Wyoming Employee Evaluation Form for Nonprofit

Description

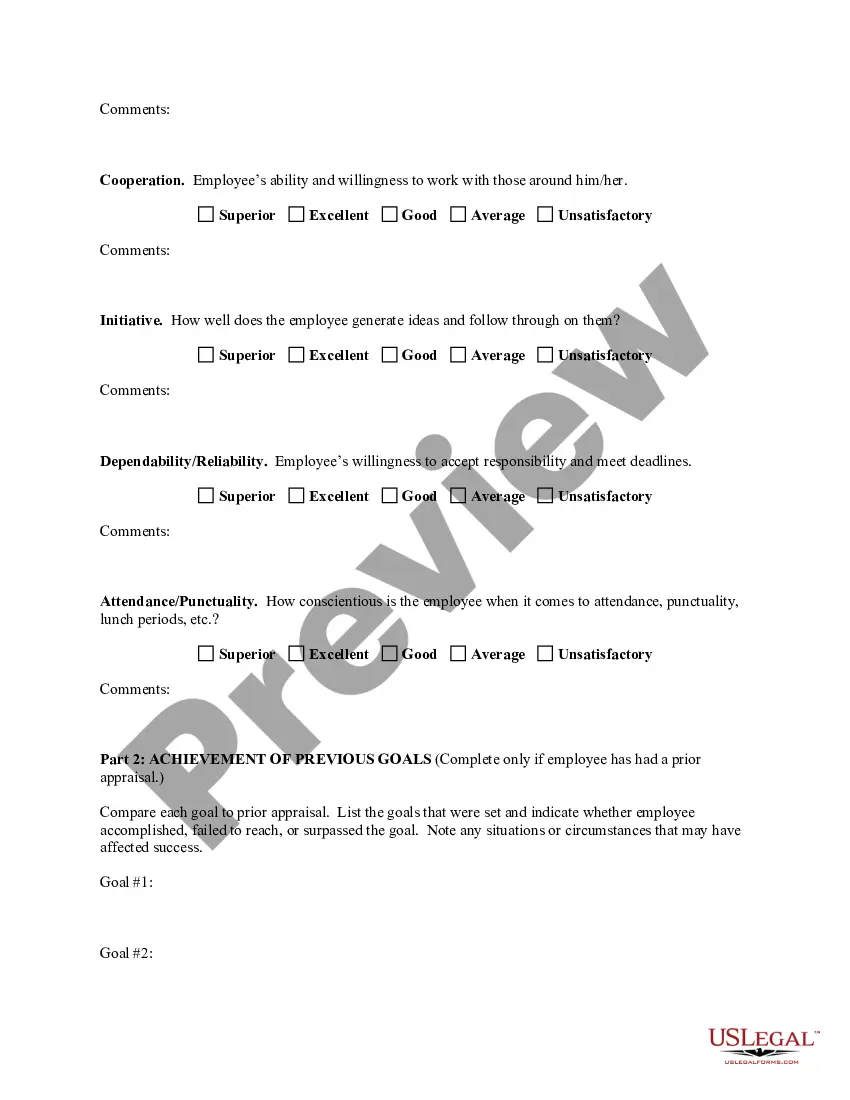

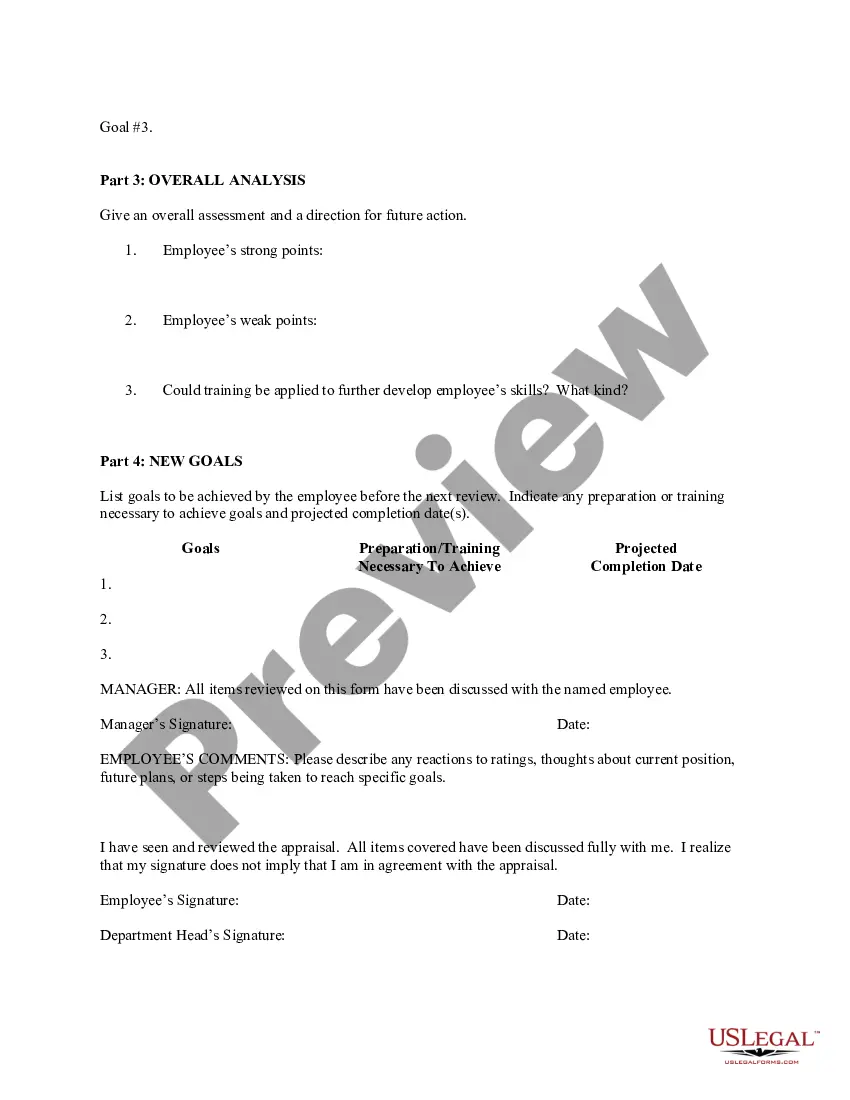

How to fill out Employee Evaluation Form For Nonprofit?

US Legal Forms - one of the largest collections of legal documents in the USA - offers an extensive selection of legal document templates that you can download or print.

Through the website, you can discover thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the latest versions of forms such as the Wyoming Employee Evaluation Form for Nonprofit in moments.

If you already have a monthly subscription, Log In and download the Wyoming Employee Evaluation Form for Nonprofit from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms from the My documents tab of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Find the format and download the form to your device. Make edits. Fill, modify, print, and sign the downloaded Wyoming Employee Evaluation Form for Nonprofit.

Every template you store in your account does not expire and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

Access the Wyoming Employee Evaluation Form for Nonprofit through US Legal Forms, one of the most extensive libraries of legal document templates. Utilize a multitude of professional and state-specific templates that fulfill your business or personal requirements.

- Make sure you have selected the correct form for your region/area.

- Click on the Review button to examine the form's details.

- Read the form description to ensure you have chosen the suitable form.

- If the form does not meet your requirements, utilize the Search field at the top of the page to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select your preferred payment plan and provide your details to create an account.

Form popularity

FAQ

To apply for nonprofit status with Facebook, administrators have to show that their organization is a 501(c)(3) registered with the IRS. They also have to supply tax ID and bank account numbers, and addresses for both the organization and the executive director.

What to Include in Your Nonprofit Annual ReportA clear mission and focus. If you could boil down your organization's values and purpose into a single sentence you would have your mission statement.Major achievements of the past year.A financial statement.An account of major contributions.

Form a Nonprofit in Eight StepsChoose a name.File articles of incorporation.Apply for your IRS tax exemption.Apply for a state tax exemption.Draft bylaws.Appoint directors.Hold a meeting of the board.Obtain licenses and permits.

9 Legal Steps to Starting Your Own NonprofitComplete the articles of incorporation.File the articles of incorporation.Draft bylaws.Hold an official meeting.Apply for a Federal Employer Identification Number.Apply for federal tax exemption.Familiarize yourself with initial state requirements.Register as a charity.More items...?

The six steps are:STEP 1: State the Program Goal.STEP 2: State the Program Objectives.STEP 3: Write the Program Description.STEP 4: List the Program Evaluation Questions.STEP 5: List the Sources of Evaluation Data.STEP 6: Describe the Methods of Data Collection.

Evaluations should include input from program participants and should monitor the satisfaction of participants. They should be candid and should be used by leadership to strengthen the organization's effectiveness, and, when necessary, be used to make programmatic changes.

An organization that normally has $50,000 or more in gross receipts and that is required to file an exempt organization information return must file either Form 990PDF, Return of Organization Exempt from Income Tax, or Form 990-EZPDF, Short Form Return of Organization Exempt from Income Tax.

To determine what the effects of the program are:Assess skills development by program participants.Compare changes in behavior over time.Decide where to allocate new resources.Document the level of success in accomplishing objectives.Demonstrate that accountability requirements are fulfilled.More items...

Form 990 is the IRS' primary tool for gathering information about tax-exempt organizations, educating organizations about tax law requirements and promoting compliance. Organizations also use the Form 990 to share information with the public about their programs.

The three main documents: the articles of incorporation, the bylaws, and the organizational meeting minutes; the nonprofit's directors' names and addresses (or the members' names and addresses if your nonprofit is a membership organization); and.