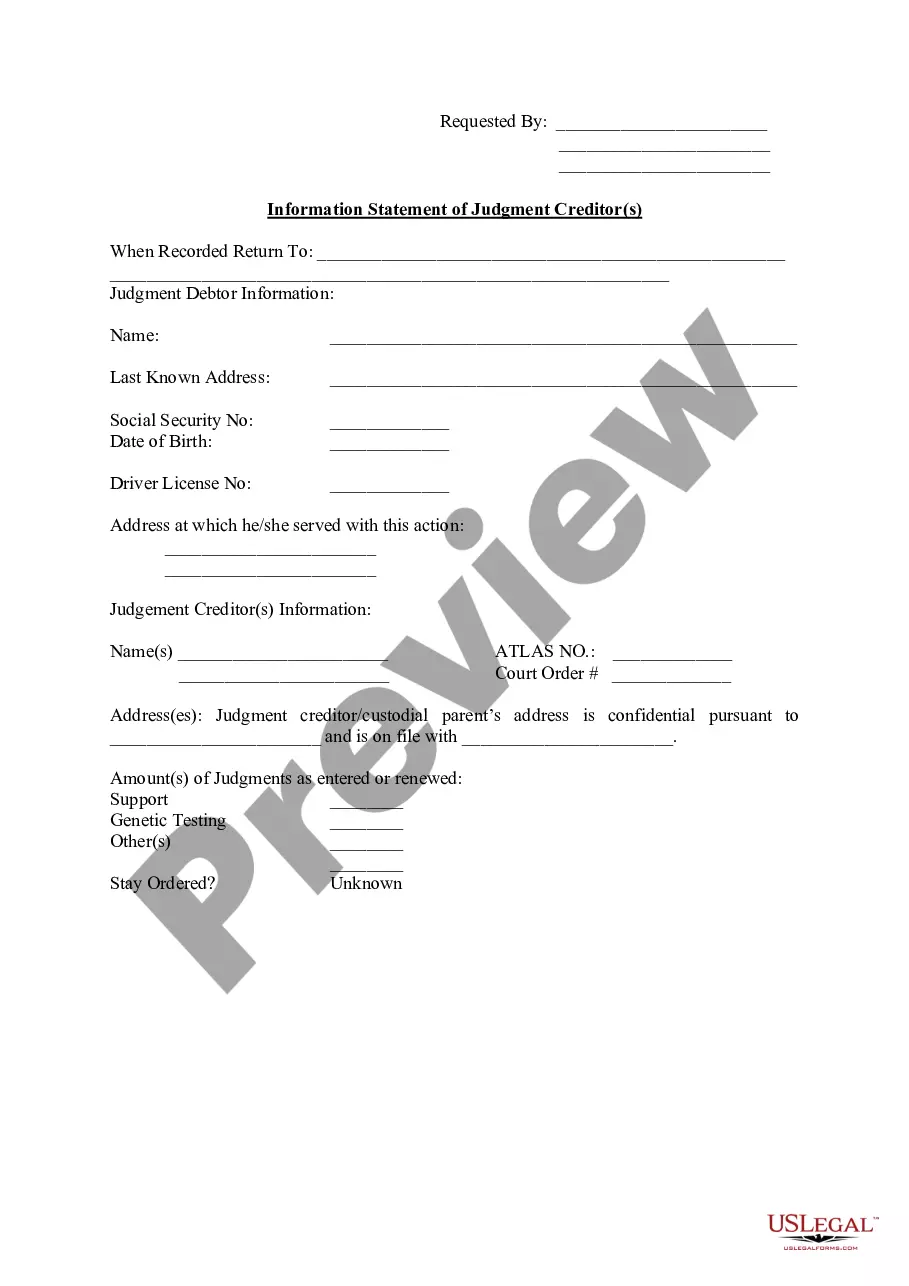

Surprise Arizona Information Statement of Judgment Creditor(s)

Description

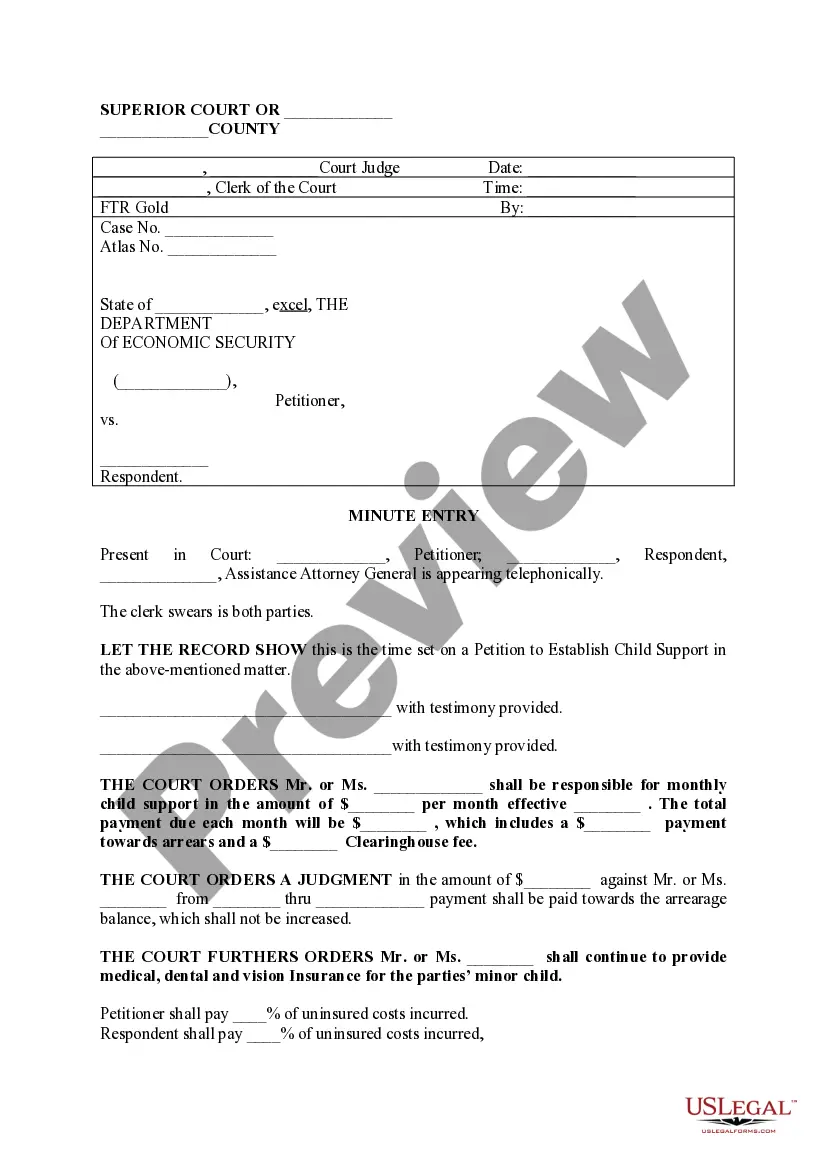

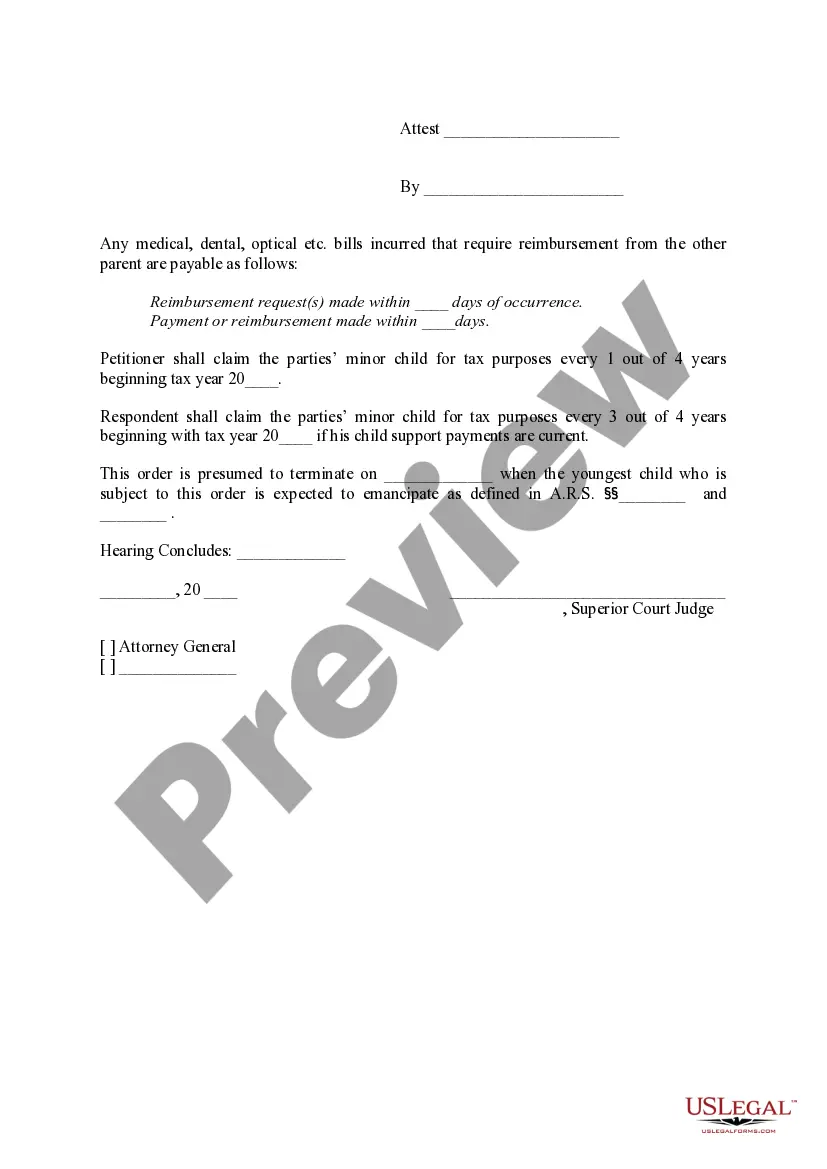

child support payments

How to fill out Arizona Information Statement Of Judgment Creditor(s)?

If you’ve previously used our service, sign in to your account and download the Surprise Arizona Information Statement of Judgment Creditor(s) onto your device by clicking the Download button. Ensure that your subscription is active. If it is not, renew it per your payment plan.

If this is your initial experience with our service, follow these straightforward steps to acquire your document.

You have perpetual access to every document you have purchased: you can locate it in your profile within the My documents section whenever you need to retrieve it again. Take advantage of the US Legal Forms service to effortlessly find and save any template for your personal or professional requirements!

- Confirm you’ve found an appropriate document. Review the description and utilize the Preview option, if available, to verify if it aligns with your needs. If it does not meet your criteria, use the Search tab above to find the correct one.

- Buy the template. Click the Buy Now button and choose either a monthly or yearly subscription plan.

- Create an account and process your payment. Use your credit card information or the PayPal option to finish the transaction.

- Acquire your Surprise Arizona Information Statement of Judgment Creditor(s). Select the desired file format for your document and save it to your device.

- Fill out your form. Print it or utilize professional online editors to complete and electronically sign it.

Form popularity

FAQ

To enforce a judgment in Arizona, you must first obtain a copy of the judgment and file it with the court. You then need to consider the methods available, such as wage garnishment or bank levies, to collect the owed amount. Utilizing the Surprise Arizona Information Statement of Judgment Creditor(s) can provide guidance on your rights and processes. If you need assistance with the enforcement process, US Legal Forms offers comprehensive resources to streamline your efforts.

Collecting judgments can present challenges, especially if the debtor lacks sufficient assets. It often requires persistent efforts from the creditor, such as filing for wage garnishments or property liens. Knowledge about the Surprise Arizona Information Statement of Judgment Creditor(s) is essential in these circumstances. Tools and templates from USLegalForms can assist creditors in streamlining the collection process and reducing complications.

When you receive a judgment against you in Arizona, it means the court has decided that you owe a debt. The creditor can then take steps to collect the debt, which may include placing a lien on your property or garnishing your wages. This process underscores the importance of understanding the Surprise Arizona Information Statement of Judgment Creditor(s) implications. Platforms like USLegalForms can provide helpful resources to navigate these situations effectively.

A lien from a judgment in Arizona generally remains on your property for 10 years. However, the lien can be extended if the creditor takes appropriate legal action to renew it before the initial period expires. This aspect is vital for anyone navigating the Surprise Arizona Information Statement of Judgment Creditor(s) landscape. To manage and document property liens effectively, consider using USLegalForms for access to the necessary legal tools.

In Arizona, a creditor can typically pursue collection on a judgment for up to 10 years from the date it was entered. This period may be extended if the creditor files for renewal before it expires. Understanding the time limits is crucial for anyone dealing with the Surprise Arizona Information Statement of Judgment Creditor(s) process. Proper documentation through services like USLegalForms can help ensure you meet all necessary requirements during this period.

An abstract of judgment in Arizona serves as a public record of a court's decision regarding a debt. This document includes essential details such as the names of the parties involved, the amount owed, and the court's ruling. When recorded, it provides notice to third parties about the creditor's rights against the debtor's property, making it a critical component for Surprise Arizona Information Statement of Judgment Creditor(s). Utilizing a reliable platform like USLegalForms can simplify the process of obtaining and filing an abstract of judgment.

Arizona has specific rules regarding judgments, including how they are obtained and enforced. Creditors must file their judgments with the court and provide notices to debtors, ensuring transparency throughout the process. The Surprise Arizona Information Statement of Judgment Creditor(s) aids creditors in understanding these rules and ensures that all legal requirements are met. Familiarizing yourself with this information can further clarify your options and obligations under Arizona law.

Not paying a judgment in Arizona does not typically lead to jail time. Instead, the court holds the ability to enforce the judgment through various methods, such as wage garnishment or bank levies, rather than criminal penalties. Understanding the Surprise Arizona Information Statement of Judgment Creditor(s) will clarify your obligations and help you navigate your rights and responsibilities. This knowledge can empower you to take appropriate actions if faced with a judgment.

In Arizona, a judgment is enforceable for a period of five years from the date it was issued. After this time, the judgment may become dormant, but you can reactivate it by taking specific legal steps. It is essential to understand that the Surprise Arizona Information Statement of Judgment Creditor(s) can help creditors in maintaining their rights during this period. Staying informed about these timelines can help you manage the implications of any judgments effectively.

Recording a judgment in Arizona involves filing a copy of the judgment with the clerk of the superior court in the relevant county. This formality gives public notice of the judgment and may affect the debtor's credit status. Utilizing platforms like uslegalforms can make this process easier by providing the necessary forms and instructions aligned with the Surprise Arizona Information Statement of Judgment Creditor(s).