Statutory Guidelines [Appendix A(3) IRC 130] regarding certain personal injury liability assignments.

Wyoming Certain Personal Injury Liability Assignments IRS Code 130

Description

How to fill out Certain Personal Injury Liability Assignments IRS Code 130?

If you have to complete, obtain, or printing legal record themes, use US Legal Forms, the biggest assortment of legal types, that can be found on-line. Use the site`s simple and convenient research to obtain the documents you require. Different themes for business and person uses are categorized by categories and suggests, or search phrases. Use US Legal Forms to obtain the Wyoming Certain Personal Injury Liability Assignments IRS Code 130 within a couple of click throughs.

If you are previously a US Legal Forms consumer, log in to your accounts and click on the Obtain option to obtain the Wyoming Certain Personal Injury Liability Assignments IRS Code 130. You may also access types you in the past saved in the My Forms tab of the accounts.

If you work with US Legal Forms initially, follow the instructions beneath:

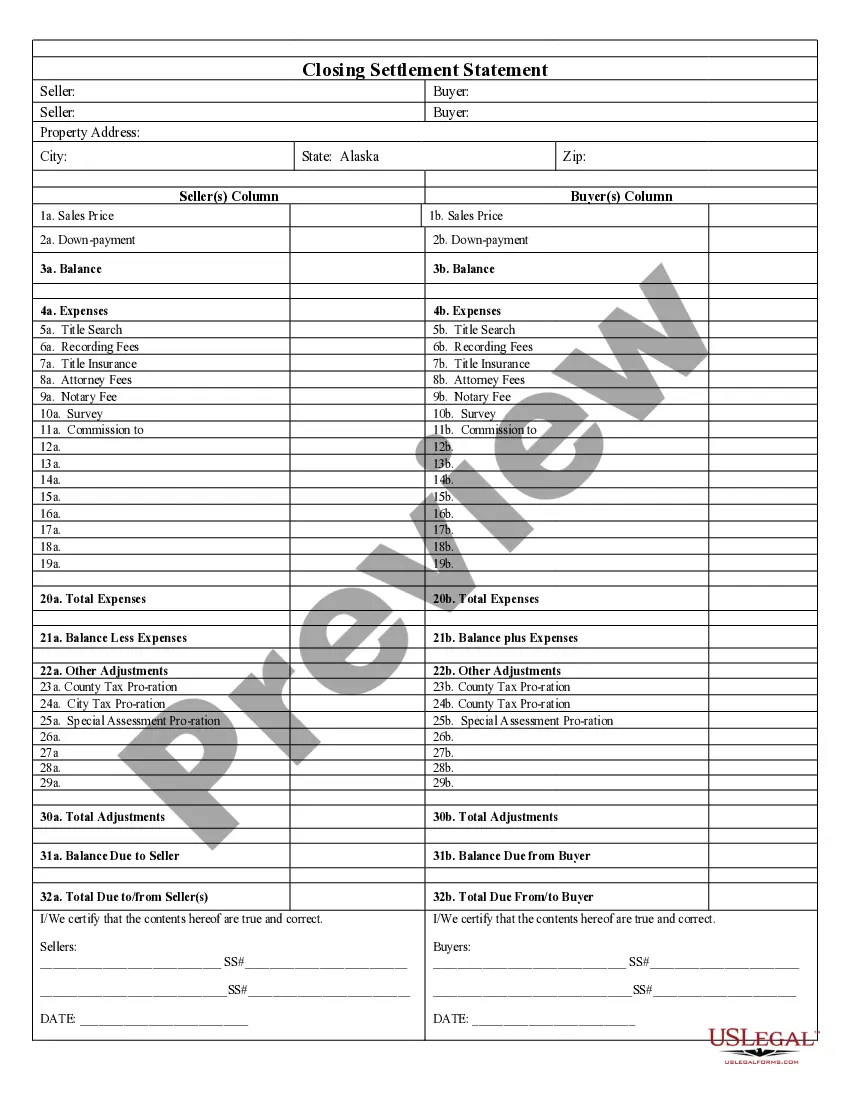

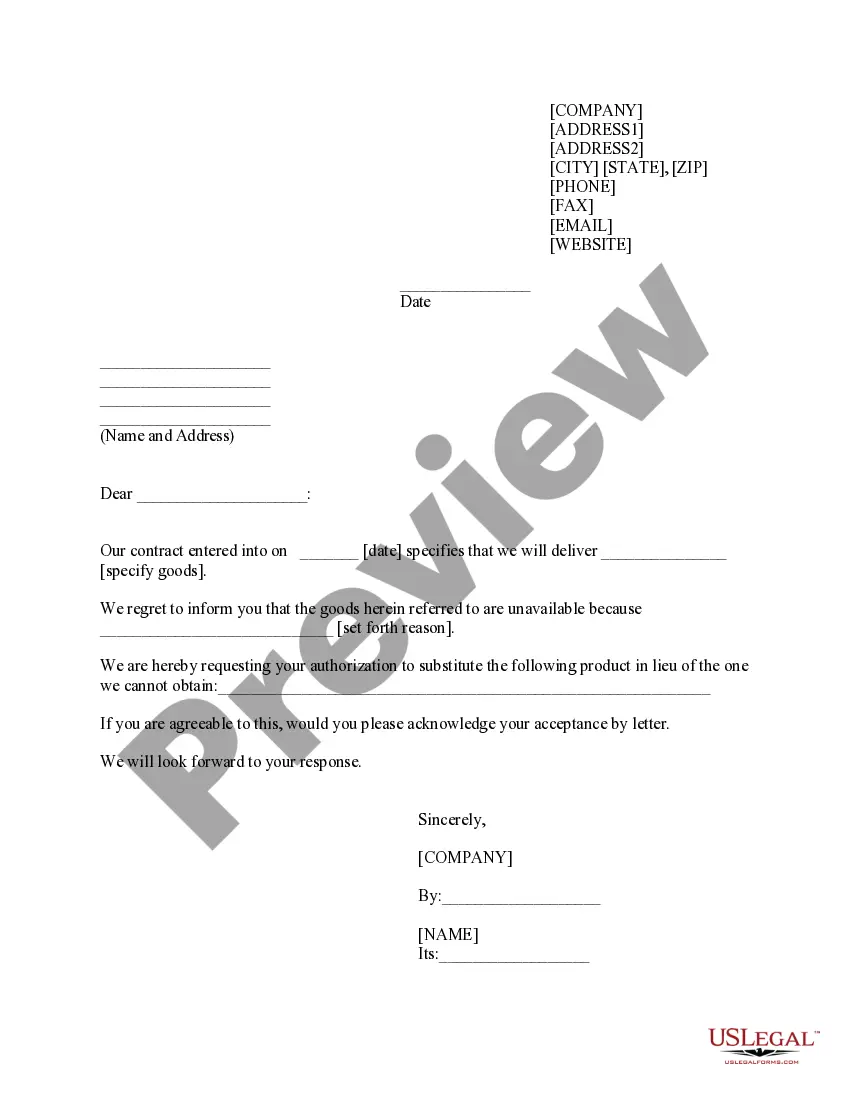

- Step 1. Make sure you have selected the form for that right metropolis/region.

- Step 2. Make use of the Preview method to look over the form`s information. Never overlook to learn the explanation.

- Step 3. If you are unsatisfied with all the form, make use of the Lookup area on top of the display screen to get other versions of your legal form template.

- Step 4. Once you have located the form you require, click the Buy now option. Choose the pricing prepare you choose and include your accreditations to sign up to have an accounts.

- Step 5. Approach the deal. You may use your credit card or PayPal accounts to accomplish the deal.

- Step 6. Find the formatting of your legal form and obtain it on the system.

- Step 7. Complete, modify and printing or signal the Wyoming Certain Personal Injury Liability Assignments IRS Code 130.

Every single legal record template you get is your own property forever. You possess acces to each form you saved within your acccount. Click on the My Forms segment and choose a form to printing or obtain once again.

Contend and obtain, and printing the Wyoming Certain Personal Injury Liability Assignments IRS Code 130 with US Legal Forms. There are many skilled and express-particular types you can utilize for your business or person needs.

Form popularity

FAQ

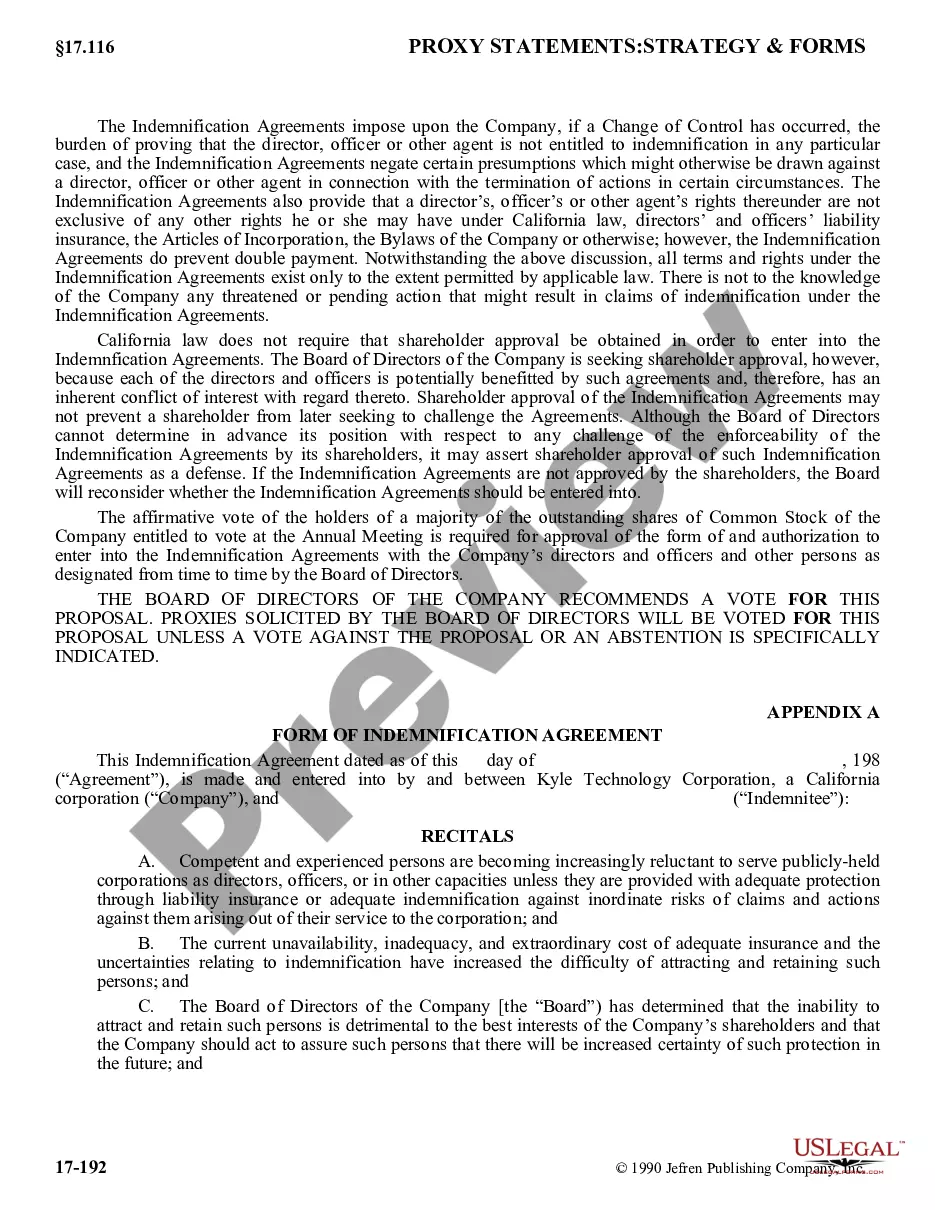

A qualified assignment is a formal arrangement wherein a defendant or its insurance company or other representative agrees to transfer their obligation to make future periodic payments to a third party (?an assignment company?). This is generally done using a uniform qualified assignment (?UQA?) document.

Section 130(c) defines a qualified assignment as any assignment of liability to make periodic payments as damages (whether by suit or agreement) on account of personal injury or sickness (in a case involving physical injury or sickness) provided, among other conditions, the periodic payments are fixed and determinable ...

For purposes of this section, the term ?qualified funding asset? means any annuity contract issued by a company licensed to do business as an insurance company under the laws of any State, or any obligation of the United States, if? 130(d)(1)

Such periodic payments are excludable from the gross income of the recipient under paragraph (1) or (2) of section 104(a).

Income tax exemption: Structured settlement payments?including growth?are 100% income tax-free. While lump sum cash settlements are income tax-free for physical injury cases, growth on funds placed in a traditional investment may be taxable.

Section 130(c) defines a qualified assignment as any assignment of liability to make periodic payments as damages (whether by suit or agreement) on account of personal injury or sickness (in a case involving physical injury or sickness) provided, among other conditions, the periodic payments are fixed and determinable ...