Wyoming Audio Systems Contractor Agreement - Self-Employed

Description

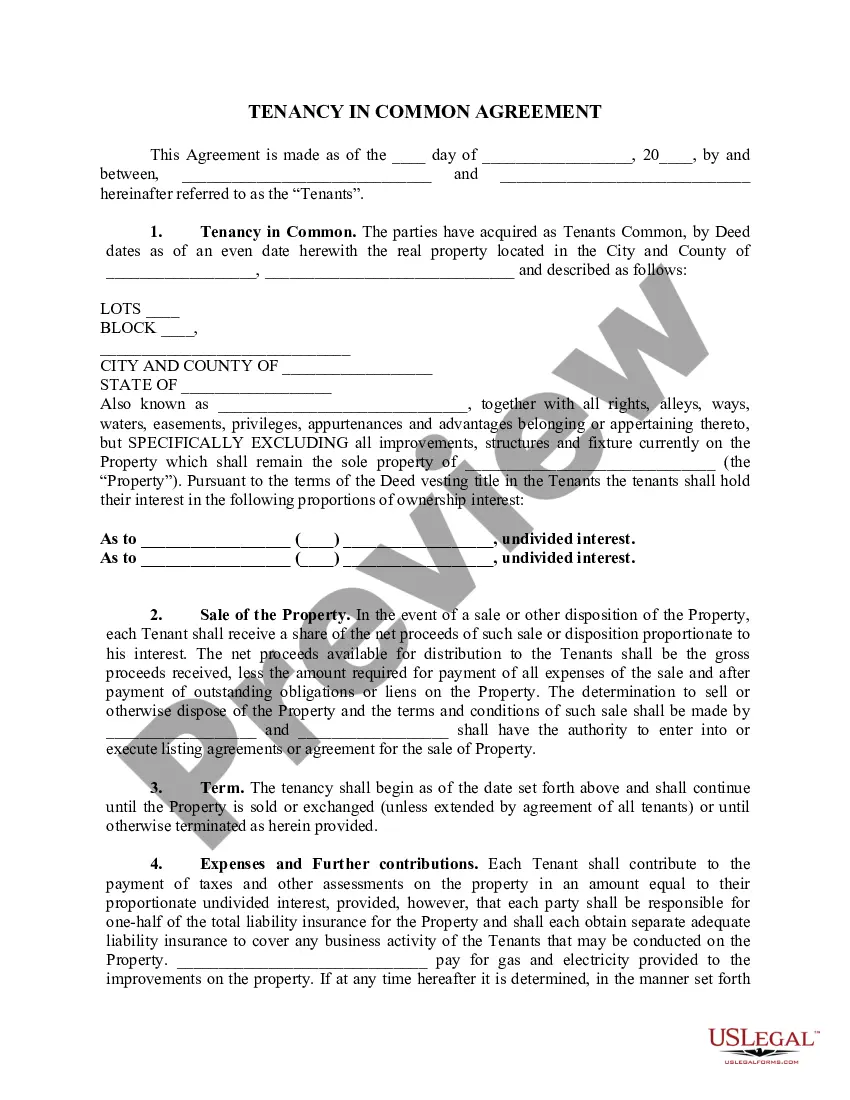

How to fill out Audio Systems Contractor Agreement - Self-Employed?

US Legal Forms - one of the largest collections of legal templates in the United States - provides a range of legal document formats that you can obtain or print. By using the website, you can find thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can access the most recent forms like the Wyoming Audio Systems Contractor Agreement - Self-Employed in moments.

If you already have an account, Log In and download the Wyoming Audio Systems Contractor Agreement - Self-Employed from the US Legal Forms collection. The Download button will be visible on every form you review. You have access to all previously saved forms from the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple steps to get started: Ensure that you have selected the correct form for your city/region. Click the Review button to check the form’s details. Read the form information to make sure you have chosen the right document. If the form doesn’t meet your needs, use the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select the payment plan you prefer and provide your information to register for the account.

By following these straightforward instructions, you can efficiently navigate the US Legal Forms platform and obtain the necessary legal documents tailored to your needs.

Ensure to utilize the vast resources available to meet all your legal documentation requirements seamlessly.

- Complete the transaction. Use Visa or Mastercard or PayPal account to finalize the purchase.

- Select the format and download the form to your device.

- Edit. Fill out, modify, and print and sign the saved Wyoming Audio Systems Contractor Agreement - Self-Employed.

- Every template you add to your account has no expiration date and is yours indefinitely. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

- Access the Wyoming Audio Systems Contractor Agreement - Self-Employed with US Legal Forms, one of the most extensive collections of legal document templates. Utilize a multitude of professional and state-specific templates that cater to your business or personal requirements and standards.

Form popularity

FAQ

An operating agreement is not legally required for an LLC in Wyoming, but it is highly beneficial. This document outlines the management structure and operational guidelines, providing clarity among members. Particularly for self-employed individuals, having an operating agreement helps establish credibility and professionalism, especially when using agreements like the Wyoming Audio Systems Contractor Agreement - Self-Employed. USLegalForms offers easy-to-use resources to create such documents.

Writing an independent contractor agreement, like the Wyoming Audio Systems Contractor Agreement - Self-Employed, involves several key components. Begin by clearly defining the scope of work, payment terms, and duration of the project. Additionally, outline confidentiality clauses and dispute resolution processes to protect both parties. You can simplify this process by using templates from platforms like USLegalForms to ensure compliance and professionalism.

In Wyoming, an operating agreement is not legally mandatory for all businesses, but it is highly recommended. This document outlines the management structure and operating procedures for your business, which can be particularly beneficial for independent contractors. Using a Wyoming Audio Systems Contractor Agreement - Self-Employed template can help you establish clear expectations and reduce potential conflicts among parties. Always consider having such agreements in place to protect your business interests.

Creating an independent contractor agreement involves several essential steps. First, both parties should define the scope of work, payment terms, and project deadlines. For those in the audio systems industry, utilizing a Wyoming Audio Systems Contractor Agreement - Self-Employed template can streamline the process. Platforms like USLegalForms provide customizable templates that simplify drafting these agreements to meet your specific needs.

The new federal rule on independent contractors focuses on how individuals are classified in the workforce. This rule emphasizes the need for clear criteria to determine if a worker is an independent contractor or an employee. Understanding these regulations is crucial for professionals entering into Wyoming Audio Systems Contractor Agreements - Self-Employed. Being compliant can help you avoid legal problems and ensure fair working conditions.

Filling out the declaration of independent contractor status form involves providing your name, the nature of your work, and your tax identification number. It's important to specify that you operate as a self-employed individual. Referencing a Wyoming Audio Systems Contractor Agreement - Self-Employed can provide clarity on how to articulate your independent status legally.

To fill out an independent contractor agreement, start by inserting your personal details and those of the client. Next, describe the services you will provide and the compensation structure. Don’t forget to refer to a Wyoming Audio Systems Contractor Agreement - Self-Employed for precise language and structure that aligns with legal standards.

Writing an independent contractor agreement starts with defining the scope of work, payment terms, and deadlines. Clearly outline your responsibilities and those of the client to avoid misunderstandings. Utilizing a Wyoming Audio Systems Contractor Agreement - Self-Employed template can simplify the process by ensuring that you include all necessary legal elements.

Filling out an independent contractor form involves providing essential information such as your name, address, and details about your services. You should also include your payment terms and project timelines. Be sure to refer to a Wyoming Audio Systems Contractor Agreement - Self-Employed for guidance on key components required for this specific arrangement.