Wyoming Business Deductibility Checklist

Description

How to fill out Business Deductibility Checklist?

If you need to finish, obtain, or print official document templates, utilize US Legal Forms, the largest collection of legal documents available online.

Employ the site's simple and user-friendly search to locate the documents you require.

A range of templates for business and personal purposes are categorized by regions, states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Select your preferred pricing plan and enter your details to create an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to locate the Wyoming Business Deductibility Checklist with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Acquire button to find the Wyoming Business Deductibility Checklist.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow these instructions.

- Step 1. Ensure you have selected the form for the correct city/state.

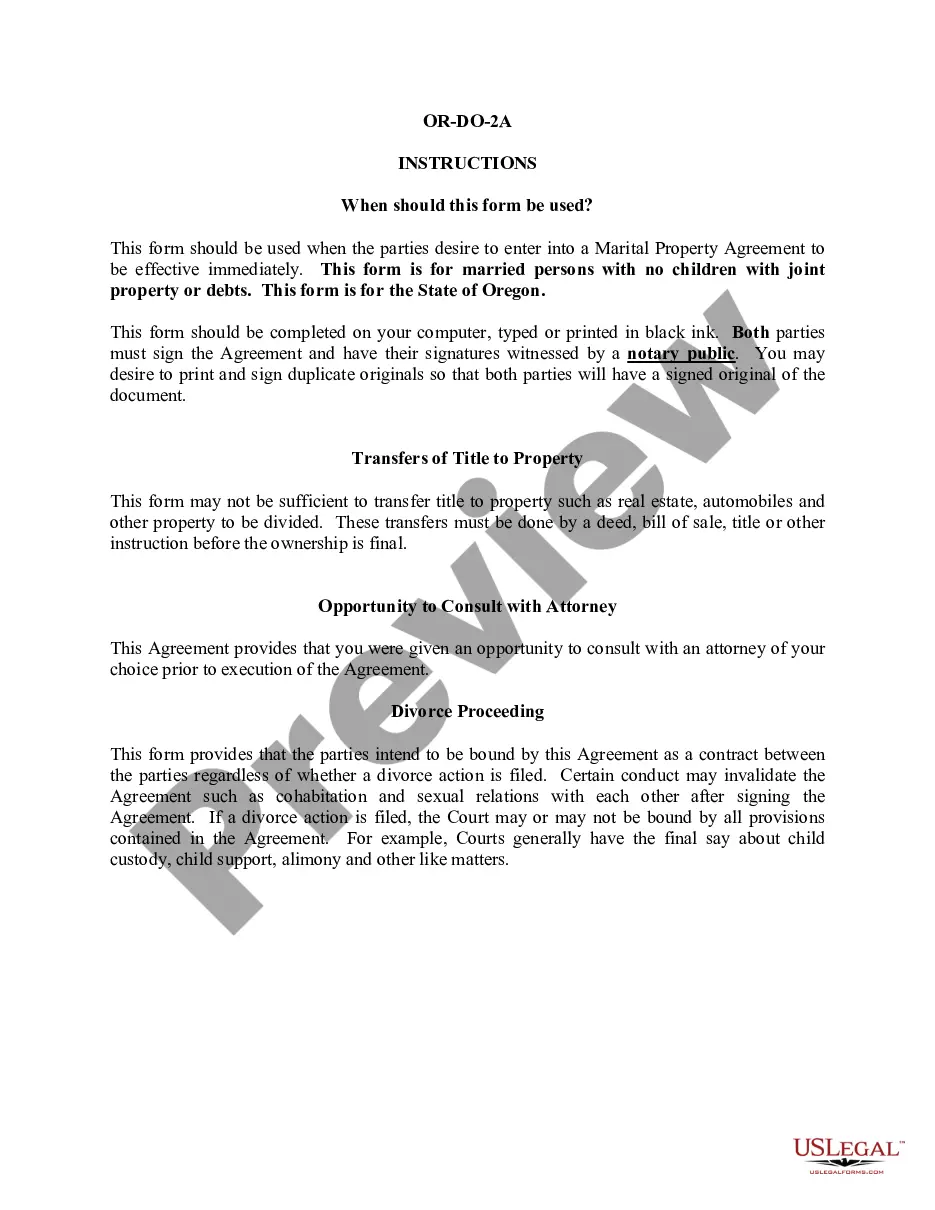

- Step 2. Use the Review option to examine the form’s content. Don’t forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other templates within the legal form category.

Form popularity

FAQ

The requisites for business expense deductibility include that the costs must be ordinary, necessary, and directly related to the business. Each expense should be documented properly, following the Wyoming Business Deductibility Checklist for accuracy. Maintain relevant records and receipts to support your claims, which can safeguard against any inquiries by tax authorities. Adhering to these principles can significantly improve your tax outcomes.