Wyoming Daily Accounts Receivable

Description

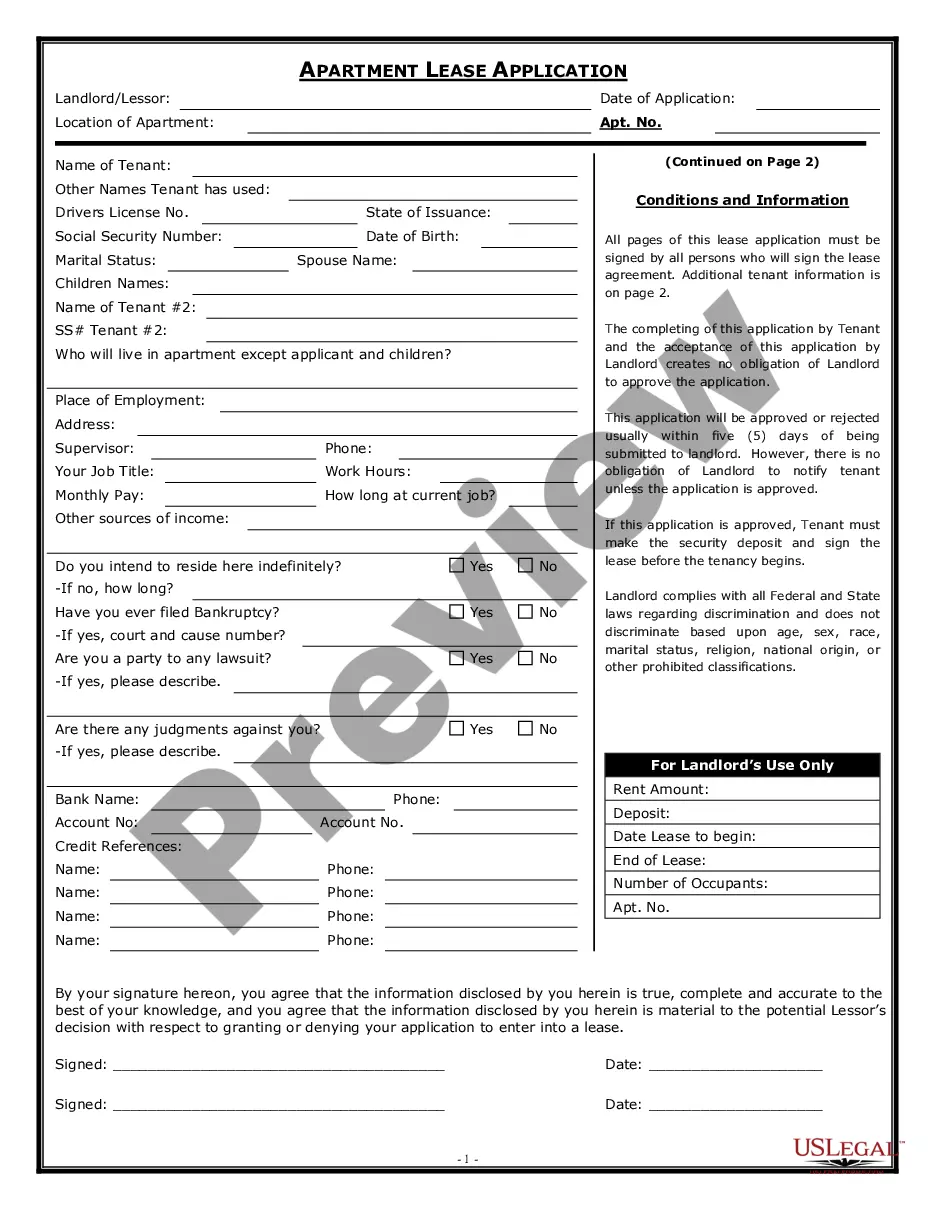

How to fill out Daily Accounts Receivable?

It is feasible to dedicate several hours online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal forms that can be reviewed by specialists.

You can easily acquire or print the Wyoming Daily Accounts Receivable from your services.

If available, use the Review button to browse the document template as well. If you want to find an additional version of your form, use the Search field to locate the template that meets your needs and requirements.

- If you already have a US Legal Forms account, you may Log In and then click the Obtain button.

- Following that, you can complete, modify, print, or sign the Wyoming Daily Accounts Receivable.

- Each legal document template you purchase is permanently yours.

- To obtain an additional copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document template for the state/city of your choice.

- Review the form outline to verify you have chosen the correct form.

Form popularity

FAQ

To write off accounts receivable, first confirm that collecting the debt is unlikely. Then, create a journal entry that debits the bad debt expense account and credits the accounts receivable account. This process removes the uncollectible amount from your books, which is vital for maintaining clean financial records, especially for those managing Wyoming Daily Accounts Receivable.

First, calculate the practice's average daily charges:Add all of the charges posted for a given period (e.g., 3 months, 6 months, 12 months).Subtract all credits received from the total number of charges.More items...

To calculate average daily balance, take the sum of all these ending balances and divide by the number of days in your period.

To calculate a day's finance charge, multiply your customer's balance that day by the daily rate. For example, a customer with a balance of $1,500 would incur a charge of about 49 cents a day.

The daily balance method of calculating your finance charge uses the actual balance on each day of your billing cycle instead of an average of your balance throughout the billing cycle. Finance charges are calculated by summing each day's balance multiplied by the daily rate, which is 1/365th of your APR.

Accounts receivable days is the number of days that a customer invoice is outstanding before it is collected.

To calculate days in AR,Compute the average daily charges for the past several months add up the charges posted for the last six months and divide by the total number of days in those months.Divide the total accounts receivable by the average daily charges. The result is the Days in Accounts Receivable.

For example, a distributor may buy a washing machine from a manufacturer, which creates an account payable to the manufacturer. The distributor then sells the washing machine to a customer on credit, which results in an account receivable from the customer.

Definition: Accounts Receivable (AR) is the proceeds or payment which the company will receive from its customers who have purchased its goods & services on credit. Usually the credit period is short ranging from few days to months or in some cases maybe a year.

An example of accounts receivable includes an electric company that bills its clients after the clients received the electricity. The electric company records an account receivable for unpaid invoices as it waits for its customers to pay their bills.