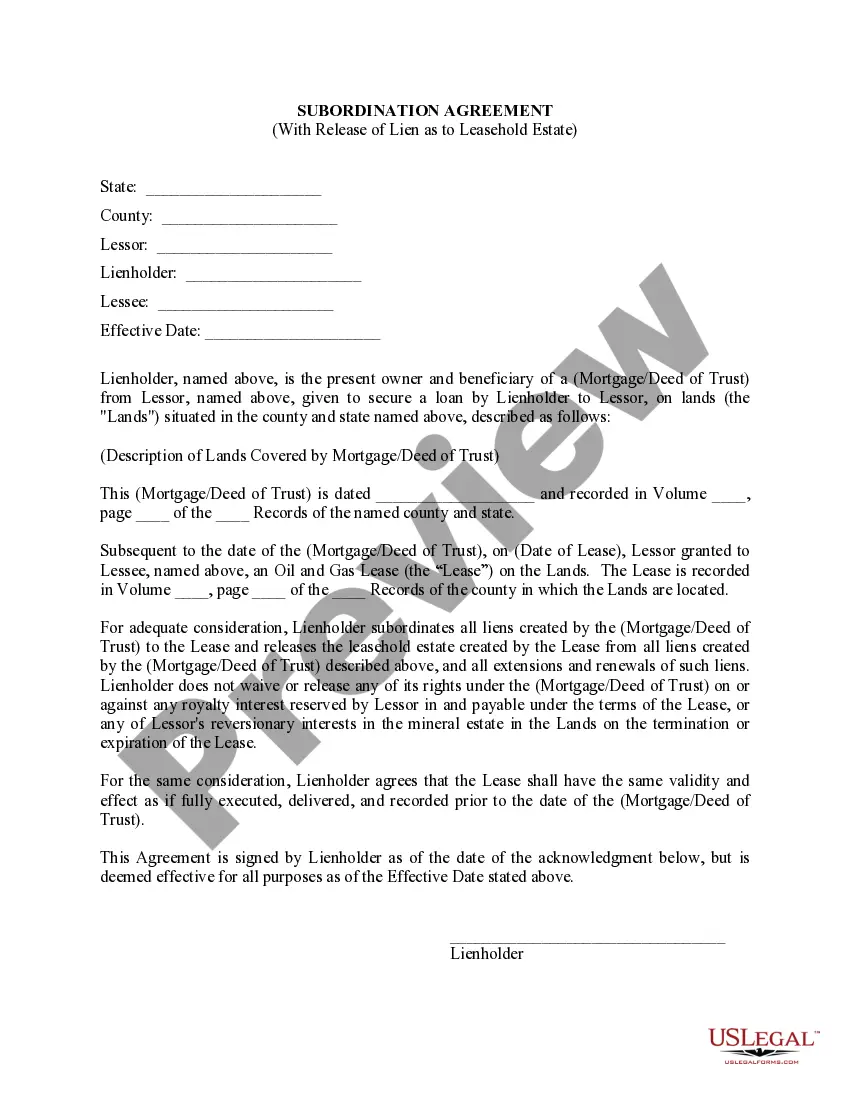

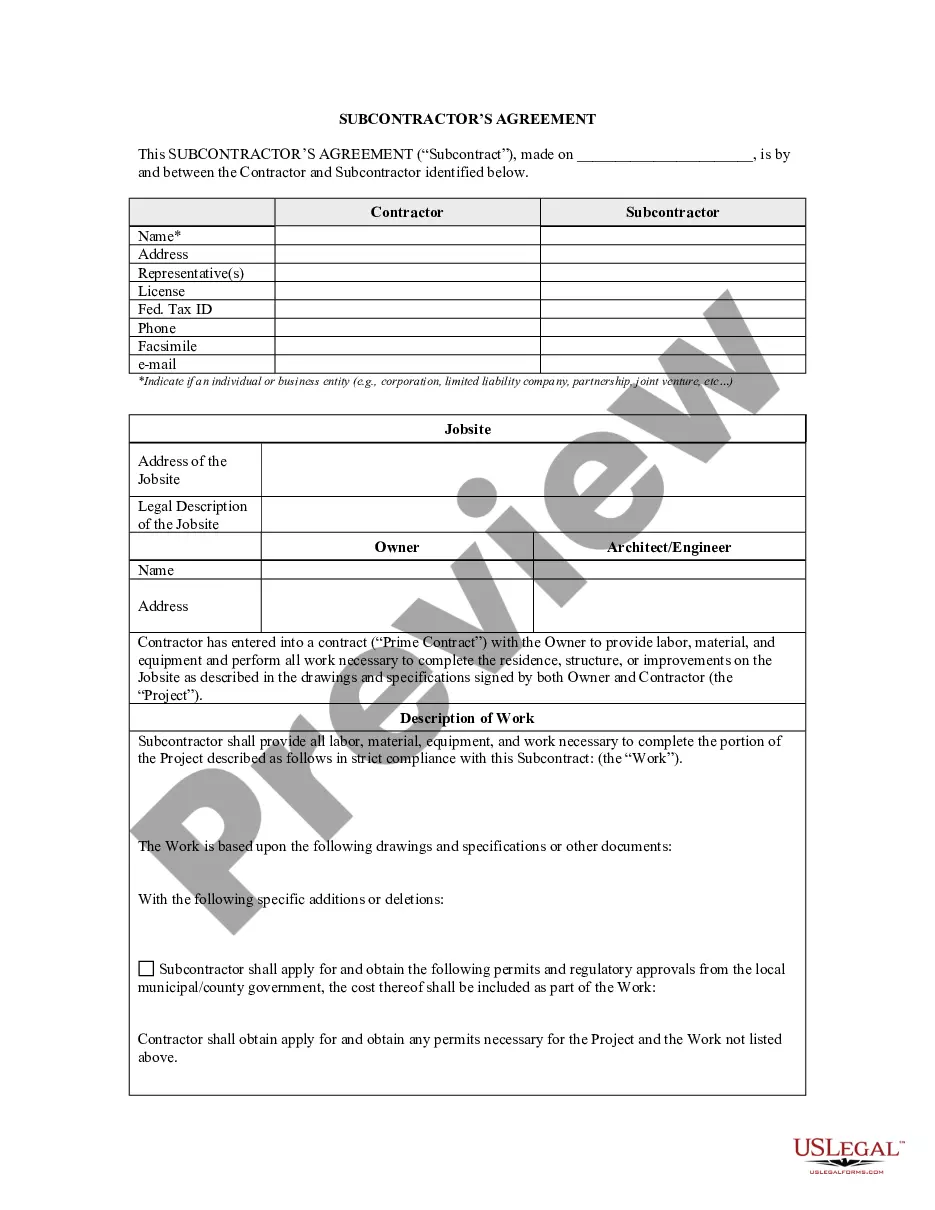

This form is a Beneficiary or Transfer on Death Deed where the grantor is an Individual and the Grantee is an Individual. This transfer is revocable by Grantor until his or her death and effective only upon the death of the Grantor. This deed complies with all state statutory laws.

Surprise Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual

Description

How to fill out Arizona Transfer On Death Deed Or TOD - Beneficiary Deed For Individual To Individual?

If you are seeking a legitimate form, it's unattainable to select a superior platform than the US Legal Forms site – likely the most comprehensive online repositories.

With this collection, you can obtain a vast number of form samples for business and personal use categorized by types and regions, or keywords.

With our enhanced search functionality, finding the latest Surprise Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual is as simple as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Choose the format and store it on your device.

- Moreover, the significance of each document is validated by a team of experienced lawyers that consistently review the templates on our site and update them according to the latest state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Surprise Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual is to Log In to your account and select the Download option.

- If you are using US Legal Forms for the first time, just adhere to the instructions listed below.

- Ensure you have accessed the form you require. Review its description and utilize the Preview option to examine its content. If it doesn't meet your expectations, use the Search feature located near the top of the screen to find the suitable document.

- Confirm your selection. Click the Buy now option. Afterwards, select your preferred pricing plan and enter your details to create an account.

Form popularity

FAQ

No, you do not have to be an attorney to prepare a Surprise Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual. While legal expertise can be beneficial, many individuals successfully prepare their own deeds using available templates and resources. Platforms like uslegalforms offer straightforward templates that guide you through the process, allowing you to create a valid deed with ease and confidence.

Yes, recording a beneficiary deed in Arizona is essential for it to be effective. The Surprise Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual must be filed with the county recorder's office where the property is located. This recording establishes your intent and ensures that the deed is legally recognized upon your passing. Make sure you complete this step to avoid any issues in the future.

You do not necessarily need an attorney to create a Surprise Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual. However, consulting with a legal professional can help ensure that you fully understand the process and its implications. An attorney can guide you through any complexities involved, helping you avoid potential pitfalls. If you prefer handling this yourself, resources like uslegalforms can provide templates and information to assist you.

One disadvantage of a Transfer on Death Deed (TOD) is that it does not allow for any control over the property once it passes to the beneficiary. If the beneficiary faces financial issues, such as creditors, the property could be at risk. Additionally, TOD deeds cannot accommodate multiple beneficiaries effectively, potentially leading to disputes. It's beneficial to consider these aspects carefully when planning with the Surprise Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual.

The primary difference between a Transfer on Death Deed (TOD) and a standard beneficiary deed lies in the transfer process. A TOD specifically allows property to be transferred upon the owner's death without court intervention, while a beneficiary deed may still require certain legal proceedings. Understanding these differences is essential for making informed decisions about how to manage your estate in Surprise, Arizona. Utilizing the Surprise Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual can help clarify these processes.

The Transfer on Death Deed (TOD) offers unique advantages over traditional beneficiary designations, particularly in real estate. Unlike other beneficiary arrangements, a TOD deed allows for a seamless transfer of property without going through probate. Often, individuals in Surprise, Arizona, find that using a TOD streamlines the estate process, making it a favorable choice for passing property directly to heirs. Therefore, consider the Surprise Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual for effective estate planning.

Naming a beneficiary is a key component of the Transfer on Death Deed, commonly known as TOD. While both terms refer to designating an individual to inherit property upon death, a TOD simplifies the transfer outlined in the deed. In this case, a TOD ensures that the asset transitions directly without court involvement. Understanding this difference can clarify estate planning strategies with the Surprise Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual.

After the death of the property owner in Surprise, Arizona, it's crucial to file the beneficiary deed with the local clerk's office. This action helps officially transfer the property to the designated beneficiary without the need for probate. Additionally, ensure that you provide a death certificate to verify the property owner's passing. This process ensures a smooth transition of ownership under the Surprise Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual.

The Surprise Arizona Transfer on Death Deed, also known as a TOD deed, allows property owners to transfer their property to designated beneficiaries upon their death, avoiding probate. In contrast, a beneficiary deed serves a similar purpose but might have specific legal distinctions in terms of how it is executed or recognized. Both options provide a straightforward way to pass property directly to individuals without lengthy legal proceedings. For your needs, consider utilizing US Legal Forms to ensure you understand the nuances between a Surprise Arizona Transfer on Death Deed and a beneficiary deed.

The main disadvantages of a Surprise Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual include the lack of control over the property after death and potential complications if beneficiaries are not clearly defined. Furthermore, if the property has liens or debts, beneficiaries may inherit those obligations. Understanding these drawbacks helps you make informed decisions regarding estate planning.