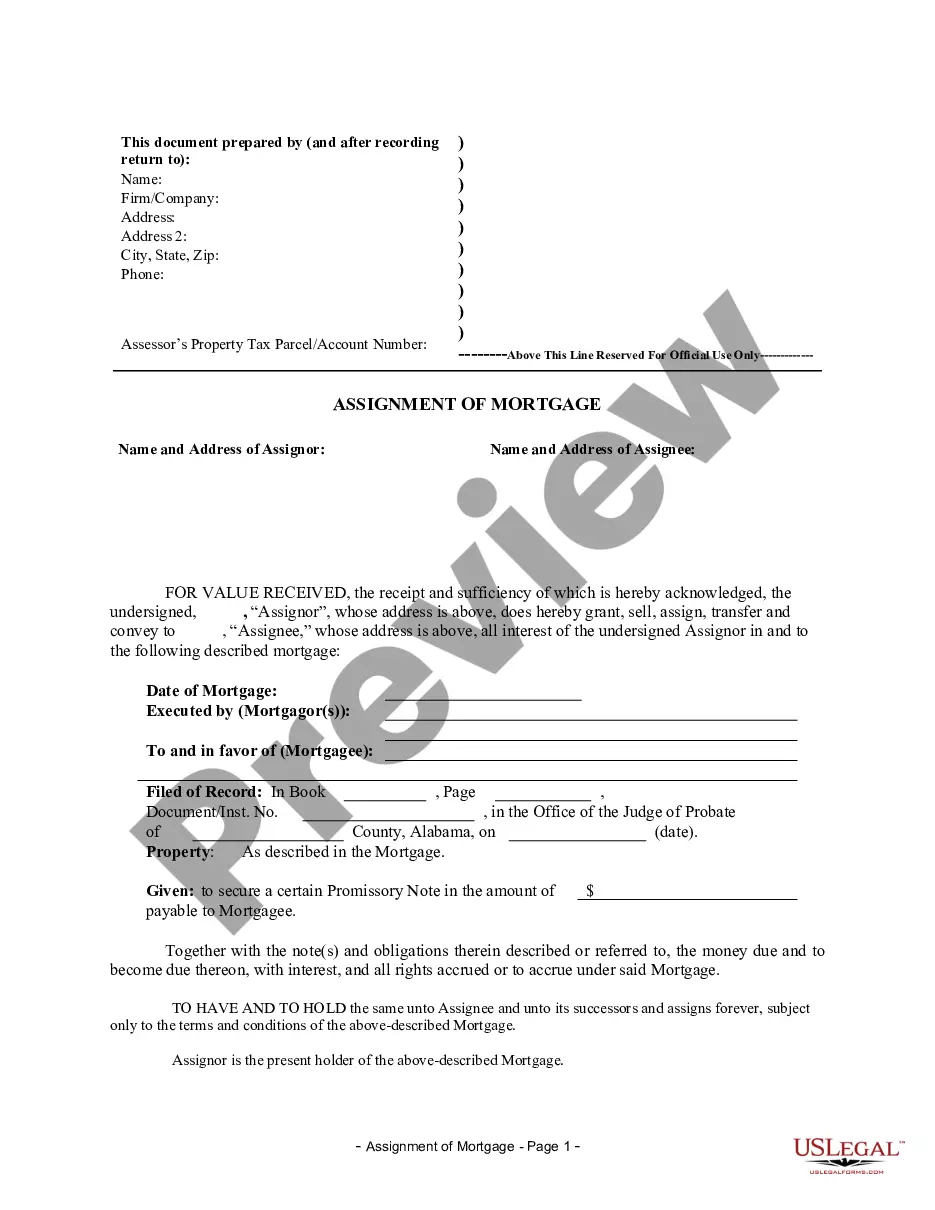

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Birmingham Alabama Assignment of Mortgage by Corporate Mortgage Holder

Description

How to fill out Alabama Assignment Of Mortgage By Corporate Mortgage Holder?

Obtaining confirmed templates tailored to your regional regulations can be difficult unless you access the US Legal Forms library.

This is an online collection of over 85,000 legal documents for both personal and business purposes, covering various real-life scenarios.

All the files are appropriately categorized by usage area and jurisdiction, making it as simple as pie to find the Birmingham Alabama Assignment of Mortgage by Corporate Mortgage Holder.

Maintaining paperwork organized and compliant with legal requirements is crucial. Take advantage of the US Legal Forms library to always have vital document templates readily available for any needs!

- Make sure to review the Preview mode and document description.

- Ensure you've selected the correct one that meets your needs and fully aligns with your local jurisdiction criteria.

- Search for another template if required.

- If you notice any discrepancies, use the Search tab above to find the right one.

- If it works for you, proceed to the next step.

Form popularity

FAQ

An assignment of mortgage is a legal document that transfers the rights to receive payment from a borrower from one lender to another. This assignment allows the new lender to enforce the mortgage terms and collect payments. When dealing with a Birmingham Alabama Assignment of Mortgage by Corporate Mortgage Holder, it is crucial to ensure that the assignment is properly executed and recorded to uphold the legality of the transaction.

If an assignment of a mortgage is not recorded, it may lead to complications regarding the ownership and rights of the mortgage. Unrecorded assignments can create disputes, especially if another lender claims a priority interest in the property. Therefore, for a Birmingham Alabama Assignment of Mortgage by Corporate Mortgage Holder, it is essential to record the assignment promptly to protect all parties involved and maintain clear title.

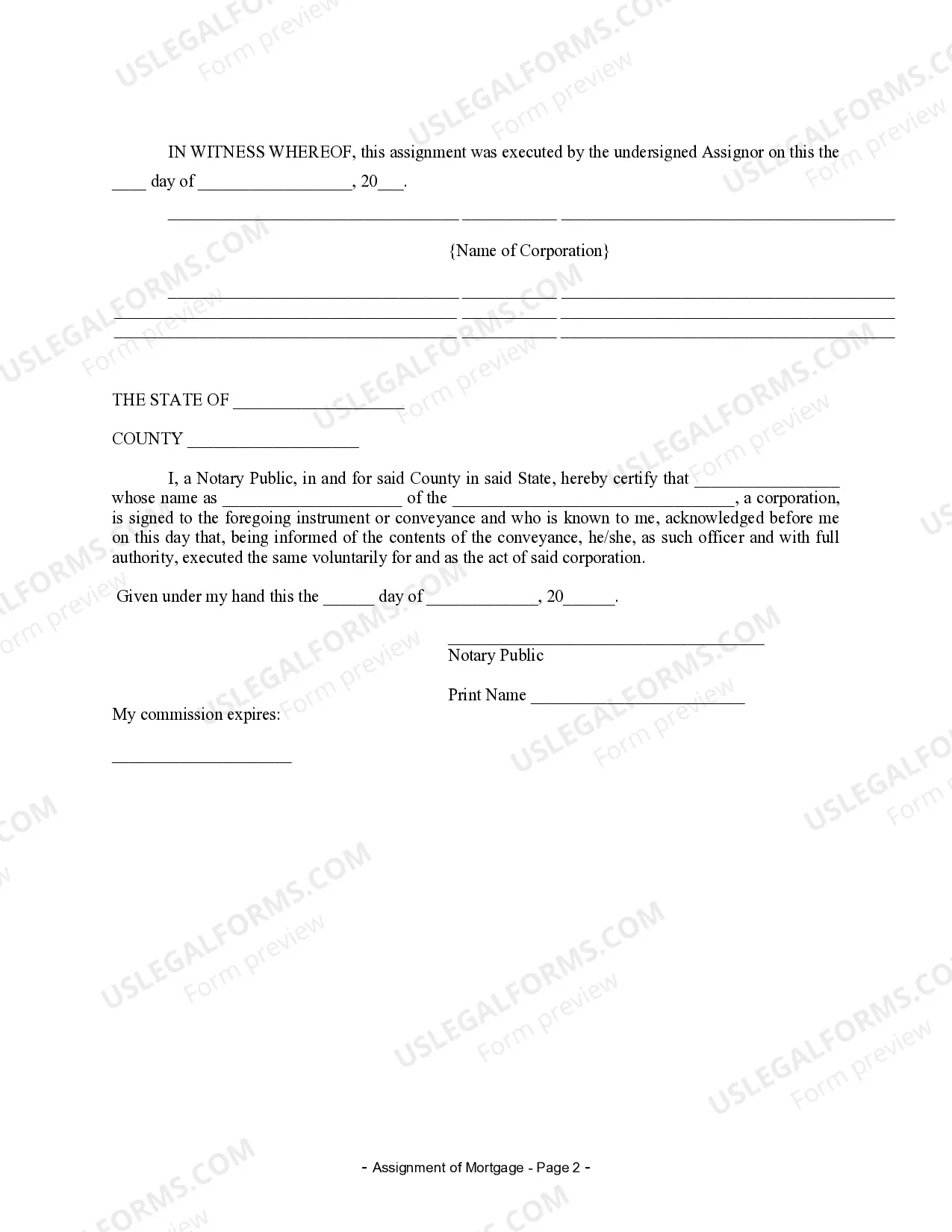

To complete an assignment of mortgage, you will need to obtain the assignment form, fill in the required details, and ensure that the current mortgage holder signs the document. After signing, it's crucial to record the assignment with the local county recorder’s office to maintain its validity. Utilizing the US Legal Forms platform can streamline this process, providing you with the necessary templates and detailed guidance for a Birmingham Alabama Assignment of Mortgage by Corporate Mortgage Holder.

A corporate assignment of a mortgage is a legal document that transfers the rights and responsibilities of a mortgage from one entity to another. In this case, it involves corporations rather than individuals. This process is an essential aspect of a Birmingham Alabama Assignment of Mortgage by Corporate Mortgage Holder, as it allows corporations to manage their mortgage assets effectively.

An assignment of a mortgage is typically signed by the current mortgage holder or lender, which could be an individual or a corporate entity. In cases involving a Birmingham Alabama Assignment of Mortgage by Corporate Mortgage Holder, the authorized representative of the corporate entity must execute the assignment. This ensures legal compliance and clarity in the transfer of the mortgage rights.

To write a dispute letter to your mortgage company, detail your account and include specific information about the disagreement. Clearly state your position regarding your mortgage issue in Birmingham Alabama, providing any supporting documentation that validates your claim. A well-structured letter enhances your chances of a satisfactory resolution.

When writing a letter to a mortgage company, begin with your account details and clearly state the purpose of your correspondence. Be specific about your situation—whether it concerns payments, disputes, or a sale in Birmingham Alabama. Providing a straightforward and respectful request will help facilitate communication.

To write an explanation letter to a company, start with an appropriate greeting followed by a brief introduction of the issue you’re addressing. Clearly outline the circumstances surrounding your mortgage situation in Birmingham Alabama, then provide any relevant documentation to support your explanation. Ensure your closing encourages open communication.

When writing a formal letter explaining a situation, begin with a clear introduction and state the purpose of your letter. Use a respectful tone, provide necessary details regarding your specific issue with the mortgage in Birmingham Alabama, and conclude with any actions you wish the lender to take. Keep the letter structured and direct.

To craft a letter of explanation to your mortgage company, start by addressing the lender and stating your intention clearly. Include specific details related to your mortgage situation in Birmingham Alabama, such as reasons for missed payments or changes in income. A concise explanation followed by the necessary documentation can help clarify your circumstances.