Wyoming Grantor Retained Annuity Trust

Description

How to fill out Grantor Retained Annuity Trust?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal template documents that you can download or print.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can obtain the latest versions of forms like the Wyoming Grantor Retained Annuity Trust in no time.

If you have an account, Log In and download the Wyoming Grantor Retained Annuity Trust from the US Legal Forms library. The Download button will appear on each template you view. You can access all previously saved documents in the My documents tab of your account.

If you are satisfied with the document, confirm your choice by clicking the Purchase now button. Then, select the payment plan you prefer and provide your details to register for an account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase. Choose the format and download the document to your device. Make modifications. Fill out, edit, print, and sign the saved Wyoming Grantor Retained Annuity Trust. Every template you add to your account has no expiration date and is yours forever. So, if you wish to download or print another copy, simply go to the My documents section and click on the document you require. Access the Wyoming Grantor Retained Annuity Trust with US Legal Forms, the most comprehensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are straightforward instructions to help you get started.

- Ensure you have chosen the correct document for your city/state.

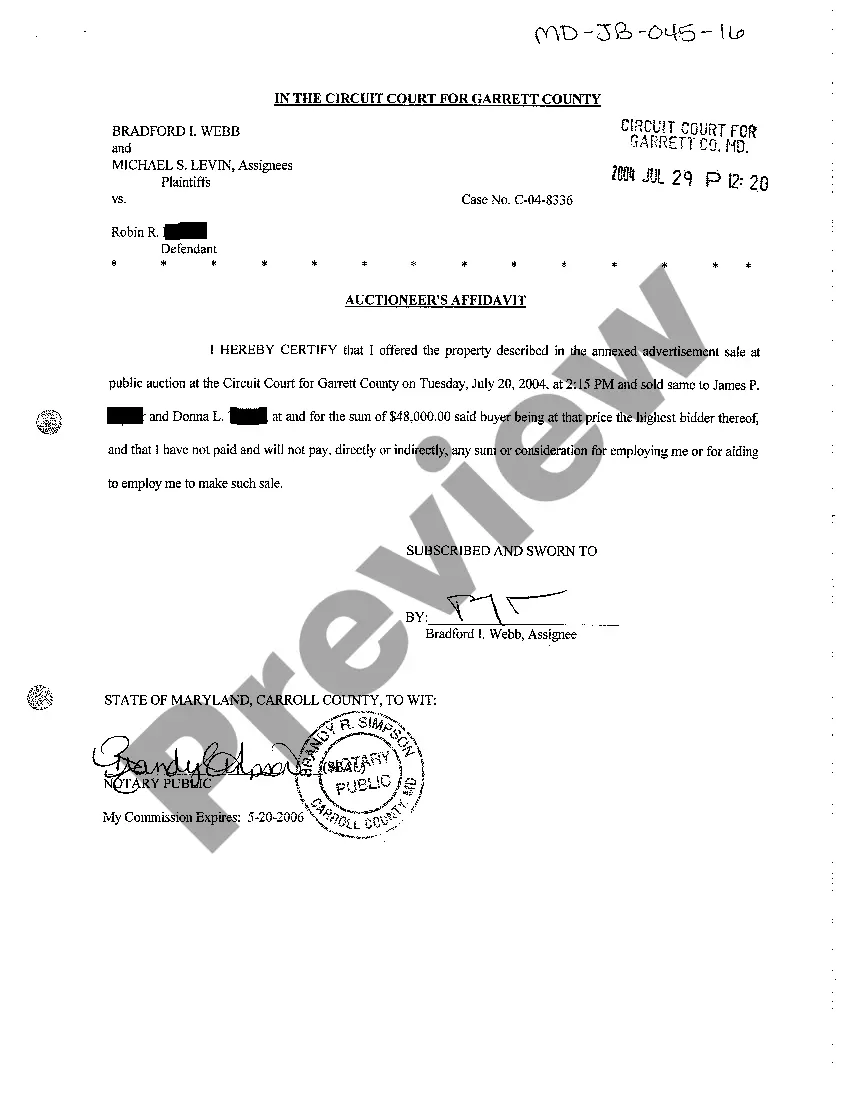

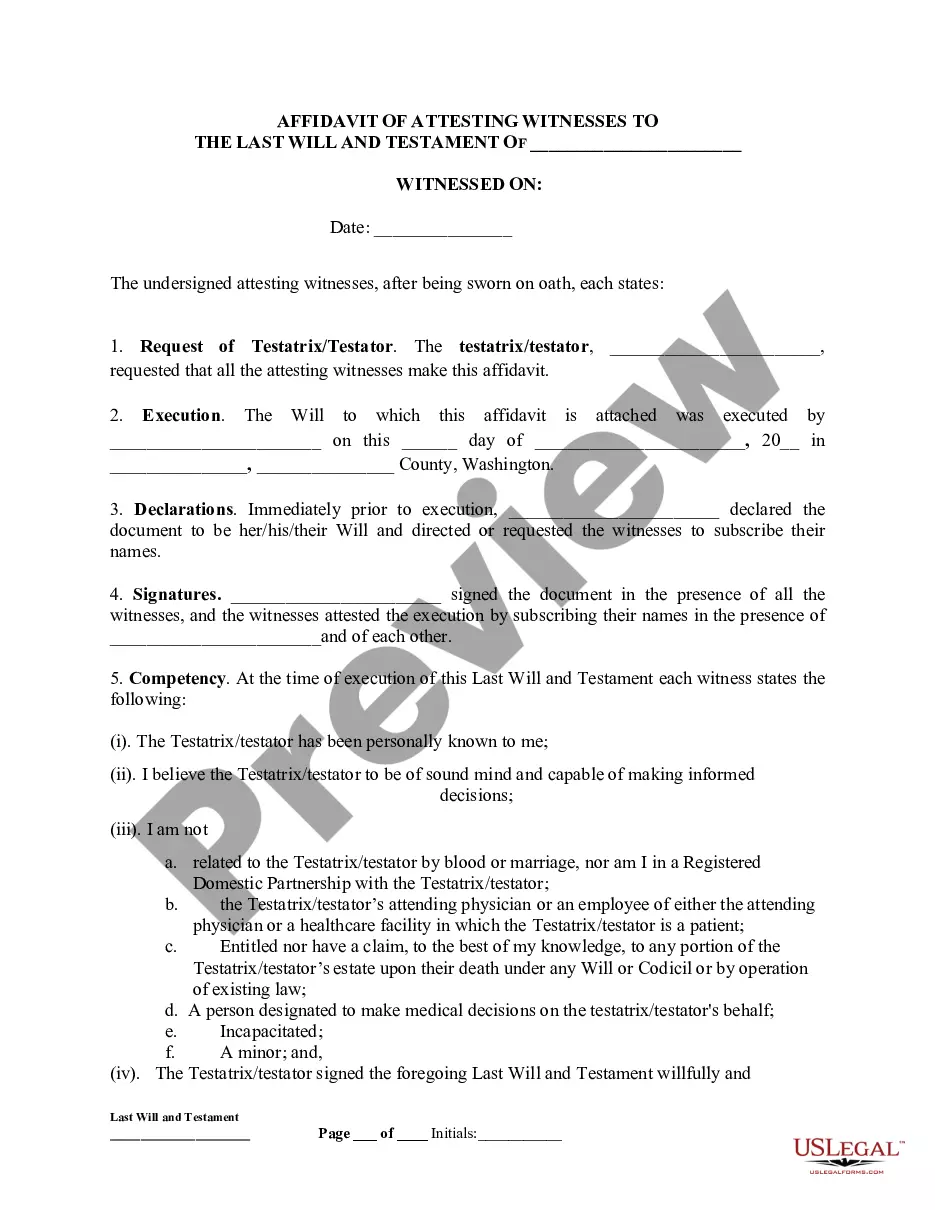

- Select the Preview button to review the document's details.

- Check the document description to confirm you have selected the appropriate form.

- If the document does not meet your requirements, use the Search bar at the top of the screen to find one that does.

Form popularity

FAQ

Tax Implications of the GRAT During the term of the GRAT, the Donor will be taxed on all of the income and capital gains earned by the trust, without regard to the amount of the annuity paid to the Donor.

In a GRAT, you receive a fixed amount from year to year (an annuity). In a GRUT, by contrast, you receive an amount equal to a fixed percentage of the trust assets (a unitrust).

GRATs are taxed in two ways: Any income you earn from the appreciation of your assets in the trust is subject to regular income tax, and any remaining funds/assets that transfer to a beneficiary are subject to gift taxes.

Pros. There are a number of benefits to setting up a GRAT. For one, the annuities can provide a steady stream of income for those who may need it in retirement. However, the main benefit of establishing a GRAT is the potential to transfer large amounts of money to a beneficiary while paying little-to-no gift tax.

In other words, during the initial term of the GRAT (the term that the Grantor is to receive the annuity payments) the Grantor will be taxed on all of the income earned by the GRAT during each such year, including capital gains.

GRATs are irrevocable trusts that last for a specific period of time of at least two years. The term you choose depends on your goals and expectations for asset growth potential, but we typically recommend a term between two and five years.

Grantor retained annuity trusts (GRAT) are estate planning instruments in which a grantor locks assets in a trust from which they earn annual income. Upon expiry, the beneficiary receives the assets with minimal or no gift tax liability. GRATS are used by wealthy individuals to minimize tax liabilities.

The annuity amount is paid to the grantor during the term of the GRAT, and any property remaining in the trust at the end of the GRAT term passes to the beneficiaries with no further gift tax consequences.

Tax Implications of the GRAT During the term of the GRAT, the Donor will be taxed on all of the income and capital gains earned by the trust, without regard to the amount of the annuity paid to the Donor.

A GRAT may be an ideal vehicle for the transfer of significant appreciation on an asset. Assume the client owns an interest in a business that may go public in the near future. If the client transfers the business interest to a short-term zeroed-out GRAT, most of the appreciation will be transferred tax free.