Wyoming Qualified Written RESPA Request to Dispute or Validate Debt

Description

How to fill out Qualified Written RESPA Request To Dispute Or Validate Debt?

Are you currently in a situation where you need documents for business or specific purposes almost every day.

There are numerous legal document templates available online, but finding ones you can trust is challenging.

US Legal Forms offers thousands of form templates, such as the Wyoming Qualified Written RESPA Request to Dispute or Validate Debt, which are designed to meet state and federal regulations.

When you locate the correct form, click Purchase now.

Select the pricing plan you want, fill in the required information to create your account, and pay for your order using either PayPal or a credit card. Choose a convenient document format and download your copy. You can find all the document templates you have purchased in the My documents menu. You can retrieve another copy of the Wyoming Qualified Written RESPA Request to Dispute or Validate Debt at any time if needed. Just navigate to the required form to download or print the document template. Use US Legal Forms, the most comprehensive collection of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates that can be utilized for various purposes. Create your account on US Legal Forms and start making your life a little easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Once logged in, you can download the Wyoming Qualified Written RESPA Request to Dispute or Validate Debt template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

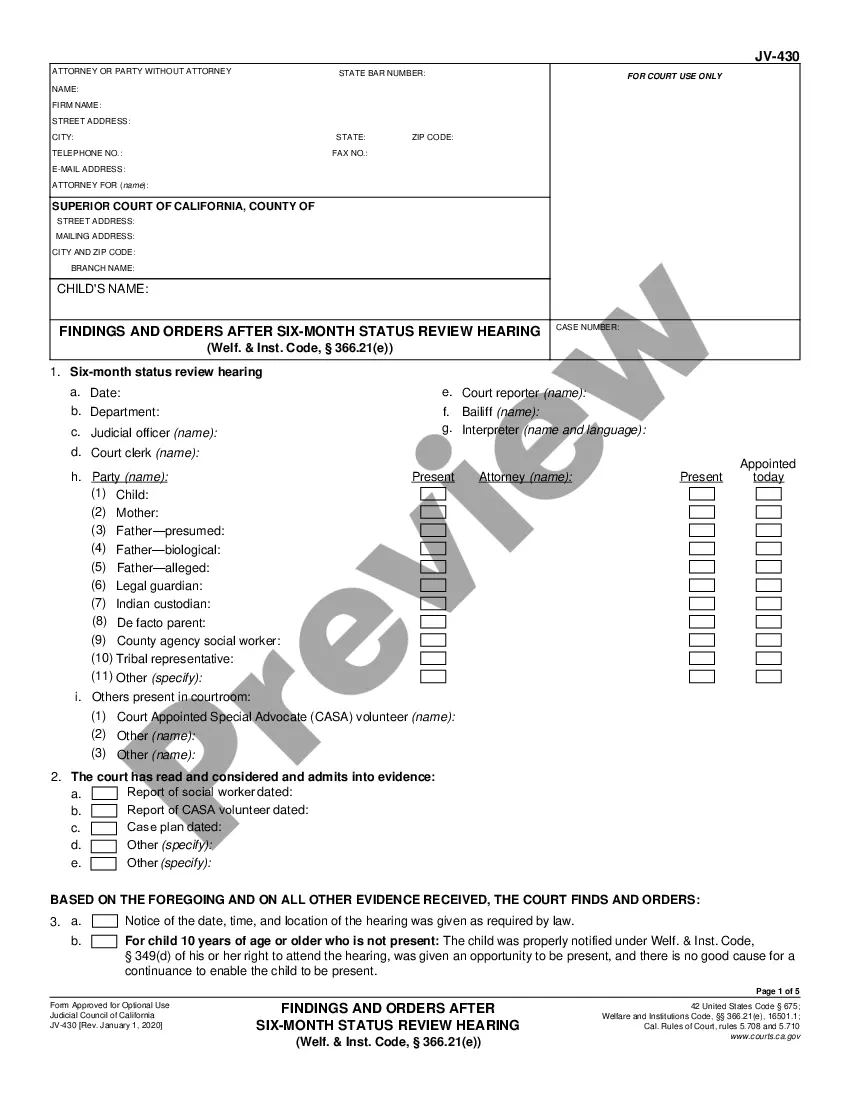

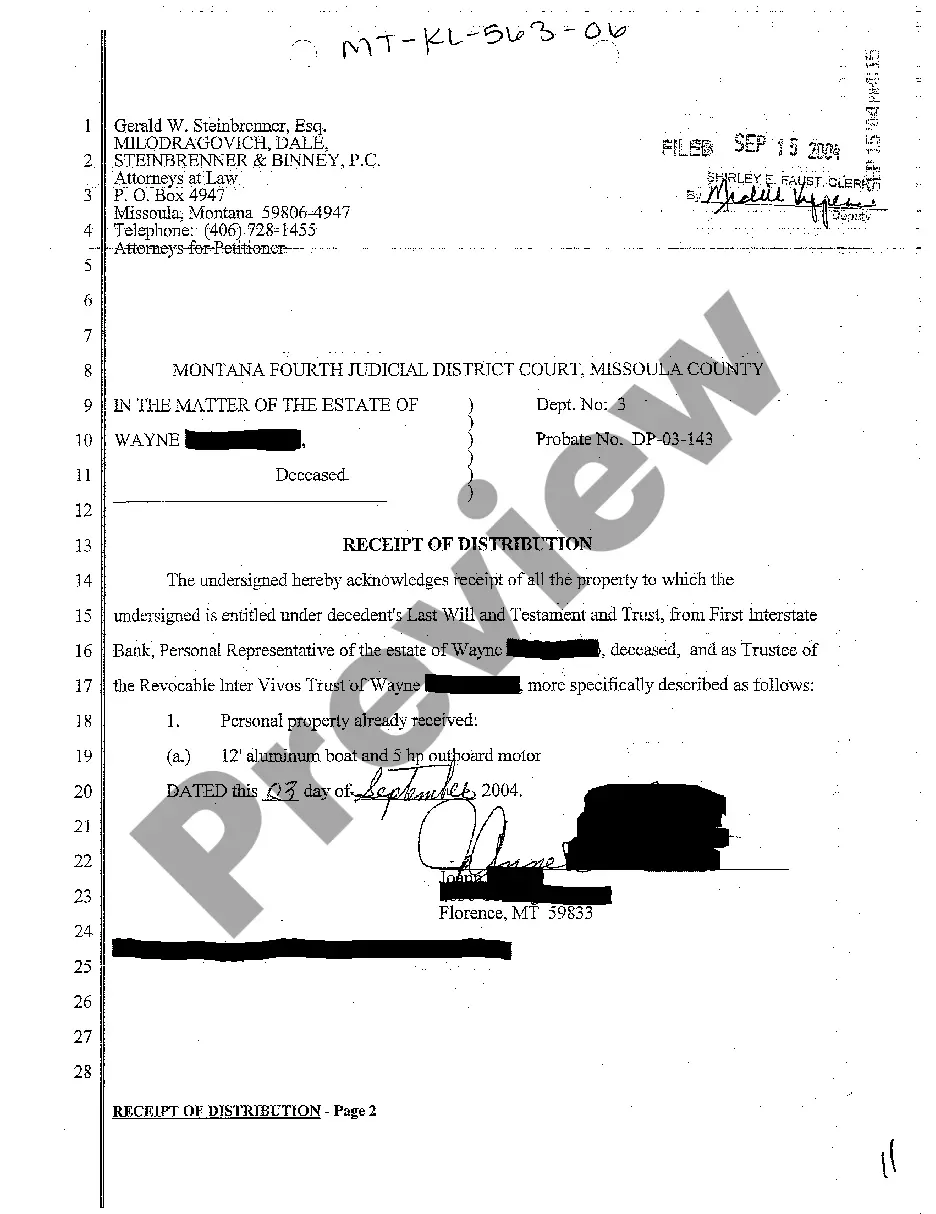

- Use the Preview button to review the form.

- Check the description to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find a form that fits your needs.

Form popularity

FAQ

A debt collector must provide you with a written validation notice within five days of their initial communication with you. This notice should include details about the debt, such as the amount owed and the name of the creditor. Understanding your rights in this context can be crucial, especially when you consider using a Wyoming Qualified Written RESPA Request to Dispute or Validate Debt.

To write a Wyoming Qualified Written RESPA Request to Dispute or Validate Debt, start by clearly stating your intent. Include your name, address, and account details, then explain the reasons for your request concisely. Ensure that you send this request via certified mail, so you have proof of delivery and can track your correspondence.

A Wyoming Qualified Written RESPA Request to Dispute or Validate Debt does not automatically stop foreclosure. However, submitting a QWR can potentially delay the process, as it may require the lender to address your concerns. It's important to understand the specifics of your situation and work closely with professionals to explore all available options.

A certified letter to validate debt is a formal communication you send to a creditor requesting proof that you owe the stated debt. This letter typically includes your demand for validation in the form of a Wyoming Qualified Written RESPA Request to Dispute or Validate Debt. Sending it via certified mail provides a record that you sent the request, which can be crucial if disputes escalate. Using certified letters also ensures the creditor is aware of your request for validation.

Yes, you can dispute a valid debt if you believe there are inaccuracies or if you do not recognize it. A Wyoming Qualified Written RESPA Request to Dispute or Validate Debt can be a tool for formally challenging the debt with the creditor. It is essential to outline your reasons for disputing the debt and request verification of any claims made. This process protects your rights and clarifies any misunderstandings.

When writing a letter to dispute the validity of a debt, start by stating your identity and the specifics of the debt in question. Employ a Wyoming Qualified Written RESPA Request to Dispute or Validate Debt to help guide your wording and structure. Specifically ask the creditor to provide proof that the debt is valid. A well-structured letter can facilitate communication and clarity in resolving the dispute.

To write a letter disputing a debt, clearly identify the debt in question and state your reasons for disputing it. Utilize a Wyoming Qualified Written RESPA Request to Dispute or Validate Debt framework to ensure you include all pertinent details and documentation requests. Keep your tone professional and direct, and remember to request a response within a reasonable timeframe. This proactive approach enhances your chances of a favorable outcome.

The best sample for a debt validation letter clearly states your intention to dispute the debt while requesting verification. You might consider using a Wyoming Qualified Written RESPA Request to Dispute or Validate Debt template available on platforms like USLegalForms. This ensures you include all necessary elements, such as your personal information, the details of the debt, and a request for supporting documentation. Tailor the sample to fit your specific situation for maximum impact.

Filing a debt validation claim involves sending a detailed request that disputes the validity of the debt. Use a Wyoming Qualified Written RESPA Request to Dispute or Validate Debt to formally challenge the creditor’s claim. Submit your claim to the creditor and request that they provide proof that the debt is valid. Document everything to ensure you have a clear record of your communications.

To respond to a debt validation letter, start by reviewing the letter closely to understand the details of the debt. You can then draft a Wyoming Qualified Written RESPA Request to Dispute or Validate Debt, specifying your request for documentation. Sending this request can prompt the creditor to provide the necessary support for their claim. Be sure to keep a copy of your response for your records.