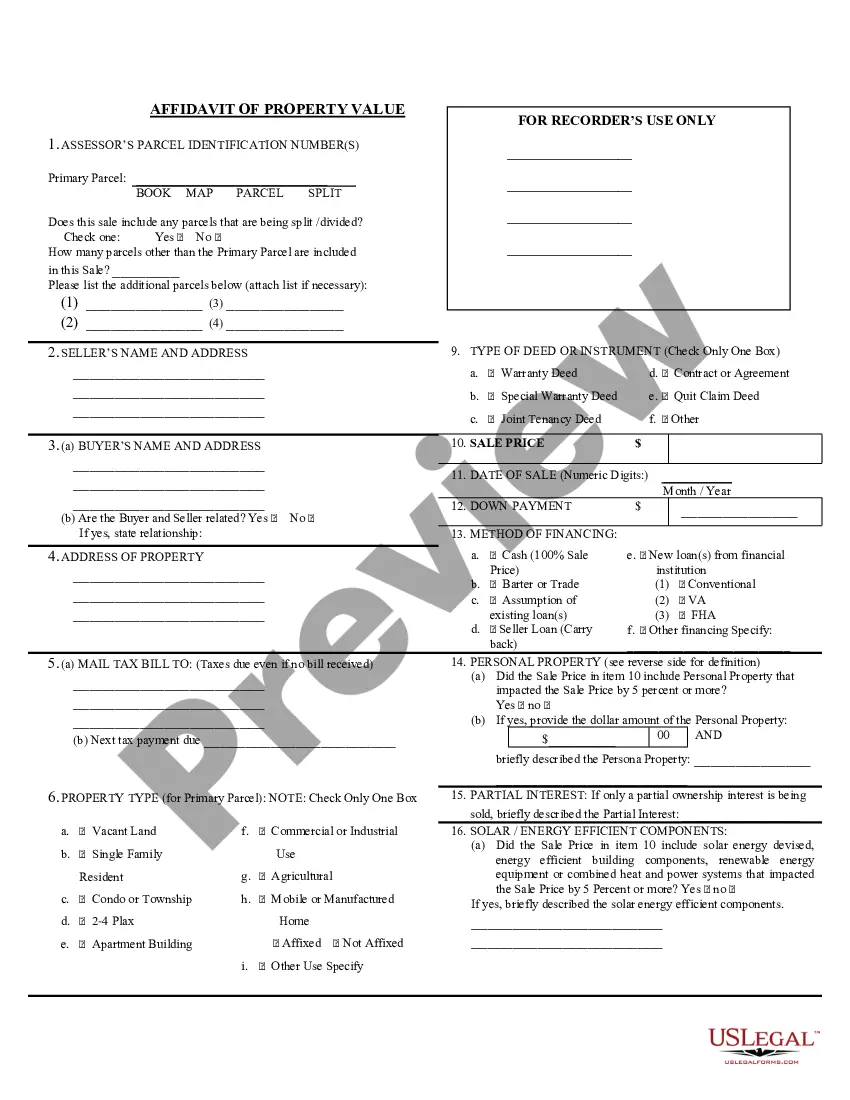

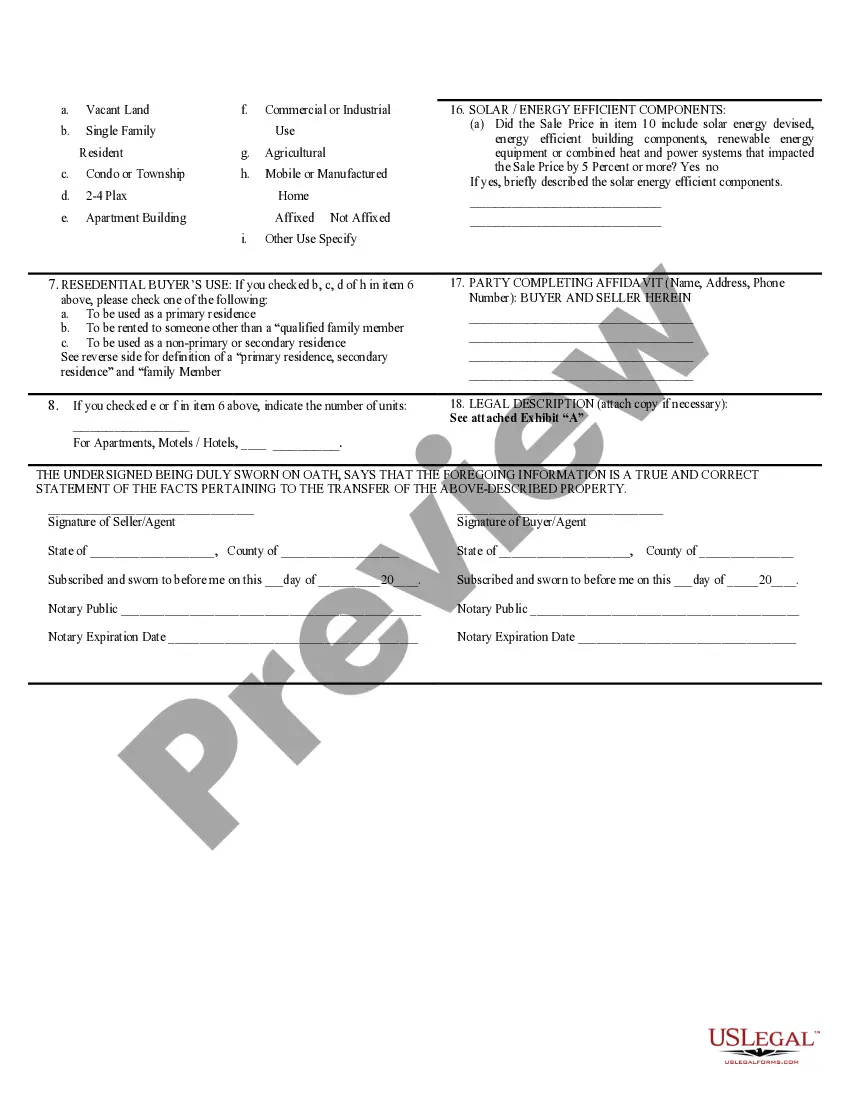

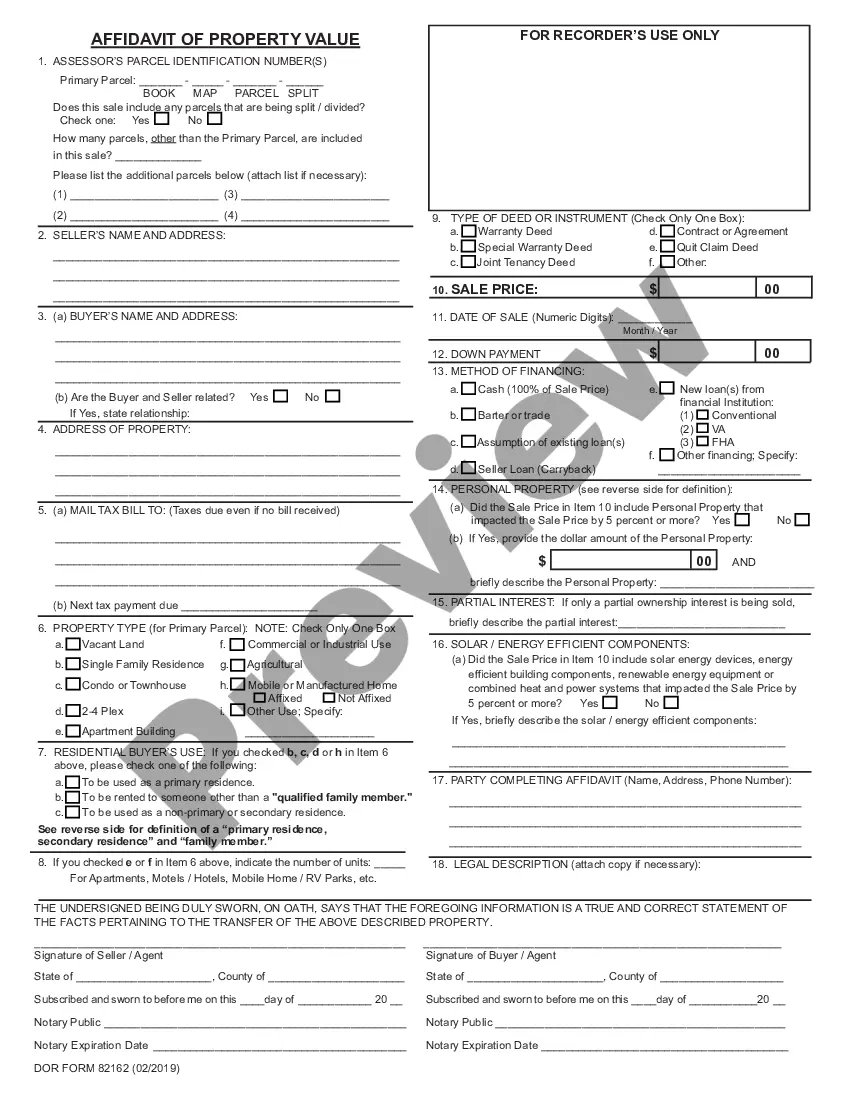

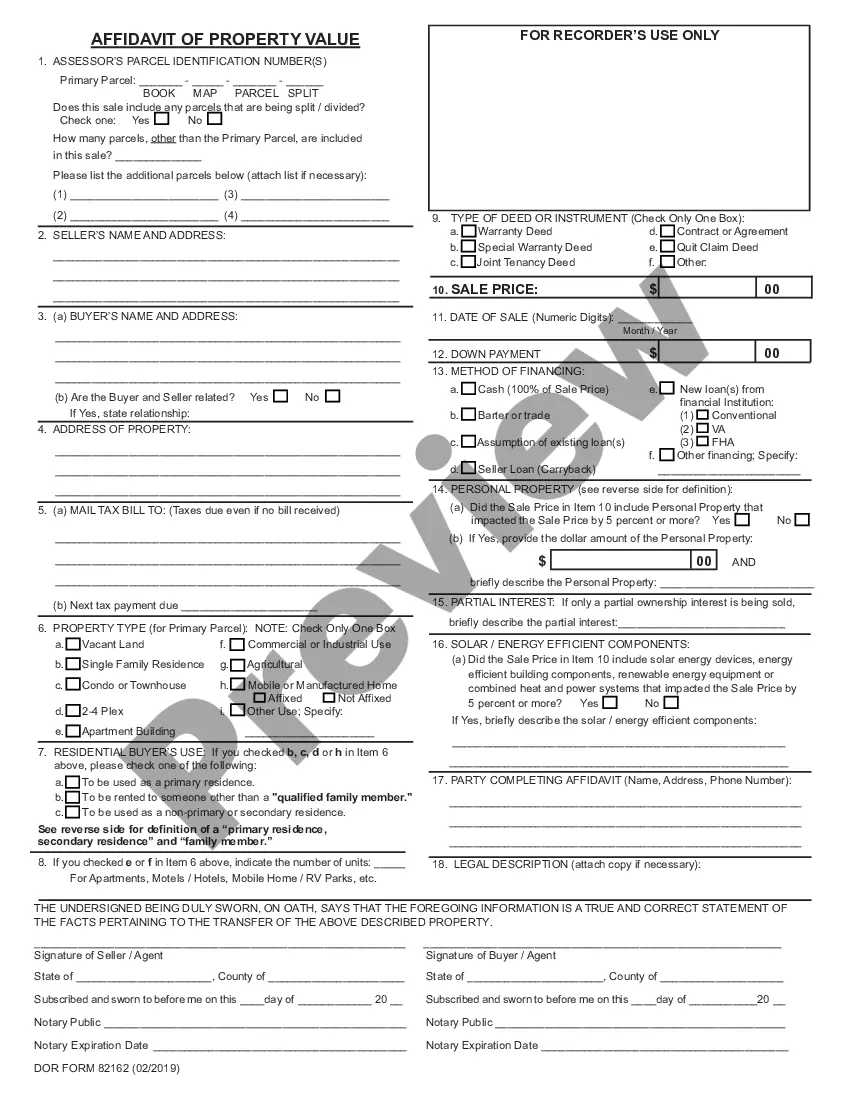

Maricopa Arizona Affidavit of Property Value

Description

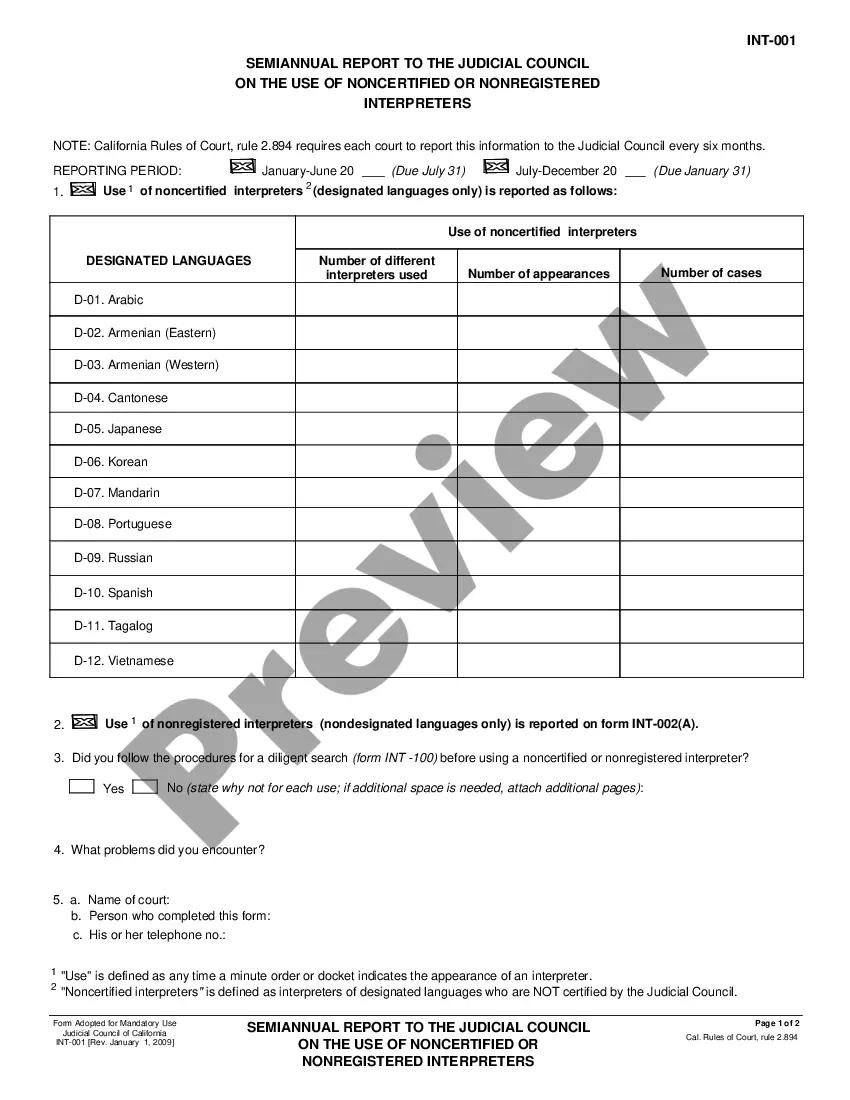

How to fill out Arizona Affidavit Of Property Value?

We constantly aim to minimize or avert legal complications when managing intricate legal or financial matters.

To achieve this, we seek attorney services that are typically quite costly.

However, not all legal issues are equally intricate.

Most of them can be addressed by ourselves.

Take advantage of US Legal Forms anytime you need to acquire and download the Maricopa Arizona Affidavit of Property Value or any other form swiftly and securely.

- US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to incorporation articles and dissolution petitions.

- Our platform empowers you to manage your matters independently without relying on a lawyer's assistance.

- We provide access to legal templates that are not always available to the public.

- Our templates are specific to state and region, which significantly eases the search process.

Form popularity

FAQ

Yes, in Arizona, most affidavits, including the Affidavit of Property Value, must be notarized to be legally binding. The notary public confirms the identity of the signer and witnesses the signing of the document. It is essential that you ensure your documents are properly notarized to avoid any issues in property transactions.

You can get an Affidavit of Affixture in Arizona by completing the required form, providing necessary documentation about the manufactured home, and filing it with the county recorder’s office. This process formalizes the status of your home as real property. Reference the Maricopa Arizona Affidavit of Property Value during this process, as it could influence your property’s value.

To affix a manufactured home in Arizona, you must have the home placed on a foundation and obtain the appropriate permits from local authorities. After meeting these requirements, you can record an affidavit of affixture with the county recorder. Knowing about the Maricopa Arizona Affidavit of Property Value helps you understand how this process can impact your property’s value.

An affidavit of affixture is a legal document that confirms the permanent placement of a manufactured home on real property. This affidavit typically includes information about the home, the land it occupies, and the owner’s intent to treat it as real estate. If you're dealing with property transactions, understanding the Maricopa Arizona Affidavit of Property Value is crucial for ensuring accurate assessments.

You can obtain a copy of your property deed in Arizona by contacting the county recorder’s office where the property is located. You can usually request a copy in person, online, or via mail. Utilizing the Maricopa Arizona Affidavit of Property Value might help clarify property ownership if you run into any disputes.

To transfer property title to a family member in Arizona, start by choosing the right type of deed, such as a quitclaim deed. It's important to fill out the Maricopa Arizona Affidavit of Property Value to document the property's current value accurately. After preparing the deed, make sure to record it with the county recorder’s office to formalize the transfer. US Legal Forms can assist you in navigating this process smoothly with helpful resources and templates.

The best way to transfer property title between family members is to use a deed that clearly states the new owner's name and the relationship to the giver. Incorporate the Maricopa Arizona Affidavit of Property Value to provide an accurate assessment of the property's worth during the transfer. Ensure that both parties understand the implications of the transfer, including any tax obligations. Consider using services from US Legal Forms for access to reliable forms and expert guidance.

An Affidavit of Value in Maricopa County is a legal document that establishes the market value of a property when it is sold or transferred. This document, often associated with the Maricopa Arizona Affidavit of Property Value, is essential for tax assessments and ensures compliance with local regulations. It provides transparency in property transactions and helps prevent fraud. You can find templates and instructions for this affidavit on platforms like US Legal Forms.

Transferring property to a family member in Arizona typically involves preparing a deed, such as a quitclaim deed or warranty deed. It's important to ensure that the Maricopa Arizona Affidavit of Property Value is completed accurately to reflect the property's worth. Additionally, you should record the deed with the county recorder’s office to finalize the transfer. Consider using services like US Legal Forms to access the necessary forms and guidance.

To transfer a house title after death in Arizona, you typically need to gather necessary documents like the death certificate and the will if applicable. If the property is not part of a probate estate, an affidavit of heirship or an affidavit of succession may be required. These documents help establish new ownership and can simplify the process. Platforms like uslegalforms provide guidance to navigate this process more easily.