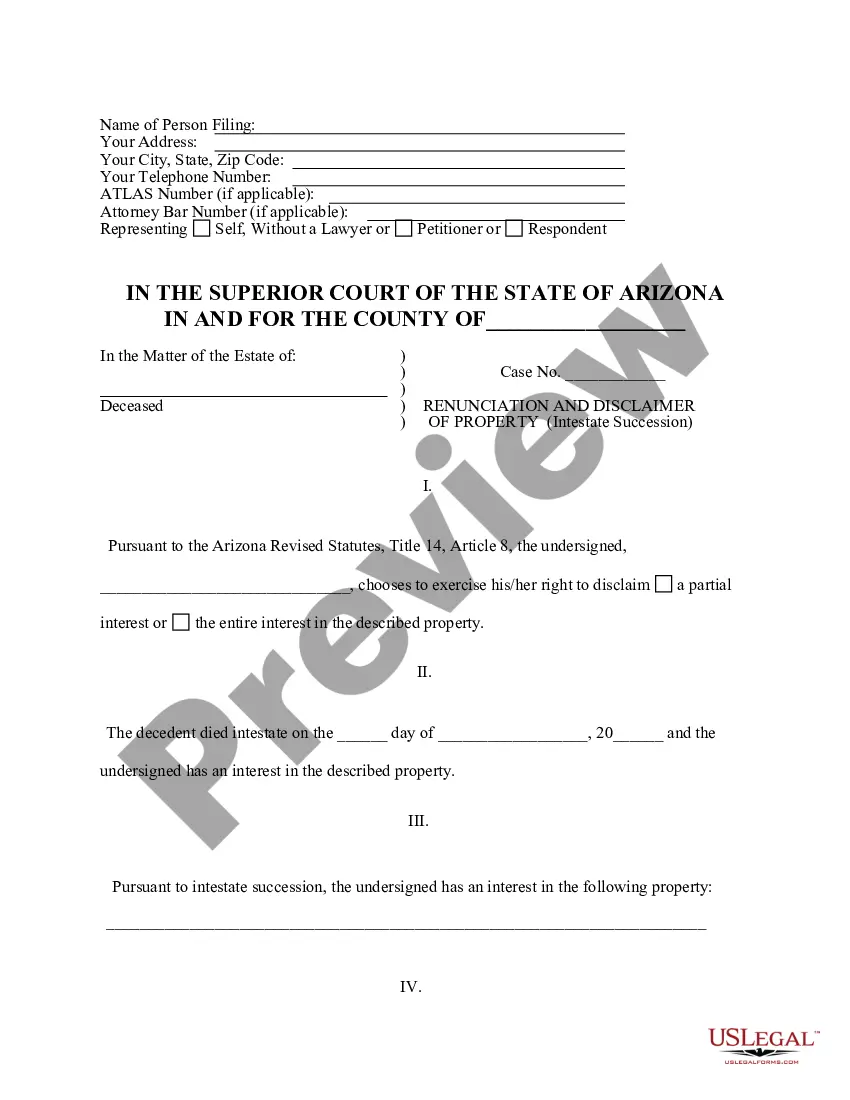

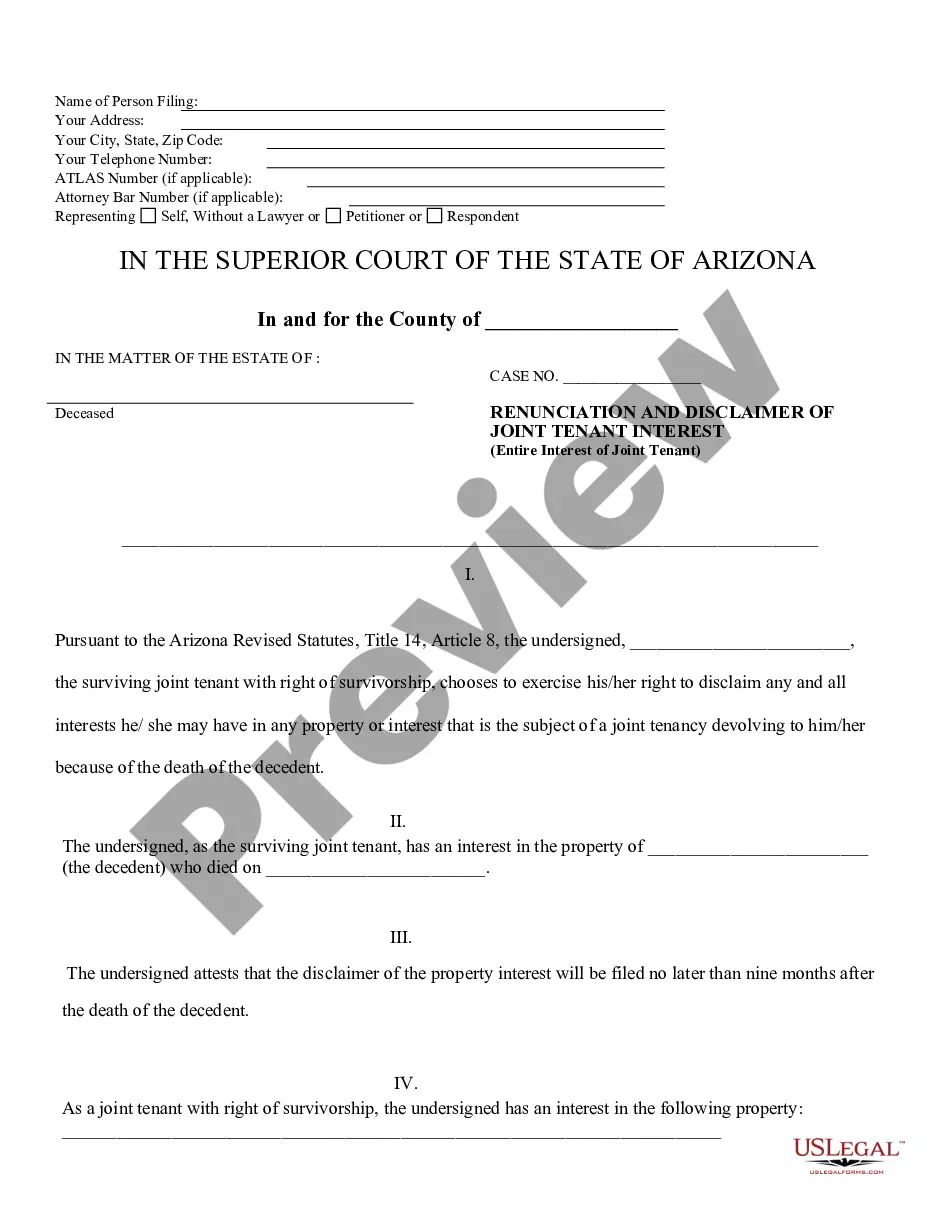

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the described property. The beneficiary has chosen to disclaim a portion of his/her entire interest in the property. Pursuant to the Arizona Revised Statutes, Title 14, Article 8, the beneficiary is entitled to disclaim the interest if the disclaimer is filed within nine months of the death of the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Arizona Renunciation and Disclaimer of Property received by Intestate Succession

Description

Key Concepts & Definitions

Arizona Renunciation and Disclaimer of Property: A legal declaration made by an heir or beneficiary, disclaiming or renouncing their right to inherit a property or part of an estate. This is often used in situations where accepting the inheritance could lead to financial downside, such as high taxes or debt associated with the property.

Step-by-Step Guide

- Review the Will or Trust: Identify the specific property or interest intended for renunciation.

- Consult with an Attorney: Seek legal advice to ensure the disclaimer complies with both federal and Arizona state laws.

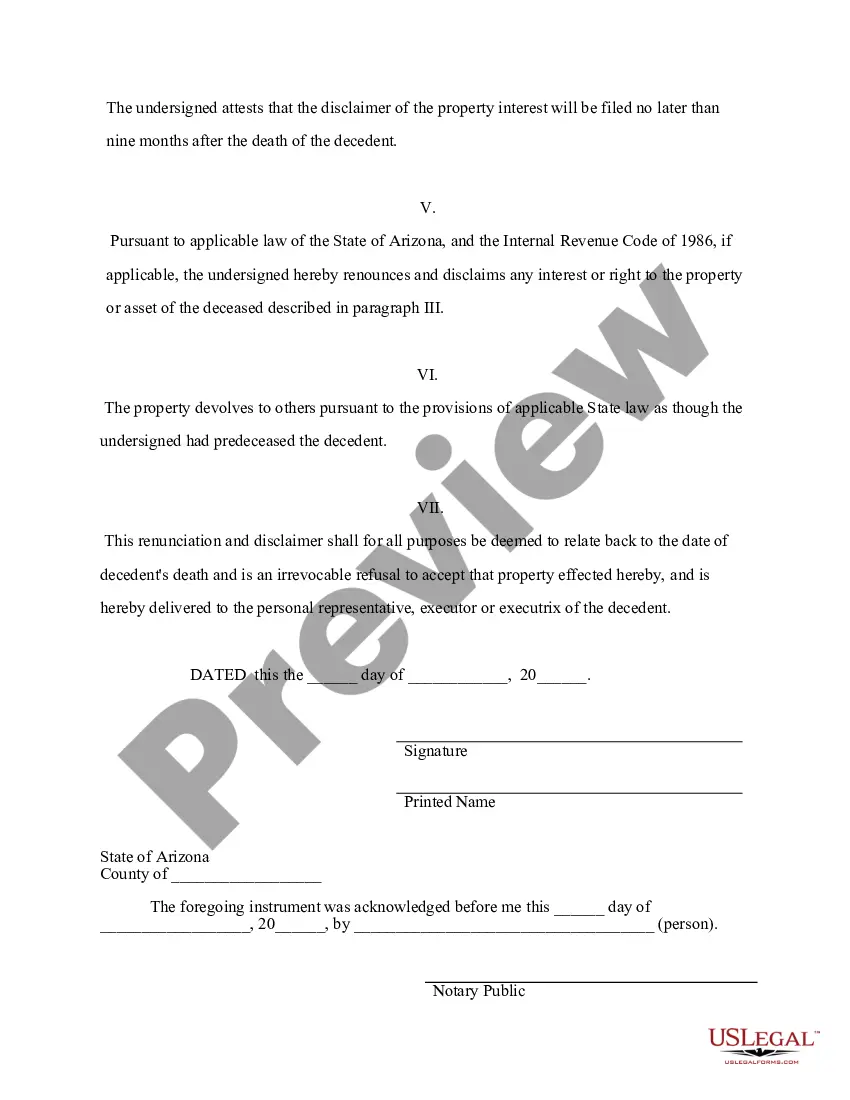

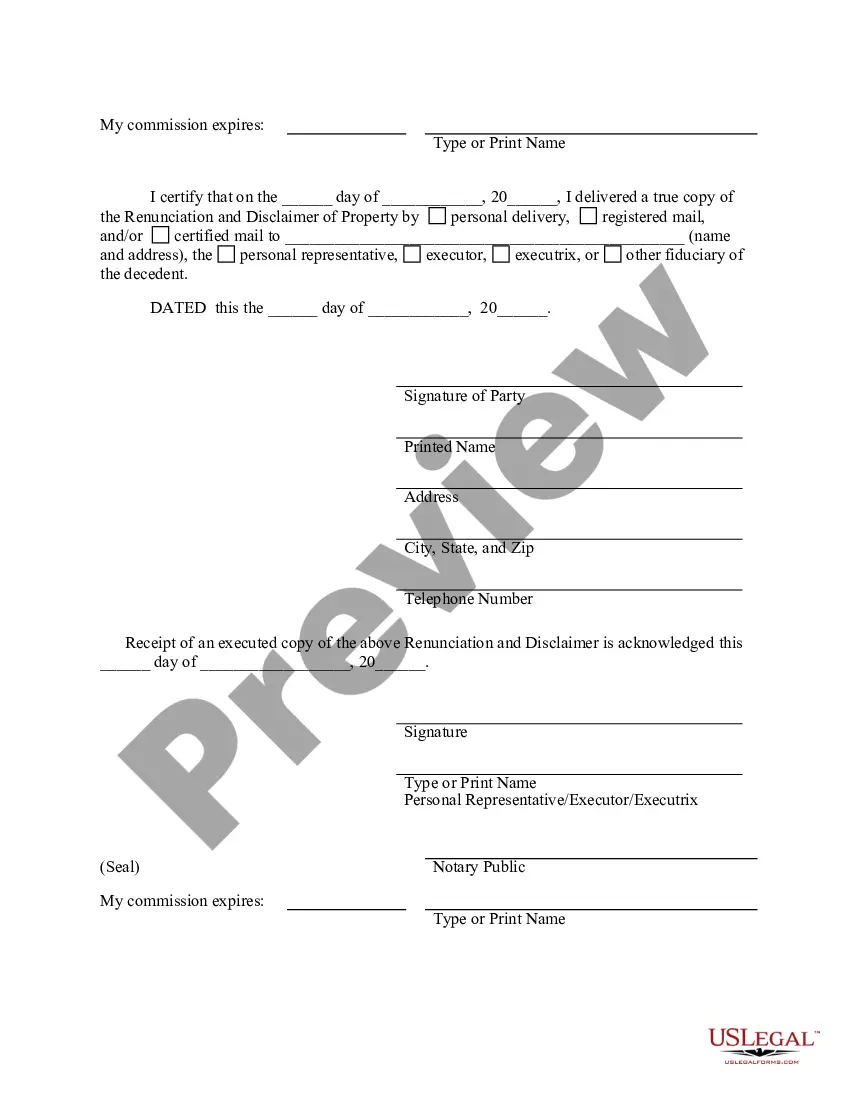

- Prepare the Disclaimer Document: Draft a formal declaration stating the decision to renounce the property, properly identifying the property and the beneficiary's relation to it.

- Execute the Disclaimer: Sign the document in the presence of a notary to make it legally binding.

- File the Disclaimer: Submit the executed document to the relevant court or entity handling the estate within nine months of the property transfer.

Risk Analysis

- Legal Risks: Incorrect filing or failure to comply with legal standards may invalidate the disclaimer.

- Financial Risks: Potential loss of valuable property which could be sold or used for personal gain.

- Tax Implications: Mismanagement of the disclaimer process could lead to unforeseen tax liabilities.

How to fill out Arizona Renunciation And Disclaimer Of Property Received By Intestate Succession?

If you're looking for precise Arizona Renunciation and Disclaimer of Property acquired through Intestate Succession templates, US Legal Forms is exactly what you require; access documents developed and verified by state-certified legal professionals.

Using US Legal Forms not only spares you from concerns related to legal documentation; furthermore, it saves you time, effort, and money! Downloading, printing, and completing a professional template is significantly more economical than hiring an attorney to handle it for you.

And that's it. With just a few simple clicks, you possess an editable Arizona Renunciation and Disclaimer of Property received through Intestate Succession. Once you set up an account, all future requests will be handled even more easily. If you have a US Legal Forms subscription, simply Log In to your account and click the Download button available on the form’s page. Then, when you need to utilize this template again, you'll always be able to find it in the My documents section. Avoid wasting your time sifting through countless forms on various websites. Purchase professional versions from a single secure source!

- To begin, complete your registration process by entering your email and creating a password.

- Follow the steps below to set up your account and locate the Arizona Renunciation and Disclaimer of Property received through Intestate Succession template to address your needs.

- Utilize the Preview option or review the file details (if available) to confirm that the form is what you require.

- Verify its relevance in your residing state.

- Click Buy Now to proceed with your purchase.

- Choose a preferred pricing plan.

- Establish your account and make a payment using your credit card or PayPal.

- Select a desired format and download the documents.

Form popularity

FAQ

Whether to choose a will or a trust in Arizona depends on individual circumstances and preferences. A trust often allows for greater control over asset distribution, potentially bypassing probate. Conversely, a will is typically simpler to create and can cover all your wishes without immediate management. An understanding of the Arizona Renunciation and Disclaimer of Property received by Intestate Succession may help clarify the best choice for your estate planning needs.

Beneficiaries in Arizona trust law possess specific rights, including the right to receive information about the trust's assets and distributions. They also have the right to challenge the actions of the trustee if they feel their interests are being neglected. Trusts must be administered according to the terms set within the trust documents, safeguarding the beneficiaries' distributions. Understanding the Arizona Renunciation and Disclaimer of Property received by Intestate Succession can further empower beneficiaries.

Intestate succession laws in Arizona dictate how property is distributed when a person dies without a valid will. Generally, the estate goes to the deceased's closest relatives, starting from spouses and children to further relatives. Arizona's laws provide a clear framework to ensure fair distribution of assets. Those considering the Arizona Renunciation and Disclaimer of Property received by Intestate Succession should consult legal advice to navigate these laws effectively.

Title 14 of the Arizona Revised Statutes contains laws relating to trusts and estates. This section outlines the legal framework governing how trusts are created, administered, and dissolved. Understanding Title 14 is essential for anyone involved in serious estate planning and management of trust assets. Knowledge about the Arizona Renunciation and Disclaimer of Property received by Intestate Succession can complement this understanding.

Arizona's trust law governs the creation, management, and termination of trusts within the state. It emphasizes the importance of adhering to the terms set forth in the trust document while providing protections for beneficiaries. The state also allows for flexibility with unique trust arrangements, which can be advantageous in estate planning. Familiarizing yourself with the Arizona Renunciation and Disclaimer of Property received by Intestate Succession is also beneficial for a well-rounded understanding.

In Arizona, trust rules are comprehensive and designed to protect both the grantor and the beneficiaries. Trusts must be established in writing, and the grantor must clearly define the trust's purpose and beneficiaries. Arizona law allows for various types of trusts, including revocable and irrevocable options. Be mindful of the Arizona Renunciation and Disclaimer of Property received by Intestate Succession when determining how property is handled after one's passing.

One significant mistake parents often make when setting up a trust fund is failing to communicate their intentions clearly. When parents do not outline their reasons for establishing the trust or its specific terms, it can lead to confusion among heirs. Proper documentation and transparency can help prevent disputes. Consider using the Arizona Renunciation and Disclaimer of Property received by Intestate Succession to avoid complications.

In Arizona, the duty to disclose refers to a legal obligation to reveal pertinent information during a transaction, especially concerning real estate. This responsibility ensures that all parties involved are aware of any potential issues affecting the property. While this duty may not directly impact the Arizona Renunciation and Disclaimer of Property received by Intestate Succession, being informed can enhance your decision-making in property transactions.

The disclaimer law in Arizona allows heirs to reject property received through intestate succession. This law offers individuals the ability to decide against accepting an inheritance, which can prevent unintended tax implications or burdens associated with inherited assets. Understanding the Arizona Renunciation and Disclaimer of Property received by Intestate Succession is key to utilizing this law effectively.

To disclaim an inherited property in Arizona, you must file a written disclaimer with the appropriate court or governing body. This document should clearly state your intention to renounce your rights to the property. Utilizing the Arizona Renunciation and Disclaimer of Property received by Intestate Succession can simplify this process, ensuring that your disclaimer is legally sound.