Wyoming Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest

Description

How to fill out Notice Of Payout, Election To Convert Interest To Party With Right To Convert An Overriding Royalty Interest To A Working Interest?

Finding the right legal record web template could be a struggle. Of course, there are a lot of templates accessible on the Internet, but how do you obtain the legal kind you want? Take advantage of the US Legal Forms web site. The service provides 1000s of templates, including the Wyoming Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest, that can be used for organization and personal demands. Every one of the kinds are examined by pros and satisfy state and federal demands.

In case you are already authorized, log in to your bank account and then click the Down load key to find the Wyoming Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest. Make use of your bank account to look throughout the legal kinds you may have bought in the past. Proceed to the My Forms tab of the bank account and have another copy of your record you want.

In case you are a brand new customer of US Legal Forms, here are simple recommendations so that you can stick to:

- Very first, make certain you have chosen the proper kind for your town/region. It is possible to examine the shape using the Preview key and study the shape explanation to guarantee it will be the right one for you.

- In the event the kind will not satisfy your preferences, make use of the Seach field to find the proper kind.

- Once you are certain the shape would work, click on the Get now key to find the kind.

- Select the pricing strategy you desire and enter the necessary information and facts. Design your bank account and pay money for your order making use of your PayPal bank account or charge card.

- Opt for the submit structure and acquire the legal record web template to your system.

- Full, edit and print and indication the received Wyoming Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest.

US Legal Forms is the largest library of legal kinds where you can discover different record templates. Take advantage of the service to acquire expertly-made paperwork that stick to status demands.

Form popularity

FAQ

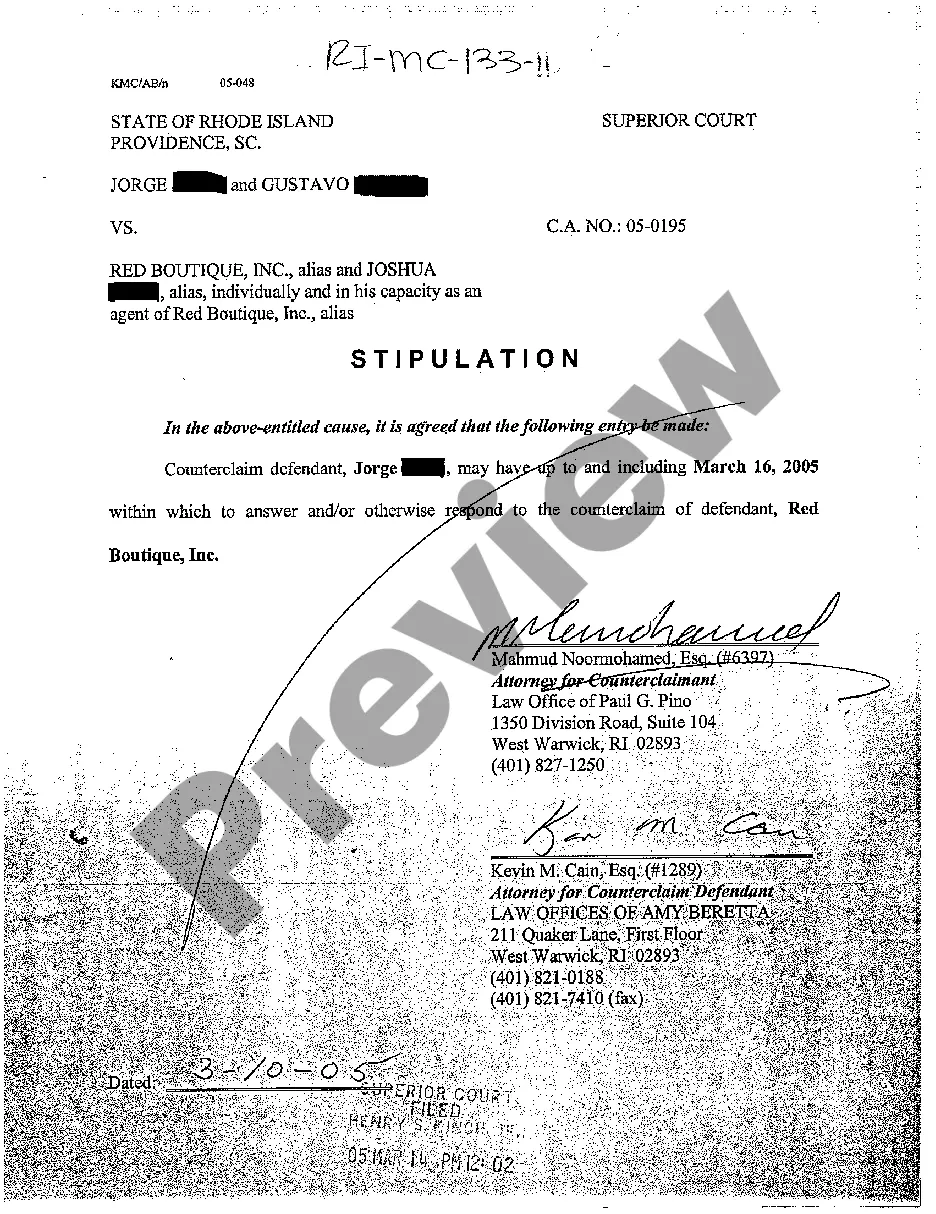

A stipulation of interest is a contract that consists of mutual conveyances, and therefore, it must conform to the requirements of both a contract and conveyance. Consequently, title to the property interest will be owned as set out in the stipulation, that is if it contains adequate granting language.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

An overriding royalty agreement is a contract that gives an entity the right to receive revenue from certain productions or sales. The specific type of occurence that royalties are required to be paid on is included in the overriding royalty agreement.

The lessee of an oil or gas lease can assign the entire lease or part of it. In other words, the lessee can sell or transfer part of the estate or the entire estate to which they have the working rights. The assignee is assigned the working interest and lease obligations, including override royalty.