Wyoming Agreement for Withdrawal of Partner from Active Management

Description

How to fill out Agreement For Withdrawal Of Partner From Active Management?

Locating the appropriate valid document template can be a challenge. Of course, there are numerous templates accessible online, but how do you find the legitimate form you require.

Utilize the US Legal Forms website. The service provides a vast array of templates, such as the Wyoming Agreement for Withdrawal of Partner from Active Management, that you can utilize for business and personal needs.

All of the documents are verified by experts and comply with state and federal regulations.

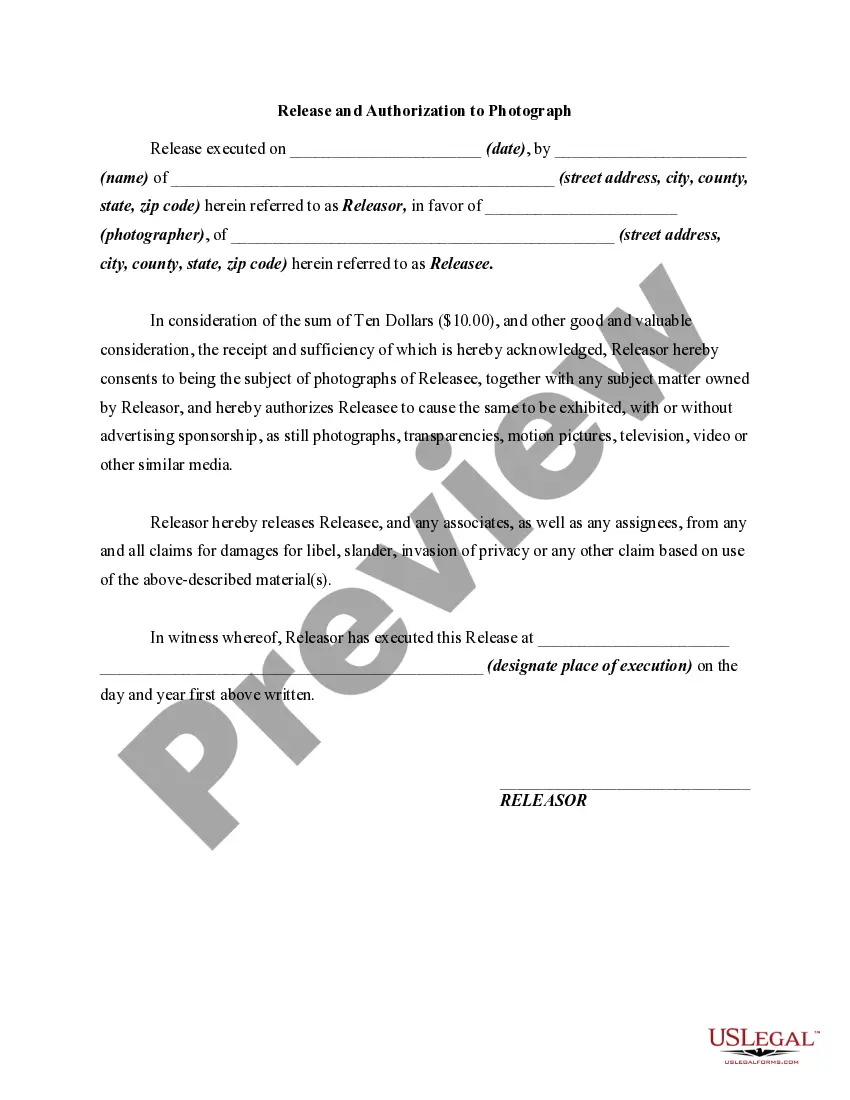

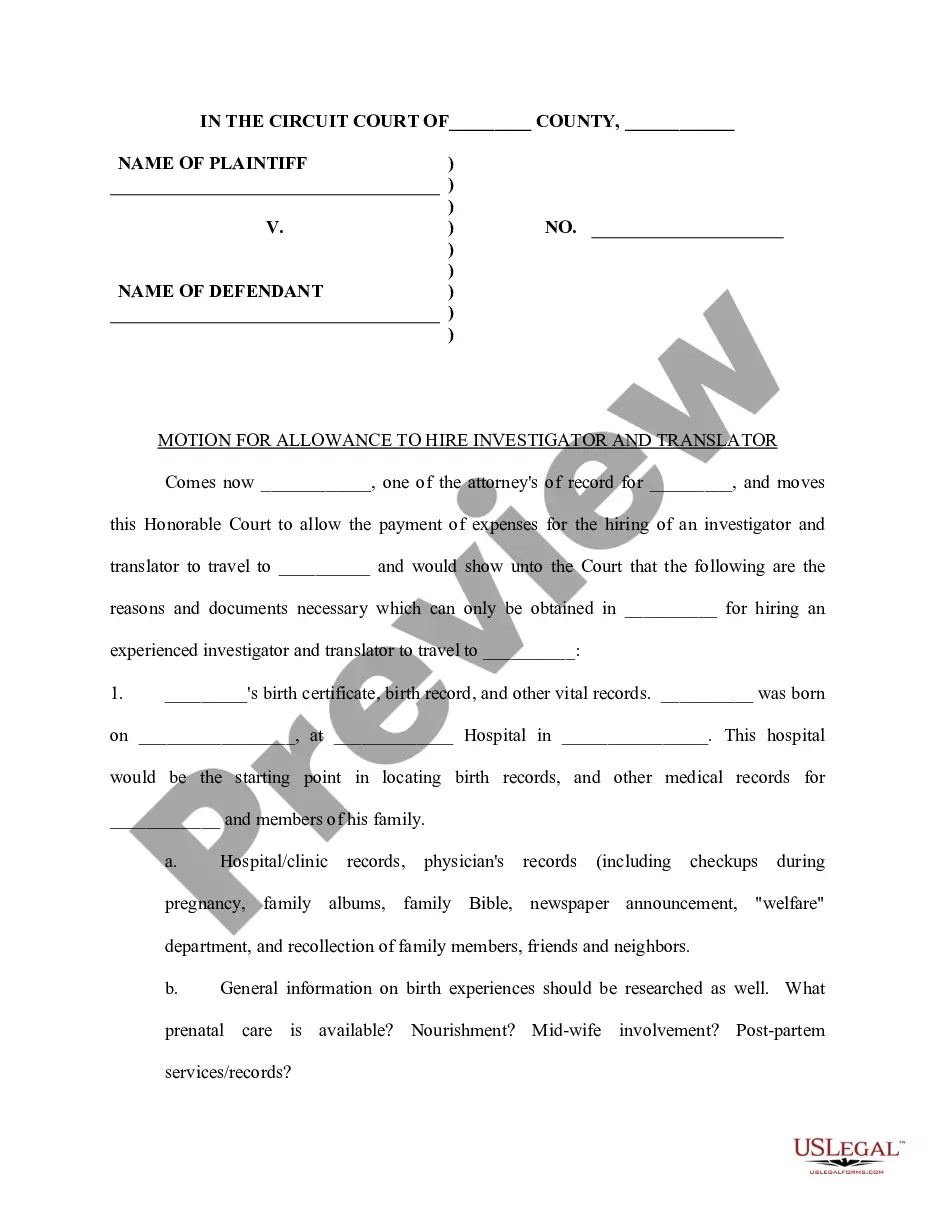

Once you are confident that the form is correct, select the Buy now button to acquire the form. Choose the payment plan you desire and enter the necessary information. Create your account and complete your purchase using your PayPal account or Visa or Mastercard. Select the document format and download the valid document template to your device. Finally, complete, modify, print, and sign the received Wyoming Agreement for Withdrawal of Partner from Active Management. US Legal Forms is the largest library of legal forms where you can access a multitude of document templates. Take advantage of the service to obtain professionally crafted papers that meet state regulations.

- If you are already registered, Log In to your account and click on the Download button to obtain the Wyoming Agreement for Withdrawal of Partner from Active Management.

- Use your account to search through the valid forms you have previously purchased.

- Visit the My documents tab of your account and retrieve another copy of the document you require.

- If you are a new customer of US Legal Forms, here are simple instructions for you to follow.

- First, ensure that you have selected the correct form for your city/region. You can review the form using the Review button and read the form description to make sure it is suitable for you.

- If the form does not meet your requirements, use the Search area to find the appropriate form.

Form popularity

FAQ

Yes, Wyoming does recognize domestic partnerships, which offer many legal rights similar to those of married couples. This recognition can affect how partnerships operate, particularly in relation to agreements like the Wyoming Agreement for Withdrawal of Partner from Active Management. Understanding the implications of this recognition can shape partnership agreements effectively.

The close limited liability company supplement is a specific form that allows close LLCs in Wyoming to opt for special rights and limitations under state law. This supplement can protect the interests of members while allowing for flexibility in management and operations. The Wyoming Agreement for Withdrawal of Partner from Active Management may intersect with these provisions if a partner decides to withdraw.

Yes, a partnership needs to file a federal tax return, specifically Form 1065. This return reports income, deductions, gains, and losses from the partnership's operations. Managing the intricate details, especially during a change in partnership, such as with the Wyoming Agreement for Withdrawal of Partner from Active Management, is crucial for accurate filings.

In Wyoming, partnerships do not file a separate state tax return due to the absence of a state income tax. However, partnerships must comply with federal tax regulations and file a federal partnership return. Ensuring compliance with all tax regulations is key, and the Wyoming Agreement for Withdrawal of Partner from Active Management can help clarify the responsibilities of each partner in such matters.

Yes, Wyoming does not impose a state income tax, which means individuals and businesses do not need to file a state tax return. However, it's important to note that certain federal obligations may still apply. Understanding how this impacts partnerships, particularly regarding the Wyoming Agreement for Withdrawal of Partner from Active Management, can simplify your tax planning.

In Wyoming, the statute of limitations for breach of fiduciary duty is generally four years. This means that if a partner feels their rights have been violated, they have four years to initiate legal action. Familiarizing yourself with the specifics of the Wyoming Agreement for Withdrawal of Partner from Active Management can provide clarity on your obligations and rights in such situations.

If a partner withdraws from a partnership, it usually affects profit distribution, management roles, and future obligations. A Wyoming Agreement for Withdrawal of Partner from Active Management ensures that both the withdrawing partner and the remaining partners have a clear understanding of their rights and responsibilities. This agreement can help mitigate disputes and promote a smooth transition for everyone involved.

When a general partner withdraws from a limited partnership, several things can happen, including a potential shift in management responsibilities and financial liabilities. It's crucial to have a Wyoming Agreement for Withdrawal of Partner from Active Management in place to clearly outline these changes and protect the interests of all partners. This document helps facilitate continuity and stability within the partnership.

To withdraw from a limited partnership, you should follow the steps detailed in the partnership agreement, which may require a written notice. Additionally, utilizing a Wyoming Agreement for Withdrawal of Partner from Active Management simplifies this process and defines the terms of your departure. This agreement ensures that all partners are informed and helps prevent misunderstandings as you exit the partnership.

Yes, a general partner can leave a limited partnership, but specific conditions usually apply. It's wise to refer to the partnership agreement to understand the necessary steps and implications of the withdrawal. Implementing a Wyoming Agreement for Withdrawal of Partner from Active Management helps ensure that all parties are aware of their rights and responsibilities, aiding in a smooth transition.