Wyoming Temporary Worker Agreement - Self-Employed Independent Contractor

Description

How to fill out Temporary Worker Agreement - Self-Employed Independent Contractor?

You have the capability to dedicate hours online looking for the appropriate document template that complies with the state and federal regulations you require. US Legal Forms offers thousands of legal templates that can be reviewed by experts.

It is easy to download or print the Wyoming Temporary Worker Agreement - Self-Employed Independent Contractor from our platform. If you already have a US Legal Forms account, you can Log In and click the Acquire button. After that, you can complete, modify, print, or sign the Wyoming Temporary Worker Agreement - Self-Employed Independent Contractor.

Every legal document template you obtain is yours to keep permanently. To obtain another copy of any purchased form, go to the My documents section and click the corresponding option. If you are using the US Legal Forms website for the first time, follow the simple guidelines below.

Select the format of the document and download it to your device. Make modifications to your document if applicable. You can complete, edit, sign, and print the Wyoming Temporary Worker Agreement - Self-Employed Independent Contractor. Obtain and print thousands of document templates using the US Legal Forms website, which provides the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

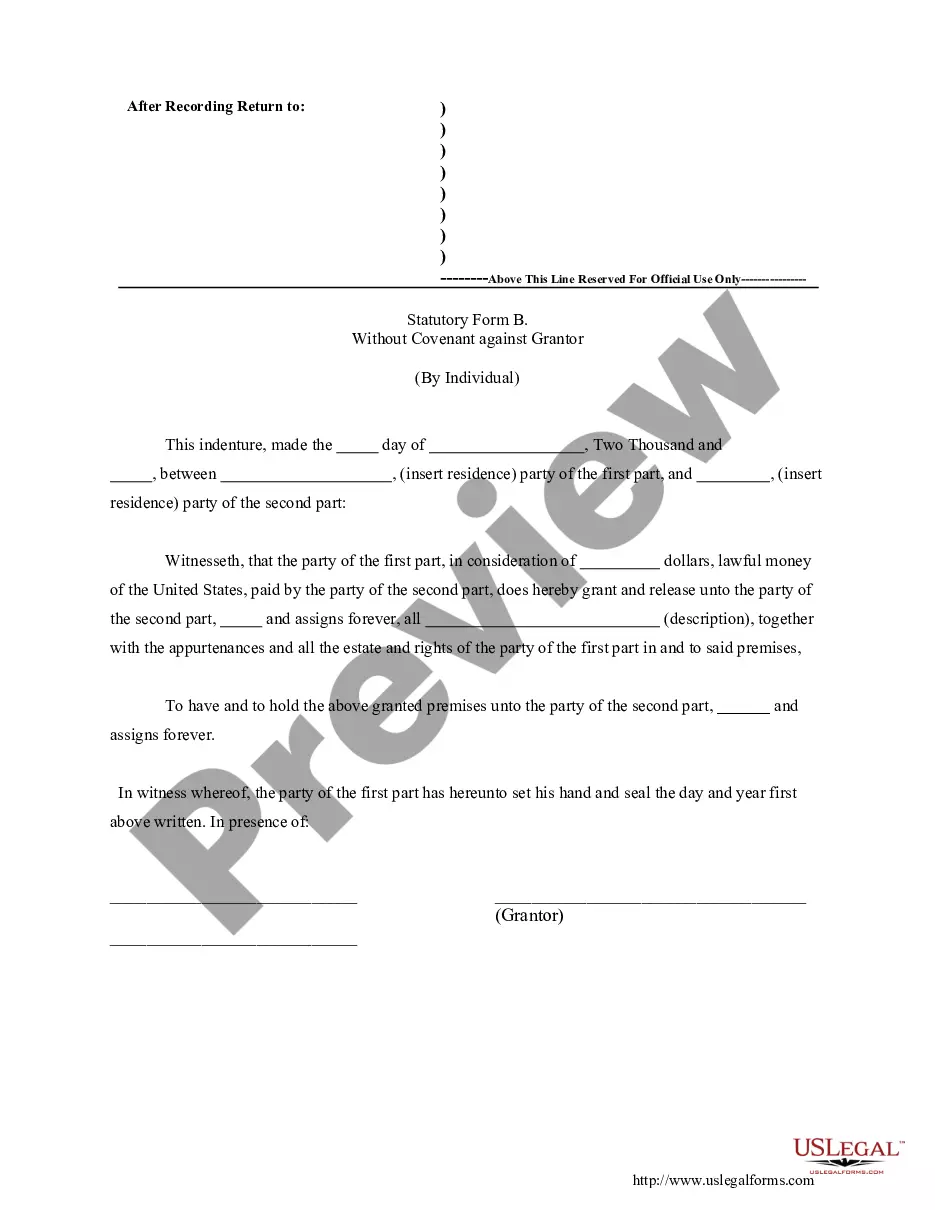

- First, ensure that you have selected the correct document template for the region/city you choose.

- Review the document details to confirm you have selected the right form.

- If available, use the Review option to browse through the document template as well.

- If you want to find another version of the form, use the Search field to locate the template that fits your needs and requirements.

- Once you have found the template you want, click on Purchase now to proceed.

- Select the pricing plan you desire, enter your credentials, and create your account on US Legal Forms.

- Complete the purchase. You can use your Visa or Mastercard or PayPal account to pay for the legal document.

Form popularity

FAQ

Filling out an independent contractor agreement is straightforward. Begin by clearly identifying the parties involved, then outline the scope of work, payment terms, and deadlines. Make sure to include key clauses that protect both sides, as well as details about the project related to the Wyoming Temporary Worker Agreement - Self-Employed Independent Contractor. Using a platform like USLegalForms can simplify this process by providing templates that guide you through each section, ensuring you don’t miss any important details.

A temporary employee is not the same as an independent contractor. While both may work for a limited time, a temporary employee typically works under an employer's control and schedules, whereas an independent contractor operates more autonomously. When engaging with a Wyoming Temporary Worker Agreement - Self-Employed Independent Contractor, it is vital to understand these distinctions for compliance and tax purposes. This agreement can provide clarity on your roles and responsibilities, ensuring a smooth working relationship.

Writing an independent contractor agreement involves specifying the project details, payment terms, and duration of the contract. Be sure to include confidentiality clauses and termination conditions for a comprehensive approach. Using a Wyoming Temporary Worker Agreement - Self-Employed Independent Contractor template from USLegalForms can streamline your writing process, ensuring you include all essential elements. After drafting your agreement, both parties should review and sign it to formalize the arrangement.

To fill out an independent contractor form, start by gathering necessary information, like your name, address, and tax identification number. Then, provide details about the work you’ll perform and the payment terms. The Wyoming Temporary Worker Agreement - Self-Employed Independent Contractor template simplifies this process with clear sections to guide you. Remember to review all information carefully to ensure accuracy before submitting.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Freelancers are independent contractors who should receive 1099 from the company using their services and are subject to paying their own taxes, including self-employment tax.

A 1099 worker is one that is not considered an employee. Rather, this type of worker is usually referred to as a freelancer, independent contractor or other self-employed worker that completes particular jobs or assignments. Since they're not deemed employees, you don't pay them wages or a salary.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.