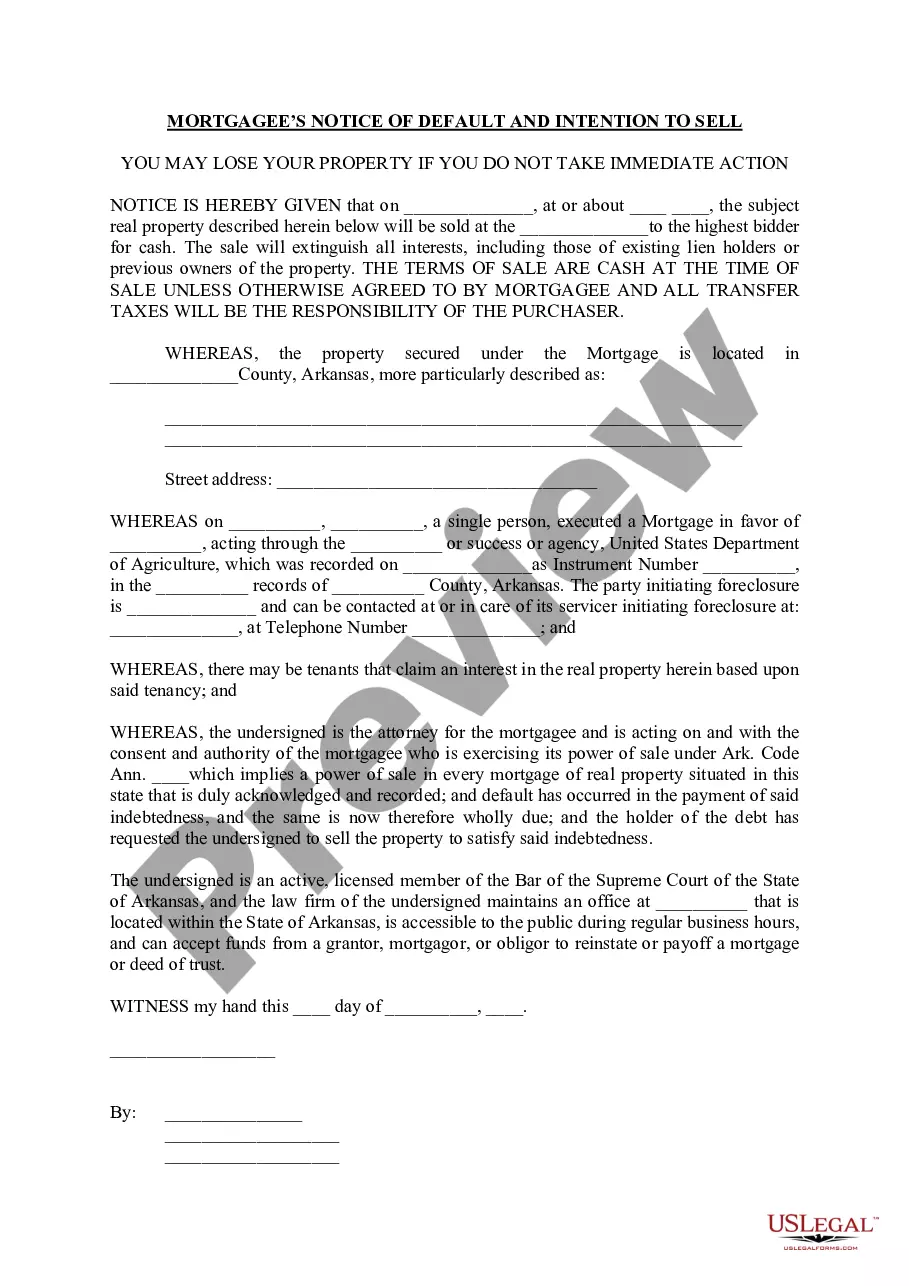

Little Rock Arkansas Mortgagee's Notice of Default and Intention to Sell is a legal document that serves as a formal notification to borrowers who have defaulted on their mortgage payments. It provides detailed information regarding the default and the lender's intention to sell the property through a foreclosure auction. This notice is a crucial step in the foreclosure process and is required by law to protect the rights of both the lender and the borrower. It includes essential details such as the borrower's name, the property address, the loan amount, the date of default, and a detailed description of the default itself. The Little Rock Arkansas Mortgagee's Notice of Default and Intention to Sell outlines the lender's intention to initiate foreclosure proceedings and sell the property to recoup the outstanding loan balance. The notice provides a specific timeline within which the borrower must address the default, usually through payment of the outstanding amount or entering into a repayment agreement with the lender. There are different types of Little Rock Arkansas Mortgagee's Notice of Default and Intention to Sell, depending on the stage of the foreclosure process. Some common types include: 1. Pre-foreclosure Notice: This is the initial notice sent to the borrower when they have missed multiple mortgage payments. It serves as a warning that foreclosure proceedings will commence if the default is not resolved within a specified time frame. 2. Notice of Acceleration: If the borrower fails to cure the default within the specified time frame, the lender will send a Notice of Acceleration. This notice states that the entire loan amount is due immediately, and the borrower must pay it in full to avoid foreclosure. 3. Notice of Sale: If the borrower does not resolve the default or reach a repayment agreement before the expiration of the Notice of Acceleration, the lender will send a Notice of Sale. This notice provides details about the foreclosure auction, including the date, time, and location of the sale. It is important for borrowers who receive a Little Rock Arkansas Mortgagee's Notice of Default and Intention to Sell to take immediate action to address the default. Seeking legal counsel or exploring options such as loan modification or short sale can help borrowers avoid foreclosure and protect their property rights.

Little Rock Arkansas Mortgagee's Notice of Default And Intention to Sell

Description

How to fill out Little Rock Arkansas Mortgagee's Notice Of Default And Intention To Sell?

No matter the social or professional standing, filling out legal documents is a regrettable requirement in the modern world.

It is frequently nearly unfeasible for an individual without legal training to create such documents from the ground up, primarily due to the intricate language and legal nuances they involve.

This is where US Legal Forms proves valuable.

Confirm that the form you have located is suitable for your region, as the regulations of one state or area may not apply to another.

Examine the document and read a brief description (if provided) of scenarios for which the document can be applicable.

- Our service provides an extensive library of over 85,000 ready-to-use state-specific documents suitable for virtually any legal situation.

- US Legal Forms is also a fantastic asset for associate professionals or legal advisors seeking to enhance their time efficiency with our DIY forms.

- Whether you require the Little Rock Arkansas Mortgagee’s Notice of Default And Intention to Sell or any other document recognized in your jurisdiction, with US Legal Forms, everything is readily available.

- Here's how to obtain the Little Rock Arkansas Mortgagee’s Notice of Default And Intention to Sell within minutes using our trustworthy platform.

- If you are already a member, you can simply Log In to your account to acquire the required form.

- But if you are new to our collection, ensure to follow these steps before obtaining the Little Rock Arkansas Mortgagee’s Notice of Default And Intention to Sell.

Form popularity

FAQ

The primary individuals who suffer in a foreclosure are the homeowners, as they lose their property and face potential financial ruin. Additionally, families often experience emotional distress and instability during this time. The impact of receiving a Little Rock Arkansas Mortgagee's Notice of Default And Intention to Sell can ripple through relationships and financial standing. It is essential to seek help and consider all possible solutions to mitigate these effects.

The foreclosure process in Arkansas generally begins when a homeowner misses mortgage payments and the lender issues a Little Rock Arkansas Mortgagee's Notice of Default And Intention to Sell. Following this notice, there is often a waiting period where the homeowner can seek alternatives. If no resolution is found, the property can be sold at a foreclosure auction. Knowing this process can help homeowners take timely action to protect their interests.

The most common reason for a foreclosure is financial hardship, often resulting in the inability to make mortgage payments. This can be caused by job loss, unexpected medical expenses, or other significant life changes. Understanding the implications of receiving the Little Rock Arkansas Mortgagee's Notice of Default And Intention to Sell can provide insight into preventing further complications. Taking proactive steps early can help you find alternatives to foreclosure.

In Arkansas, a homeowner has a redemption period after the foreclosure sale when the property is sold due to a Little Rock Arkansas Mortgagee's Notice of Default And Intention to Sell. This period lasts for 12 months, allowing the original homeowner to reclaim their property by paying the total amount owed. It's vital to act promptly during this time if you wish to exercise this right. You can find valuable resources on platforms like US Legal Forms to help you navigate this process effectively.

In Arkansas, a bank can often complete the foreclosure process within three to six months, depending on several factors. This timetable starts from the moment you receive a Little Rock Arkansas Mortgagee's Notice of Default and Intention to Sell. Being proactive and understanding the foreclosure timeline can help you take the necessary steps to protect your interests.

Yes, Arkansas provides a redemption period of one year after foreclosure, allowing homeowners to regain their properties by paying off the total amount owed. This aspect of Arkansas law offers a chance for homeowners to reclaim their homes, particularly after receiving a Little Rock Arkansas Mortgagee's Notice of Default and Intention to Sell. Knowing about this option can be crucial for those in distress.

A 10-day pre-foreclosure notice is a formal notification sent to homeowners, indicating the lender's intention to initiate foreclosure proceedings. This notice gives you ten days to address the default issue before formal actions begin, including receiving a Little Rock Arkansas Mortgagee's Notice of Default and Intention to Sell. It is essential to take this notice seriously and seek assistance if needed.

Foreclosing a house in Arkansas can take about three to six months, depending on various factors, including the court's schedule and whether the homeowner contests the foreclosure. Receiving a Little Rock Arkansas Mortgagee's Notice of Default and Intention to Sell typically marks the start of this timeframe. Being informed about the process can empower you to respond effectively.

A deed in lieu of foreclosure is a legal arrangement where a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure. This can be a beneficial alternative if a homeowner receives a Little Rock Arkansas Mortgagee's Notice of Default and Intention to Sell. It eliminates the need for lengthy foreclosure proceedings and can be less damaging to the homeowner's credit.

In Arkansas, the redemption period usually lasts one year from the date of the sale of the property. During this time, the original owner can reclaim their home by paying off the total debt. This period offers a valuable opportunity for those who receive a Little Rock Arkansas Mortgagee's Notice of Default and Intention to Sell to explore options and potentially save their property.