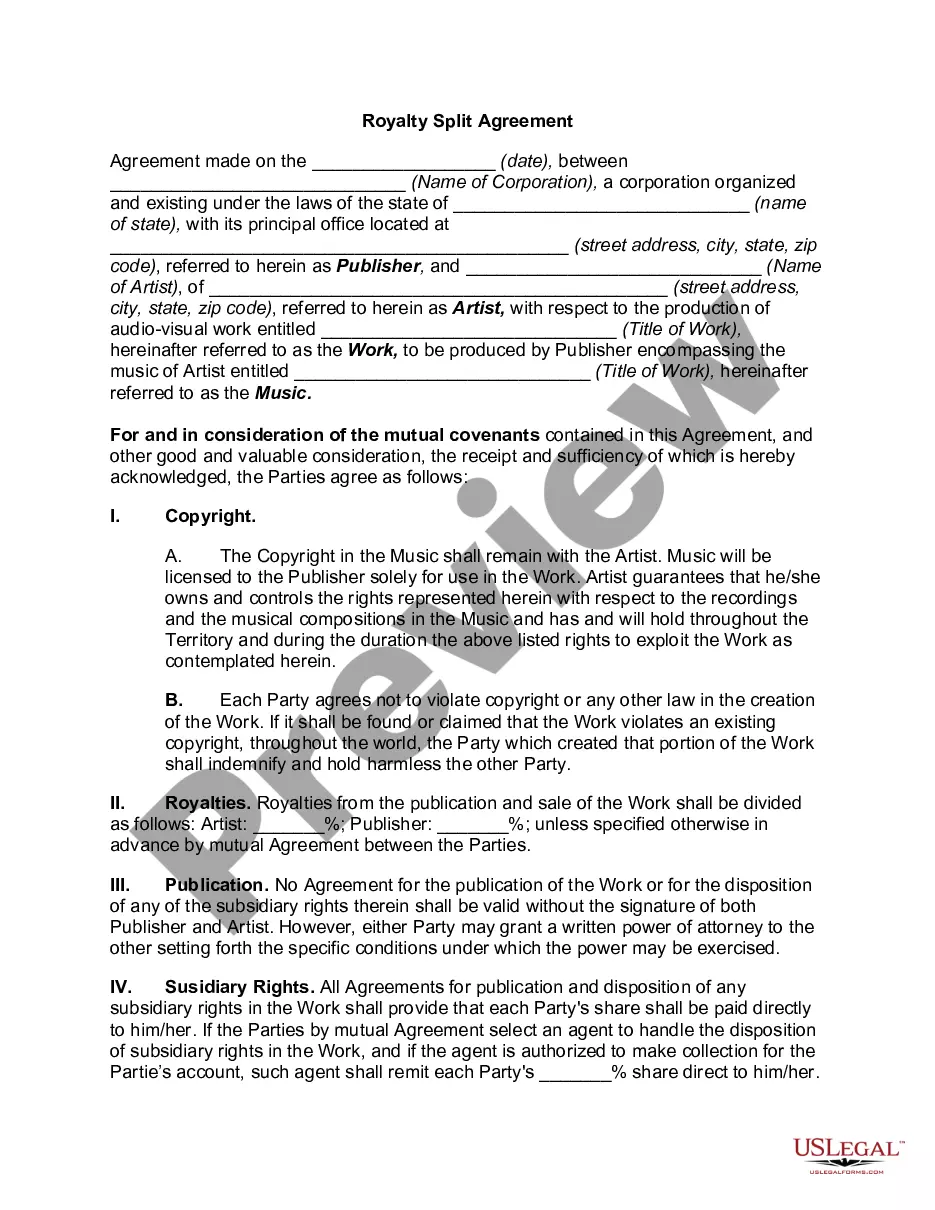

Wyoming Royalty Split Agreement

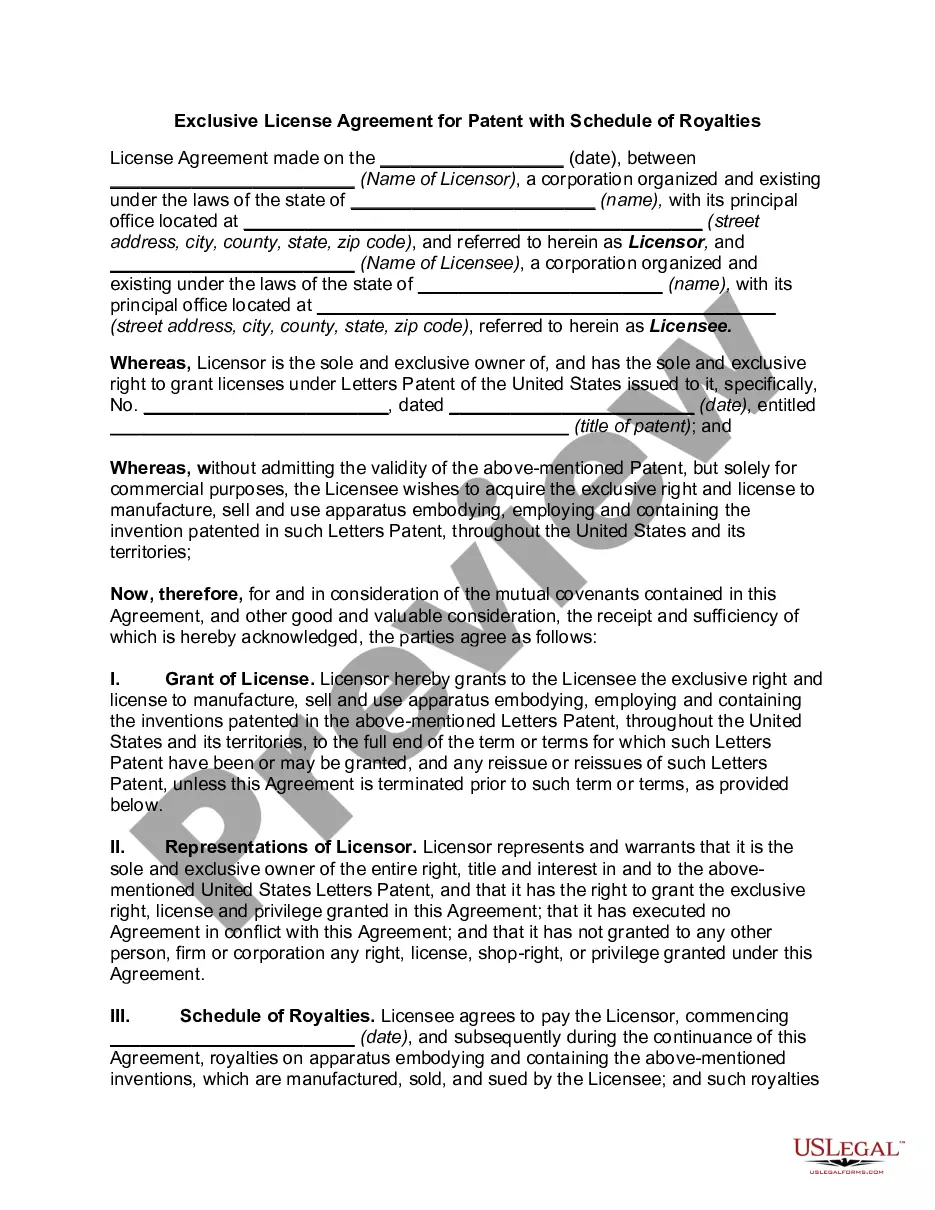

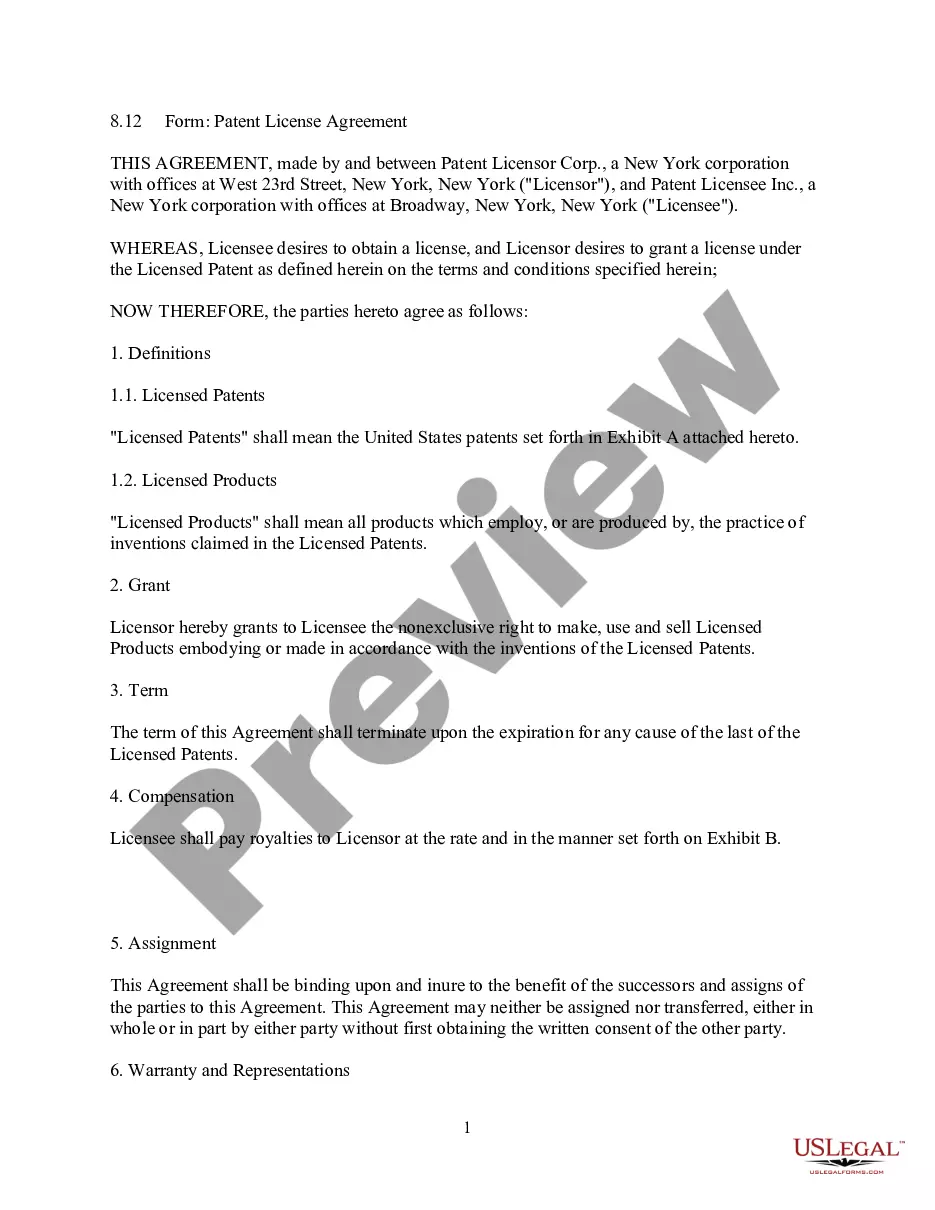

Description

How to fill out Royalty Split Agreement?

It is feasible to spend hours online searching for the legal document template that satisfies the state and federal requirements you need.

US Legal Forms provides a vast array of legal forms which can be assessed by professionals.

You are able to download or print the Wyoming Royalty Split Agreement from our platform.

If available, use the Review button to view the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- After that, you may complete, modify, print, or sign the Wyoming Royalty Split Agreement.

- Each legal document template you acquire is yours indefinitely.

- To obtain another copy of a purchased form, go to the My documents tab and click on the relevant button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions listed below.

- First, ensure you have selected the correct document template for your area/city of your choice.

- Check the form description to confirm you have picked the right form.

Form popularity

FAQ

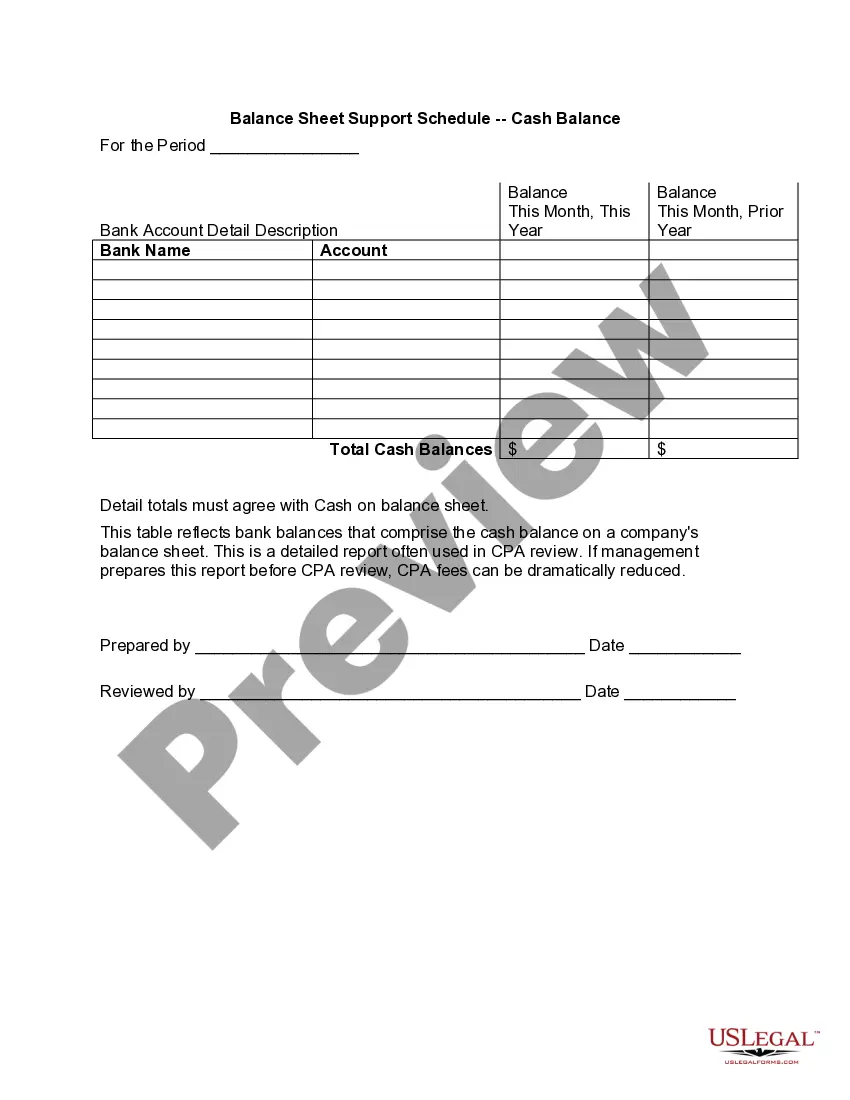

To calculate the number of net royalty acres I'm selling, I use this formula: acres in tract X % of minerals owned X 8 X royalty interest reserved in lease X fraction of royalty interest being sold. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.

Convert royalty from a fraction or percentage to a decimal value. Divide the decimal value by 0.125 (12.5% or 1/8th). Multiply the result by the number of net mineral acres.

February 12, 2019The Formula. Decimal Interest = (Net Mineral Acres ÷ Drilling Unit Acres) x Royalty Rate.Finding Your Net Mineral Acres. Your net mineral acreage is found in the Mineral Deeds or other property deed information.Finding the Drilling Unit Acres.Finding Your Royalty Rate.Where to Find More Information.

To calculate the NMA, you need the gross number of acres and the percentage of your mineral interest. To complete the calculation, simply multiply the gross acreage by your mineral interest. For example, if you owned 25% interest on the minerals under a 400-acre tract of land, you would have 100 NMA.

To calculate the number of net mineral acres owned by a mineral owner, we multiply the mineral owner's undivided interest in the tract by the number of acres in the tract. If I own a 1/4 mineral interest in Blackacre and Blackacre contains 640 acres, I own 1/4 X 640 = 160 net mineral acres.

Use a formula to calculate the royalties. Multiply the royalty percentage by the price of the book. Then multiply that amount by the number of books sold. For example: 6 percent royalty x $7.95 price = $0.48 x 10,000 sold = $4,800 royalties earned.

To estimate mineral rights value for producing properties, take the average of your last 3 months of royalty income. Once you have a monthly average, plug it into the mineral rights calculator below. You can expect to sell mineral rights for around 4 years to 6 years times the average monthly income you receive.

If you know the decimal interest in your mineral tract and you have the legal description, you can calculate the Net Acres owned.Here's an Example:Net Revenue Interest = Net Mineral Acres / Drilling Spacing Unit Acres Royalty Rate.So, our NRI = 17.78 / 1280 0.15 = 0.0020835.

Net revenue is the amount that is shared among the property owners. To determine net revenue interest, multiply the royalty interest by the owner's shared interest. For example, if you have a 5/16 royalty, your net royalty interest would be 25% multiplied by 5/16, which equals 7.8125% calculated to four decimal places.