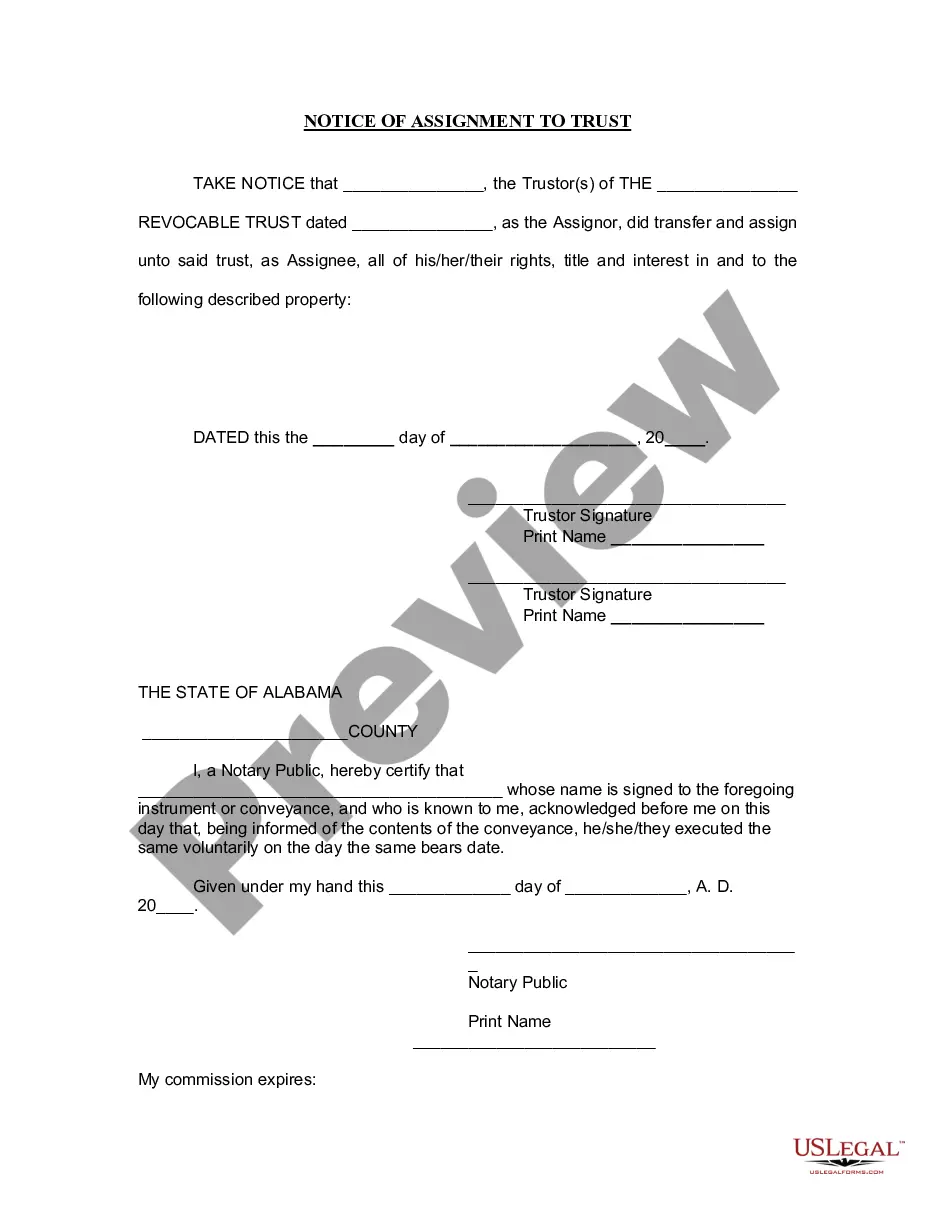

Notice of Assignment to Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form serves as notice that the

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

Birmingham Alabama Notice of Assignment to Living Trust

Description

How to fill out Alabama Notice Of Assignment To Living Trust?

Take advantage of the US Legal Forms and gain immediate access to any document you need.

Our helpful website, stocked with a multitude of files, makes it easy to locate and obtain almost any document sample you might require.

You can download, fill out, and authenticate the Birmingham Alabama Notice of Assignment to Living Trust in mere moments instead of spending hours online trying to find the correct template.

Using our directory is a fantastic method to enhance the security of your document submissions.

Additionally, you can retrieve all the previously saved documents in the My documents section.

If you do not possess an account yet, follow these steps: Locate the form you require. Ensure that it is the template you were looking for: inspect its title and description, and utilize the Preview feature when available.

- Our skilled attorneys frequently examine all the documents to ensure that the forms are suitable for a specific state and adhere to current regulations and rules.

- How can you access the Birmingham Alabama Notice of Assignment to Living Trust.

- If you have a subscription already, simply sign in to your account. The Download button will be activated for all the samples you explore.

Form popularity

FAQ

In Alabama, trusts are not typically recorded in the same way that real estate deeds are. However, documentation must be maintained to show the creation and terms of the trust. For clarity on managing your documents, consider the Birmingham Alabama Notice of Assignment to Living Trust as an informative resource to keep your trust properly organized.

Trusts in Alabama must adhere to state-specific laws concerning creation, management, and taxation. It’s vital to ensure that the trust complies with these regulations, as improper setups may lead to legal issues. Check the Birmingham Alabama Notice of Assignment to Living Trust for comprehensive information on these rules and how they affect your trust.

There generally isn't a strict minimum amount required to set up a trust, but you should consider whether your assets warrant the setup. It's important to think about the types of assets you want to include and their value. By reviewing the Birmingham Alabama Notice of Assignment to Living Trust, you can find guidance tailored to your needs and financial situation.

To place your house in a trust in Alabama, you first need to create the trust document, and then execute a new deed for the property, transferring ownership to the trust. This involves filling out the deed correctly and ensuring it is signed and notarized. Leveraging advice on the Birmingham Alabama Notice of Assignment to Living Trust can simplify this process and minimize potential errors.

One significant mistake parents make when setting up a trust fund is failing to properly fund it. This means not transferring assets such as property or investments into the trust, which can lead to complications down the road. To avoid this, consider consulting resources like the Birmingham Alabama Notice of Assignment to Living Trust, which can guide you through the funding process effectively.

Yes, a trust generally avoids probate in Alabama, which can simplify the transfer of assets upon your death. By utilizing a living trust, your assets are managed according to your wishes and don't require court intervention. This benefit, highlighted by the Birmingham Alabama Notice of Assignment to Living Trust, allows your loved ones to receive their inheritance more quickly and efficiently.

Certain assets typically cannot be transferred to a trust, including retirement accounts or assets that have designated beneficiaries. Additionally, some types of tangible personal property might pose issues if not explicitly outlined in the trust document. It’s important to review these details with a legal advisor, especially in the context of the Birmingham Alabama Notice of Assignment to Living Trust.

Alabama does impose taxes on trusts, depending on the income generated by the assets within them. If a trust produces net income, it may be subject to state taxes. However, there might be some exemptions, so consulting with a tax professional can clarify how the Birmingham Alabama Notice of Assignment to Living Trust impacts tax responsibilities.

A trust in Alabama operates as a legal arrangement where one party holds property for the benefit of another. The creator, or grantor, transfers assets to the trust, which a trustee manages according to the terms laid out in the trust document. Beneficiaries receive the benefits of the trust, and the Birmingham Alabama Notice of Assignment to Living Trust comes into play to formalize these arrangements and instructions.

To set up a living trust in Alabama, start by defining your goals for the trust. You will need to create a trust document that outlines how you want to manage and distribute your assets. It’s advisable to work with an attorney to ensure your documents comply with Alabama laws. Remember to fund your trust by transferring assets into it for the Birmingham Alabama Notice of Assignment to Living Trust to take effect.