North Carolina Articles of Association

Description

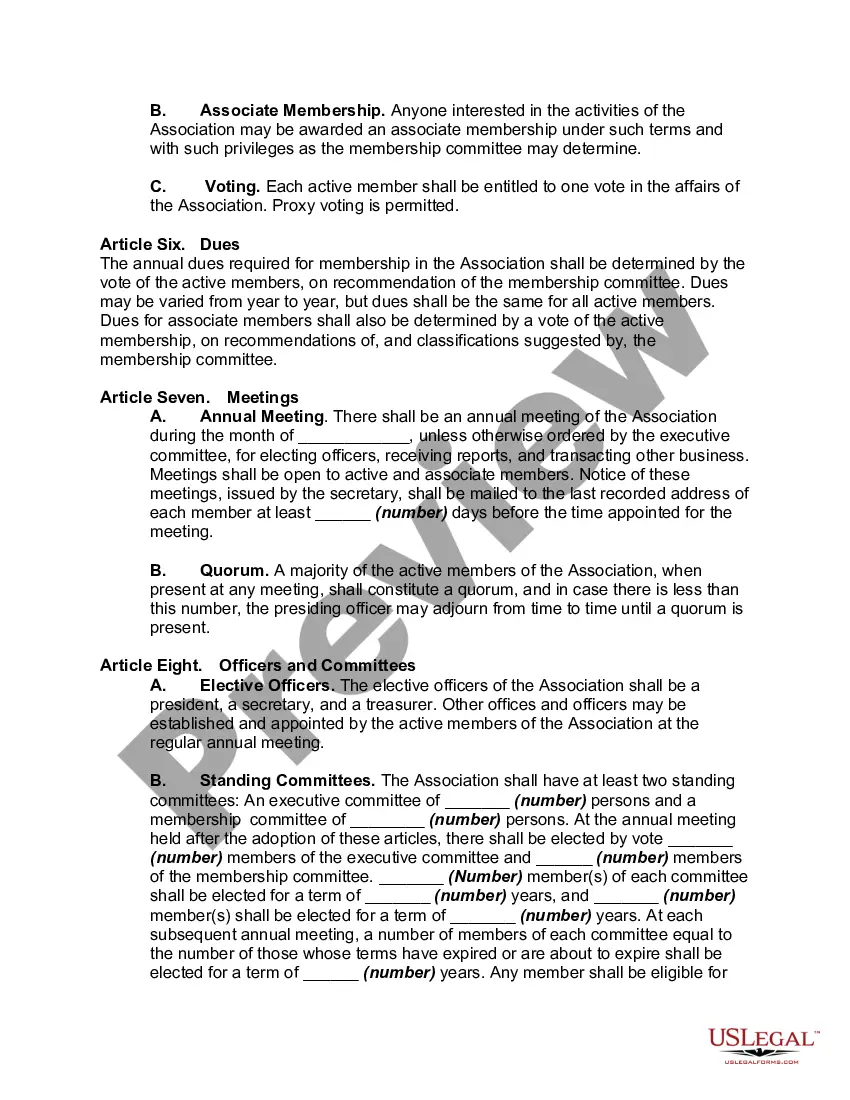

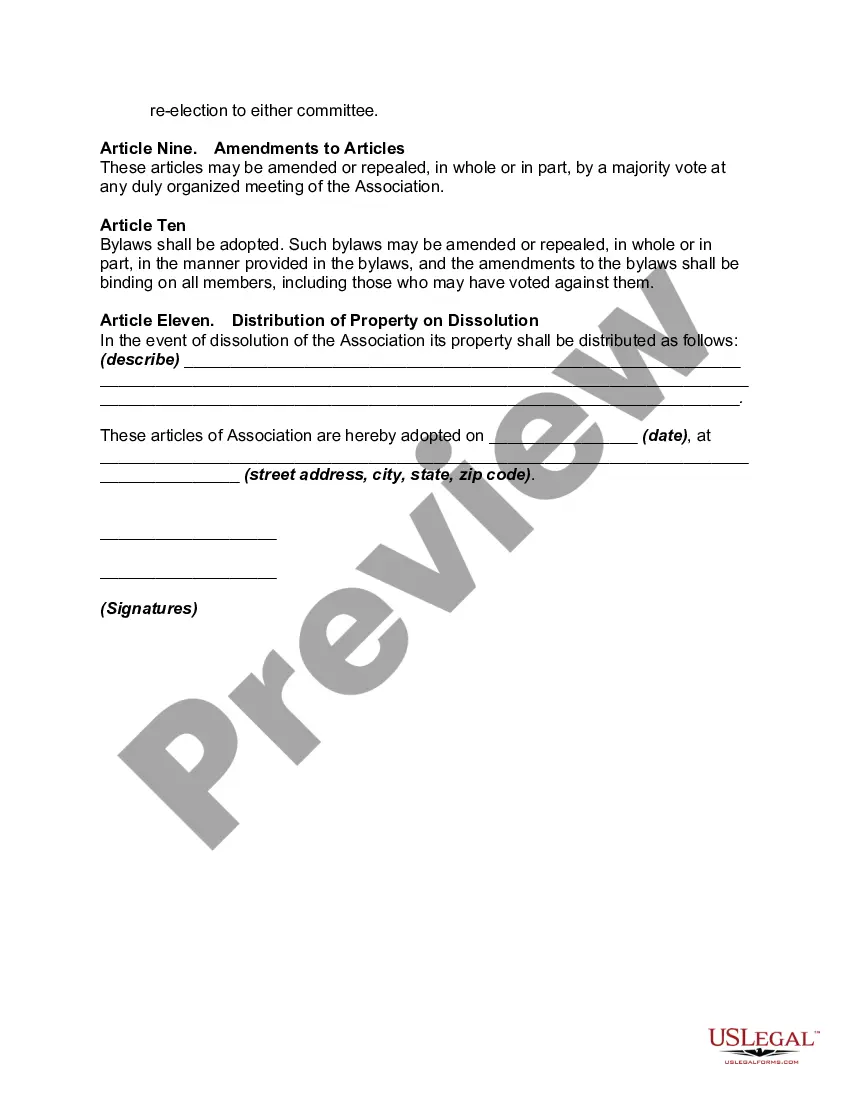

Statutes in some jurisdictions require that the constitution or articles of association, and the bylaws, be acknowledged or verified. In some jurisdictions, it is required by statute that the constitution or articles of association be recorded, particularly where the association or club owns real property or any interest in real property.

How to fill out Articles Of Association?

You can dedicate time online to searching for the valid document format that meets the state and federal requirements you will need.

US Legal Forms offers a vast array of valid templates that can be examined by experts.

You can obtain or print the North Carolina Articles of Association from our service.

If available, use the Preview option to look through the document format as well.

- If you have a US Legal Forms account, you can Log In and select the Download option.

- After that, you can complete, modify, print, or sign the North Carolina Articles of Association.

- Every valid document format you acquire is your property indefinitely.

- To obtain another copy of any downloaded form, go to the My documents section and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for your desired area/town.

- Review the form details to make sure you have chosen the correct form.

Form popularity

FAQ

To determine if you have filed Articles of Organization for your LLC, check your records or consult your attorney. You can also visit the North Carolina Secretary of State's online database to verify your LLC's filing status. If you need assistance locating or filing this document, our US Legal Forms platform provides helpful resources tailored to North Carolina Articles of Association.

Yes, North Carolina requires Articles of Organization as a mandatory step for forming an LLC. This document legally establishes your business and provides essential information to the state. By filing the Articles of Organization, you ensure compliance with North Carolina regulations, allowing your LLC to operate smoothly. Our platform offers tools and resources to help you navigate this requirement effectively.

A copy of the Articles of Organization is an official document that establishes your Limited Liability Company (LLC) in North Carolina. It outlines key information such as the company name, address, and the members involved. This document is vital for your business as it provides legitimacy and is often required for legal operations. Consider using our US Legal Forms platform for easy access to templates and filing services for North Carolina Articles of Association.

To acquire your Articles of Incorporation document in North Carolina, you can request it from the Secretary of State's office. You can place an order online or by mail, ensuring to include relevant identifying information about your business. Using tools from uslegalforms can simplify this process for you, saving you time and effort.

Yes, you can file articles of dissolution online in North Carolina. The Secretary of State provides an online service for this purpose, making it a straightforward process. If you need guidance during the dissolution process, uslegalforms is available to help you navigate the requirements effectively.

Getting a copy of your Articles of Incorporation in North Carolina involves contacting the Secretary of State’s office. You can request a copy online or through mail by including your business details. For a smoother request process, consider using uslegalforms for step-by-step assistance.

To obtain a copy of your articles of organization in North Carolina, you can request it through the Secretary of State's office either online or by mail. You should make sure to provide the necessary details such as your LLC's name and incorporation date. Utilizing services like uslegalforms can help guide you through obtaining these documents effortlessly.

The time it generally takes to obtain articles of organization in North Carolina is around 5 to 7 business days after you have submitted your application. The processing duration may fluctuate based on the office's workload. To facilitate faster processing, check out uslegalforms for helpful resources.

After filing the necessary documents for your LLC in North Carolina, you can typically expect to receive your approval within 5 to 7 business days. However, remember that processing times may vary. To mitigate waiting times, consider using uslegalforms for accurate and efficient filings.

In North Carolina, the approval for an LLC can take approximately 5 to 7 business days. The processing speed depends on the current workload of the Secretary of State's office. If you want to avoid delays, utilizing platforms such as uslegalforms can help streamline the submission process.