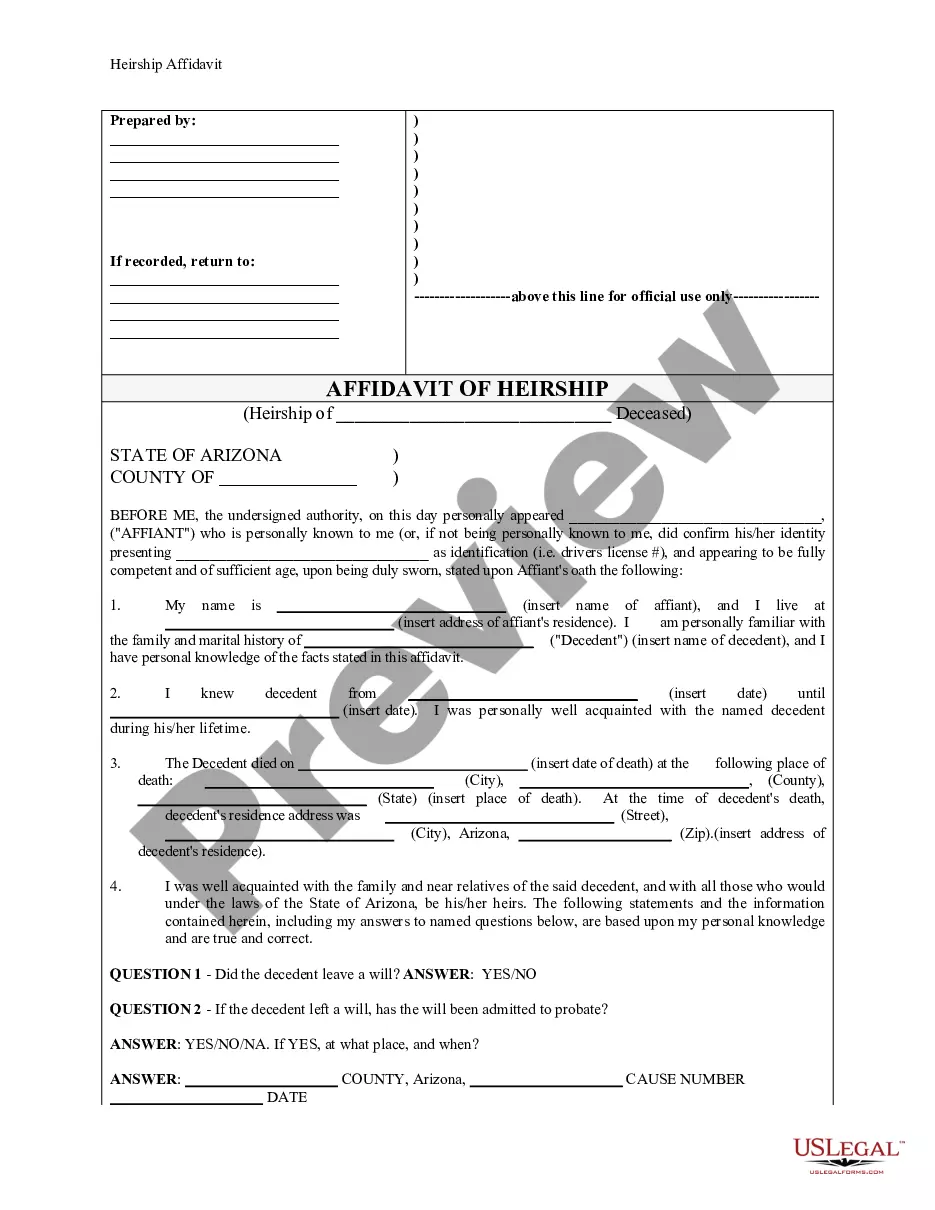

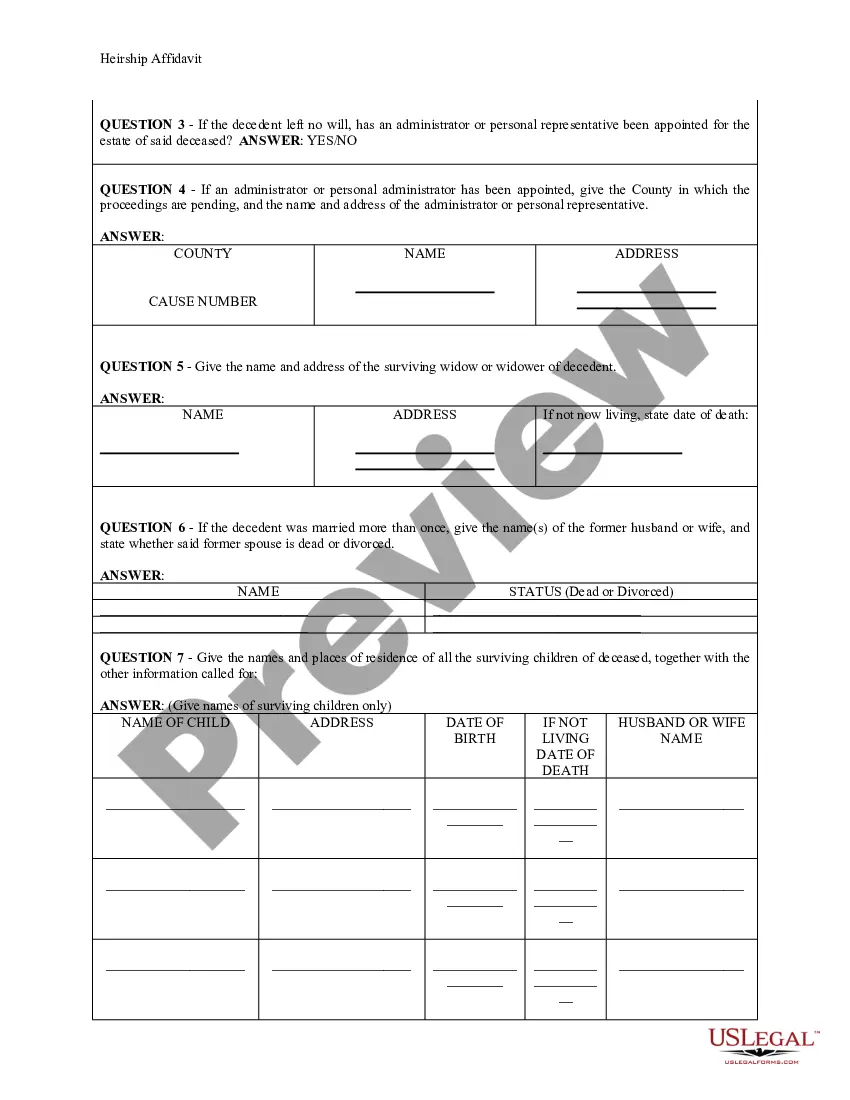

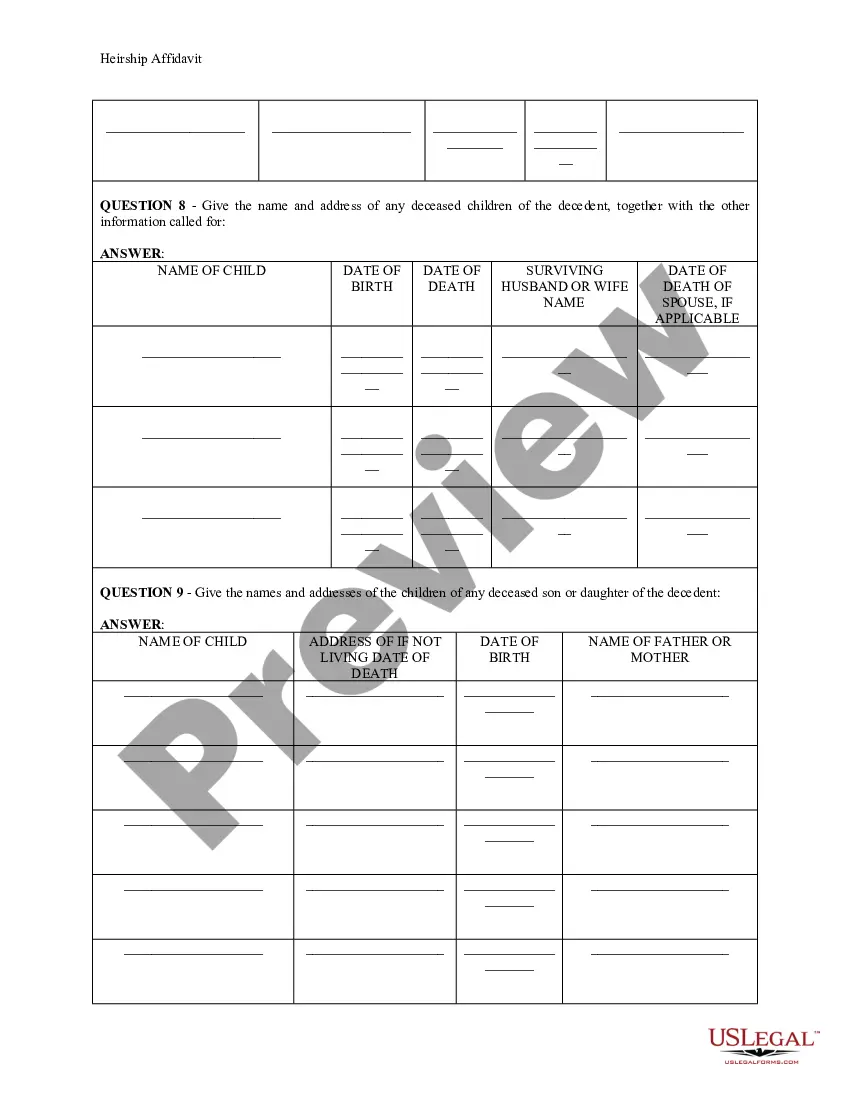

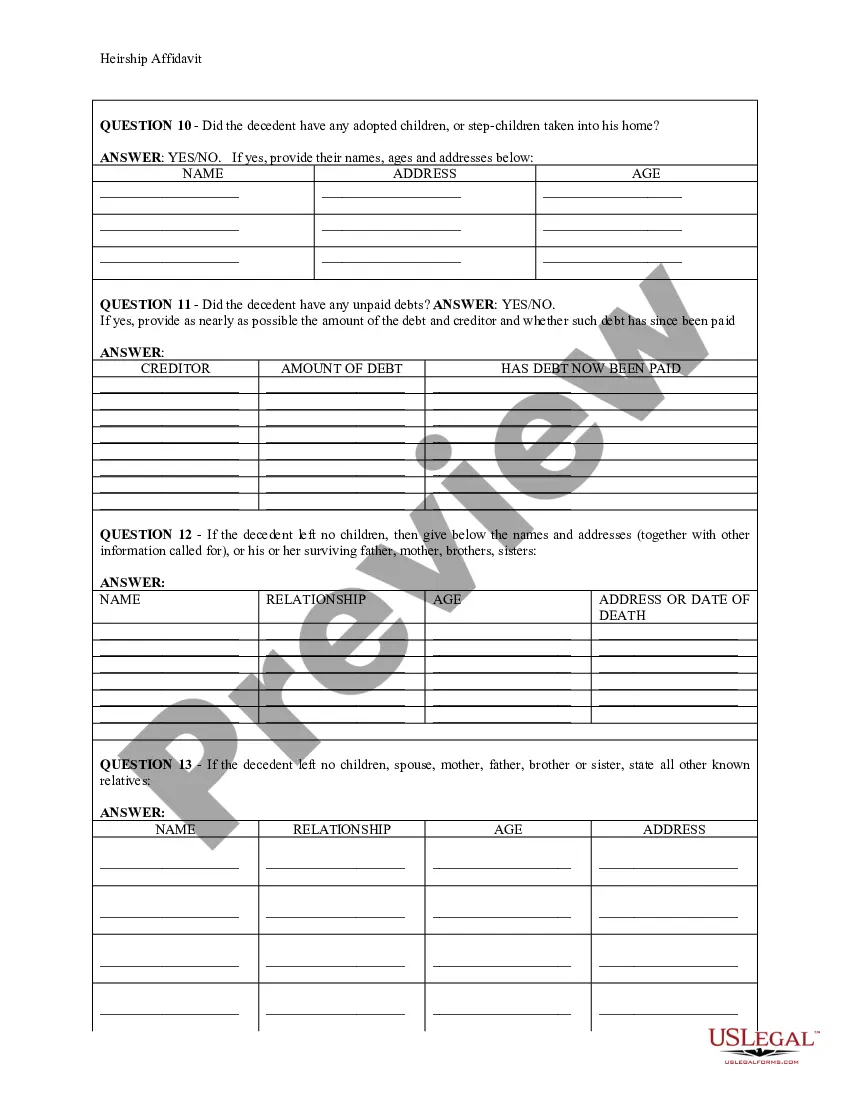

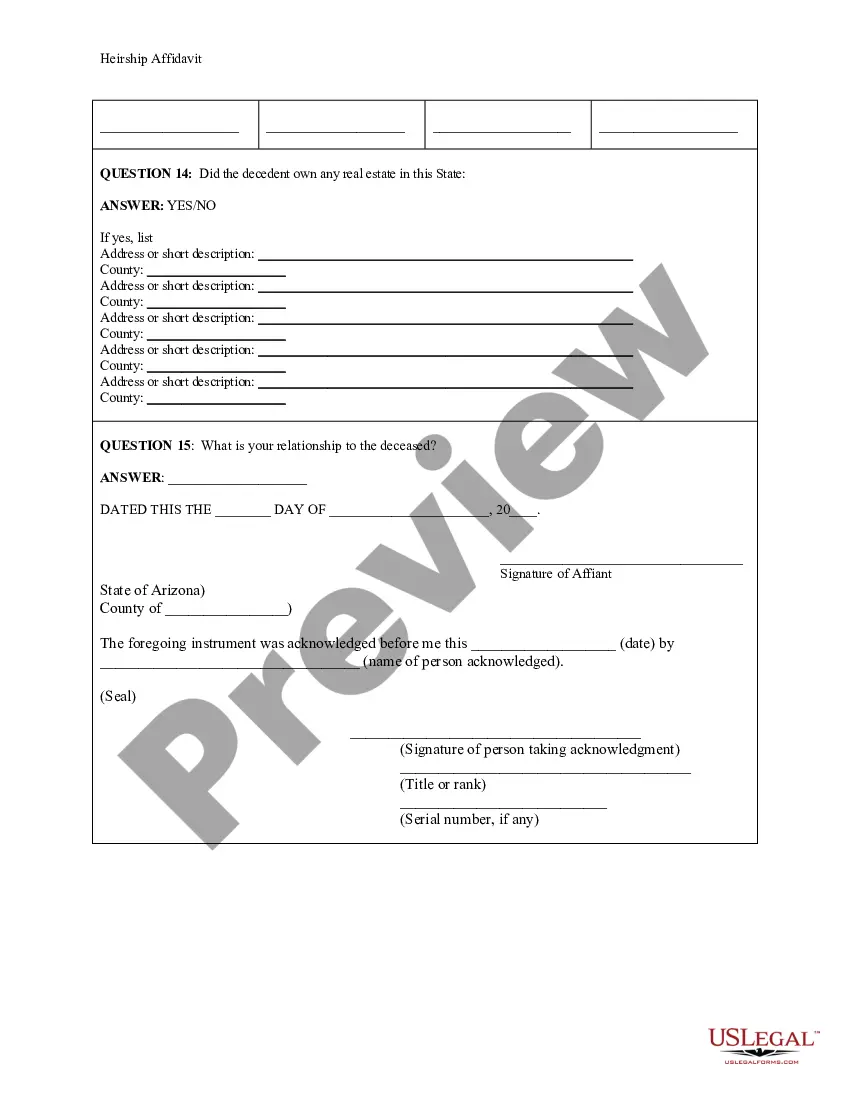

This Affidavit of Heirship form is for a person to complete stating the heirs of a deceased person. The affidavit is filed with the court six months after the death of the decedent. The Heirship Affidavit is commonly used to establish ownership of personal and real property. It may be recorded in official land records, if necessary. Example of use: Person A dies without a will, leaves a son and no estate is opened. When the son sells the land, the son obtains an heirship affidvait to record with the deed. The person executing the affidavit should normally not be an heir of the deceased, or other person interested in the estate.

Phoenix Arizona Heirship Affidavit - Descent

Description

How to fill out Arizona Heirship Affidavit - Descent?

We consistently aim to reduce or evade legal repercussions when handling intricate legal or financial issues.

To achieve this, we seek out legal services that are typically quite costly.

However, not all legal issues are equally complicated.

Many can be managed by us directly.

Utilize US Legal Forms whenever you need to locate and retrieve the Phoenix Arizona Heirship Affidavit - Descent or any other document with ease and security. Simply Log In to your account and click the Get button adjacent to it. If you've lost the form, you can always download it again from the My documents section. The procedure is just as straightforward for newcomers to the site! You can set up your account in a matter of minutes. Ensure that the Phoenix Arizona Heirship Affidavit - Descent complies with the laws and regulations of your state and locality. Additionally, it's crucial to review the form's outline (if provided), and if you notice any inconsistencies with what you initially sought, look for a different template. After confirming that the Phoenix Arizona Heirship Affidavit - Descent is suitable for your needs, you can choose a subscription plan and move forward to payment. Then, you can download the form in any available file format. For over 24 years, we have assisted millions by offering ready-to-customize and current legal forms. Take full advantage of US Legal Forms now to conserve time and resources!

- US Legal Forms is an online directory of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our collection empowers you to take charge of your affairs without needing to consult an attorney.

- We provide access to legal document templates that are not always available to the public.

- Our templates are tailored to specific states and regions, greatly easing the search process.

Form popularity

FAQ

Four Ways to Avoid Probate in Arizona Establish a Trust.Title Property with Rights of Survivorship.Make Accounts Payable on Death or Transfer of Death.Provisions for Small Estates.

The Arizona beneficiary deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

The Arizona Affidavit of Heirship for Real Estate allows successors to transfer real estate, finances, cars, and other ?property? after the owner has died, without the need for a will or probate court.

Typically, you need the property ownership document and the Will, or the Will with probate or succession certificate. In the absence of a Will, you may also need to prepare an affidavit along with a no-objection certificate from other legal heirs or their successors.

A beneficiary deed allows for the avoidance of probate. Arizona allows for the transfer of real estate by affidavit if the equity of all the real property in the estate is not greater than $100,000.

In case a male dies intestate, i.e. without making a will, his assets shall be distributed according to the Hindu Succession Act and the property is transferred to the legal heirs of the deceased. The legal heirs are further classified into two classes- class I and class II.

Probate is not required to deal with the property but may be needed if the deceased's estate warrants it. Much depends on what the deceased owned and what the beneficiaries intend to do with the property.

If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

To establish a beneficiary deed in Arizona, the deed must: Grant the real estate property to a beneficiary designated by the owner of said property. Be recorded in the office of the county where the property is located. Be recorded in the county office before the property owner's death.

In Arizona, your surviving spouse will automatically inherit your half of the community property if you have no descendants or if you have descendants -- children, grandchildren, or great grandchildren ? resulting only from your relationship with your surviving spouse.