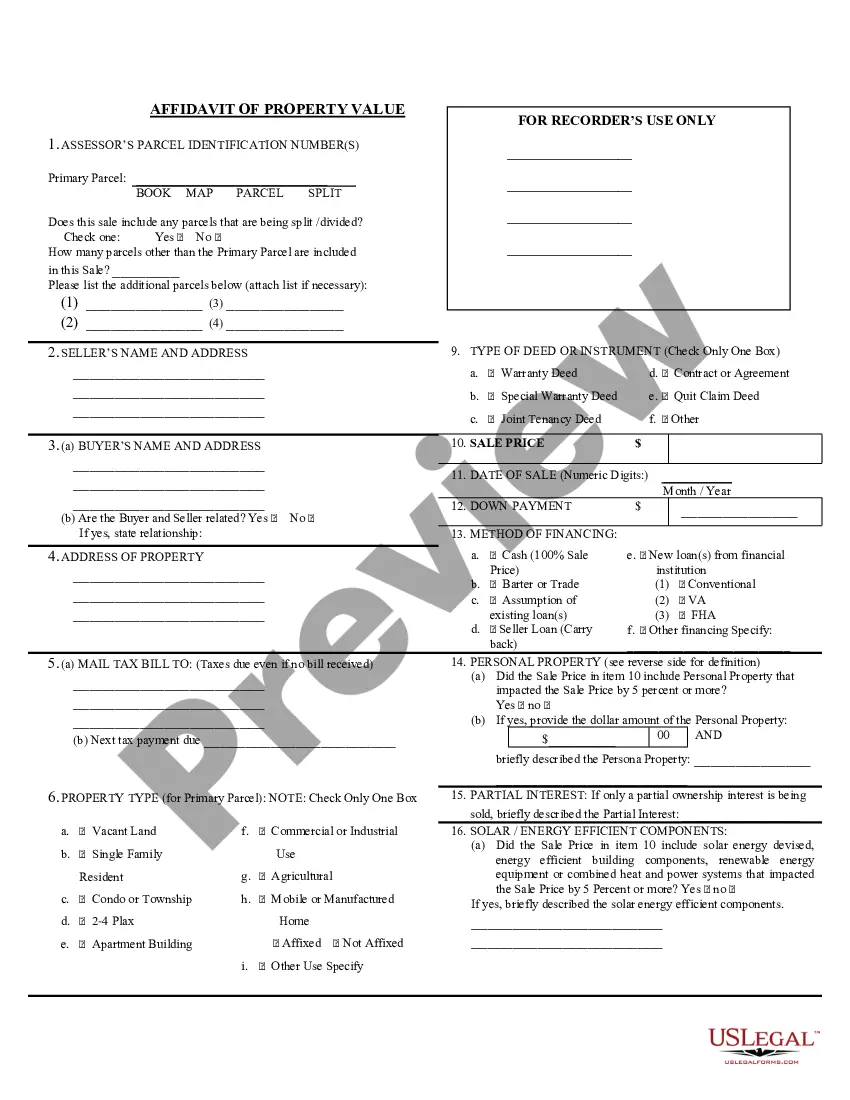

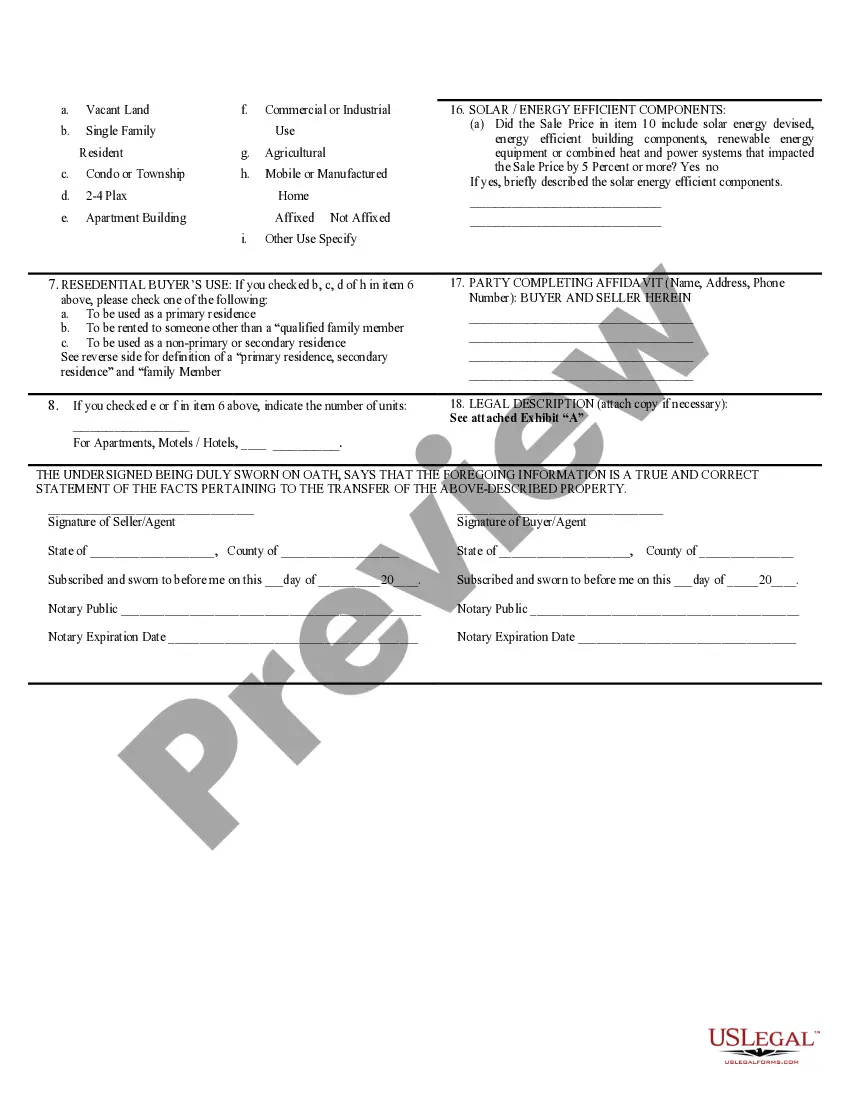

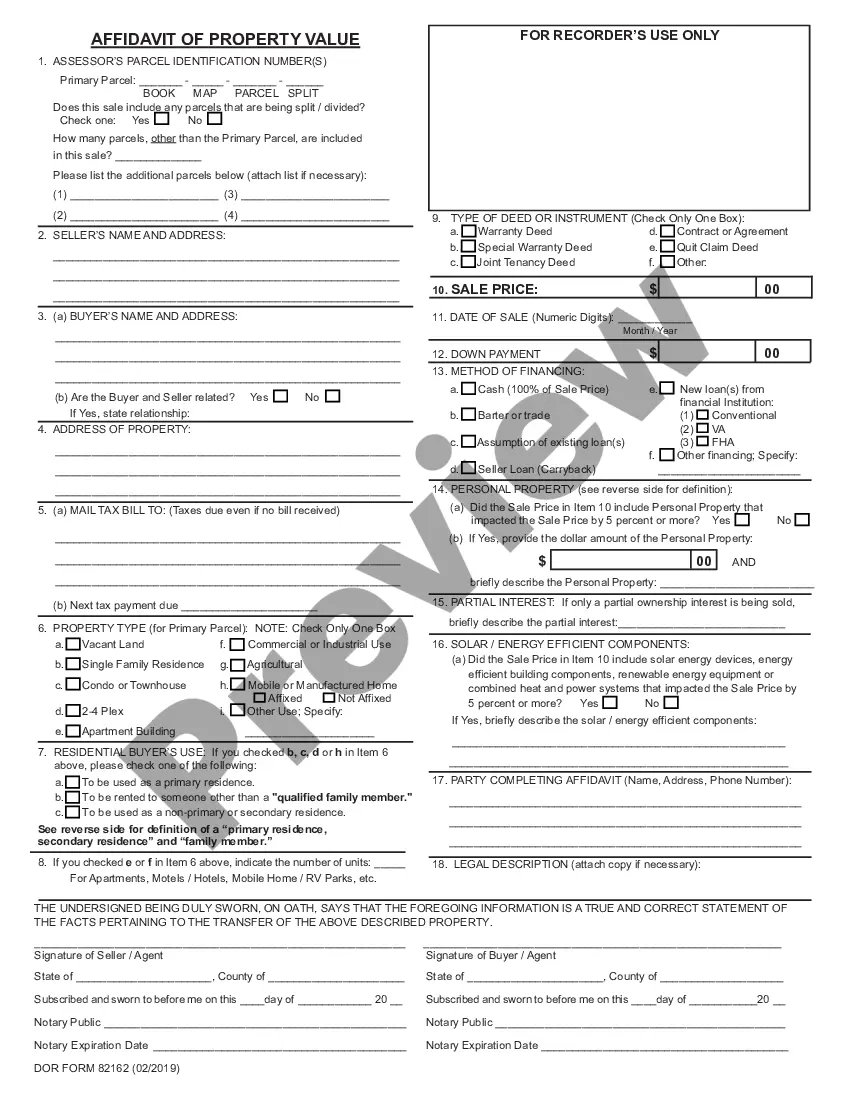

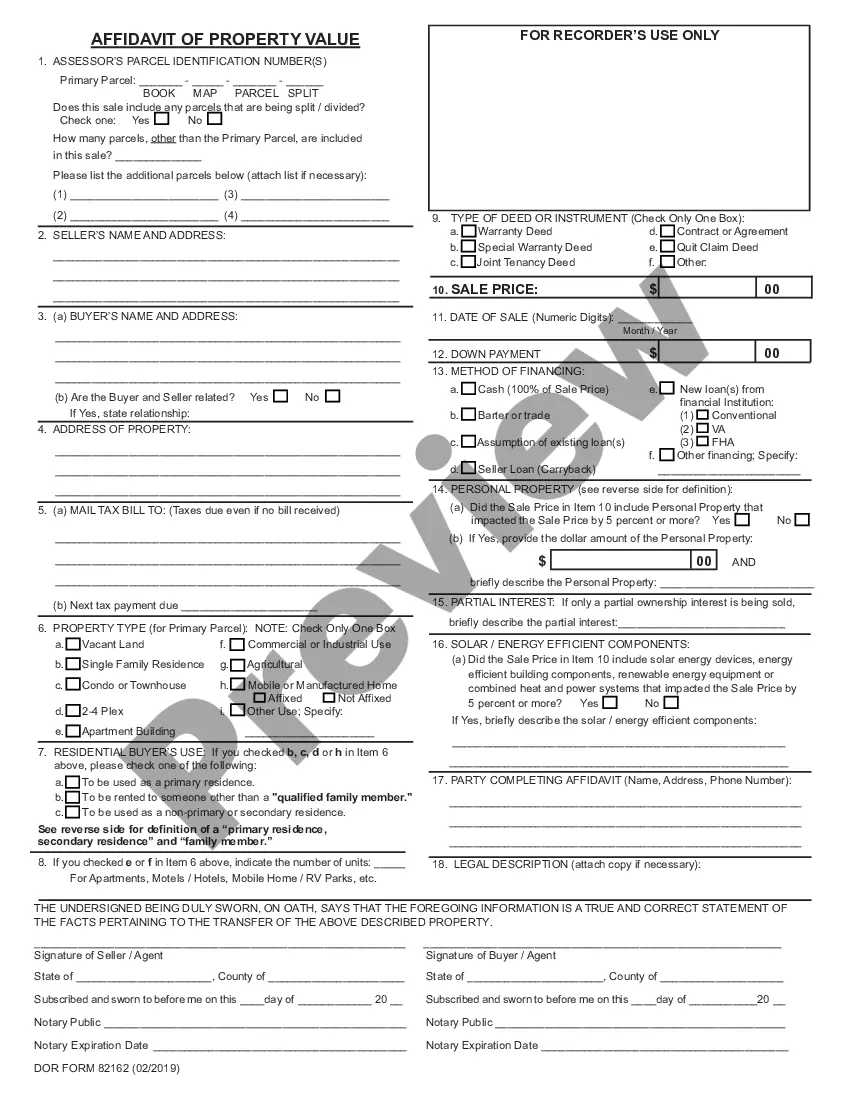

Phoenix Arizona Affidavit of Property Value

Description

How to fill out Arizona Affidavit Of Property Value?

Regardless of social or occupational standing, finishing legal paperwork is a regrettable obligation in the contemporary world.

Frequently, it is nearly unfeasible for individuals lacking legal expertise to draft such documents from scratch, primarily due to the intricate language and legal subtleties they encompass.

This is where US Legal Forms proves to be beneficial.

Ensure that the template you have selected aligns with your locality since the laws of one state or region may not correspond to another.

Examine the document and review a brief summary (if available) of situations where the document can be applied.

- Our platform offers an extensive collection of over 85,000 ready-to-use, state-specific documents applicable to nearly any legal situation.

- US Legal Forms also acts as a valuable tool for associates or legal advisors aiming to conserve time by using our DIY forms.

- Whether you need the Phoenix Arizona Affidavit of Property Value or any other document valid in your jurisdiction, US Legal Forms has everything readily available.

- Here’s how you can quickly obtain the Phoenix Arizona Affidavit of Property Value using our reliable service.

- If you are already a member, simply Log In to your account to download the necessary form.

- However, if you are new to our collection, make sure to follow these procedures before downloading the Phoenix Arizona Affidavit of Property Value.

Form popularity

FAQ

An Affidavit of Title is a legal document that is issued by the purchaser of a piece of property specifying the status of potential legal issues involving the property or the seller. The affidavit is a signed statement of facts stating a property's seller holds the title to it.

Property Valuation Property in Arizona is classified and valued in each county by the County Assessor , with the exception of centrally valued property, such as airlines, mines, railroads, and utilities, which are valued by the Department.

This form is used to record the selling price, date of sale and other required information about the sale of property.

Every year, the local Assessor's office will send you an updated assessment of the value of your home. This amount is what your property tax calculations are based upon.

To calculate appraised value, a licensed appraiser considers the location, size and condition of your home, and any renovations you've completed. The appraised value is what mortgage lenders look at when a borrower buys a home or refinances their mortgage.

Agent Market Valuations Are A Simple Way To Determine Value Of Land In Arizona. Many real estate agents offer free market valuations to homeowners and land owners. So you may consider calling up an agent and asking for a market valuation.

It is a sworn statement, in which the affiant attests under oath to the inheritance right and certain other facts relating to the estate. The heir or devise files the affidavit with the probate court registrar in the county where the real estate is located.

Annually the Assessor must determine the full cash value legal classification and resulting net assessed valuation for all locally assessed and centrally assessed property located within the legal boundaries of each of the 70+ taxing jurisdictions within Cochise County.

Role of the County Assessor The assessor is responsible for identifying, classifying, valuing, and assessing all property under their jurisdiction that is not valued by the Department. See A.R.S. 42-13051 , 42-15052 , and 42-15053 . Such property includes agricultural, commercial, personal, and residential.