Wyoming Balance Sheet Notes Payable

Description

How to fill out Balance Sheet Notes Payable?

If you desire to finalize, acquire, or generate authentic document templates, utilize US Legal Forms, the premier collection of legal forms, which can be accessed online.

Utilize the site's straightforward and user-friendly search feature to locate the documents you require.

Various templates for corporate and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to find the Wyoming Balance Sheet Notes Payable within a few clicks.

Every legal document template you purchase is yours forever. You will have access to every form you acquired in your account. Visit the My documents section and select a form to print or download again.

Compete and obtain, then print the Wyoming Balance Sheet Notes Payable with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms customer, sign in to your account and click the Download button to obtain the Wyoming Balance Sheet Notes Payable.

- You can also access forms you previously acquired in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

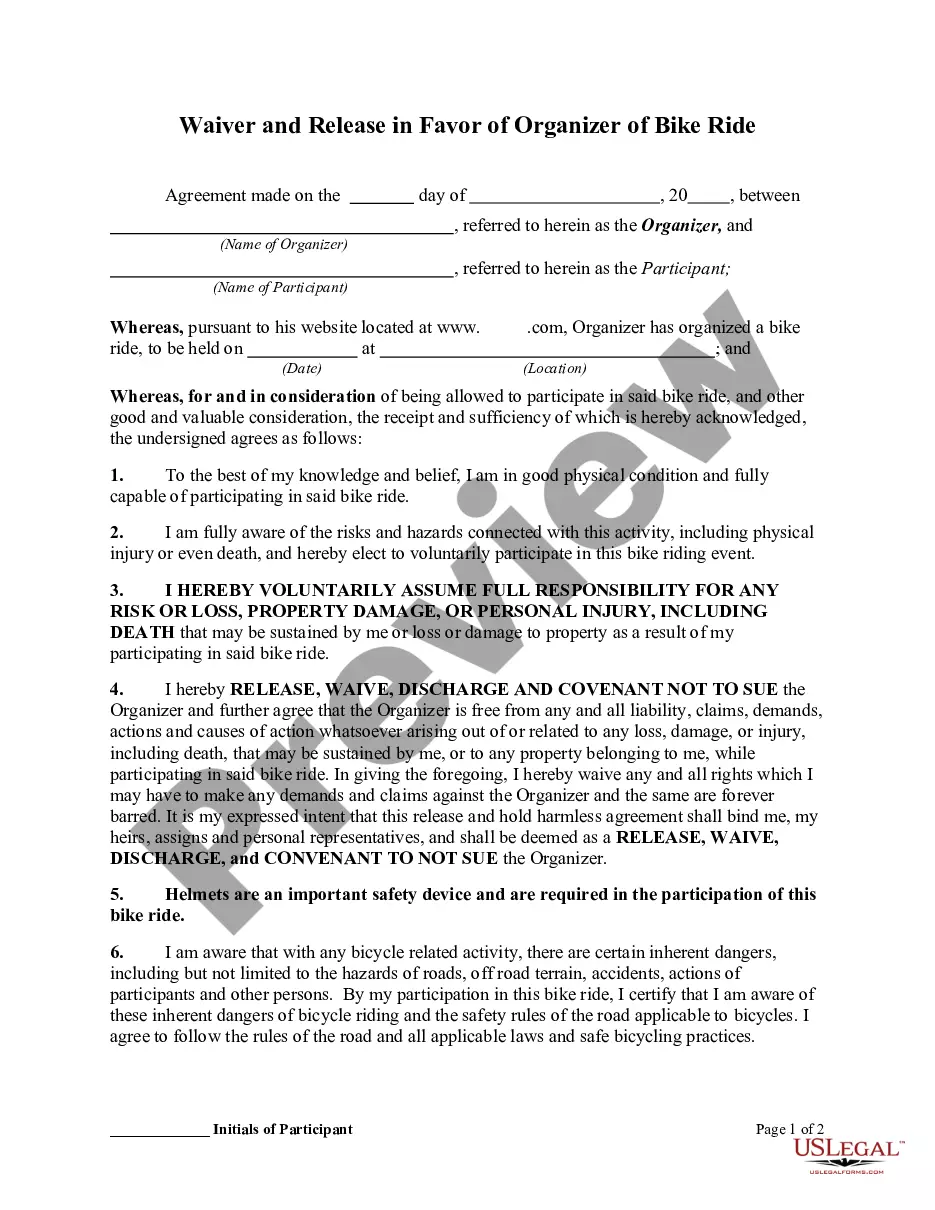

- Step 2. Use the Preview option to review the form's content. Don't forget to read the details.

- Step 3. If you are unsatisfied with the form, utilize the Search field at the top of the screen to find other forms in the legal document template.

- Step 4. Once you have found the form you need, click the Buy Now button. Choose your preferred pricing plan and enter your details to register for an account.

- Step 5. Process the transaction. You may use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Wyoming Balance Sheet Notes Payable.

Form popularity

FAQ

Notes payable should be listed under the liabilities section of your balance sheet. Typically, they appear alongside short-term and long-term debts, categorized by repayment period. This visibility is important for understanding your overall obligations, particularly in the context of your Wyoming Balance Sheet Notes Payable. Uslegalforms can help guide you in presenting these entries clearly and accurately.

The balance sheet provides a snapshot of the business' financial standing at a specific point in time. For example, an accounting period is typically 12 months long. The line items or accounts on the balance sheet would reflect the number of assets and liabilities at the final moment of the accounting period.

Notes payable to officers, shareholders or owners represent cash which the shareholders or owners have put into the business. For tax reasons, owners may increase their equity investment, beyond the initial company capitalization, by making loans to the business rather than by purchasing additional stock.

Examples of current liabilities include accounts payable, short-term debt, dividends, and notes payable as well as income taxes owed.

As an overview of the company's financial position, the balance sheet consists of three major sections: (1) the assets, which are probable future economic benefits owned or controlled by the entity; (2) the liabilities, which are probable future sacrifices of economic benefits; and (3) the owners' equity, calculated as

Notes to the financial statements disclose the detailed assumptions made by accountants when preparing a company's: income statement, balance sheet, statement of changes of financial position or statement of retained earnings. The notes are essential to fully understanding these documents.

How to make a balance sheetStep 1: Pick the balance sheet date.Step 2: List all of your assets.Step 3: Add up all of your assets.Step 4: Determine current liabilities.Step 5: Calculate long-term liabilities.Step 6: Add up liabilities.Step 7: Calculate owner's equity.Step 8: Add up liabilities and owners' equity.

Notes to accounts generally represent the issue of shares, buyback programs, convertible shares, arrears, etc.

The first note to the financial statements is usually a summary of the company's significant accounting policies for the use of estimates, revenue recognition, inventories, property and equipment, goodwill and other intangible assets, fair value measurement, discontinued operations, foreign currency translation,

A balance sheet is a financial statement that contains details of a company's assets or liabilities at a specific point in time. It is one of the three core financial statements (income statement and cash flow statement being the other two) used for evaluating the performance of a business.