This form is a Renunciation and Disclaimer of Property received by the beneficiary. The beneficiary received an interest in the described property through the last will and testament of the decedent. However, under the provisions of the Arizona Revised Statutes, Title 14, Article 8, the beneficiary has decided to disclaim a partial interest or the entire interest in the described property. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Tucson Arizona Renunciation and Disclaimer of Property from Will by Testate

Description

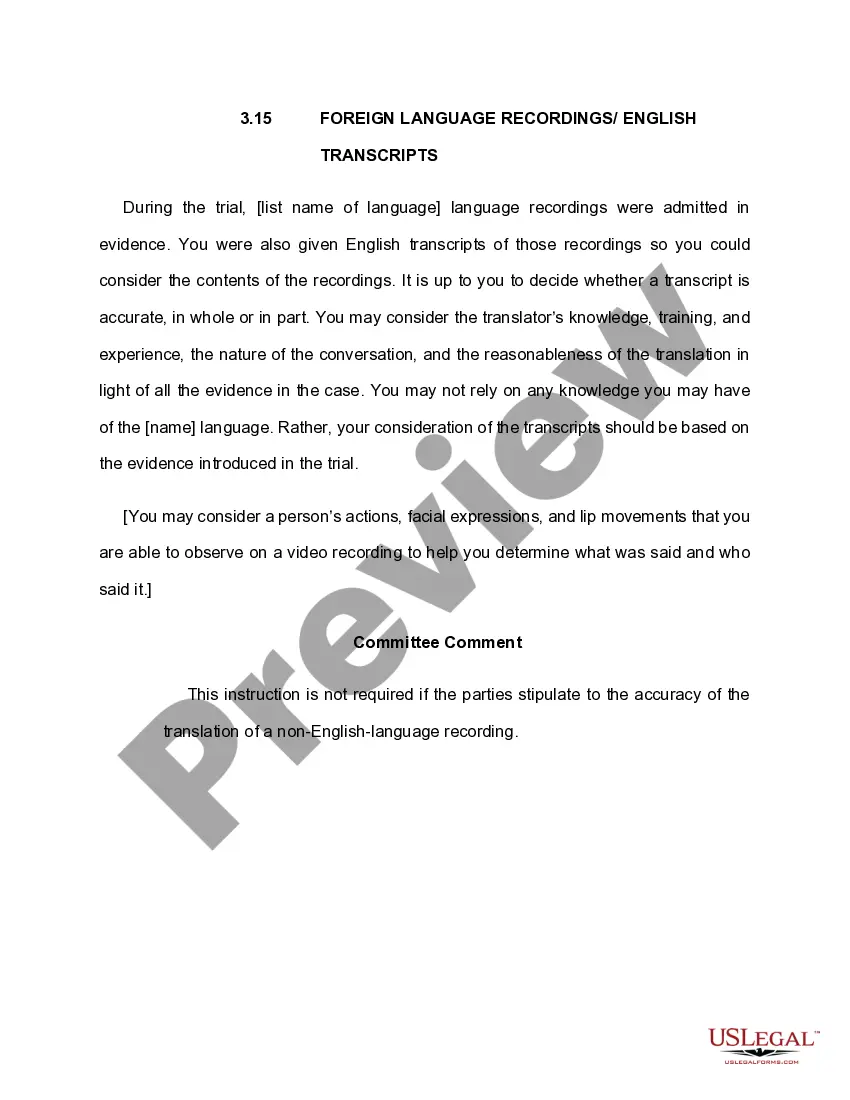

How to fill out Arizona Renunciation And Disclaimer Of Property From Will By Testate?

If you have previously utilized our service, sign in to your account and download the Tucson Arizona Renunciation and Disclaimer of Property from Will by Testate onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your file.

You have lifelong access to every document you have acquired: you can find it in your profile under the My documents section whenever you need to retrieve it again. Utilize the US Legal Forms service to effortlessly locate and save any template for your personal or business needs!

- Ensure you’ve found the correct document. Review the description and make use of the Preview option, if available, to verify if it suits your requirements. If it’s not suitable, use the Search tab above to find the right one.

- Purchase the template. Click the Buy Now button and select either a monthly or yearly subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal method to finalize the purchase.

- Receive your Tucson Arizona Renunciation and Disclaimer of Property from Will by Testate. Choose the file type for your document and save it to your device.

- Complete your document. Print it or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

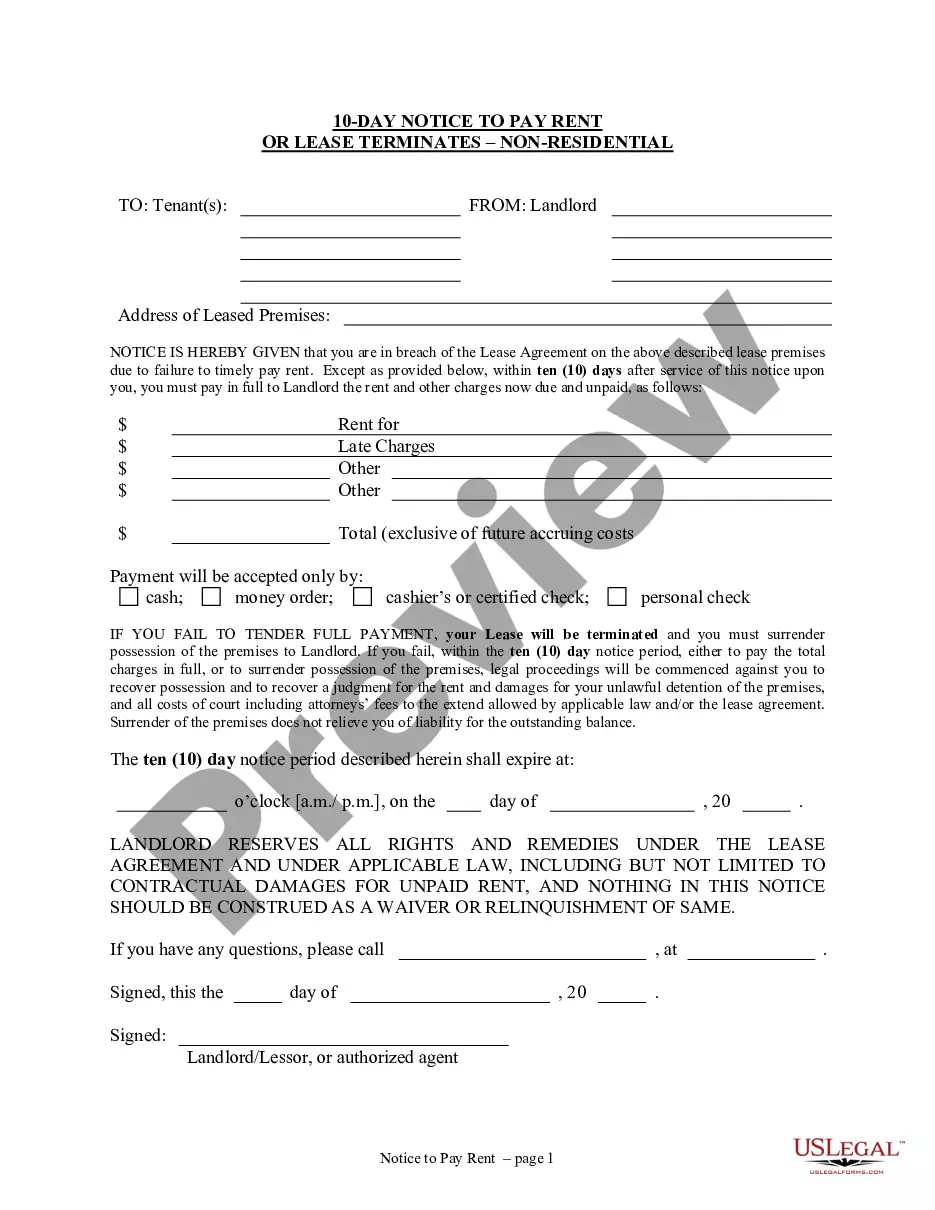

How to Make a Disclaimer Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate?usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property.Do not accept any benefit from the property you're disclaiming.

Key Takeaways. Common reasons for disclaiming an inheritance include not wishing to pay taxes on the assets or ensuring that the inheritance goes to another beneficiary?for example, a grandchild. Specific IRS requirements must be followed in order for a disclaimer to be qualified under federal law.

In the law of inheritance, wills and trusts, a disclaimer of interest (also called a renunciation) is an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust.

If the decedent left a will and named you as a beneficiary and you decline the bequest, most states treat the event the same as if you had predeceased him. The executor must probate the will as if you had died and were no longer available to accept your inheritance. Your bequest will then revert back to the estate.

Disclaiming means that you give up your rights to receive the inheritance. If you choose to do so, whatever assets you were meant to receive would be passed along to the next beneficiary in line. It's not typical for people to disclaim inheritance assets.

Disclaiming means that you give up your rights to receive the inheritance. If you choose to do so, whatever assets you were meant to receive would be passed along to the next beneficiary in line. It's not typical for people to disclaim inheritance assets.

To be valid under Arizona law, a disclaimer of a bequest or inheritance must be in writing, signed by the person disclaiming, and delivered (or recorded) according to the statute.

Renunciation of inheritance means that an heir renounces his/her right to inherit any of legacy when the heir does not want to inherit the legacy of the ancestor (a deceased person).

One way for an asset to avoid gift tax liability is if it is a qualified disclaimed gift. The government does not consider a gift or inheritance to be a gift, and it subject to the gift tax if the original recipient refused or disclaimed it.

How to Make a Disclaimer Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate?usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property.Do not accept any benefit from the property you're disclaiming.