Wyoming Reaffirmation Agreement, Motion and Order

Description

How to fill out Reaffirmation Agreement, Motion And Order?

Finding the right lawful record web template could be a struggle. Needless to say, there are tons of web templates available online, but how can you get the lawful type you want? Utilize the US Legal Forms internet site. The service provides 1000s of web templates, for example the Wyoming Reaffirmation Agreement, Motion and Order, which can be used for organization and private demands. All the varieties are examined by professionals and satisfy state and federal requirements.

When you are already authorized, log in to your accounts and then click the Download key to obtain the Wyoming Reaffirmation Agreement, Motion and Order. Utilize your accounts to appear with the lawful varieties you may have purchased formerly. Visit the My Forms tab of your accounts and get one more copy in the record you want.

When you are a whole new user of US Legal Forms, listed here are basic recommendations that you should stick to:

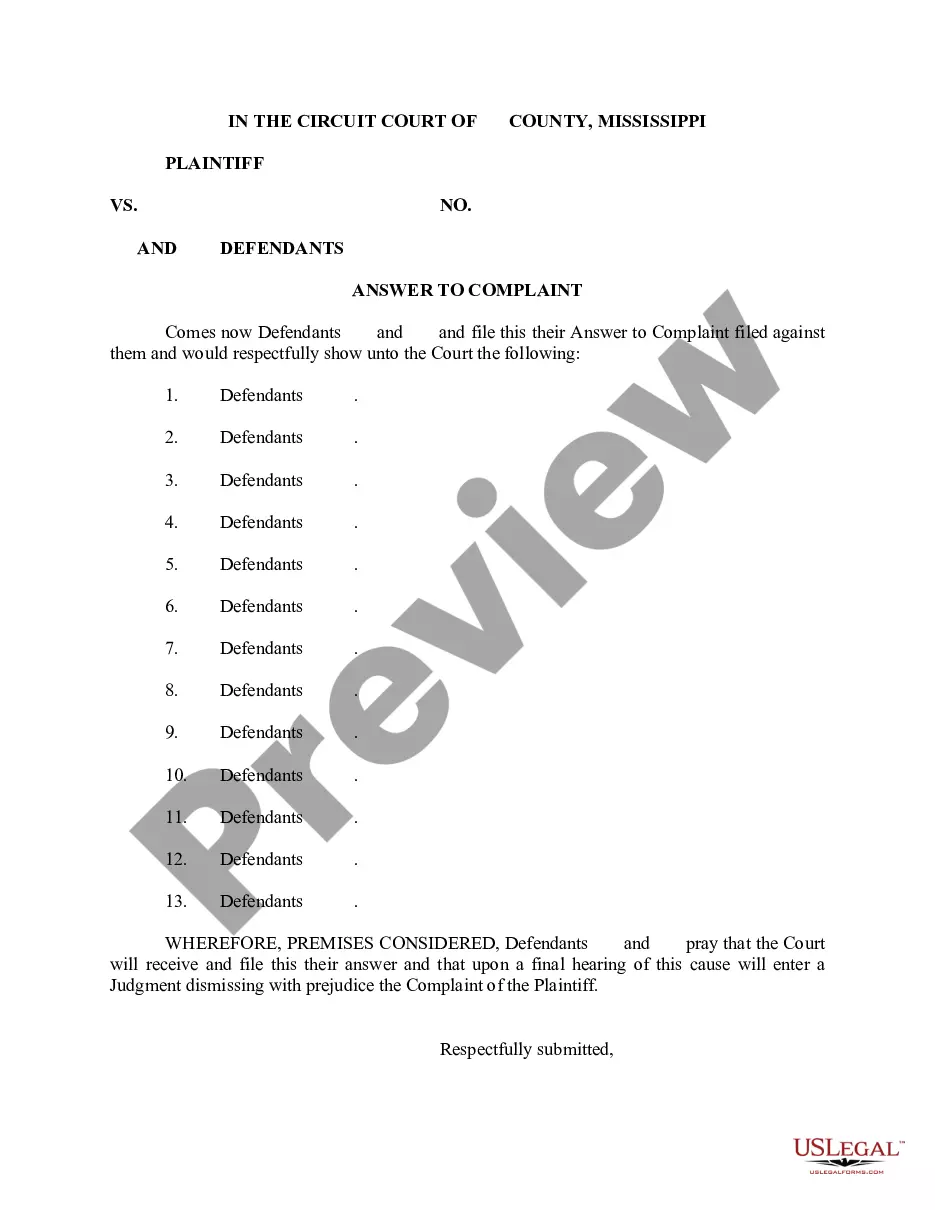

- Initially, make certain you have chosen the correct type to your area/county. You are able to examine the shape using the Review key and read the shape description to ensure it will be the right one for you.

- In case the type will not satisfy your needs, use the Seach field to get the correct type.

- When you are certain the shape is acceptable, select the Purchase now key to obtain the type.

- Select the rates program you need and enter the required information and facts. Build your accounts and pay money for an order using your PayPal accounts or charge card.

- Pick the document format and obtain the lawful record web template to your device.

- Total, revise and print and indication the acquired Wyoming Reaffirmation Agreement, Motion and Order.

US Legal Forms is definitely the biggest local library of lawful varieties that you will find a variety of record web templates. Utilize the company to obtain professionally-created documents that stick to express requirements.

Form popularity

FAQ

Making a reaffirmation agreement can be helpful if you want to stay in your home or you need to keep driving your car during a bankruptcy settlement. However, this type of agreement means you are still responsible for some sort of payment on the loan.

Reaffirmation is an agreement by a debtor, to a lender, to repay some or all of their debt. Debtors make reaffirmation agreements purely voluntarily. When a borrower reaffirms a debt, this is noted by credit reporting agencies, which then register that the person will make regular on-time payments.

Creditors holding a security interest that they want to protect post-bankruptcy will request that a Reaffirmation Agreement is signed. They will prepare it and provide it to your attorney's office for review.

A reaffirmation agreement is where you agree to pay a debt even though you could have eliminated the debt in your bankruptcy case. When you reaffirm a debt, you continue to be legally responsible for paying it back. This gives the creditor some legal rights.

In this article, you'll learn that lenders sometimes agree to new terms when completing a reaffirmation agreement, including lowering the amount owed, interest rate, or monthly payment. A local bankruptcy lawyer can help you with the negotiation process.

Agreeing to repay the excess loan amount in ance with the terms of the promissory note is called ?reaffirmation.? You can reaffirm an excess loan amount by signing a reaffirmation agreement with your loan servicer.

Any agreement to reaffirm must be made before the discharge is entered. If you are in the process of reaffirming a debt and feel it will not be filed before the discharge deadline, notify the clerk's office in writing to delay entry of the discharge until the reaffirmation is filed.

After you have entered into a reaffirmation agreement and all parts of this form that require a signature have been signed, either you or the creditor should file it as soon as possible.