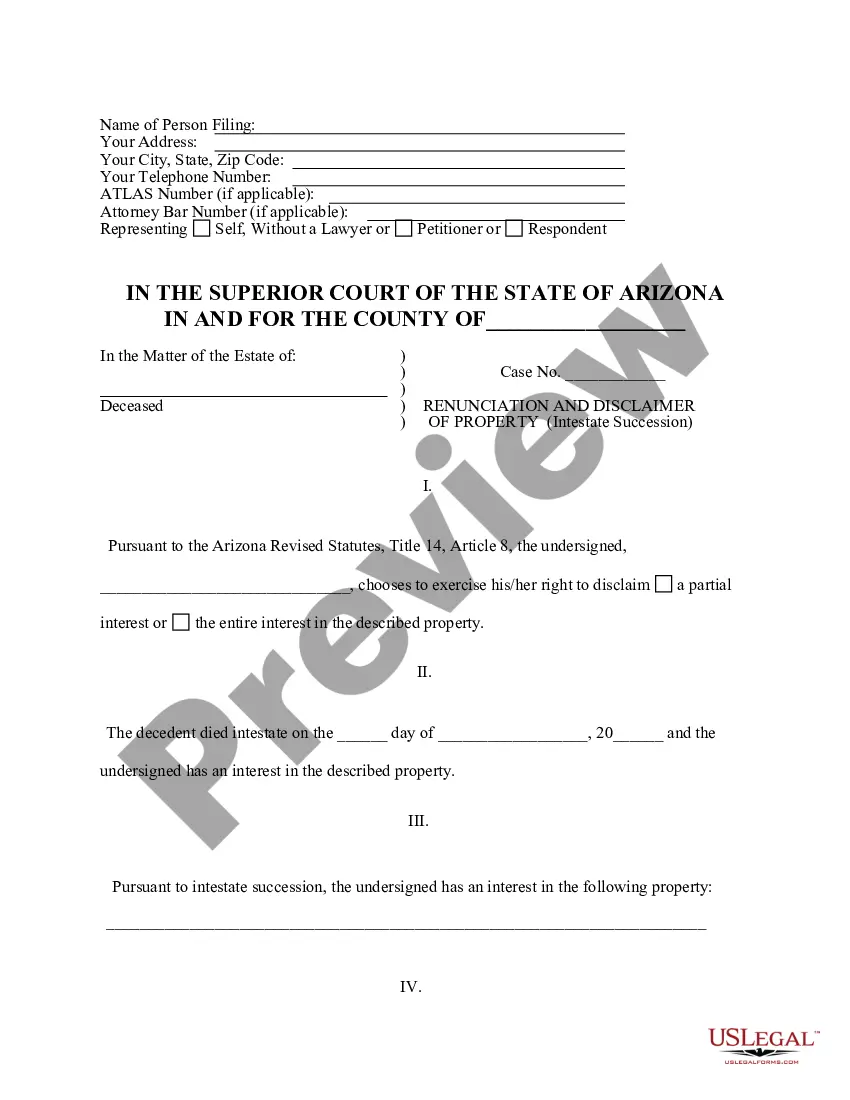

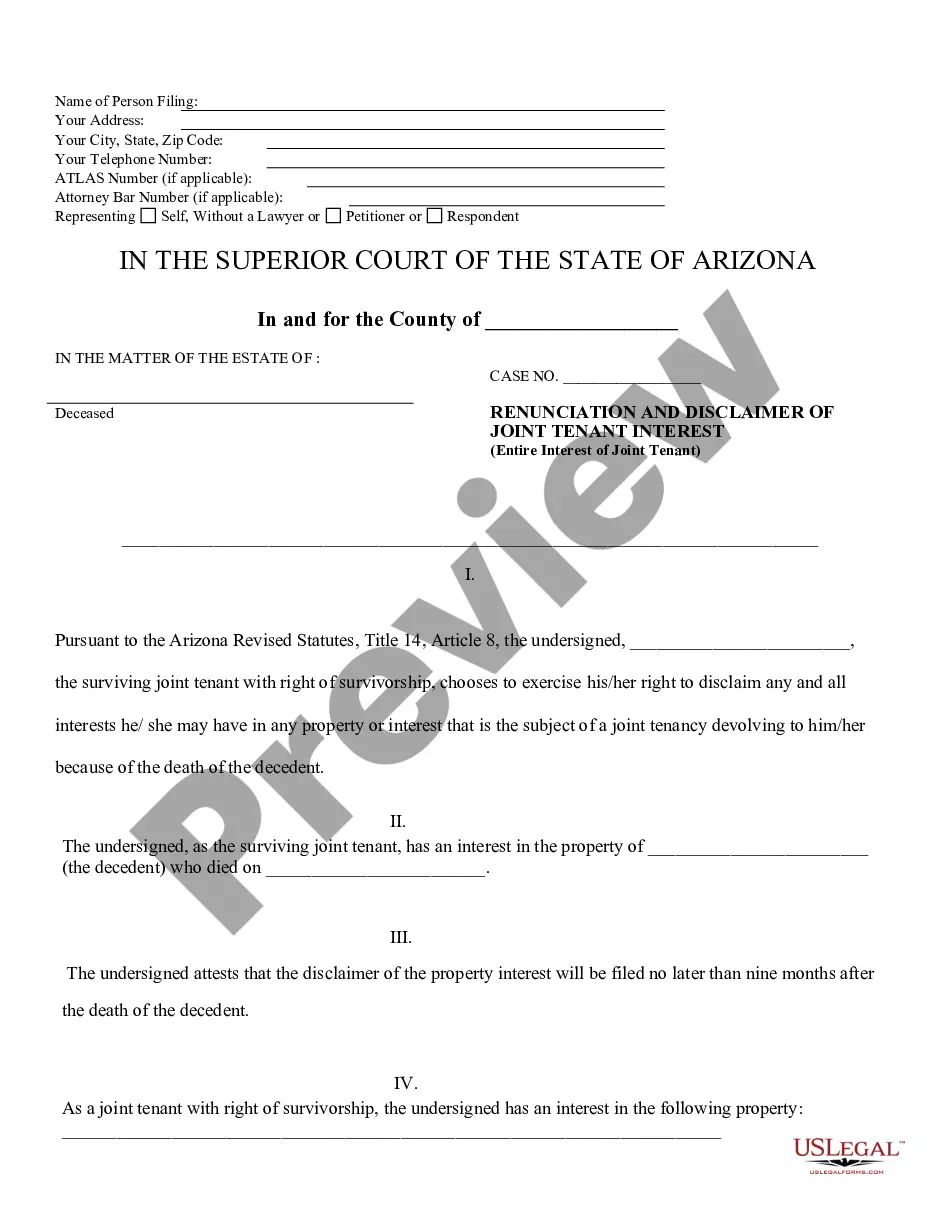

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the described property. The beneficiary has chosen to disclaim a portion of his/her entire interest in the property. Pursuant to the Arizona Revised Statutes, Title 14, Article 8, the beneficiary is entitled to disclaim the interest if the disclaimer is filed within nine months of the death of the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Phoenix Arizona Renunciation and Disclaimer of Property received by Intestate Succession

Description

How to fill out Arizona Renunciation And Disclaimer Of Property Received By Intestate Succession?

Obtaining validated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms repository.

It’s a digital collection of over 85,000 legal documents for both personal and business requirements as well as various real-world situations.

All the forms are properly categorized by field of use and jurisdictional areas, so finding the Phoenix Arizona Renunciation and Disclaimer of Property acquired through Intestate Succession is as simple as 1-2-3.

Maintaining documentation orderly and compliant with legal requirements holds significant importance. Leverage the US Legal Forms repository to always have vital document templates for any requirement right at your fingertips!

- Review the Preview mode and form overview.

- Ensure you’ve chosen the correct template that suits your needs and completely aligns with your local jurisdiction regulations.

- Look for a different template if necessary.

- If you notice any discrepancies, use the Search tab above to locate the appropriate one. If it fits your criteria, proceed to the subsequent step.

- Complete the transaction.

Form popularity

FAQ

If the decedent left a will and named you as a beneficiary and you decline the bequest, most states treat the event the same as if you had predeceased him. The executor must probate the will as if you had died and were no longer available to accept your inheritance. Your bequest will then revert back to the estate.

The Arizona beneficiary deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

Four Ways to Avoid Probate in Arizona Establish a Trust.Title Property with Rights of Survivorship.Make Accounts Payable on Death or Transfer of Death.Provisions for Small Estates.

A beneficiary deed allows for the avoidance of probate. Arizona allows for the transfer of real estate by affidavit if the equity of all the real property in the estate is not greater than $100,000.

One way for an asset to avoid gift tax liability is if it is a qualified disclaimed gift. The government does not consider a gift or inheritance to be a gift, and it subject to the gift tax if the original recipient refused or disclaimed it.

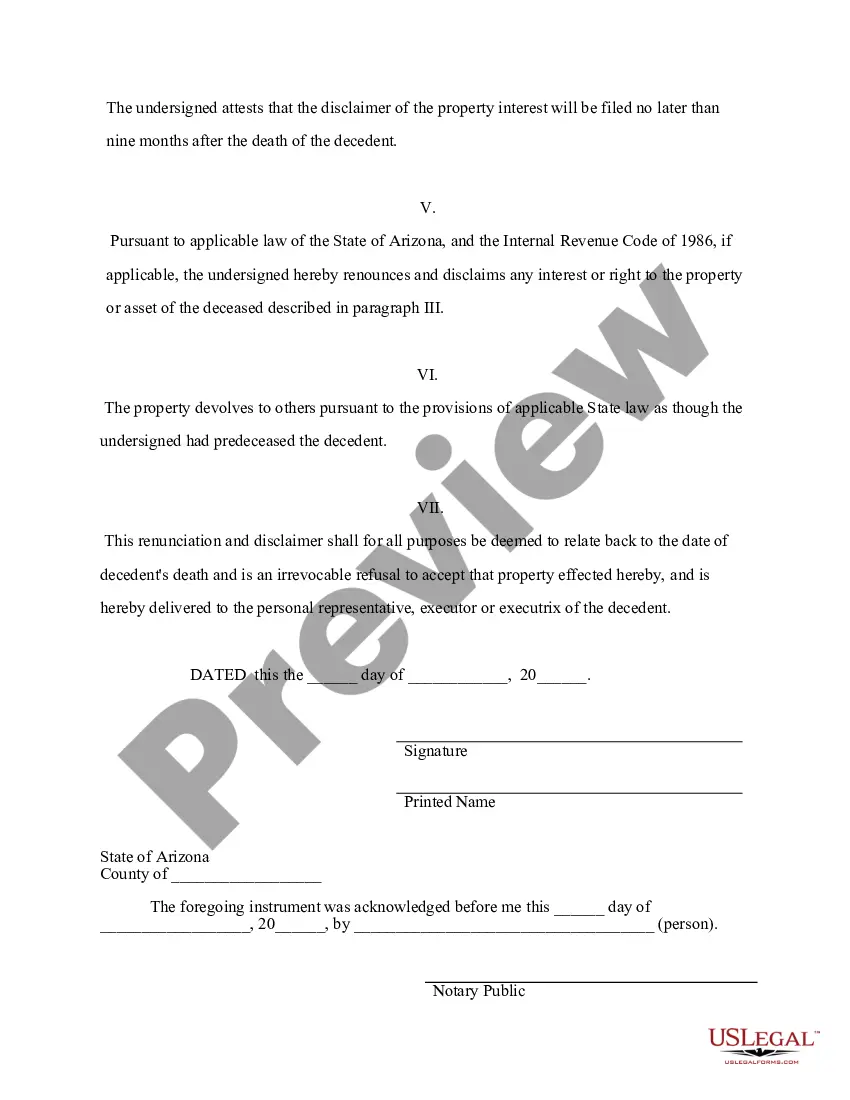

To be valid under Arizona law, a disclaimer of a bequest or inheritance must be in writing, signed by the person disclaiming, and delivered (or recorded) according to the statute.

To establish a beneficiary deed in Arizona, the deed must: Grant the real estate property to a beneficiary designated by the owner of said property. Be recorded in the office of the county where the property is located. Be recorded in the county office before the property owner's death.

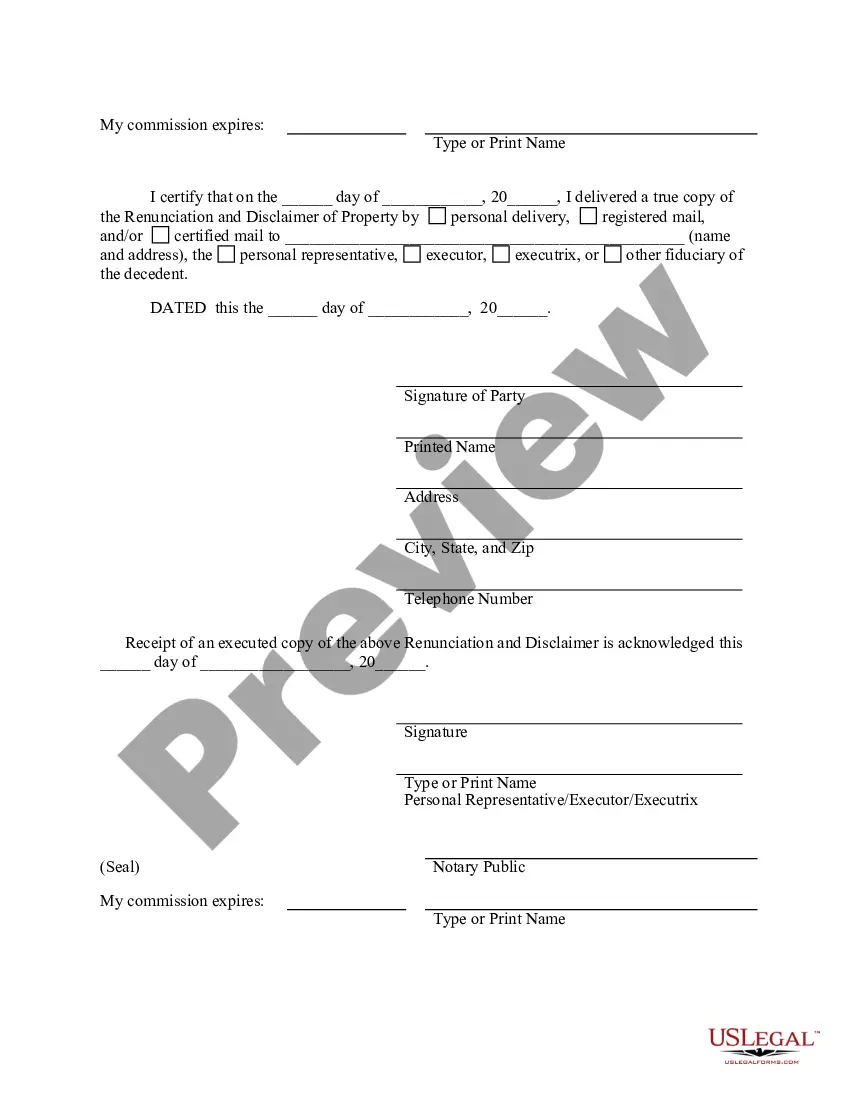

How to Make a Disclaimer Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate?usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property.Do not accept any benefit from the property you're disclaiming.

The general rule is that if a beneficiary dies during probate but prior to the point at which assets earmarked for him/her have legally been transferred into his/her name, those assets become part of the deceased beneficiary's estate.

In order to remove the name of the deceased, Form DJP (Deceased Joint Proprietor) must be completed and filed along with a copy of the death certificate. There is no requirement to show the Grant of Representation to the Land Registry, which means updating the title deed can be done soon after death.