Wyoming Job Expense Record

Description

How to fill out Job Expense Record?

You could spend numerous hours online trying to locate the valid document template that meets the federal and state requirements you require.

US Legal Forms offers thousands of valid forms that can be evaluated by experts.

It is easy to download or print the Wyoming Job Expense Record from our service.

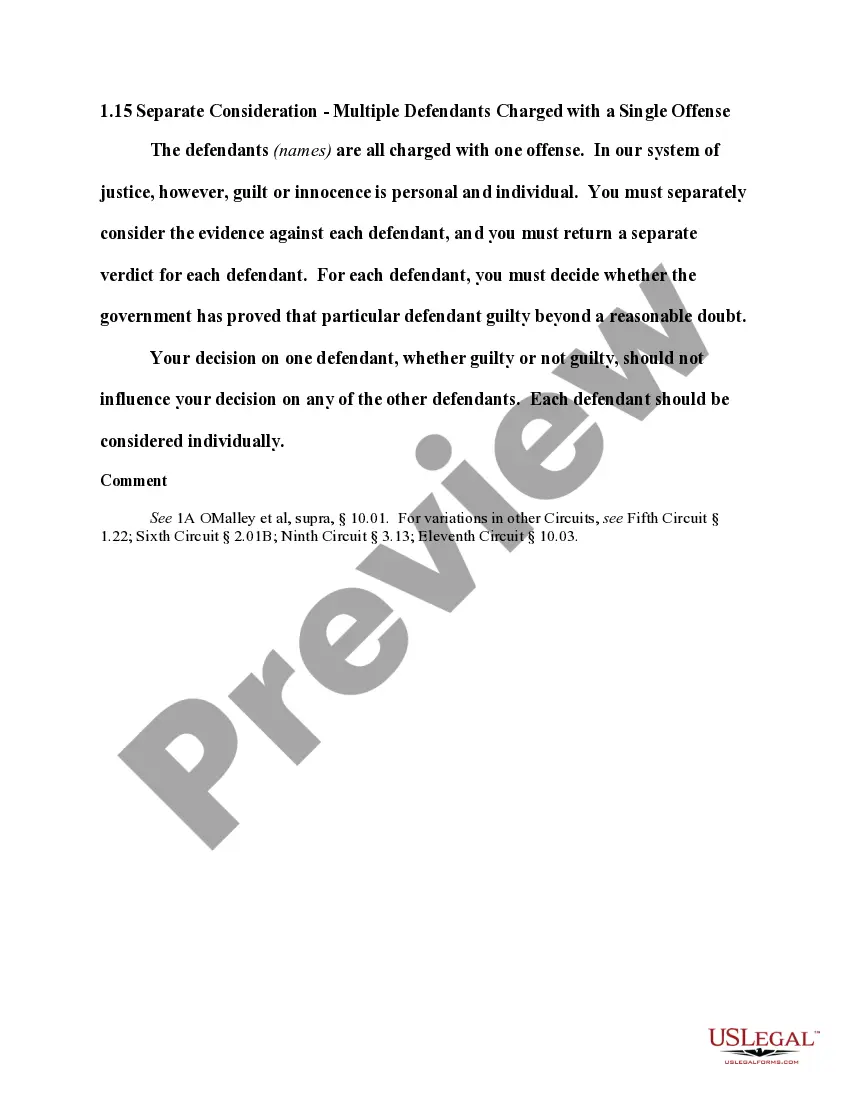

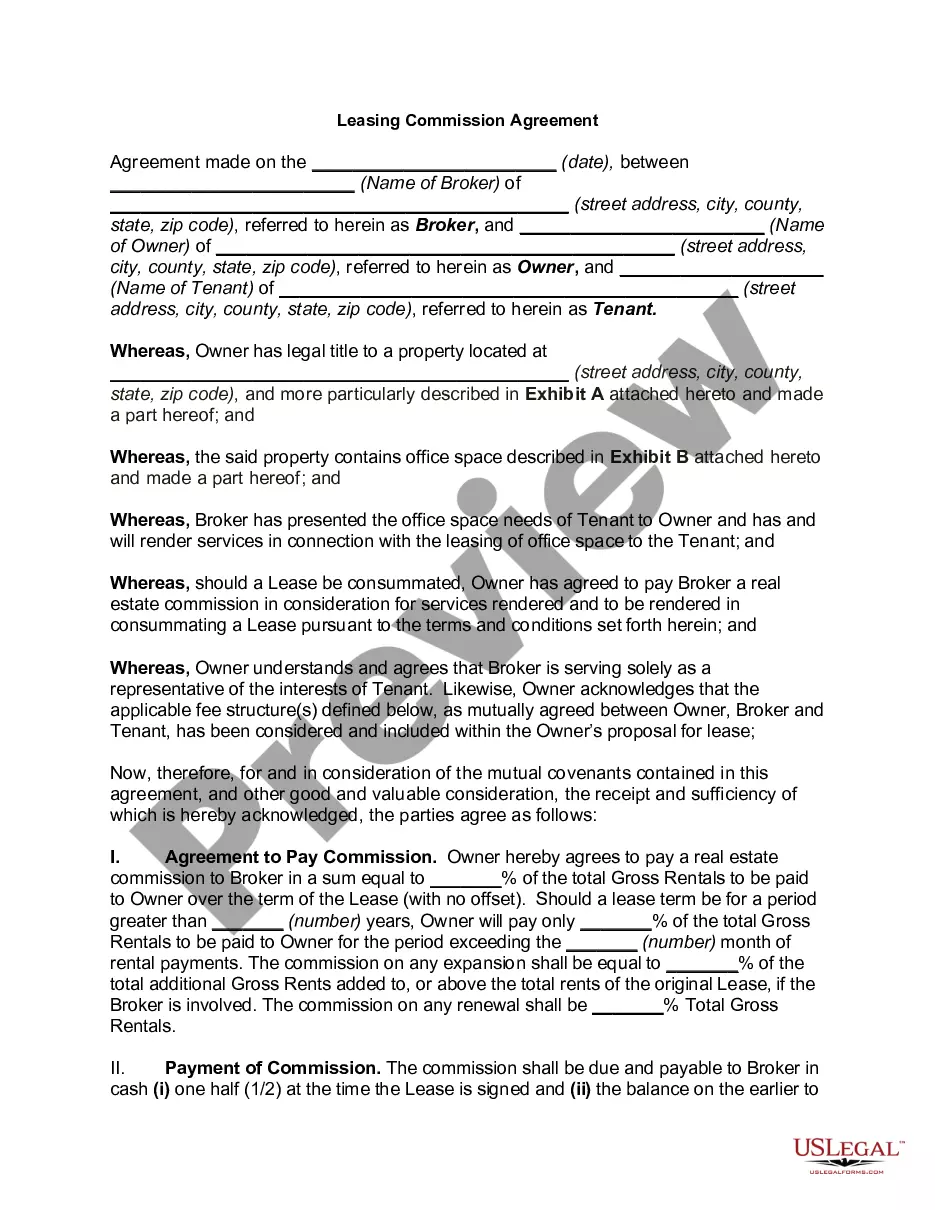

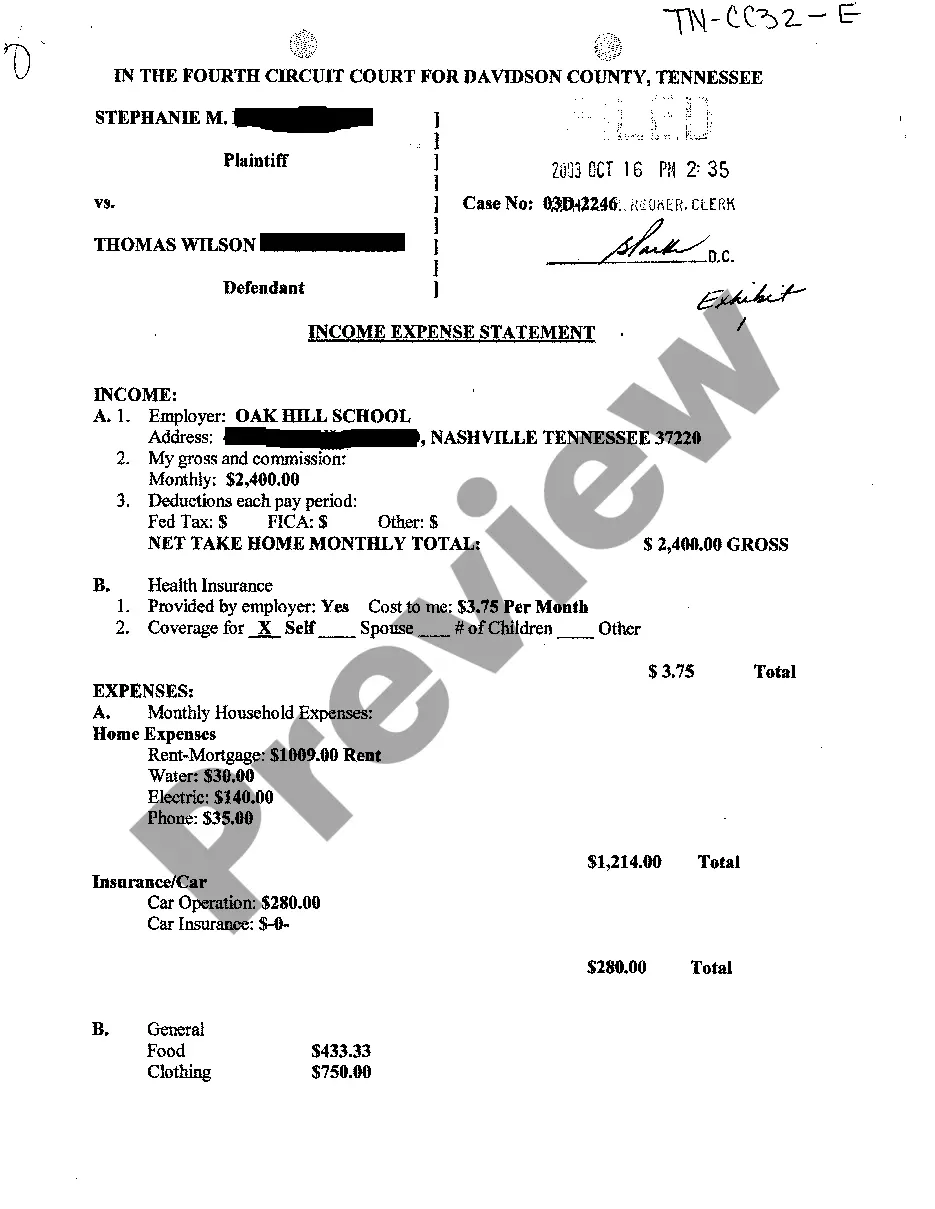

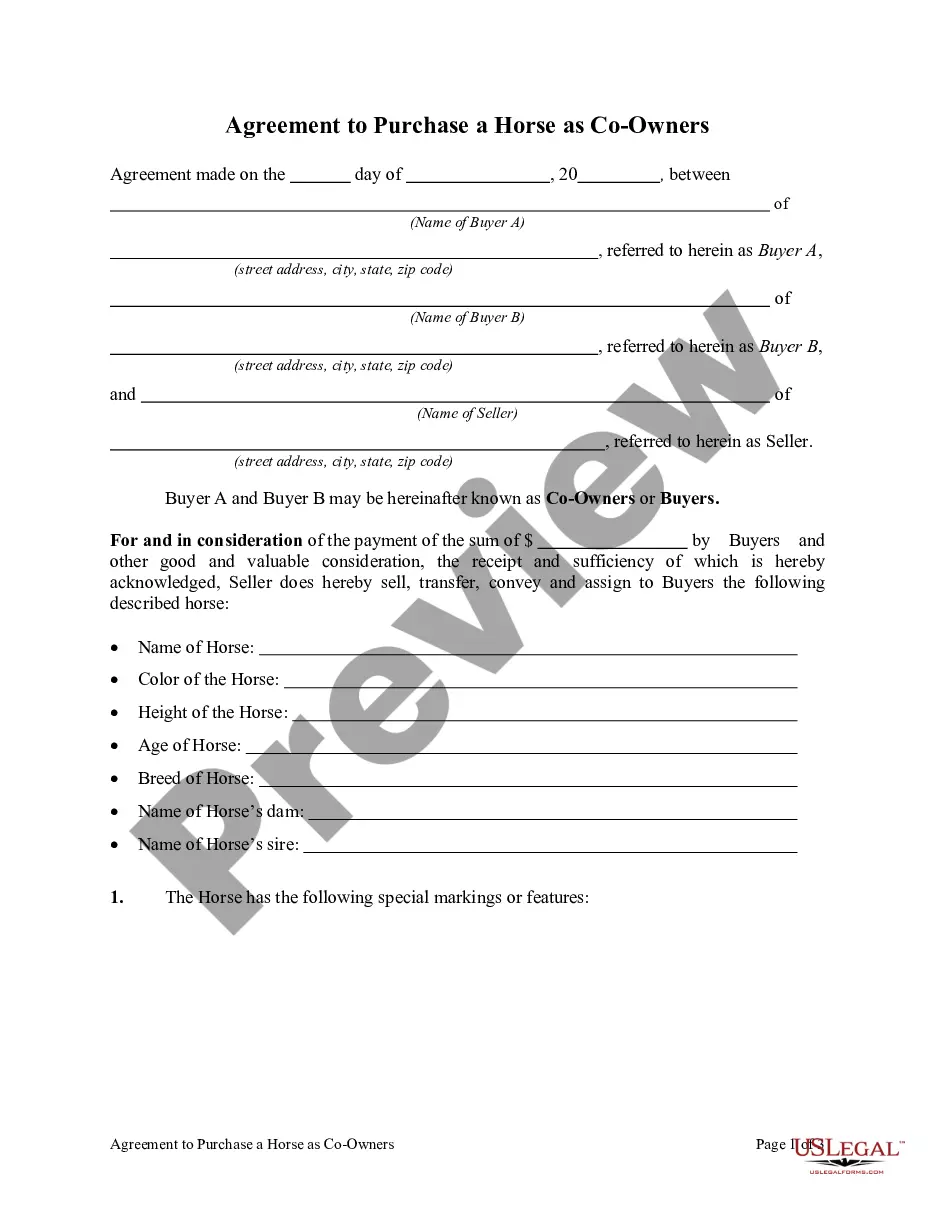

Check the form description to confirm you have chosen the right one. If available, use the Preview option to review the document template as well.

- If you possess a US Legal Forms account, you can sign in and click the Obtain button.

- Then, you can complete, modify, print, or sign the Wyoming Job Expense Record.

- Each valid document template you purchase belongs to you indefinitely.

- To obtain another copy of a purchased form, navigate to the My documents section and select the relevant option.

- If you are visiting the US Legal Forms website for the first time, follow the straightforward instructions provided below.

- First, ensure you have selected the correct document template for your specific county/town.

Form popularity

FAQ

You may be asked to produce a record of your work searches at any time. Each week you must contact at least two (2) different employers. To receive benefits, you are required to be actively registered for work. Contact your local workforce center during the first week of your claim.

If you are eligible to receive unemployment, your weekly benefit rate is 4% of your earnings in the highest paid quarter of the base period. The current maximum is $508 per week; the minimum weekly benefit amount is currently $36. Ordinarily, you may receive benefits for a maximum of 26 weeks.

You will not be paid benefits. for that week if your earnings equal or exceed your weekly benefit amount or if you work 35 or more hours that week. If you fail to report earnings or other compensations properly you could be disqualified from receiving benefits for 52 weeks.

A claimant must actively seek new job opportunities to remain eligible for UC. State law requires that a claimant must make at least two employer contacts per week.

If you are eligible to receive unemployment, your weekly benefit rate is 4% of your earnings in the highest paid quarter of the base period. The current maximum is $508 per week; the minimum weekly benefit amount is currently $36. Ordinarily, you may receive benefits for a maximum of 26 weeks.

You are allowed to earn up to 30% of your weekly benefit amount without any reduction. For earnings above 30% of your weekly benefit then your benefit is reduced dollar-for-dollar for every dollar above the 30%. Always report all work and all earnings on your weekly continued claim.

The weekly benefit amount is calculated by dividing the sum of the wages earned during the highest quarter of the base period by 26, rounded down to the next lower whole dollar. The result cannot exceed the utmost weekly benefit permitted by rule.

Wyoming stopped paying PUA benefits on June 19, 2021. Sources: Wyoming Unemployment Insurance Claims and U.S. Department of Labor.

We recommend that you complete at least 5 work-search activities each week. In instructed, register with a workforce center at or in person at your local workforce center if they are accepting in-person customers.