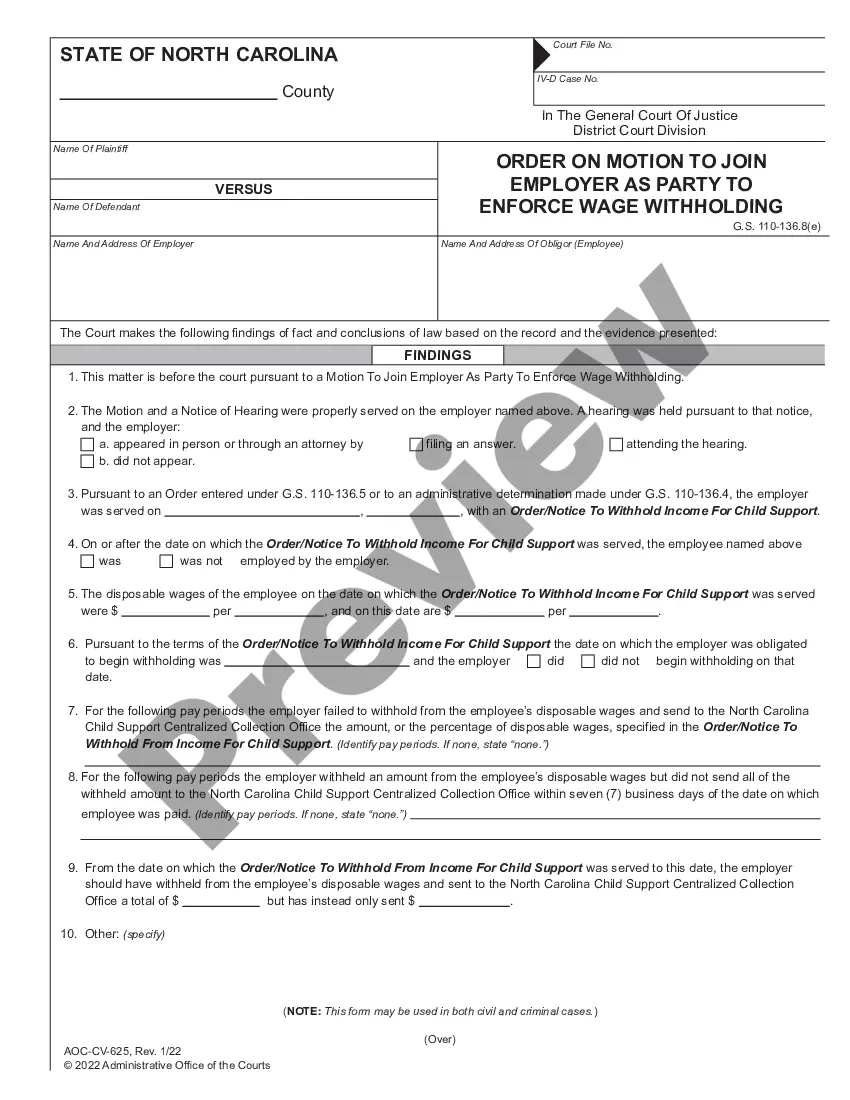

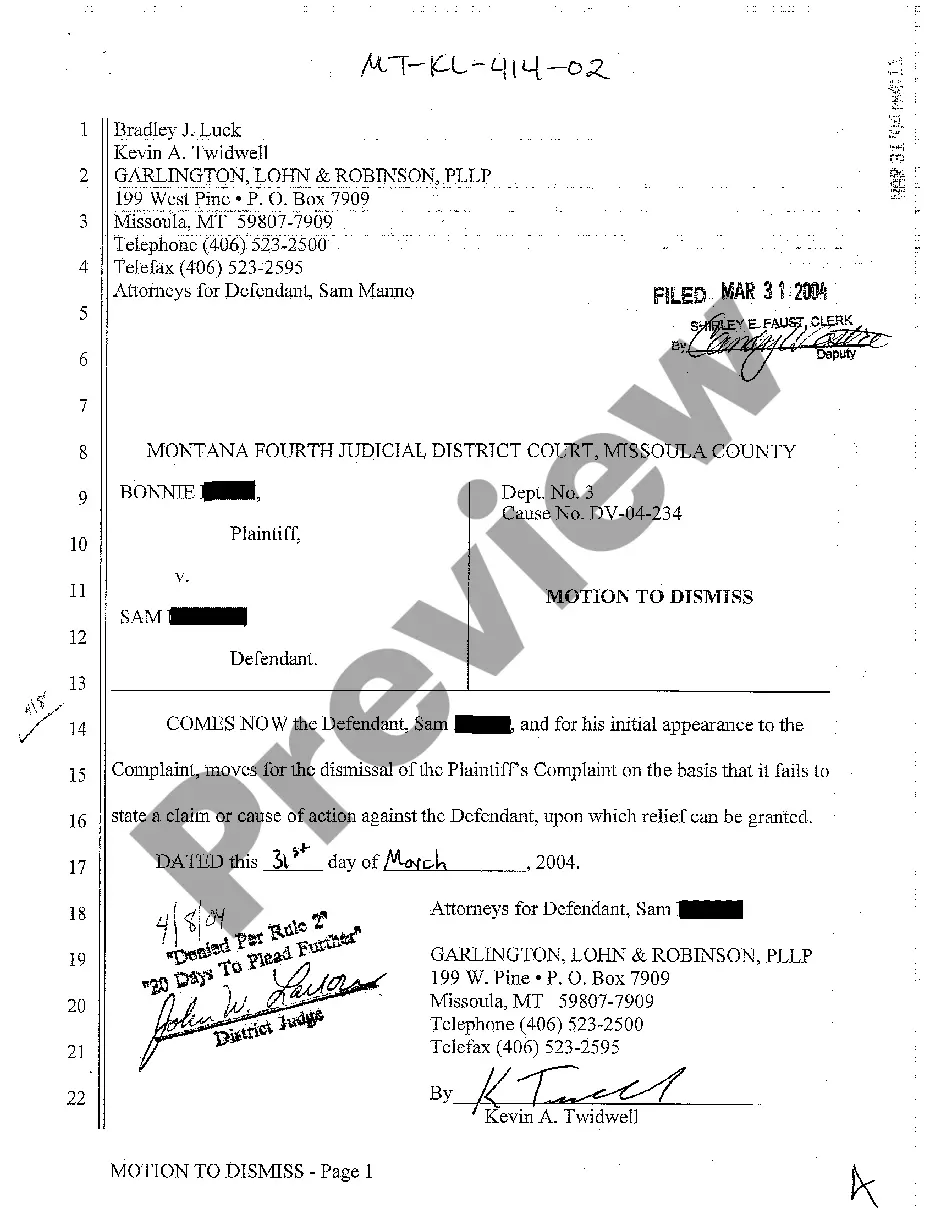

This is the accounting form used in an accounting of a law firm on the complaint of a former partner. It includes assets, liabilities, total liabilities, net assets, and a computation of the former partner's share.

Wyoming Form of Accounting Index

Description

How to fill out Form Of Accounting Index?

It is feasible to spend hours online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers a vast selection of legal forms that can be examined by professionals.

You can download or print the Wyoming Form of Accounting Index from our site.

If available, use the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Acquire button.

- Next, you can complete, modify, print, or sign the Wyoming Form of Accounting Index.

- Every legal document template you obtain is yours for life.

- To obtain an additional copy of a purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the easy instructions below.

- First, ensure that you have chosen the correct document template for your desired state/city.

- Review the form description to confirm you have selected the right form.

Form popularity

FAQ

Wyoming is viewed as a tax haven due to its lack of corporate and personal income taxes, along with lower overall tax rates. This appealing landscape invites businesses and individuals alike to capitalize on the financial benefits. By leveraging the Wyoming Form of Accounting Index, individuals and companies can maximize their tax advantages while maintaining compliance.

Wyoming's wealth stems from its abundance of natural resources and its proactive approach to economic development. The state's strategic focus on industries like energy and tourism has attracted significant investments. Understanding the Wyoming Form of Accounting Index can further enhance financial stability and prosperity for businesses looking to thrive in this flourishing economy.

Yes, a Wyoming LLC does require an annual report, but the process is streamlined and not burdensome. This report is relatively simple to file and ensures compliance with state regulations. Entrepreneurs can effectively manage their LLC's financial standing using the tools outlined in the Wyoming Form of Accounting Index, making the annual reporting process a breeze.

Wyoming's tax structure prioritizes business and personal income retention, making it extremely tax-friendly. The absence of a state income tax allows individuals to keep more of their earnings. For businesses, this means utilizing the Wyoming Form of Accounting Index can enhance financial management without the burden of excessive taxes.

Wyoming is often called a tax haven because it has no state income tax, low corporate taxes, and favorable regulations for businesses. This environment encourages both individuals and corporations to establish their presence in the state, thereby boosting the local economy. For many entrepreneurs, the Wyoming Form of Accounting Index becomes a strategic asset when managing finances in this tax-friendly state.

Wyoming's main source of income comes from various industries, including agriculture, energy production, and tourism. The state has rich natural resources, particularly fossil fuels, which contribute significantly to its economy. Additionally, Wyoming attracts businesses because of its favorable business regulations, making it a viable option for those utilizing the Wyoming Form of Accounting Index.

If an LLC does not file an annual report in Wyoming, it may face penalties, including late fees. Continuing to neglect this requirement could lead to the dissolution of the LLC. Understanding the Wyoming Form of Accounting Index helps you comply with financial reporting standards and avoid such issues. Platforms like uslegalforms can guide you through the process, ensuring that your filings meet state requirements.

One disadvantage of an LLC in Wyoming is the lack of privacy for members. While the state offers asset protection, the names of LLC owners are publicly accessible. Additionally, without proper knowledge of the Wyoming Form of Accounting Index, members might face challenges in adhering to tax regulations. This can lead to complications, so understanding these aspects is essential.

To file an annual report in Wyoming, you need to visit the Wyoming Secretary of State's website and access the business services section. You will find the option to file your annual report online, which includes details about your business and its financial status. It's crucial to use the Wyoming Form of Accounting Index for accurate reporting. By ensuring your filing is complete on time, you maintain your good standing in the state.

Yes, Wyoming has an annual report requirement for LLCs. This report is necessary to keep your business in good standing and ensures compliance with the Wyoming Form of Accounting Index. By filing your annual report timely, you can avoid unnecessary fees and complications. Utilizing platforms like Uslegalforms can streamline this process, making it more manageable.