Wyoming Surety Agreement

Description

How to fill out Surety Agreement?

Are you currently in a situation where you require documentation for either professional or personal purposes on a daily basis.

There are numerous legal document templates available online, yet finding trustworthy versions can be challenging.

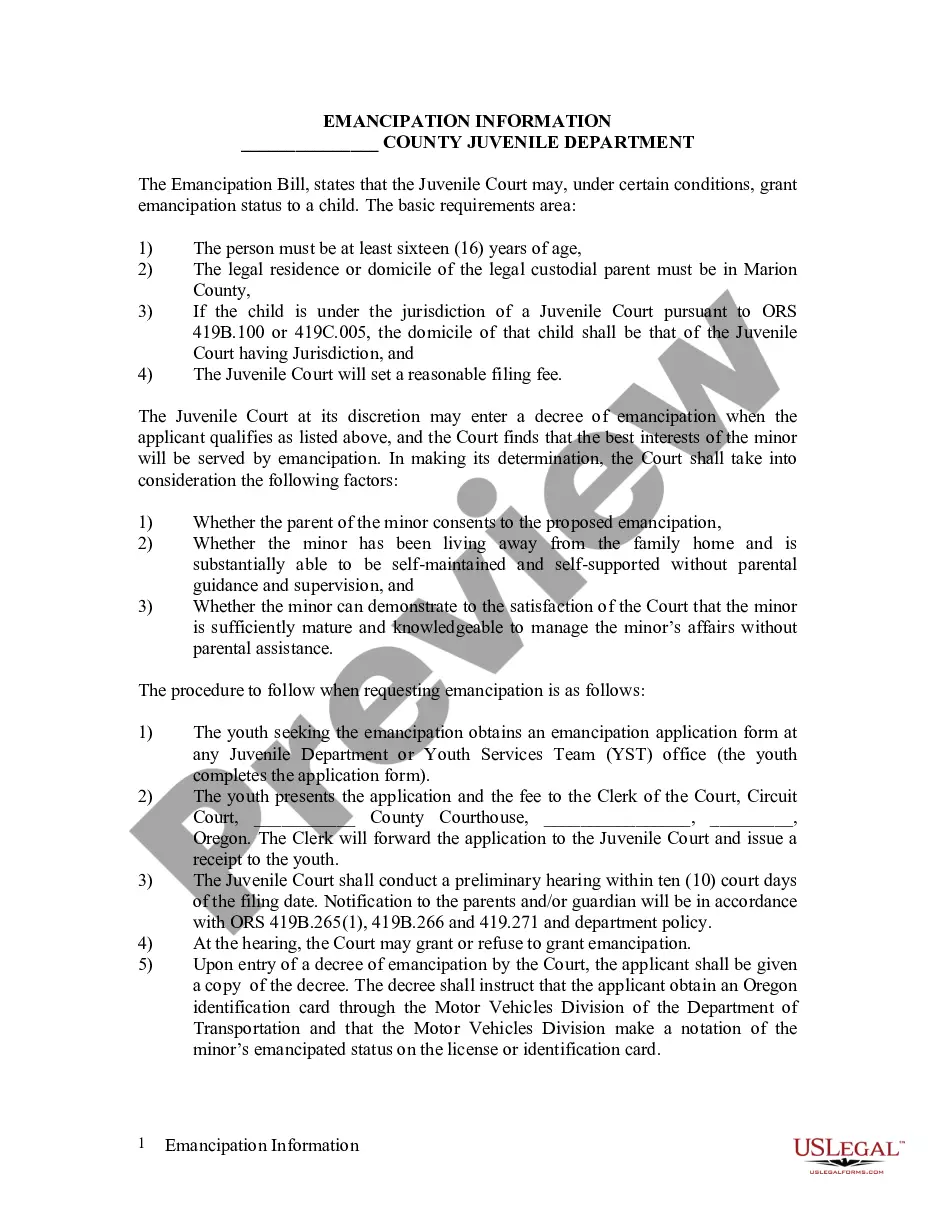

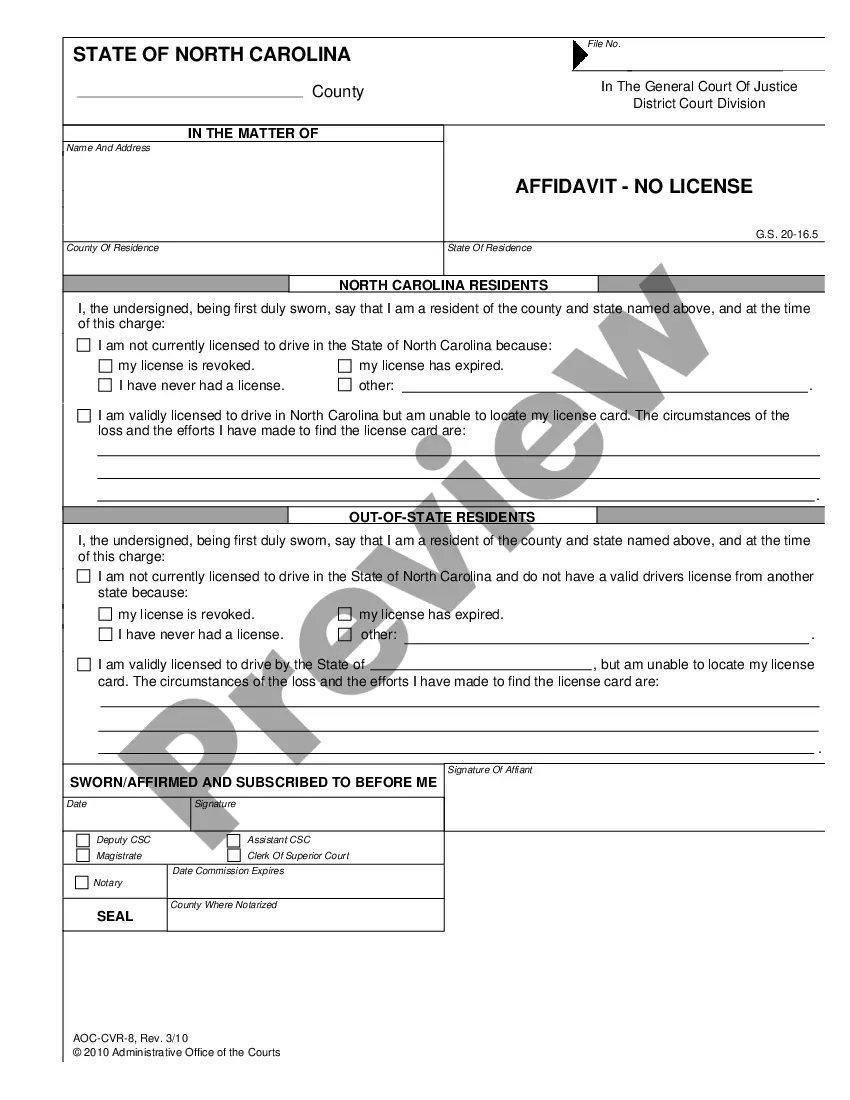

US Legal Forms offers a vast array of form templates, including the Wyoming Surety Agreement, designed to meet federal and state regulations.

Once you find the appropriate form, click on Get now.

Select the pricing plan you prefer, fill in the required information to create your account, and make your payment using either PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Wyoming Surety Agreement template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Identify the form you need and ensure it corresponds to your specific city/region.

- Use the Review option to examine the form.

- Read the description to confirm you have selected the correct form.

- If the form isn’t what you’re looking for, utilize the Research section to find the form that fits your needs and requirements.

Form popularity

FAQ

The fundamental difference between a surety and a co-surety revolves around the responsibility and support structure among the parties. A surety stands alone in its obligation, whereas a co-surety operates in tandem with other sureties. This distinction is crucial in Wyoming Surety Agreements, where partnership among sureties can enhance financial security and risk management.

The primary distinction between a surety and a co-surety lies in the level of entitlement and responsibility. A co-surety shares the obligations and risks of the surety arrangement, providing additional layers of security. In the context of a Wyoming Surety Agreement, both parties collectively ensure that the commitments are met, but only a co-surety has the right to seek reimbursement from the principal under certain circumstances.

These bond types are also referred to as commercial bonds" or business bonds." Examples of license and permit surety bonds include auto dealer bonds, mortgage broker bonds, and collection agency bonds.

Certificate of Title Surety Bond Information A Certificate of Title Surety Bond (also known as a Bonded Title, Title Bond, Defective Title Bond, Lost Vehicle Title Bond or DMV Bond) allows a vehicle owner to claim ownership and register the vehicle with the state when a title has been lost, stolen or is missing.

A surety bond guarantees that your company will meet its legal and contractual obligations. State and federal law often require a surety bond as a condition for obtaining a license to lawfully conduct business.

Surety Explained in Detail A surety bond is a legal binding agreement signed between three partiesthe lender, the trustee, and the guarantor. The obligee, generally a government agency, allows the principal to receive a security bond as a protection against future work output, normally a business owner or contractor.

For example, if a construction contractor takes on a project but cannot fulfill the terms of that project, the surety bond company would compensate those who were counting on the project's completion. Surety bond rates are largely determined by two things: Overall risk of the surety bond. Your business/financial

Insurance protects the business owner, home owner, professional, and more from financial loss when a claim occurs. Surety bonds protect the obligee who contracted with the principal to perform specific work on a project by reimbursing them when a claim occurs.

A surety is a person or party that takes responsibility for the debt, default or other financial responsibilities of another party. A surety is often used in contracts where one party's financial holdings or well-being are in question and the other party wants a guarantor.

Someone who assumes direct liability for another's obligation. Financial creditors may require the debtor to find a surety, who then signs the loan agreement along with the debtor.