This is a Promissory Note for use in any state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Wyoming Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Unsecured Installment Payment Promissory Note For Fixed Rate?

If you require to extensive, download, or print valid document templates, utilize US Legal Forms, the largest collection of legal forms, available online.

Employ the site’s straightforward and convenient search to find the documents you need. Various templates for business and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to locate the Wyoming Unsecured Installment Payment Promissory Note for Fixed Rate in just a few clicks.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

Step 6. Choose the format of the legal form and download it onto your device. Step 7. Complete, modify, and print or sign the Wyoming Unsecured Installment Payment Promissory Note for Fixed Rate. Every legal document template you purchase is yours permanently. You have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again. Be proactive and download, and print the Wyoming Unsecured Installment Payment Promissory Note for Fixed Rate with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Wyoming Unsecured Installment Payment Promissory Note for Fixed Rate.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

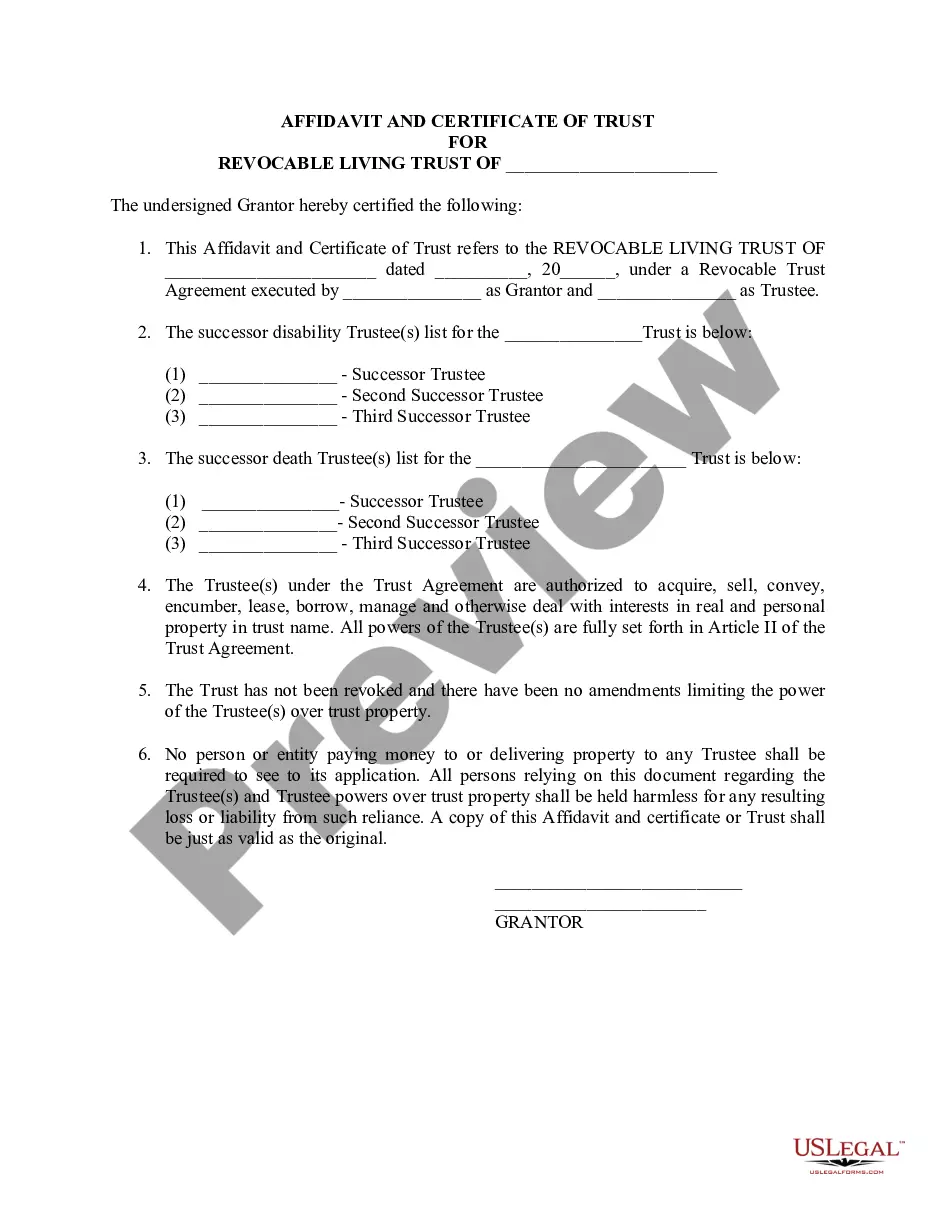

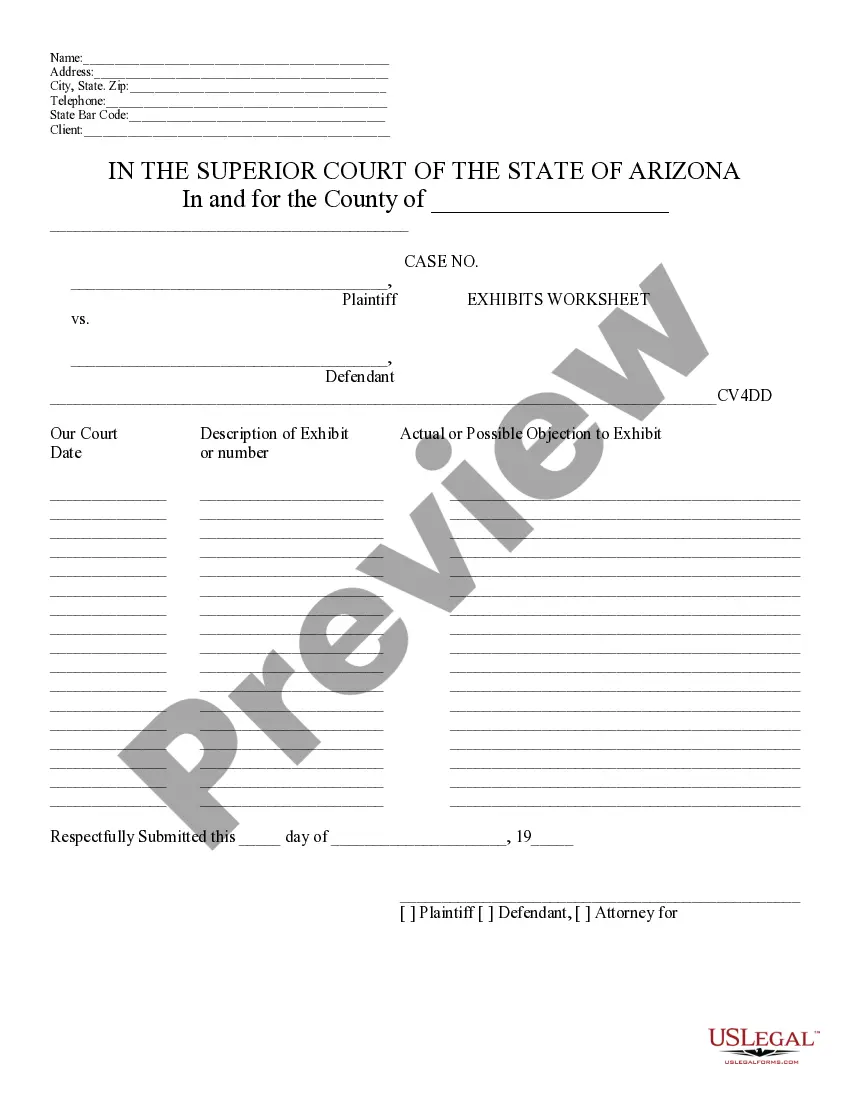

- Step 2. Use the Preview option to review the form’s details. Do not forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, select the Get now button. Choose the pricing plan you prefer and enter your information to register for an account.

Form popularity

FAQ

Promissory notes can be either secured or unsecured. A secured promissory note is backed by collateral, while an unsecured promissory note, such as the Wyoming Unsecured Installment Payment Promissory Note for Fixed Rate, does not require collateral. This means that the lender relies solely on the borrower's promise to repay. If you prefer a straightforward borrowing option without collateral, an unsecured note might be the right choice for you.

Writing a promissory note example requires including a few key elements: the date, parties' names, the principal amount, interest rate, payment schedule, and signatures. You can refer to templates like the Wyoming Unsecured Installment Payment Promissory Note for Fixed Rate for a comprehensive example. These templates help illustrate how to effectively structure your document for clarity and legality.

In general, a promissory note does not need to be notarized to be considered legal and enforceable. However, having it notarized can provide an additional layer of protection and verification. For those utilizing the Wyoming Unsecured Installment Payment Promissory Note for Fixed Rate, notarization may enhance the document's credibility, especially in disputes.

Enforcing a Wyoming Unsecured Installment Payment Promissory Note for Fixed Rate involves a clear understanding of legal rights. You can begin by documenting the default and sending a formal demand for payment. If the borrower still does not comply, you may need to file a lawsuit to recover the owed amount. Utilizing platforms like uslegalforms can guide you through the enforcement process effectively.

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.

The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

You can create a Promissory Note as a lender or borrower by following these steps:Select the location. Our Promissory Note template will customize your document specifically for the laws of your location.Provide party details.Establish the terms of the loan.Include final details.Sign the document.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.