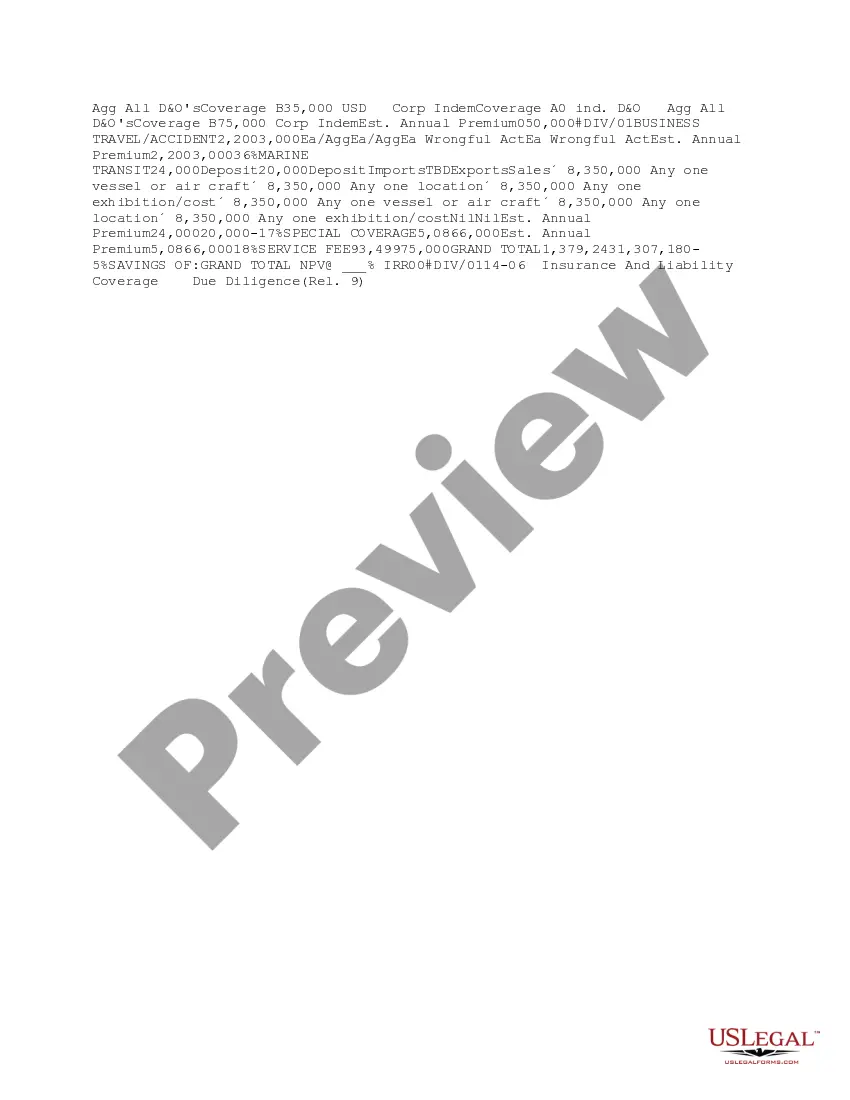

This due diligence form contains information documented from a risk evaluation within a company regarding business transactions.

Wyoming Risk Evaluation Specialist Matrix

Description

How to fill out Risk Evaluation Specialist Matrix?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a broad selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of forms like the Wyoming Risk Evaluation Specialist Matrix in moments.

If you possess a subscription, Log In and download the Wyoming Risk Evaluation Specialist Matrix from your US Legal Forms library. The Download button will appear on each form you review. You have access to all previously downloaded forms under the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Choose the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Wyoming Risk Evaluation Specialist Matrix. Every document you added to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need.

- Make sure you have selected the correct form for your city/county.

- Click the View button to review the form's content.

- Check the form summary to ensure that you have selected the right form.

- If the form does not meet your needs, utilize the Search bar at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Download now button.

- Next, choose the pricing plan you prefer and provide your credentials to create an account.

Form popularity

FAQ

How to Conduct a Risk AssessmentStep 1: Identify Hazards. Relating to your scope, brainstorm potential hazards.Step 2: Calculate Likelihood. For each hazard, determine the likelihood it will occur.Step 3: Calculate Consequences.Step 4: Calculate Risk Rating.Step 5: Create an Action Plan.Step 6: Plug Data into Matrix.

The Health and Safety Executive's Five steps to risk assessment.Step 1: Identify the hazards.Step 2: Decide who might be harmed and how.Step 3: Evaluate the risks and decide on precautions.Step 4: Record your findings and implement them.Step 5: Review your risk assessment and update if. necessary.

How do you calculate risk in a risk matrix?Step 1: Identify the risks related to your project.Step 2: Define and determine risk criteria for your project.Step 3: Analyze the risks you've identified.Step 4: Prioritize the risks and make an action plan.

A Risk Assessment Matrix, also known as a Probability and Severity risk matrix, is designed to help you minimize the probability of potential risk to optimize project performance. Essentially, a Risk Matrix is a visual depiction of the risks affecting a project to enable companies to develop a mitigation strategy.

Use the links below to find information on the steps you should take when performing a risk assessment in your organisation.Identify hazards in risk assessment.Establish who might be harmed and how in risk assessment.Evaluate and decide on precautions in risk assessment.Record and share key findings of risk assessment.More items...?

- Licensed and retail premises.Overview.Step 1: Identify the hazards.Step 2: Decide who might be harmed and how.Step 3: Evaluate the risks and decide on precautions.Step 4: Record your findings and implement them.Step 5: Review your risk assessment and update if necessary.

The risk assessment matrix will help your organization identify and prioritize different risks, by estimating the probability of the risk occurring and how severe the impact would be if it were to happen....The process:Identify the risk universe.Determine the risk criteria.Assess the risks.Prioritize the risks.

A risk assessment matrix is the table (matrix) used for allocating risk ratings for risks that you identify, based on two intersecting factors: the likelihood (or probability) of a security risk-based event occurring, and the consequence (or impact) to an asset if it did.

A risk matrix is a matrix that is used during risk assessment to define the level of risk by considering the category of probability or likelihood against the category of consequence severity. This is a simple mechanism to increase visibility of risks and assist management decision making.

Critical risk also expresses the likelihood of severe injuries, potential damages, and financial loss. Minor indicates that little attention is required as the risk has a low probability of occurring....Risk Impact (Risk Severity)Minor (Blue)Moderate (Green)Major (Orange)Critical (Red)