Colorado Closing Statement

Understanding this form

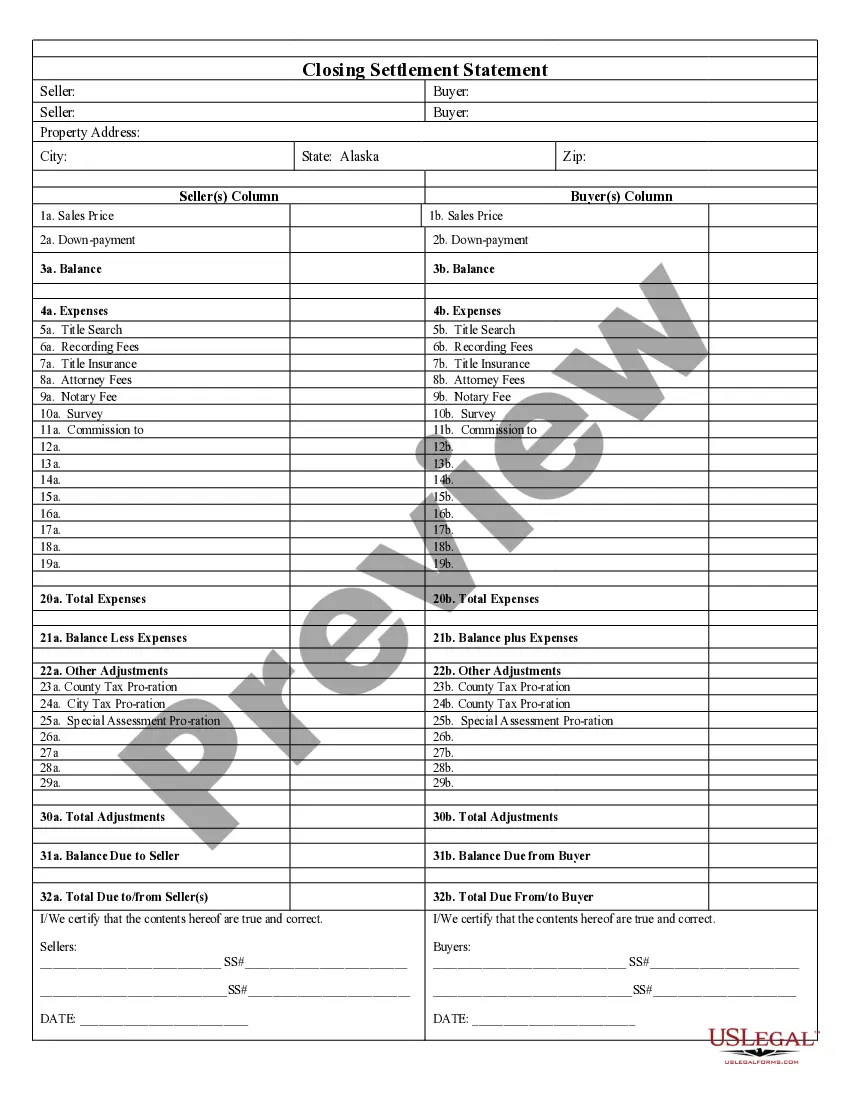

The Closing Statement is a critical document used in a real estate transaction, specifically when the sale is a cash transaction or involves owner financing. This form serves to summarize all financial details, including expenses and balances, related to the sale. It is verified and signed by both the seller and the buyer, ensuring accuracy and clarity about the transaction's financial aspects.

Form components explained

- Balance summary outlining the total amount due from the buyer and to the seller.

- Detailed breakdown of expenses, including title search fees, recording fees, and attorney fees.

- Sections for pro-rating taxes to ensure the appropriate payment period is covered.

- Signature lines for both parties to confirm the accuracy of the information provided.

- Final balance calculations to indicate the total adjustments and amounts due.

Situations where this form applies

This form should be used during the closing phase of a real estate sale. It is essential for documenting the final terms of the transaction, detailing all financial exchanges between the seller and buyer. It provides clarity on costs incurred during the sale and ensures that all parties agree to the final amounts before the transfer of ownership.

Who should use this form

Typically, the following parties should use this form:

- Homebuyers engaging in a cash sale or transaction with owner financing.

- Sellers transferring property in a cash transaction or with owner financing.

- Real estate agents or attorneys involved in the closing process who need to formalize the transaction details.

Instructions for completing this form

- Identify the seller and buyer by entering their names and contact information.

- Specify the property address and details of the real estate being sold.

- Fill out the sections for various expenses such as title search and recording fees.

- Calculate the total expenses and final amounts due, including any adjustments for taxes.

- Ensure both parties sign and date the form to verify the accuracy of its contents.

Does this document require notarization?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to include all relevant expenses, which can lead to disputes later.

- Not obtaining signatures from both parties, which invalidates the document.

- Incorrectly calculating totals, leading to financial discrepancies.

Benefits of using this form online

- Convenience of accessing the form from anywhere at any time.

- Easy editing options to customize the document as needed.

- Reliability of using templates drafted by licensed attorneys.

Looking for another form?

Form popularity

FAQ

A signature is indeed required on the closing disclosure in Colorado. This document details all costs associated with a mortgage and needs to be signed by the borrower, emphasizing their acknowledgment of the terms outlined, including those in the Colorado Closing Statement. Proper signatures help ensure transparency and protect the interests of all parties involved.

Yes, signing the closing statement is a standard procedure in Colorado. All parties involved in the transaction, including the buyer and seller, must sign to acknowledge their agreement with the terms outlined in the Colorado Closing Statement. This ensures that everyone is legally bound to the terms discussed.

In Colorado, the closing statement is typically prepared by the closing agent or the title company handling the transaction. They compile all financial information related to the sale, including the Colorado Closing Statement, to provide an accurate overview of costs and credits. Ensuring this document is correctly prepared is crucial for a smooth closing process.

The 3-day rule for closing refers to the requirement that buyers receive their closing disclosure at least three business days before closing. This period allows buyers time to review the details, including the Colorado Closing Statement, and ensure they understand all costs and terms before finalizing the transaction. This rule protects consumers and promotes informed decision-making.

Yes, closing instructions are often required in Colorado. These instructions guide the closing agent in executing the transaction smoothly. They should detail the parties involved, financial obligations, and provide specifics related to the Colorado Closing Statement, ensuring all conditions are met for a successful closing.

The closing statement in Colorado is usually signed by all parties involved in the transaction, including the buyer and seller. In certain cases, real estate agents or attorneys may also sign to verify the details. It is essential that everyone understands the contents of the Colorado Closing Statement before signing to ensure all parties agree on the terms.

Closing an estate in Colorado typically involves several steps. Firstly, you need to gather and prepare necessary documents, including the Colorado Closing Statement, which outlines the financial aspects of the estate. After that, the estate executor must ensure all debts and taxes are settled before distributing assets to beneficiaries. Finally, you can file the necessary paperwork with the court to formally close the estate.

To get your closing statement, reach out to your real estate agent or closing company. They manage these documents and can provide you with the necessary copies. If a Colorado Closing Statement is what you need, be sure to clarify this request. It's crucial for your peace of mind to ensure you have all important documents related to your transaction.

To obtain a bank closing statement, contact your bank directly, either by phone or by visiting a local branch. They typically keep a record of all closing statements and can issue a copy upon your request. Be specific about needing a Colorado Closing Statement to ensure clarity. Having this document on hand aids in keeping your financial records in order.

You can get your settlement statement from your attorney or the title company that handled your real estate transaction. They are the custodians of this document and should provide you with a copy upon request. If you require a Colorado Closing Statement, make sure to specify this to ensure you receive the correct paperwork. Proper documentation is essential for understanding your financial commitments.