This is a Preferred Stock Purchase Agreement. It contains the agreement to sell and purchase, the closing, delivery and payment options, representations and warranties, and the schedule of purchasers, among other things.

Wyoming Series A Preferred Stock Purchase Agreement

Description

How to fill out Series A Preferred Stock Purchase Agreement?

Finding the right legitimate document template can be a battle. Of course, there are a variety of templates accessible on the Internet, but how would you find the legitimate kind you will need? Utilize the US Legal Forms internet site. The services offers 1000s of templates, for example the Wyoming Series A Preferred Stock Purchase Agreement, which can be used for organization and personal demands. Each of the types are examined by pros and meet federal and state demands.

In case you are currently registered, log in to your account and then click the Download option to get the Wyoming Series A Preferred Stock Purchase Agreement. Use your account to look with the legitimate types you may have bought formerly. Check out the My Forms tab of your account and have yet another copy of your document you will need.

In case you are a fresh consumer of US Legal Forms, listed below are easy recommendations for you to comply with:

- First, ensure you have selected the appropriate kind for your area/county. It is possible to check out the shape utilizing the Preview option and read the shape explanation to guarantee this is the right one for you.

- In the event the kind will not meet your expectations, use the Seach discipline to obtain the correct kind.

- When you are positive that the shape is suitable, select the Acquire now option to get the kind.

- Choose the prices strategy you would like and type in the needed details. Make your account and buy your order utilizing your PayPal account or credit card.

- Choose the submit file format and download the legitimate document template to your product.

- Full, change and produce and indication the acquired Wyoming Series A Preferred Stock Purchase Agreement.

US Legal Forms may be the biggest library of legitimate types in which you can find different document templates. Utilize the service to download professionally-made files that comply with express demands.

Form popularity

FAQ

Some of the key items that are listed in a stock purchase agreement are: Name of the company whose shares are being bought and sold; Name of the buyer and seller of shares; The number of shares being sold and the par value of those shares; The date and place of the transaction;

In finance, a class A share refers to a share classification of common or preferred stock that typically has enhanced benefits with respect to dividends, asset sales, or voting rights compared to Class B or Class C shares.

Preferred stock is issued with a par value, often $25 per share, and dividends are then paid based on a percentage of that par. For example, if a preferred stock is issued with a par value of $25 and an 8 percent annual dividend, this means the dividend payment will be $2 per share. What Is Preferred Stock, And Who Should Buy It? | Bankrate bankrate.com ? investing ? what-is-preferre... bankrate.com ? investing ? what-is-preferre...

The first round of stock made available to the public by a startup is referred to as Series A preferred stock. This type of stock is generally offered for purchase during the seed stage of a new startup and can be converted into common stock in the event of an initial public offering or sale of the company.

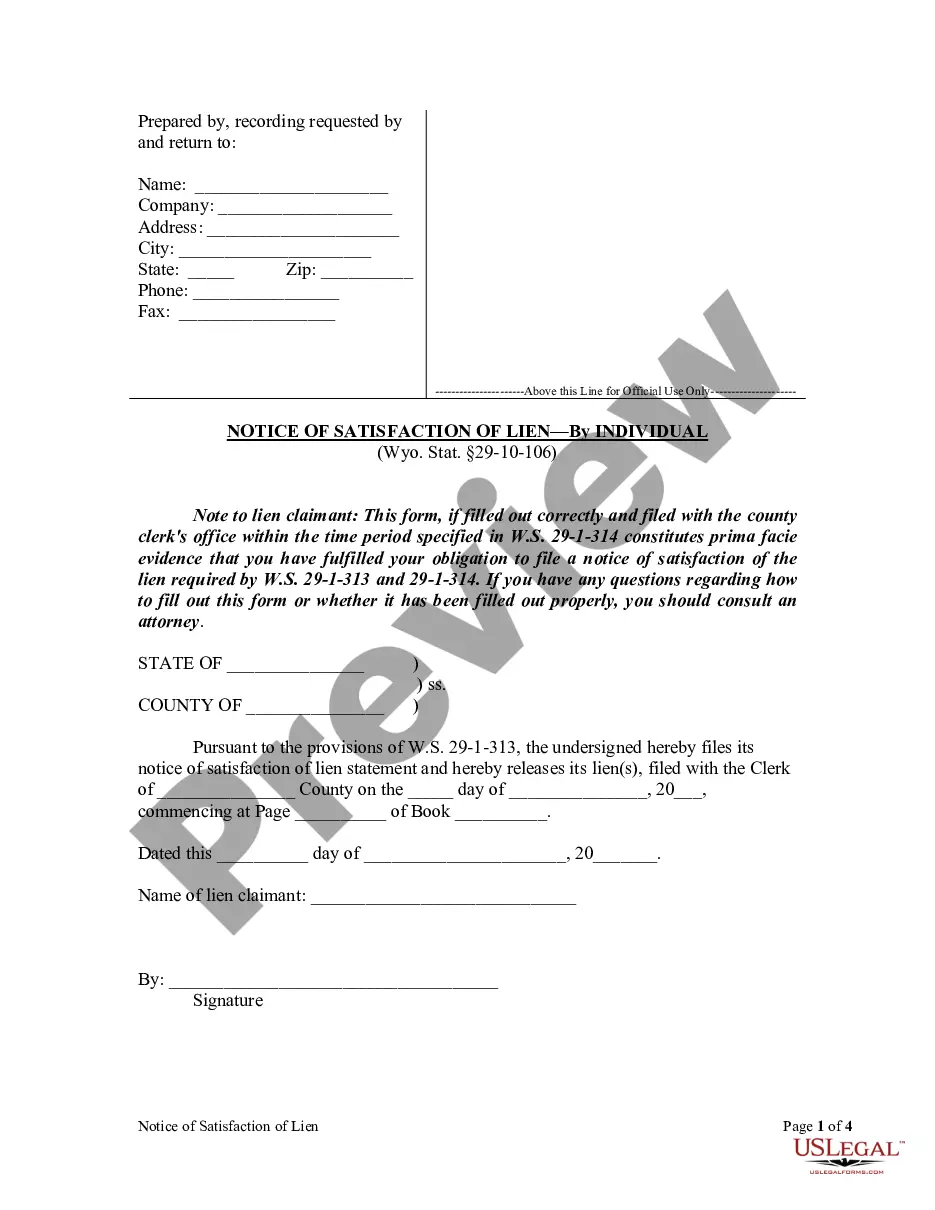

In a preferred stock financing, the Stock Purchase Agreement contains the terms of the stock purchase, representations and warranties of both the issuing company and the purchaser and conditions to closing.