Wyoming Installment Promissory Note and Security Agreement

Description

How to fill out Installment Promissory Note And Security Agreement?

You may spend numerous hours online attempting to locate the authentic document template that satisfies the state and federal requirements you need.

US Legal Forms offers a vast array of authentic forms that have been vetted by experts.

You can obtain or print the Wyoming Installment Promissory Note and Security Agreement from our service.

To find an additional version of the form, utilize the Search field to discover the template that meets your requirements and specifications.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Subsequently, you can complete, modify, print, or sign the Wyoming Installment Promissory Note and Security Agreement.

- Every authentic document template you receive is yours permanently.

- To obtain another copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document template for the state/region of your preference.

- Check the form description to confirm you have chosen the proper form.

Form popularity

FAQ

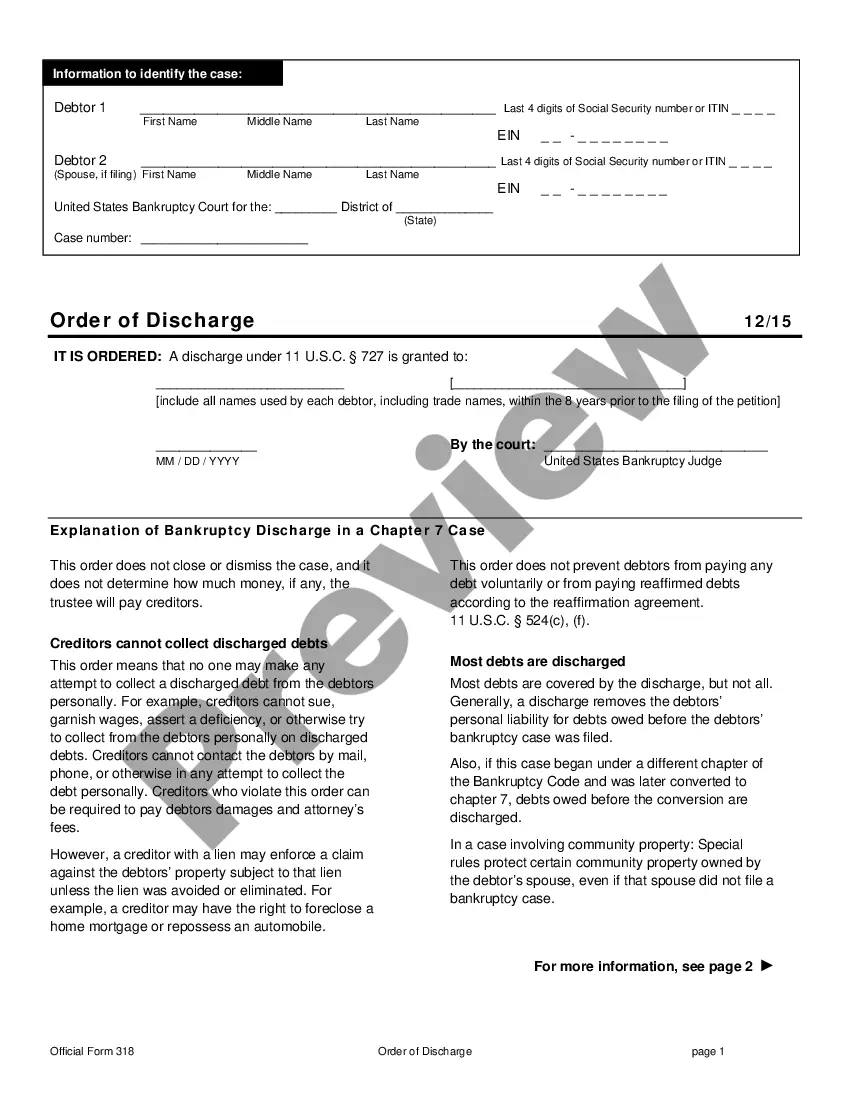

General Definition. Promissory notes are defined as securities under the Securities Act. However, notes that have a maturity of nine months or less are not considered securities.

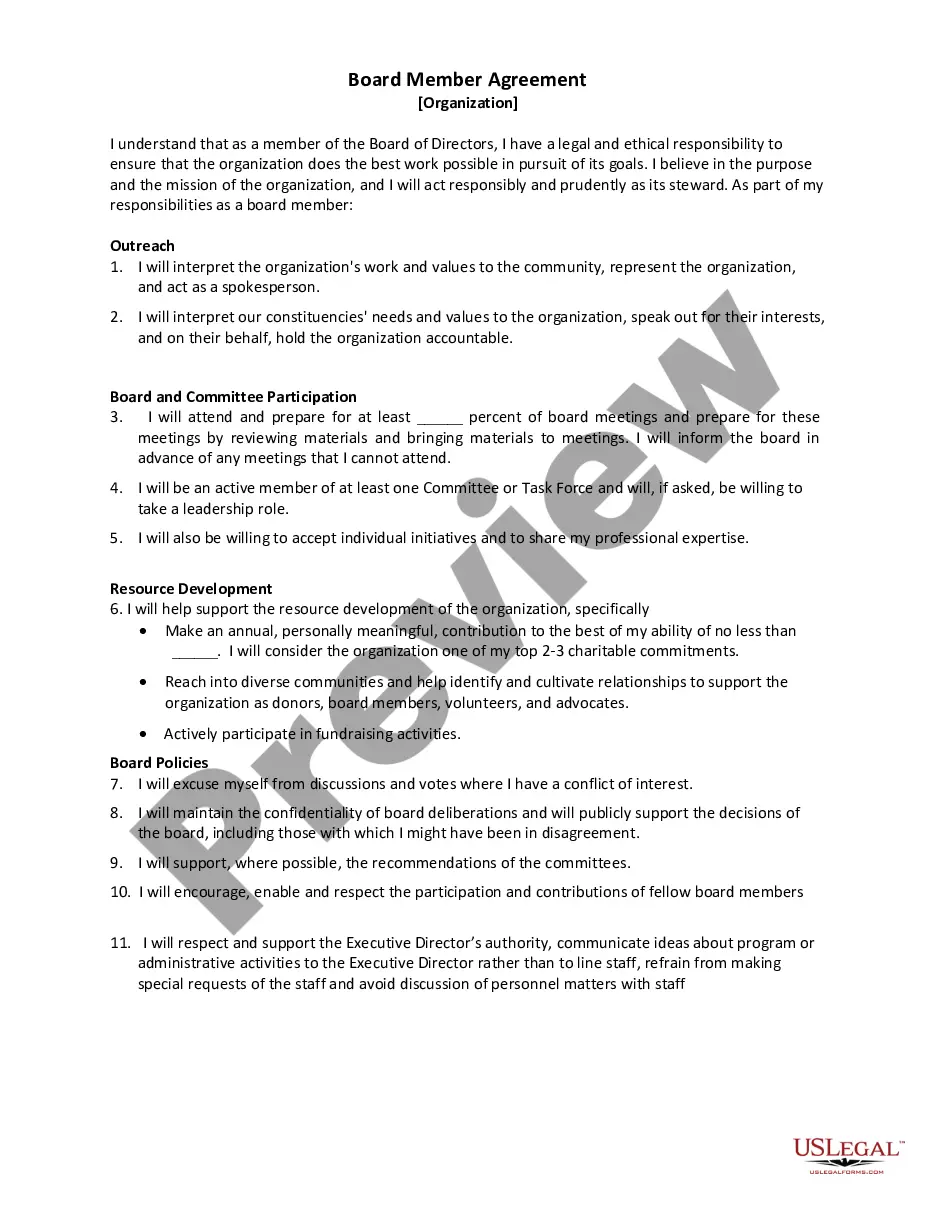

A promissory note is a written agreement to pay someone essentially an IOU. But it's not something to be taken lightly. "It is a legally binding written document effectuating a promise to repay money," says Andrea Wheeler, a business attorney and owner of Wheeler Legal PLLC of Florida.

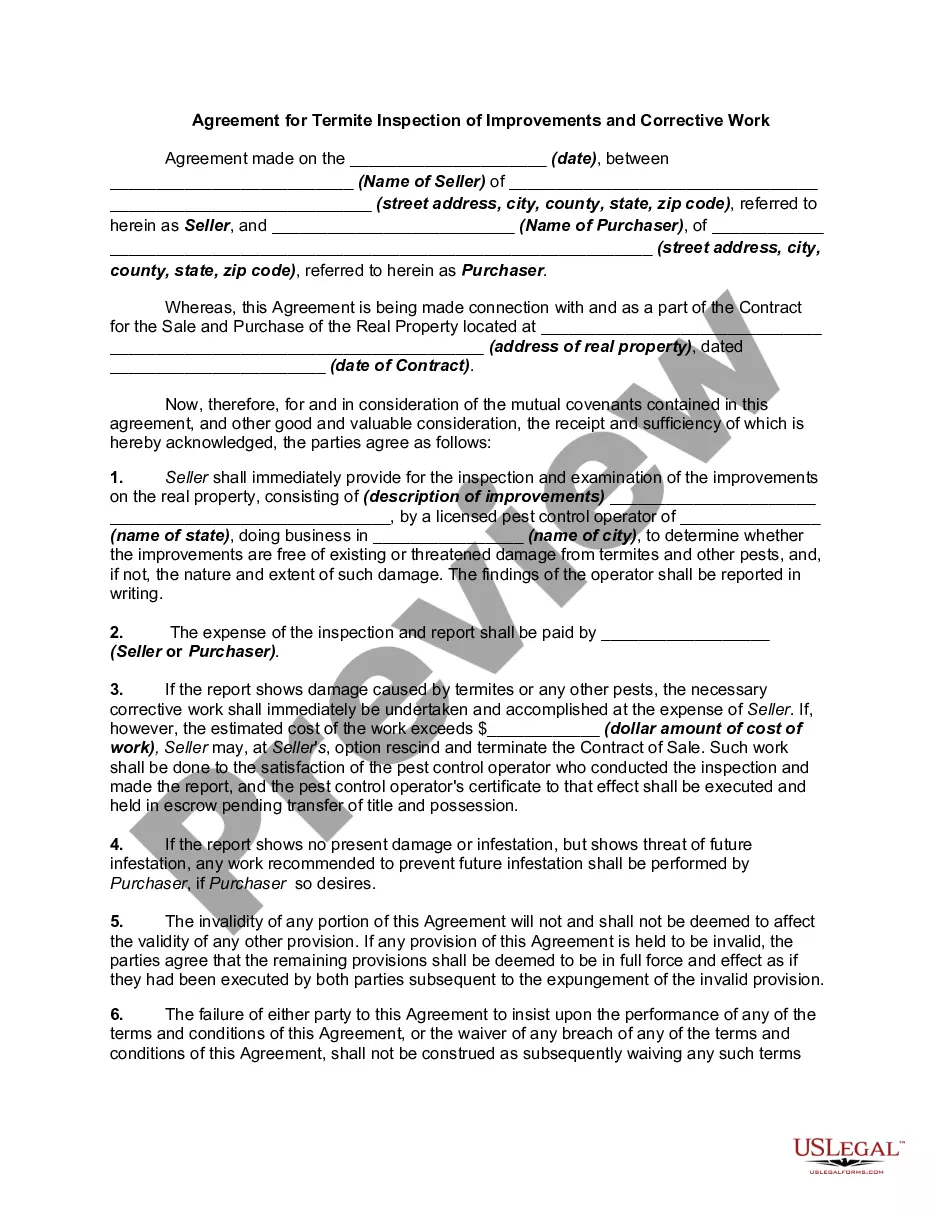

A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust. If the collateral is personal property, there will be a security agreement.

If the issuer of the note sells a note as an investment to persons who resemble investors, in an offering that resembles a securities offering, then the note is a security.

Secured Promissory Notes A secured promissory note is an obligation to pay that is secured by some type of property. This means that if the payor fails to pay, the payee can seize the designated property to obtain reimbursement of the loan.

Enforcing a secured promissory note is simply a matter of either repossessing the secured asset through your own efforts, or hiring a professional agency to accomplish the task on your behalf. These agencies will charge a set fee for their services, but they usually have a very high rate of success.

Executing a note involves signing, dating and having your signature witnessed.Create the promissory note.Create date and signature lines for yourself and a witness.Sign the form in front of a witness.Give the note to the lending party.

A secured promissory note may include a security agreement as part of its terms. If a security agreement lists a business property as collateral, the lender might file a UCC-1 statement to serve as a lien on the property. A security agreement mitigates the default risk faced by the lender.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.