Wyoming Modeling Services Contract - Self-Employed

Description

How to fill out Modeling Services Contract - Self-Employed?

If you desire to total, obtain, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Utilize the site’s straightforward and user-friendly search to find the documents you require.

Numerous templates for business and personal use are categorized by groups and states, or keywords.

Step 4. Once you have found the form you need, click on the Get now button. Choose the pricing plan you prefer and enter your information to register for an account.

Step 5. Proceed with the payment. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to acquire the Wyoming Modeling Services Contract - Self-Employed in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to get the Wyoming Modeling Services Contract - Self-Employed.

- You can also access forms you previously saved in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for the correct town/state.

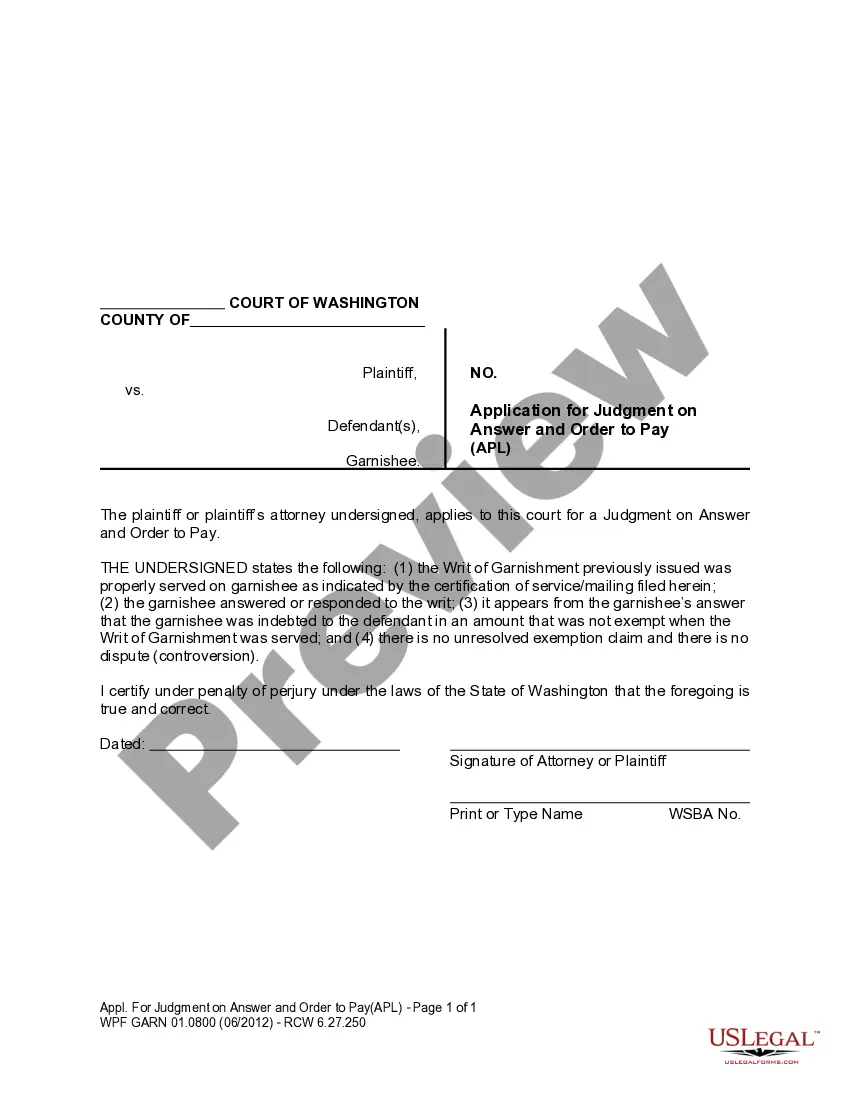

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the summary.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find other versions of the legal document template.

Form popularity

FAQ

Legal requirements for independent contractors mainly include obtaining the necessary permits, paying self-employment taxes, and ensuring compliance with local, state, and federal laws. Contractors must also be aware of their responsibilities when it comes to contracts, especially when it involves the Wyoming Modeling Services Contract - Self-Employed. It is essential to have clear, written agreements defining the scope of work and payment terms. For thorough legal forms and guidelines, US Legal Forms is a valuable resource.

The new federal rule on independent contractors, implemented by the Department of Labor, outlines the criteria that determine whether a worker qualifies as an employee or an independent contractor. It focuses on the level of control a business has over the worker and the economic dependence of the worker on the business. Understanding these criteria is crucial for self-employed individuals, especially those utilizing the Wyoming Modeling Services Contract - Self-Employed, to ensure compliance and avoid misclassification. Staying updated with these regulations can lead to better business decisions.

In Wyoming, an operating agreement is not legally required for an LLC, but it is highly advisable. This document outlines the management structure and operating procedures for your business. Having a well-crafted operating agreement can help prevent disputes and clarify each member's responsibilities, especially when using contracts like the Wyoming Modeling Services Contract - Self-Employed. For more detailed templates or assistance, consider using US Legal Forms for your needs.

Yes, you can start an LLC in Wyoming even if you do not reside in the state. Many entrepreneurs choose Wyoming due to its favorable business laws and policies, which provide privacy and asset protection. By establishing your LLC with a Wyoming Modeling Services Contract - Self-Employed, you can take advantage of these benefits regardless of your home state.

While various states have different tax structures, Wyoming offers a favorable environment with no personal income tax, making it one of the better options for self-employed individuals. This means you can focus on your income without worrying about high taxes, especially if you utilize a Wyoming Modeling Services Contract - Self-Employed. Always consult with a tax professional for personalized advice.

Yes, LLCs in Wyoming are required to file an annual report. This report includes important information about your business and must be submitted to the Wyoming Secretary of State. Ensuring your annual report is filed properly is crucial for maintaining good standing, especially when operating under a Wyoming Modeling Services Contract - Self-Employed.

While an operating agreement is not legally required in Wyoming, having one is highly recommended for an LLC. This document outlines the management structure and operating procedures, providing clarity in agreements, especially when using a Wyoming Modeling Services Contract - Self-Employed. It helps protect your interests and avoid disputes between members.

The self-employment tax in Wyoming primarily consists of Social Security and Medicare taxes. Currently, the rate is 15.3% on your net earnings from self-employment. When you structure your business under a Wyoming Modeling Services Contract - Self-Employed, you can better understand your tax obligations while optimizing your overall tax strategy.

Yes, Wyoming does have a self-employment tax that applies to individuals who earn income through self-employment. However, Wyoming is known for not having a personal income tax, which can be beneficial for your business when using a Wyoming Modeling Services Contract - Self-Employed. This makes it an attractive option for those looking to maximize their earnings.

Setting up as a self-employed contractor involves determining your services, registering your business name, and keeping proper financial records. Make sure you understand tax obligations and how to file as self-employed to avoid penalties. Utilizing a Wyoming Modeling Services Contract - Self-Employed from USLegalForms can provide you with the structure you need for contracts, ensuring that both you and your clients are protected.